Accounts Payable Software: How It Works + 5 Best AP Solutions

Accounts Payable Software: How It Works + 5 Best AP Solutions

Processing hundreds or thousands of invoices per month manually leads to logjams and burnout. Accounts payable software simplifies AP processes to make teams more efficient, informed, and prepared to create value.

This guide covers the essentials of selecting an accounts payable software solution. You’ll learn what AP platforms are, how they operate, and what to look for when selecting an automated accounting solution.

Download the Free Ebook: How Automation Can Solve Finance Teams’ Biggest Challenges

What is accounts payable software?

Accounts payable software is financial technology that automates the management of an organization's accounts payable processes. It simplifies tasks and minimizes manual steps related to vendor payments, including:

- Purchase order processing

- Approval workflows

- Invoice processing

- Payment execution

- Fraud monitoring

- Risk management

- AP reporting and analysis

Businesses use accounts payable software to reduce manual tasks, improve accuracy, ensure timely payments, avoid late fees, and strengthen vendor relationships. It also provides insightful reports on payable amounts, due dates, and vendor performance.

How does AP software work?

Accounts payable software functions through a series of workflows that streamline the process of managing payables.

When an invoice arrives from a vendor, the AP system captures it electronically via direct integration, API, email, or by digitizing it with optical character recognition (OCR). It then automatically extracts all relevant invoice data, eliminating the need for manual data entry.

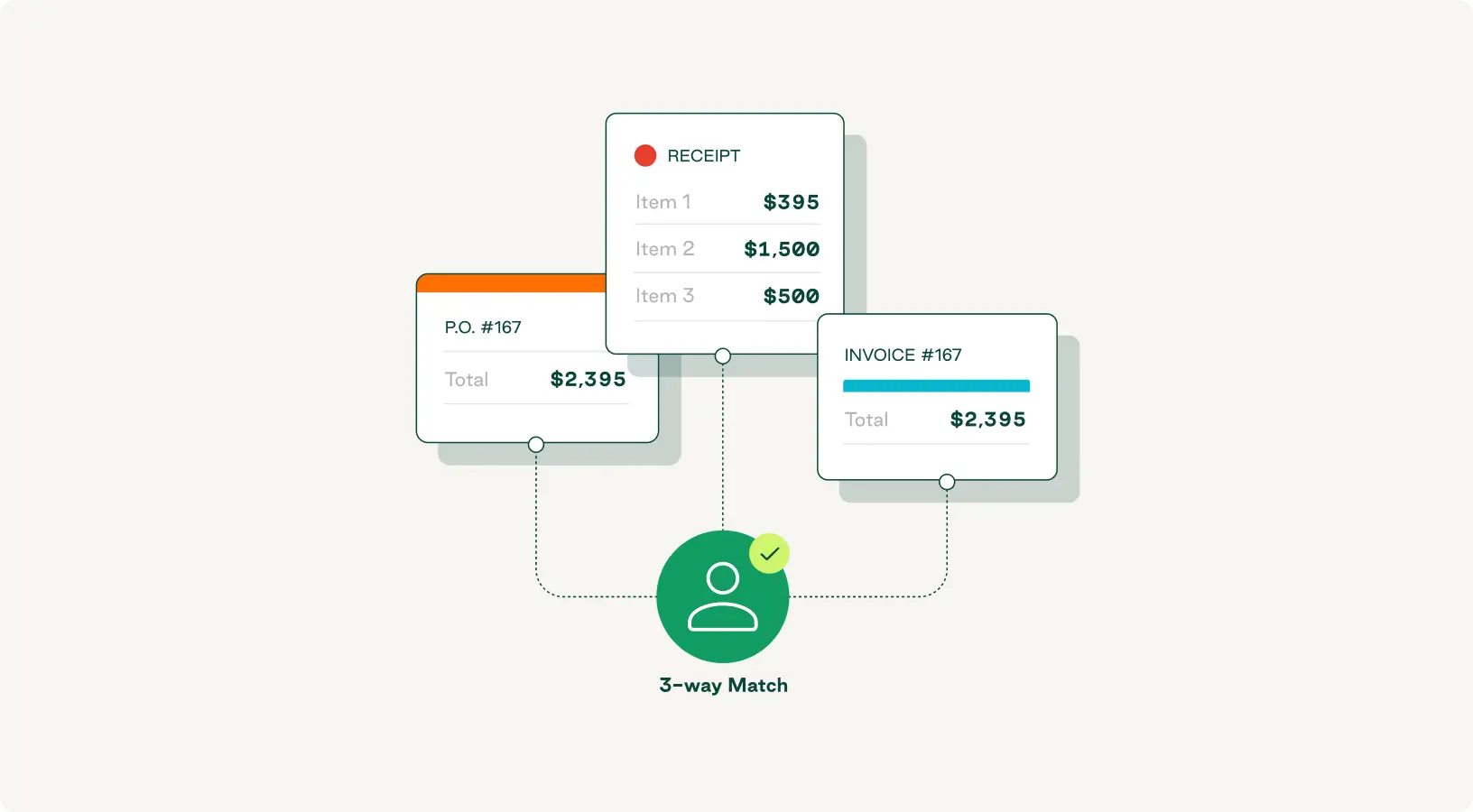

Next, the software matches the invoice with the corresponding purchase order and receiving data (such as your bill of lading). This three-way matching process verifies that you received exactly what you ordered and at the agreed-upon price.

The invoice then enters an automated approval workflow. It gets routed to appropriate individuals or departments based on predefined rules set within the platform. You can program the software to schedule payments before or on their due dates.

Throughout the process, the software monitors for any signs of fraud by flagging unusual transactions, duplicate invoices, or payments that fall outside company policies. Robust AP automation solutions also have features to centralize vendor management and generate comprehensive reports, providing you with insights into payable amounts, supplier performance, and spending patterns.

What are the best accounts payable software options?

One of the best ways to ensure your AP team’s processing and practices provide maximum efficiency and control is to select a software solution that has the features and flexibility you need. These five accounts payable software platforms offer a balance of functionality, scalability, and competitive pricing.

1. Order.co

Order.co provides a total spend management software solution for procurement, AP processing, and spend efficiency. Its capabilities include guided procurement, dynamic spend management, AI-driven insights, robust reporting, and multiple payment methods (including credit cards and ACH). The platform also offers financing options that create more cash flow flexibility for businesses ready to scale.

Features

- Automatic general ledger (GL) coding

- Extensive accounts payable automation

- Three-way matching

- Curated procurement catalogs

- Financing with Order.co Financial Offerings

- Virtual procurement cards

Pros

- Users can purchase from any vendor via direct integrations, API connectors, and even human support for offline vendors.

- Order.co’s Financial Offerings preferred advance program gives businesses access to up to $500,000 in spending power with universal terms and reasonable approval processes.

- Budgetary controls and role-based permissions make it easy to manage spending by department, individual, location, organizational level, or other key parameters.

Cons

- Order.co does not currently support raw materials purchasing that requires RFP/bid-based processes or has market price volatility.

- Users cannot purchase software directly through the platform. However, it can issue a virtual card that lets you pay vendors for subscriptions while automatically capturing and tracking the expense.

2. Airbase

Airbase provides a modular approach to procurement and spend management, offering powerful, enterprise-style tools for AP automation, expense management, and corporate card issuance. Airbase uses a combination of robust integration options, no-code workflows, and payment in 145 currencies to help growing businesses operate globally.

Features

- Guided procurement

- Multi-subsidiary support

- Expense management

- Mobile app access

Pros

- The platform is built with a user-friendly interface that makes it easy to learn the system.

- Guided procurement provides an automated intake process with a no-code solution for coordinating internal and external stakeholders.

Cons

- The app has minor glitches, specifically with workflows and expense imaging.

- Some basic functions, such as backing out payments or rejecting incorrectly assigned invoices, require support assistance to remedy.

3. Tipalti

This finance automation solution offers users ways to improve their procurement process, automate AP functions, and get control of expense reporting and employee-led spending—all in one place. It has features to assist with supplier onboarding, tax compliance, and inter-system data sharing.

Features

- Third-party integrations and API

- Mass payment features

- Expense management

Pros

- The system integrates with both well-known and lesser-known software programs.

- It offers mass payment for multiple vendors to save time and prevent fees from missed payments.

- Tipalti is generally easy to use, even for non-finance team members.

Cons

- Some users have trouble paying vendors in certain countries, though the system offers payment in over 140 currencies.

- Reconciliation reports can be challenging to work with, requiring research and journal entries to tie transactions back to bank records.

4. Precoro

Precoro’s procure-to-pay solution offers businesses access to easier inventory management, faster reconciliation, improved invoice approval practices, and enhanced budgetary control. It emphasizes process and workflow automation as a means to help customers improve and expand their AP and procurement management practices.

Features

- Versatile request management

- Industry-specific support

- Customizable settings

Pros

- The system offers strong budget features with flexibility for unique business processes.

- Precoro is a straightforward solution with a simple and effective UI.

- It features robust custom reporting capabilities for visualizing data and driving decision-making.

Cons

- Some UI experiences, such as making receipts for company POs, route workflows back to the main page rather than the processing screen, making them more difficult.

- Some users feel invoice management is slow due to how the system handles error checking.

5. Ramp

Ramp offers a complete AP solution for bringing together expense tracking, corporate card features, payment processing, and vendor management. It helps businesses automate their finance operations processes and unifies data entry and management through integrations.

Features

- Procurement cards

- App-based expense management

- Procurement management

- Accounting automation

Pros

- The system helps finance teams set and enforce dynamic spending limits through its procurement and corporate card features for better budgetary control.

- Receipt capture and reminder tools ensure expenses are recorded accurately and on time.

- Emergency spend requests allow users to get approvals through the mobile app for one-time expenses and out-of-policy purchases.

Cons

- Bank cash flow fluctuations may cause instances where funds are unavailable, meaning cardholders cannot charge purchases.

- The lack of access to a live, phone-based technical support person makes it harder for users to get support when needed.

Do you need accounts payable software?

Investing in AP software too early or too late can result in added challenges when it comes to balancing operations and cash flow. But automation is essential for cost-effective scaling.

Here are some signs that it’s time to invest in an automated AP software solution:

- Time-consuming manual processes: If you’re feeling bogged down by administrative invoice processing, AP software can significantly improve efficiency.

- High rate of errors: Manual workflows typically have a 2% error rate, which can lead to bottlenecks in your AP process and non-compliance issues.

- Weak vendor relationships: AP software solves problems that strain supplier relationships, such as late payments, processing delays, and payment errors.

- Lack of financial transparency: Without real-time visibility into outstanding payables and payment schedules, your business is more likely to struggle with cash flow issues and miss out on early payment discount opportunities.

- Scalability challenges: Slow manual processes make it hard to find the time to focus on growth. Automation becomes critical as your company expands across locations or adds new vendors.

What should you look for in AP software?

Good AP software solutions deliver the right mix of key features and functionality to make AP teams more effective.

Centralized vendor management

Centralized vendor data platforms help improve supplier relationships and enhance spending control. Order.co offers advanced vendor management tools—including seamless vendor onboarding, contract management, performance tracking, and risk management—that support smarter, more efficient procurement.

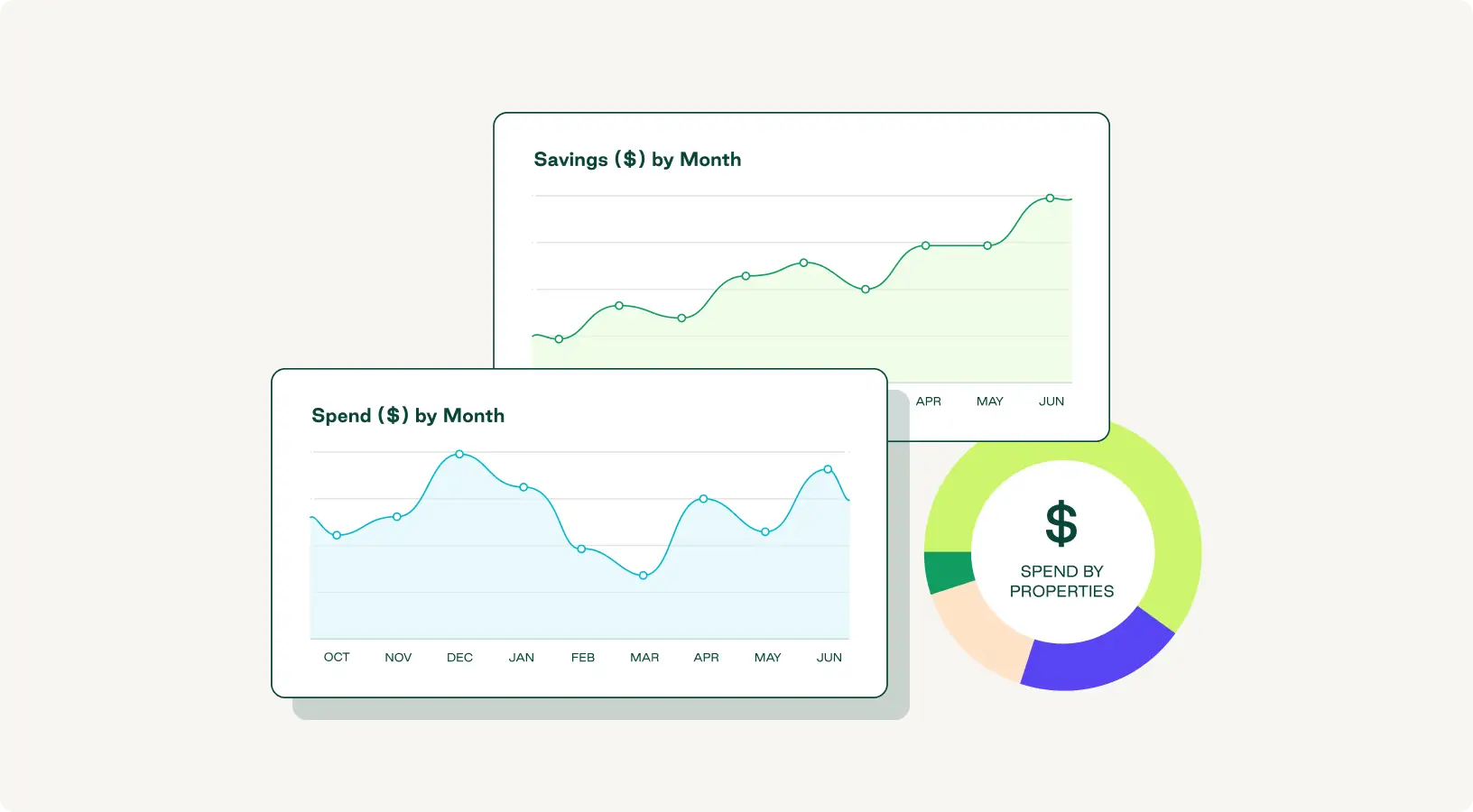

Reporting and analytics

Comprehensive spend analysis and reporting platforms like Order.co provide insights into payable amounts, spending patterns, vendor details, and category trends. Look for a solution with reporting capabilities that aid in strategic decision-making and enable effective communication of AP data across your organization.

AP automation

With automation, your CFO and finance teams can enhance activities like purchase order creation, approvals, payments, reporting, and spend analysis. Automating repetitive tasks saves time and reduces errors without resorting to AP outsourcing.

Accounts payable software like Order.co helps you:

- Automate repetitive AP workflows

- View spend data in real time

- Accelerate approval processes

- Speed up invoice reconciliation

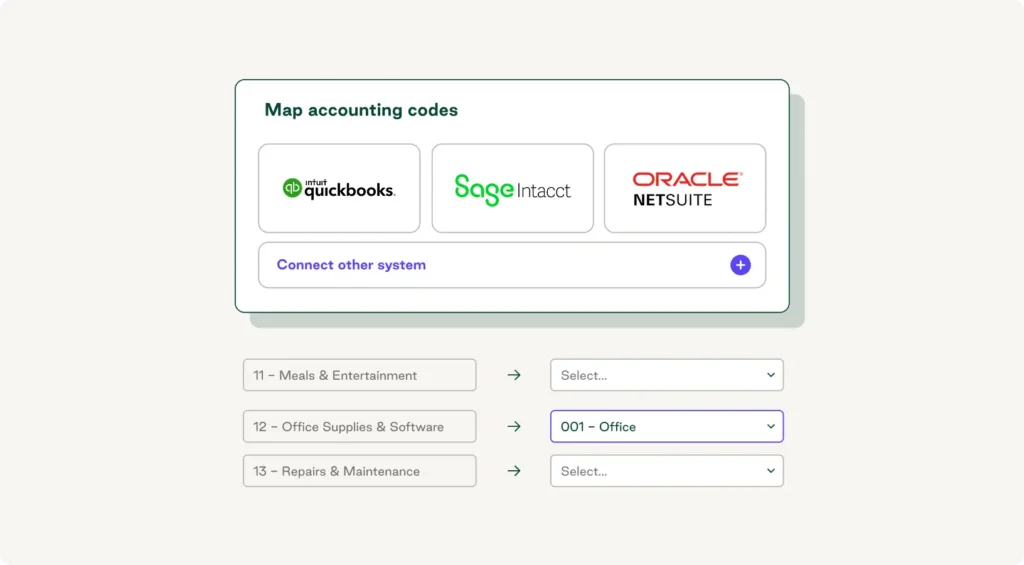

Good AP software also integrates with your existing financial tools, such as your accounting systems or ERP, to automatically share up-to-date data.

What are the benefits of AP software?

AP software delivers measurable improvements across multiple business areas, enabling more efficient workflows that save time and money and improve compliance.

Reduced operational costs

Automated AP systems reduce invoice processing costs by up to 81% while helping you avoid late penalties and capture early payment discounts.

After implementing Order.co’s AI-powered AP automation software, office catering company ZeroCater lowered its total number of invoices by over 50 times—reducing monthly Amazon invoices alone from 200 to just three or four.

Read more AP automation case studies to learn how other companies have reported similar results using accounts payable software to cut costs and increase efficiency.

Improved data accuracy

AP software helps eliminate errors, such as duplicate payments and data inconsistencies, through automated data extraction and three-way matching. This ensures your invoices are accurate and compliant, minimizing the risk of costly mistakes and fraud.

Stronger vendor relationships

AP software supports timely, accurate payments and a seamless supplier onboarding workflow, strengthening supplier satisfaction rates. It also centralizes vendor data to unlock valuable performance insights that can lead to better contract terms.

Better compliance and security

By establishing digital audit trails, automated approval workflows, and advanced fraud detection, AP systems improve regulatory compliance and minimize financial risks. This makes the auditing process faster and easier, reducing your administrative burden.

Make accounting faster and more accurate with Order.co

AP automation software provides the tools you need to capture data accurately, accelerate the approval process automatically, and pay vendors promptly. Order.co goes beyond AP processing to help you manage sourcing, purchasing, payment, and spend within a single platform.

Schedule a free demo to see how Order.co’s accounts payable software automates invoice processing and coding for faster, error-free payments.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields