How GPOs Work and When You Should (and Shouldn’t) Use Them

How GPOs Work and When You Should (and Shouldn’t) Use Them

Many small businesses pay retail rates for office supplies and materials simply because they lack the large-scale buying power or negotiating skills to secure better prices.

As businesses grow, however, the expense of retail pricing puts increased pressure on working capital. Companies must find ways to optimize cash flow and get ahead of rising costs.

Group purchasing organizations (GPOs) fit the bill for many businesses, promising savings and pricing consistency without requiring bulk purchasing or a fully built-out procurement function. But GPOs may not be the best option for preserving cash and simplifying buying.

Explore what GPOs offer, whether you need one, and how to make smarter, more strategic decisions to maximize profitability.

Download the free ebook: The Modern Guide to GPOs–What They Are & Why They're Not Enough

What is a group purchasing organization?

A group purchasing organization (GPO) is a buying group that leverages the collective purchasing power of multiple businesses, typically within a specific industry, to obtain better pricing on goods and services.

GPOs help members reduce costs by securing improved contracts with suppliers and manufacturers. They give members access to discounts and benefits they likely couldn't secure on their own.

What a GPO is not: 4 common myths

Despite their appeal, misconceptions about GPOs can lead to missed savings or operational inefficiencies. Here are some common falsities about the organizations:

Myth: A GPO makes your procurement department unnecessary.

Reality: GPOs support your procurement process by providing pre-negotiated prices and supplier access. They don’t replace your department since they aren’t involved in your purchasing decisions. You still need to evaluate terms and nurture your vendor relationships.

Myth: GPOs are helpful only for enterprises or niche industries.

Reality: Many businesses can join a GPO and benefit from its collective buying power. However, you have limited control over strategic decisions and how these decisions affect your internal goals.

Myth: Once you commit to the GPO, you can only buy through them.

Reality: Joining a GPO doesn’t mean you’re limited to their choices—unless the contract terms specify otherwise. Be sure to choose agreements that fit your standards, budget, and needs.

Myth: GPOs are expensive and require a significant amount of time to achieve ROI.

Reality: Some GPOs have low membership fees and can deliver quick savings if managed well. However, ongoing value depends on their performance, which you typically can’t control.

Types of GPOs

GPOs typically fall into three categories: vertical, horizontal, and master.

- Vertical GPOs are industry-specific groups formed by organizations that purchase similar products or services within a defined sector. Vertical GPOs are common in healthcare, hospitality, and public institutions such as school districts or municipal governments. Smaller entities often join vertical GPOs to meet purchasing volume requirements and gain access to more favorable contracts.

- Horizontal GPOs operate across multiple industries at the regional or national level. They serve businesses of all types and sizes willing to contract for their services. While these arrangements may meet the needs of smaller enterprises looking for volume discounts, the selection may be less targeted than that of vertical GPOs.

- Master purchasing organizations (MPOs) are formed by large corporations to aggregate company purchasing across subsidiaries, divisions, or related entities. These arrangements help enterprise-level businesses standardize procurement and maximize internal buying power.

How a GPO works

A traditional vertical GPO uses a centralized purchasing system that allows members to order goods and services at pre-negotiated prices from the organization’s network of suppliers.

1. GPOs negotiate contracts with suppliers on behalf of their members to secure volume-based pricing and additional benefits.

2. Many GPOs also offer value-added services, such as electronic invoicing, cost-savings reports, trend analysis, product standardization assistance, and budgeting tools to help members make more strategic purchasing decisions.

3. GPOs simplify ordering by consolidating supplier contracts and offering a centralized platform for placing orders. This reduces administrative work by eliminating redundant tasks and allows members to use pre-vetted suppliers, which improves sourcing efficiency.

How do GPOs make money?

Most GPOs generate revenue by charging a membership fee or taking a percentage of member spend. They may also charge suppliers contract fees, typically as a percentage of sales.

Sometimes, a GPO earns money using both of these methods. Be sure to carefully evaluate all relevant fees before selecting a partner for your procurement needs.

Advantages of a group purchasing organization

For small and medium-sized businesses without a dedicated procurement team, a reputable GPO offers numerous benefits, including better pricing, reduced purchasing barriers, and expedited access to essential supplies.

Access to volume discounts: GPOs offer a strength-in-numbers approach to buying, allowing smaller and newer businesses to unlock better pricing. This is often the primary appeal for organizations looking to control costs.

Group buying power: Small businesses may struggle to meet order minimums required by some vendors. GPOs remove this barrier by pooling member purchases to meet volume thresholds. However, some contracts may still require members to buy a minimum quantity during the contract term, meaning buying outside the contract could impact compliance or savings.

Curated selection: GPOs offer access to pre-vetted vendors with negotiated contracts. This one-stop-shop approach saves time by reducing the need to compare pricing or vet vendors manually. Buying through a curated catalog also simplifies sourcing and supports cost savings.

Average cost savings of GPOs

When considering a GPO partnership, it pays to weigh potential savings against opportunity costs. While one study of healthcare GPOs pegged savings at 15 to 20%, actual ROI will depend on your spend volume, fee structure, and contract relevance. Horizontal GPO members, in particular, may see different returns based on the range and availability of goods within their contract.

Ask the following questions to assess whether a GPO is the right fit:

- What are the ongoing membership fees?

- Are there any order minimums?

- Does the GPO generate revenue through vendor fees or other sources?

- How much of our total spend will be on contract?

- How will we source items that aren't covered by the GPO?

- How will we prevent off-contract and maverick spend?

Taking the time to answer these questions will help you determine whether a GPO aligns with your procurement strategy and delivers real value for your organization.

Disadvantages of a group purchasing organization

The GPO model has some limitations that deserve careful consideration before you commit.

Unavailable on-contract goods: GPOs are structured to serve the collective needs of the group, which can reduce flexibility for individual members. If a specific item isn't covered under the GPO’s contracts, you may have to settle for an alternative or buy off-contract and lose your negotiated pricing benefits.

Loss of free market opportunities: When considering a GPO contract, carefully review how it may impact outside purchases. If the GPO under-negotiates an item's pricing or doesn't offer what you need, staying compliant could reduce your buying power and limit your ability to seek better deals.

Lack of transparency: Not all GPOs are upfront about how they make money or structure vendor relationships. Ask detailed questions about fees, revenue sources, and supplier terms. Due diligence is essential to avoid partnerships that don't align with your procurement goals.

What others don't tell you about GPOs

Despite the rosy picture GPOs paint about savings, many operate as for-profit organizations that generate revenue from both members and suppliers. While there’s nothing inherently wrong with this model, it's essential to approach the relationship with a clear understanding of how it may affect your bottom line.

Here are a few realities you likely won't find highlighted in your GPO’s promotional materials.

GPOs may encourage unnecessary spending

Volume is a key component of the GPO model, so representatives conducting procurement audits may recommend buying more items than you actually need. Always review GPO suggestions carefully to check whether they make sense with your current requirements, not just the GPO's volume goals.

Larger members carry the group

While GPOs serve businesses of all sizes, smaller members often benefit the most. As your company grows and scales, your volume needs and negotiation power increase—reducing the value of a GPO. For high-growth organizations, a GPO may offer diminishing returns over time.

GPOs can’t help you control shadow spend

Partnering with a GPO for supplies can be a money-saving venture—if you can get your team to keep on contract. In many cases, enforcing compliance with a specific GPO or vendor is an uphill battle. Without a centralized purchasing platform to track spending, it’s hard to identify off-contract spending. Those accustomed to buying exactly what they want may bypass GPO agreements, reducing the financial benefit and creating hidden costs.

Alternatives to GPOs and when to use them

While GPOs can be helpful in some cases, they shouldn't be your default procurement strategy. It's important to weigh your company's size, resources, and needs before making a decision. In many situations, alternative solutions can address specific challenges more effectively.

Strategic sourcing

Developing an internal procurement strategy can help you negotiate customized deals and competitive pricing by carefully selecting and leveraging beneficial partnerships. However, strategic sourcing is time-consuming and requires expertise. You'll also need sufficient purchase volume to have negotiating power with suppliers.

Procurement software like Order.co can bridge this gap. Its AI-powered sourcing tools can help you save an average of 5%, while its customized workflows and catalogs simplify the entire process.

Purchasing cooperatives

A purchasing cooperative is a member-owned organization where similar businesses work together to negotiate better deals. Members typically pay a fee to join co-ops and share in the cost savings. This is a practical choice for your business if you need industry-specific contracts and greater influence over procurement decisions.

While co-ops may sound similar to GPOs, the two have key distinctions:

| Aspect | GPO | Co-op |

| Governance | Managed by a legal entity (nonprofit or for-profit) that negotiates on behalf of its members | Members have voting rights and a say in operations |

| Goal | The entity negotiates discounts and services, with profits flowing back to the GPO | Members leverage maximum collective buying power, with profits going back to the people |

| Leadership model | A centralized team determines the strategy and negotiates the contracts with limited member input | Members democratically shape contract terms, vendor choices, and policies through committees |

Centralized procurement by a parent organization

Another alternative to a GPO is centralizing procurement under a parent company or umbrella organization. This model organizes purchasing decisions under one coordinated function that supports all departments, teams, or business entities.

If you have an enterprise organization with multiple branches or subsidiaries, a centralized approach could be effective. By consolidating purchasing, you can leverage company-wide volume to negotiate more favorable contracts, improve vendor relationships, and increase efficiency.

Order.co: Where automation meets group purchasing efficiency

GPOs offer certain advantages, but they don't replace your procurement process. In fact, you may not need a GPO at all. GPOs typically lack automated spend controls, multi-vendor intelligence, and integrated payment and invoicing workflows—all essential tools for modern, cost-effective purchasing.

Order.co offers many of the benefits of a GPO while enhancing visibility and control. It helps you save on supplies your business needs and offers additional benefits like:

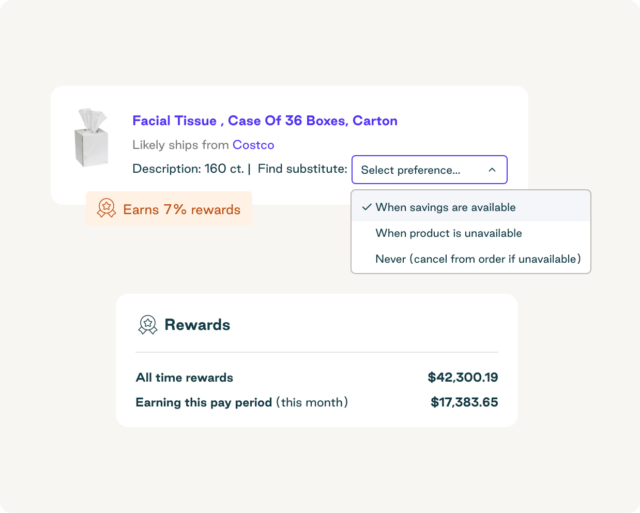

- Access to thousands of vendors to secure the best pricing, plus automatic substitutions when goods are backordered or unavailable

- A centralized platform featuring curated item catalogs and role-based spending guardrails to keep purchasing within budget and aligned with company goals

- Spend management and reporting features that help track organizational spend, enforce compliance, and improve decision-making

- $4 billion in buying power through Order.co’s purchase order software for smarter sourcing and deeper savings, even on items you’re already buying

If you're already using a GPO, Order.co can enhance your existing partnership by filling gaps in automation, oversight, and supplier access. If you aren't using one, Order.co can help you unlock measurable cost savings without order minimums or contract restrictions.

Schedule a demo of Order.co today to see how it can transform your procurement strategy.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields