The 13 Best Cash Back Business Credit Cards (2026 Guide)

The 13 Best Cash Back Business Credit Cards (2026 Guide)

Cash flow is the lifeblood of any business, but it’s often the hardest part to get right.

Cash back business credit cards provide a practical solution for optimizing working capital. They help drive more value from your business purchases by returning a percentage of spending as a reward. The more money you spend, the more you earn back.

In this guide, you’ll learn everything you need to know about cash back business credit cards—what they are, how they work, and how to maximize their rewards. You'll also see how Order.co’s virtual cards compare with 12 leading cash back options.

Download the free ebook: Choose the Right Procurement Technology With This Decision Matrix

What is a cash back business credit card?

A cash back business credit card is a payment solution that returns a percentage of spending as cash or statement credits. By providing money back from qualified business purchases, these cards can help improve your bottom line and strengthen your cash flow position.

Unlike personal credit card offers that reward users with points or miles, cash back business credit cards are easy to redeem and deliver straightforward value.

The perks of Order.co vs. traditional cash back cards

Traditional cash back cards can help you earn rewards from everyday purchasing, but Order.co’s approach delivers additional benefits by combining virtual procurement cards with strategic sourcing savings, built-in controls, and increased operational efficiency.

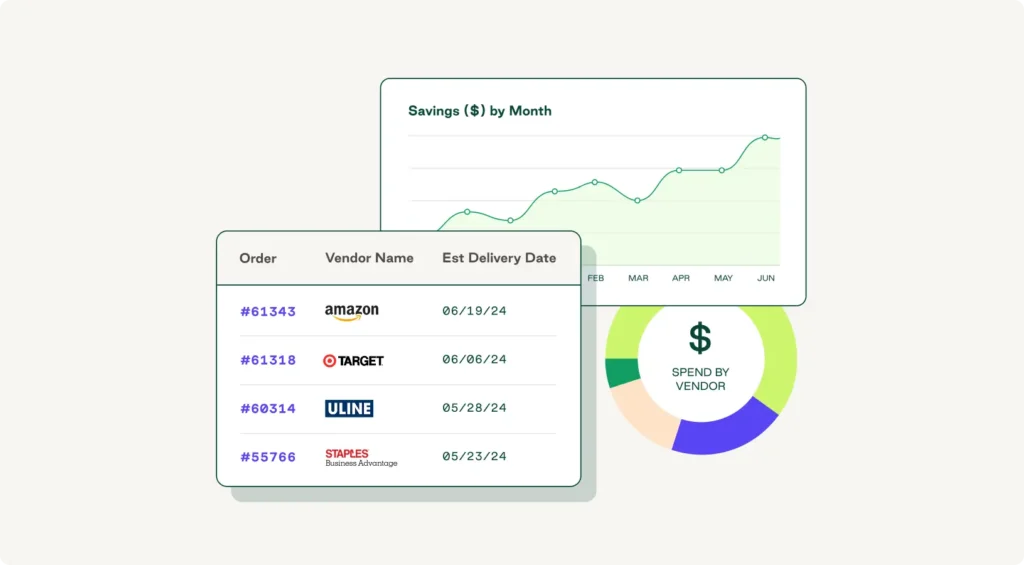

While most cash back cards offer average returns of 1.17%, Order.co can help you save 5–10% on all procurement purchases made through cost-effective AI sourcing across a network of 30,000+ suppliers.

Simplified purchasing

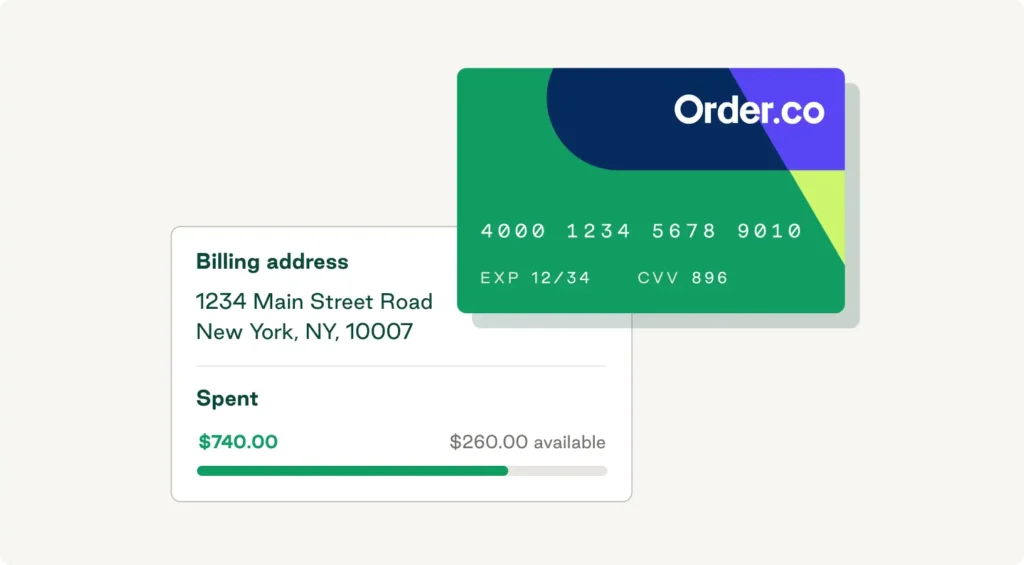

Order.co’s virtual cards help you increase purchasing efficiency for routine expenses, such as software subscriptions, utilities, and services. They enable fast, automated purchasing with user-specific limits for enhanced spend control. Each card locks to its first vendor for added security, and all activity flows into a single, consolidated platform for clear visibility into available spend.

Absolute control of approvals, catalogs, and spend

Order.co isn’t a credit card provider—it’s a comprehensive procure-to-pay solution. Where virtual cards help improve spend efficiency for routine business expenses, the integrated spend management software lets you set custom approval workflows, create catalogs of pre-approved vendors and products, and establish granular spend controls for specific users. Your spending limits automatically carry through to Order.co virtual cards to prevent budget overruns.

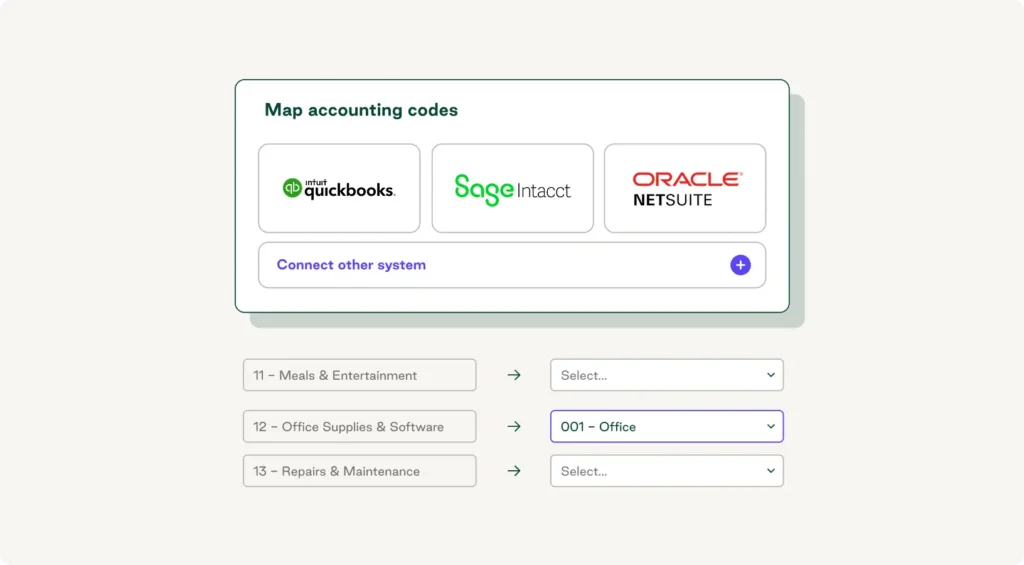

Seamless bookkeeping

Traditional credit cards are a headache to reconcile at month’s end, largely due to manual data entry, receipt management, and expense categorization. Order.co integrates directly with major accounting systems like QuickBooks and NetSuite to sync transaction data and eliminate the need for retroactive categorizing. Every purchase is precoded to your GL, included on your consolidated invoice, and flows automatically through your approval and payment processes.

Comparing 12 other cash back business credit cards for different spending profiles

While Order.co allows you to save an average of 5% across procurement spend through strategic sourcing, improved pricing and terms, and automation efficiencies, it's still worth comparing traditional cash back card programs. Here’s how 12 top options stack up, including enrollment bonuses, APRs, and credit history requirements.

Note: The information below is accurate as of October 2025.

Flat-rate cards for simplified rewards

| Card | Annual fee | Welcome bonus | Introductory APR | Variable APR | Rewards rate | Credit score needed |

| Chase Ink Business Premier | $195 | $1,000 cash back after spending $10,000 within the first three months of account opening | None | None (paid in full monthly) | 2.5% on qualifying purchases of $5,000 or more; 5% on business travel; 2% unlimited on everything else | Excellent |

| Capital One Spark Cash Plus | $150 | $2,000 cash bonus after spending $30,000 within the first three months of account opening | None | None (paid in full monthly) | 2% unlimited cash back on eligible purchases | Excellent |

| Wells Fargo Signify Business Cash | $0 | $500 cash bonus after spending $5,000 within the first three months of account opening | 0% for the first 12 months | 17.24% to 25.24% | 2% unlimited cash back on eligible purchases | Good |

Recommendation: With no annual fee and the highest flat-rate rewards on unlimited spending, the Wells Fargo Signify Business Cash card is one of the best business credit cards for mid-sized and small business owners.

High category bonus cards for specialized spending

| Card | Annual fee | Welcome bonus | Introductory APR | Variable APR | Rewards rate | Credit score needed |

| Chase Ink Business Cash | $0 | $900 cash back after spending $6,000 within the first three months | 0% for the first 12 months | 17.49% to 25.49% | 5% on the first $25,000 spent annually in office supplies, internet, phone, and gas stations; 2% on the first $25,000 at restaurants; 1% on everything else | Good |

| U.S. Bank Triple Cash Rewards Visa | $0 | $750 cash back after spending $6,000 or more within the first 180 days | 0% for the first 12 months | 17.74% to 26.74% | 3% on gas and EV stations (up to $200/transaction), restaurants, office supply stores, and phone services; 1% on everything else | Good |

| Bank of America Business Advantage Customized Cash Rewards | $0 | $300 statement credit after spending $3,000 within the first 90 days | 0% for the first nine billing cycles | 17.49% to 27.49% | 3% on the category of your choice and 2% on dining up to $50,000 per calendar year, then 1%; 1% on everything else | Good |

Recommendation: The Chase Ink Business Cash rewards credit card is a great option for businesses of all sizes, with a 5% cash back rate on common business expenses and no annual fee.

No annual fee options with strong rewards

| Card | Annual fee | Welcome bonus | Introductory APR | Variable APR | Rewards rate | Credit score needed |

| American Express Blue Business Cash Card | $0 | $250 statement credit after spending $3,000 within the first three months | 0% for the first 12 months | 17.24% to 27.24% | 2% on eligible purchases up to $50,000 per calendar year, then 1% | Good |

| Chase Ink Business Unlimited | $0 | $900 cash back after spending $6,000 within the first three months | 0% for the first 12 months | 17.49% to 23.49% | 1.5% unlimited cash back on eligible purchases | Good |

| Bank of America Business Advantage Customized Cash Rewards | $0 | $300 statement credit after spending $3,000 within the first 90 days | 0% for the first nine billing cycles | 17.49% to 27.49% | 3% on the category of your choice and 2% on dining up to $50,000 per calendar year, then 1%; 1% on everything else | Good |

Recommendation: The American Express Blue Business Cash Card delivers a simple rewards structure with no annual fee. Its introductory 2% rate on your first $50,000 in annual spending and low-threshold welcome bonus are ideal for companies with moderate spending.

Cards with 0% intro APR periods and cash back

| Card | Annual fee | Welcome bonus | Introductory APR | Variable APR | Rewards rate | Credit score needed |

| American Express Blue Business Plus | $0 | 15,000 membership rewards points after spending $3,000 within the first three months | 0% for the first 12 months | 17.24% to 27.24% | 2X bonus points on first $50,000 annually (up to 2 cents per point value), then 1X | Good |

| Bank of America Business Advantage Unlimited Cash Rewards | $0 | $300 statement credit after spending $3,000 within the first three months | 0% for the first nine billing cycles | 17.49% to 27.49% | 1.5% unlimited on eligible purchases | Good |

| PNC Cash Rewards Visa Signature | $0 | Bonus 1.5% cash back on all net purchases within the first 12 months | 0% for the first nine billing cycles | 18.24% to 28.49% | 1.5% unlimited on eligible purchases | Good |

Recommendation: Thanks to its 1.5% bonus cash back rate, the PNC Cash Rewards Visa Signature card is a great option for businesses expecting to spend over $20,000 in the first year.

How can you choose the best cash back business credit card?

To choose the right cash back card for your business needs, start by analyzing your spending patterns and matching them to the credit card plans that will maximize your returns.

First, map out your monthly business expenses. Categorize your spending and calculate the percentage of total spending for each category to determine whether a category bonus card or a flat-rate card is the best fit.

Next, compare annual card fees with your projected cash back earnings and consider any additional benefits. Then review cash back redemption methods: Some cards offer statement credits, some allow deposits into business checking accounts, and others require manual redemption.

How can you maximize your cash back earnings?

By strategically managing your credit card stack, you can increase your annual rewards and improve cash flow. But in some cases, the added complexity of monitoring multiple rewards programs outweighs the benefits. Here are some best practices for maximizing your cash back returns.

Stack multiple cards for optimal category coverage

Maintaining multiple credit cards can help you capture more spending category bonuses. However, this approach requires constant attention to spending limits and cash back deadlines—not to mention expense reconciliation across accounts.

Order.co simplifies business procurement with a single platform that unifies all your purchases and rewards. You can save an average of 5% on purchases made through your custom catalog without the administrative overhead of managing multiple accounts.

Set up automated redemptions for better cash flow

Many card issuers allow you to configure automatic cash back redemptions through an online card management portal. By setting a redemption threshold, you can ensure rewards are automatically deposited into your accounts to increase liquidity for operational expenses.ission compliance rates.

Order.co makes this easier by leveraging AI technology, a vast vendor network, and bulk discounts to simplify cost savings and secure better pricing. It also lets you automate payments and provides complete visibility into available funds to help optimize cash flow.

Use real-time transaction monitoring and alerts

Real-time spend monitoring and notifications let you proactively identify and respond to unauthorized activities. This helps keep your staff compliant with company purchasing policies.

Order.co’s virtual card numbers provide enhanced tracking, enabling you to generate unique employee cards for specific vendors with custom spending limits.

Set individual spending limits and category restrictions

Granular controls help you curtail maverick spending and enforce budget allocations. For better control and policy enforcement, you can set daily, weekly, or monthly spending limits for individual cardholders and restrict specific categories that are not relevant to an employee’s role.

Enable automated expense categorization and reporting

Integrating your cash back business credit card with your accounting software—either through a direct integration or spend management software like Order.co—enables you to automatically apply the appropriate general ledger codes to each transaction to eliminate the need for manual intervention.

Start earning cash back today with Order.co

Order.co offers the combined value of enhanced spending controls and a more flexible and efficient procurement workflow. The platform seamlessly integrates with your existing accounting software and features customizable workflows for simpler, more efficient spend management.

With Order.co, you gain access to tools that help you optimize and improve:

- Spend management: Automate purchasing, payments, and approvals

- Control: Create custom spend controls, vendor catalogs, and reports

- Bookkeeping: Accelerate reconciliation, audits, and transaction coding

For more on how Order.co’s virtual credit cards help you boost purchasing efficiency and achieve more procurement savings, book a free demo today.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business

"*" indicates required fields