Vendor Risk Management Checklist and Best Practices

Vendor Risk Management Checklist and Best Practices

Evaluating vendor risk can save your organization thousands of dollars in mitigation costs and prevent hard-to-quantify losses—like reputational damage or business continuity disruptions.

A consistent, detailed vendor risk management checklist makes the assessment process more effective. It helps you identify and manage third-party risks while strengthening your overall vendor management strategy.

Discover how a checklist can enhance your risk prevention—and get one for free.

What should a vendor risk management checklist contain?

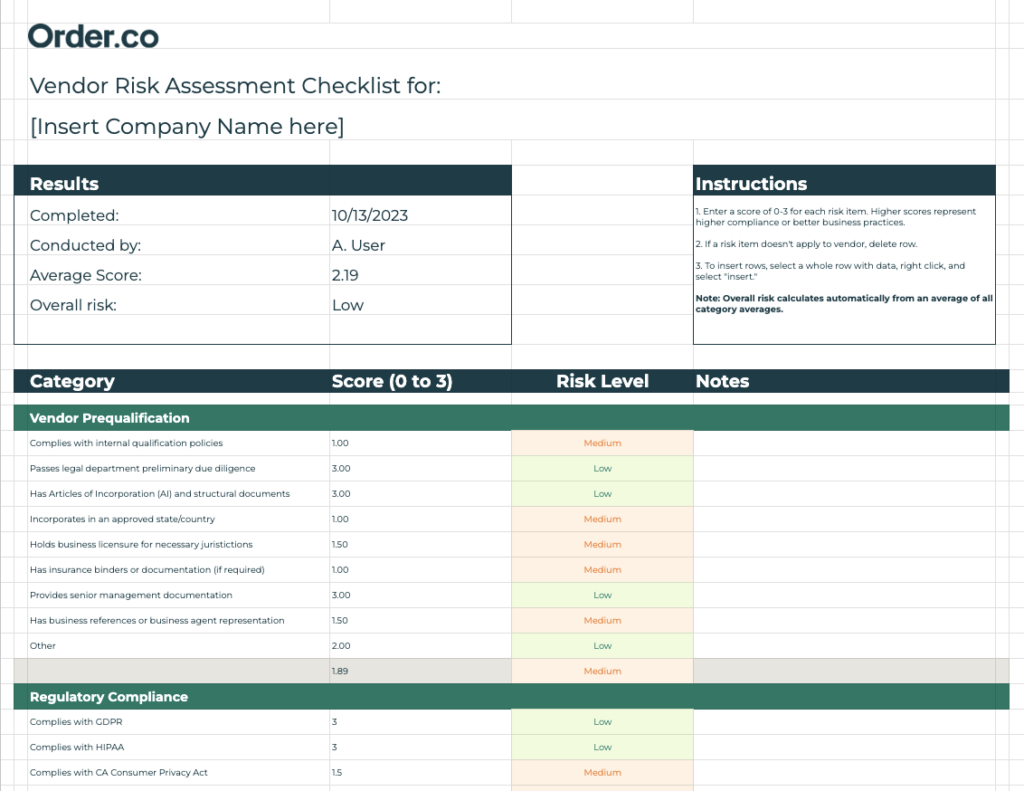

A vendor risk management checklist should include key risk categories, such as compliance, cybersecurity, and financial stability. It can help you evaluate new or existing partners on critical categories like:

- Regulatory compliance: Risks based on data privacy and regulations, including HIPAA (for healthcare in the US), PCI DSS (for payments), and GDPR (for data privacy in Europe)

- IT and cybersecurity risks: How partners handle and protect data, whether they have incident response plans in place, and the details of their information security policies

- Financial risks and concentration: A vendor’s economic stability, insurance coverage, payment terms, or overreliance on a single source

- Operational risks: Risks related to each partner’s service level agreement, how it manages or subcontracts, and whether it has the resources to meet its responsibilities

- Reputational considerations: Controversial past incidents (such as lawsuits), references that reflect negatively on the vendor (like negative reviews), or misalignment with your brand (including core values or sustainability practices)

- Strategic pitfalls: How well vendors align with your long-term business goals, including innovation and scalability, contract flexibility, and exit options

You can download a free vendor risk management checklist here. This easy-to-use worksheet lets you customize risk factors to fit your needs and prioritize vendors by risk level. It scores each category on a scale of 0 to 3 based on common risk factors, then calculates an average score for each category along with an overall risk score and level for the vendor.

How to gauge risk at a category level

Vendor risk comes in many forms, from data security incidents to third-party vendor delays that impact your operations. However, even without a major issue like a cyberattack, unchecked third-party risk can make running your business more expensive and time-consuming.

Scoring vendors by category helps you focus on the areas that matter most based on your organization's risk tolerance. It highlights the risks associated with a specific partner as well as the potential consequences if the vendor fails to meet standards.

Low risk

These risks indicate minor inconveniences to your procurement, operations, security, or reputation. While they may seem insignificant on their own, they can add up over time and lead to more serious issues. Addressing these issues after resolving higher-risk categories is essential.

Example: A late delivery from a paper supplier is a low risk for an eco-conscious company that almost always uses digital documents. The delay may cause a slight inconvenience, but it isn't critical since it doesn't significantly impact operations or open up access to sensitive data.

Medium risk

If problems occur, medium risks can moderately impact your procurement process. They could cause short delays or issues that affect customer experience or brand reputation.

Example: A CRM provider without a formal disaster recovery plan represents a medium risk. If the platform goes down, your support team will be unable to resolve issues or interact with customers. While it doesn’t completely halt your core operations, it can impact service levels and erode trust.

High risk

High risks can severely disrupt operations, compromise sensitive information, and cause significant financial and reputational damage. These should be addressed immediately and monitored closely.

Example: A vulnerability or security gap at a cloud infrastructure partner that stores customer login information represents a high risk. If exploited, these weaknesses could lead to financial liabilities, customer loss, and long-term reputational damage.

These risk levels can guide how you structure vendor scorecards and prioritize vendor reviews. For a more detailed framework, explore the vendor management risk matrix inspired by NASA.

Benefits of vendor risk management

Once you’ve scored your partners, here’s how vendor risk management can improve your business.

Lower costs

A strong vendor risk management program can reduce costs by optimizing your vendor list to include only high-quality, responsive supply chain partners. This focus lets you build stronger relationships with fewer vendors, giving you better leverage during negotiations.

Effective third-party risk management also catches issues early, helping you stay proactive and avoid unexpected expenses. For example, if a vendor has a history of missing contractual obligations, you can add safeguards or choose an alternative supplier.

Stronger operations

Risk management helps you monitor vendor relationships closely, allowing quicker risk identification and mitigation.

Consistent vendor due diligence reduces unexpected vendor behavior, lowers the chances of security breaches, minimizes last-minute orders, and improves visibility into vendors’ financial and operational practices. All these perks improve daily operations and make the procurement process more predictable.

Better supplier relationships

Better vendor relationships yield more strategic, cooperative, and competitive service. Building long-term partnerships fosters supplier enablement through clearer expectations, stronger communication, and shared goals.

These relationships often lead to more flexible contracts, improved payment terms, increased support during disruptions, and more consistent product quality and availability.

Regulatory trends impacting vendor risk management

Regulatory bodies shape trends, expectations, and standards. These compliance requirements help you raise the bar on who you choose as a partner and how you adapt to new vulnerabilities.

To ensure your vendor choices meet evolving standards and reduce risk exposure, consider the following trends:

- Environmental, social, and governance (ESG) mandates: The US, EU, and other global regulatory regions consistently add standards and due diligence laws related to environmental impact. Review practices related to your vendors and supply chain, such as fair labor and sustainability, during vendor selection and evaluation.

- Data privacy and security regulations: Third-party vendors that handle cloud infrastructure, cloud security, or sensitive data should adhere to security best practices. Depending on your industry and location, consider GDPR (EU), CCPA (California), HIPAA (US healthcare), NIST (cybersecurity frameworks), and other relevant standards.

- Supply chain transparency and ethical sourcing: Transparency laws vary by region. For example, the UK's Modern Slavery Act bans materials made with forced labor and requires clear reporting on the sourcing and handling of goods. Research local regulations and ensure your vendors comply (and that you can trace each step in your supply chain). Meeting these standards supports your brand’s reputation and builds consumer trust.

Order.co’s vendor management platform helps you stay ahead of evolving regulatory requirements by providing centralized visibility, automated purchase compliance (with approval rules and a controlled catalog), and detailed reporting. These features allow you to manage vendors and reduce risk confidently.

5 steps to improve vendor risk management

Vendor risk management is most effective when it’s a continuous process of vetting, onboarding, evaluating, and refining supplier relationships. To begin tracking performance and risk metrics for new and existing vendors, follow these five steps.

1. Document vendor risk management policies and processes

Create a formal policy outlining the standards, guidelines, and procedures for managing vendor risk. Include assessment criteria for risk factors like financial stability and security compliance.

Build a vendor lifecycle management program for every stage, from sourcing to renewal or termination, with clear procedures:

- Sourcing: Define departmental requirements up front to establish a strong vendor sourcing policy and parameters long before negotiations begin.

- Onboarding: Structure the supplier onboarding process and gather key information and documents like insurance, invoicing information, payment accounts, and contracts. Centralizing this data saves time if issues arise.

- Management: Regularly review performance metrics, including compliance scores, delivery exceptions, and price adjustments, to ensure ongoing alignment. Reference these reviews at contract renewals or annually for multi-year agreements.

- Fulfillment: Measure delivery performance against the agreed-upon contract terms, noting quality, accuracy, timeliness, and exceptions. Changes can sometimes indicate larger issues like fraud, so consistent monitoring is essential.

- Renewal/termination: Establish clear processes for renewing or ending supplier relationships. Review performance against contract terms, including data preservation and access controls, to ensure proper offboarding.

2. Collect data on current vendor contracts

Centralizing vendor data makes it easier to review performance metrics and identify areas needing improvement.

When onboarding a vendor, collect the following:

- Point of contact information

- Pricing, payment terms, and delivery schedules

- The most recent contract

- Price and delivery performance metrics

- Known risk information, such as previous assessments

Having this information helps you prepare for unexpected events. Comprehensive vendor data in a centralized location ensures stakeholders can access the data and metrics needed to evaluate and update risk.

3. Establish performance metrics for vendor management

Integrate performance metrics into your ongoing vendor management program to track key data like onboarding and offboarding times, performance ratings, and customer satisfaction scores. Tracking ensures your third-party risk management program works effectively and flags issues quickly. Additionally, using benchmarking data from industry peers guarantees your program aligns with best practices.

Choose metrics that match your risk management goals, such as:

- Time since last known data breach

- Security questionnaire responses

- Disaster recovery documentation

- Previous security ratings

- Number of unmitigated risks

- Time to issue detection and resolution

- Delivery exception and damage rates

- Average uptime percentage

- Net promoter score (NPS)

- Number of third-party vendor integrations

4. Build a vendor risk audit methodology

Audits should evaluate vendors’ data protection, operational and IT security practices, and internal risk management effectiveness. This includes examining existing policies and procedures as well as testing for technical compliance with industry standards. The audit should also cover processes, such as background checks, security training, and incident response plans.

Conduct bi-annual reviews to spot changes in the vendor’s environment or operations that may increase risk. For software and portal-based service providers, schedule periodic system scans to ensure vendors maintain up-to-date patches, vulnerability scans, and logging protocols. Document all evaluation activities in audit reports or vendor report cards to help track changes and maintain a historical record of vendor performance and risk trends.

5. Use a vendor assessment framework

A standardized framework ensures consistency in how you evaluate suppliers regarding operational risk, financial performance, third-party relationships, and management oversight.

To improve accuracy, timeliness, and exception handling in the assessment process, automate workflows using technology and analytics. Set clear assessment criteria to assess compliance and decide when to offboard suppliers. Regular risk reviews strengthen supplier relationships and help prevent fraud.

How often should you assess the risk associated with each of your vendors?

Vendor analysis should be consistent and scheduled according to the vendor's risk category. A good rule of thumb is:

- High-risk vendors: Review quarterly to spot any changes in performance, security, financial health, or other areas

- Medium-risk vendors: Assess twice a year to verify continued compliance, consistency, and quality

- Low-risk vendors: Review annually, focusing on any performance issues or security concerns

While this schedule helps keep your risk assessments up to date, maintain flexibility to conduct additional assessments whenever changes occur that require additional review.

Planning ahead to respond to vendor risk incidents

Unfortunately, no matter how well you assess a risk, incidents inevitably happen. Part of vendor risk management is having a solid approach to limit how much damage those problems cause.

Start with these steps:

- Build an incident response plan: Create a detailed outline of each risk scenario, such as a data breach, compliance failure, or a delayed shipment. Define communication channels, roles, responsibilities (for both your team and the vendor), and tasks.

- Prepare for vendor failures: Establish a backup plan in case a vendor can't meet expectations, goes out of business, or can't help resolve an issue. Have alternate vendors ready and plan how to address problems to minimize supplier disruptions.

- Practice and refine your approach: Test your plans with your procurement team and other departments. For example, simulate a critical item shortage—like a restaurant chain running out of buns—and test how your team responds, such as sourcing inventory from another location. Use these exercises and real incidents to find gaps and revise your plan accordingly.

While these steps prepare you for vendor risks, managing them manually or across disconnected tools can lead to delays, miscommunication, and missed warning signs. A unified procurement platform helps you prevent risks, plan responses, and make informed vendor decisions within a single system.

Example: Vendor risk management improvements in action

Here’s how Pacaso, a real estate co-ownership tech company, improved its vendor management system using a comprehensive procurement solution.

The company was manually managing 120+ vendor relationships, which was not only time-consuming, expensive, and prone to error but also increased procurement risk. Pacaso adopted Order.co to centralize purchases, vendor management, and partner relationships.

With Order.co, Pacaso was able to:

- Consolidate 120+ vendors into a single platform

- Centralize over 5,550 products

- Simplify purchasing for more than 250 properties

This level of visibility and risk management gives Pacaso a competitive edge as it operates in 40 different US markets. According to Sourcing Manager Maria C. Jimenez, “Order.co helps us move faster without sacrificing accuracy or control, which is huge when we're operating across many markets.”

Other companies have seen similar benefits. For example, Grasshopper Farms was able to recoup $70K after a vendor went bankrupt, thanks to its heightened ability to identify and mitigate risks early with Order.co.

Build a risk-reduced procurement strategy with Order.co

Effective vendor risk management requires ongoing evaluation across multiple risk categories, including compliance and financial health, as well as operational and reputational factors. Using standardized checklists, scoring frameworks, and regular assessments helps you identify risks early, strengthen supplier relationships, and reduce unexpected costs and disruptions.

With Order.co, you can:

- Monitor and assess vendor risks in real time with order tracking, vendor relationship management, and full procurement visibility

- Make informed decisions with detailed spending reports and cost-saving insights

- Reduce product costs by an average of 5% using AI-powered spend management tools

- Maintain compliance with evolving regulatory standards and strengthen supplier relationships through centralized data and automated workflows

Schedule a demo today to see how Order.co can help you manage vendor risks—all while increasing savings and profitability.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields