How Do Business Credit Cards for Fair Credit Work?

How Do Business Credit Cards for Fair Credit Work?

A fair credit rating may limit your options when it comes to applying for a business credit card, but that doesn’t mean there aren’t plenty of good card programs available. While traditional credit cards are often the first solution that comes to mind, options like corporate cards and virtual cards can provide increased control, visibility, and flexibility without relying on your personal credit score.

This guide breaks down the best business credit card options for fair credit, explains how to choose a card that aligns with your growth strategy, and highlights the benefits of using virtual cards to centralize company spend.

Download the free ebook: Choose the Right Procurement Technology With This Decision Matrix

What counts as “fair credit” and why it matters

A fair credit rating sits below the "good" credit threshold but above a poor credit rating, typically shown on a credit report as a FICO score between 580 and 669. While a fair credit rating shows some financial reliability, it can limit your access to premium financing options and often comes with higher interest rates or stricter terms.

For businesses, a fair credit score can make it harder to secure loans, negotiate favorable vendor terms, get approved for traditional business credit cards, or lease essential equipment or real estate.

Improving your credit score helps build a foundation of financial credibility that supports sustainable growth. It allows you to use business credit strategically to improve cash flow, access better financing, and strengthen supplier relationships.

Best business credit card options for fair credit (2026 comparison)

Many business credit card issuers consider both personal credit and business factors when evaluating applications, especially for new businesses or those without an established credit profile.

While a fair credit rating limits your options, several good solutions remain:

- Order.co’s virtual cards: Best for spend control and vendor management

- Capital One Spark 1% Classic: Best unsecured option

- Capital on Tap Business Credit Card: Best for fast access and rewards

- Bank of America Business Advantage Unlimited Cash Rewards Secured: Best for cash back rewards and credit building

- FNBO Business Edition® Secured Mastercard®: Best for high deposit flexibility

- Ramp corporate cards: Best for automation and control

- BILL Divvy Card: Best for budgeting tools

Note: The information below is accurate as of October 2025.

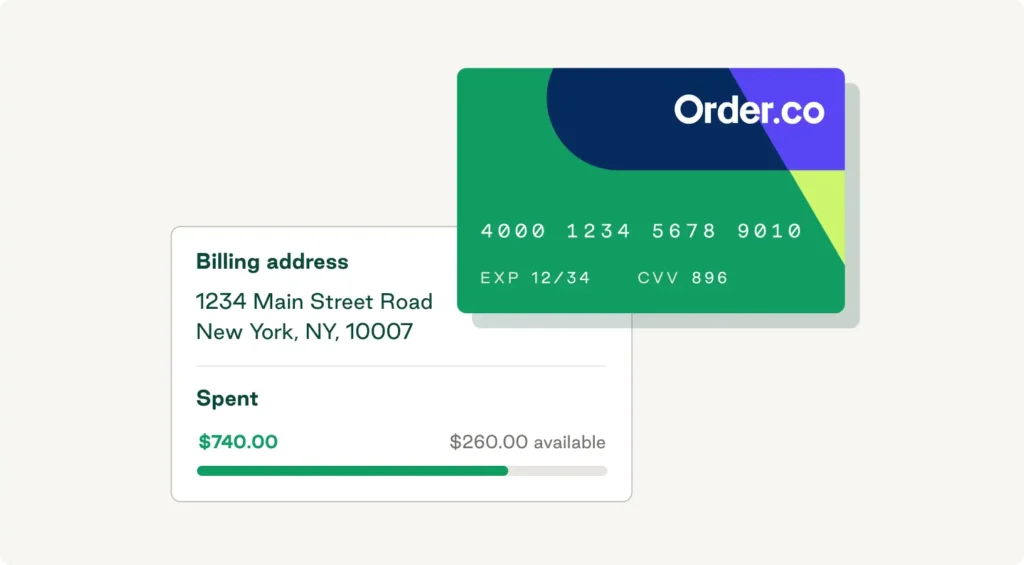

Order.co virtual cards

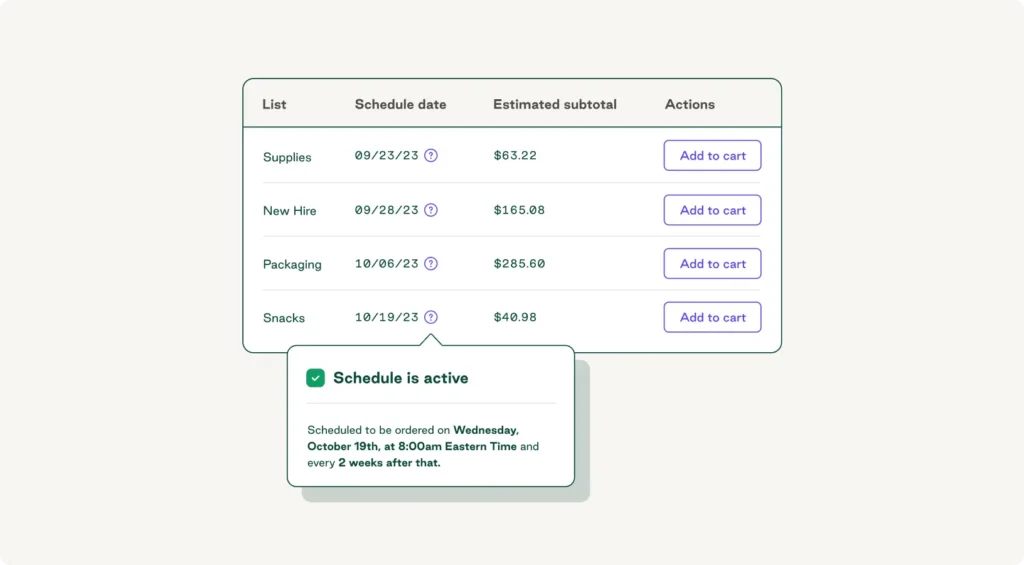

Order.co’s virtual cards are not traditional credit cards because they don't rely on personal credit for approval. Instead, eligibility is based on your business itself. As part of a comprehensive procure-to-pay platform, these cards tackle challenges that traditional credit cards often overlook, such as granular vendor spend control, real-time visibility into every transaction, automated payments, and simplified card reconciliation.

You can issue virtual cards for individual users, specific vendors, or distinct projects, each configured with customizable spending limits, expiration dates, or vendor‑lock features that prevent use outside approved parameters. Every transaction appears instantly in your dashboard, providing immediate visibility with fewer manual steps.

For businesses with fair credit, these cards don’t replace traditional credit cards—they complement them by improving spend management, increasing operational efficiency, and safeguarding working capital for growth.

Unsecured business credit cards for fair credit

Unsecured business credit cards don’t require a security deposit, meaning you don't have to provide any upfront cash and don't stand to lose your deposit if you miss a payment. They typically offer lower limits and fewer perks than cards for businesses with good or excellent credit, but they still allow businesses with fair credit to access rewards programs and build credit through responsible usage.

Capital One Spark 1% Classic

Capital One’s Spark 1% Classic credit card is a reliable unsecured card for fair credit that provides solid rewards, enables access to digital expense management tools, and supports credit-building. It has no annual fee and gives 1% cash back on every purchase with no limits or category restrictions, plus unlimited 5% cash back on hotels and rental cars booked through Capital One’s travel booking site.

Capital on Tap Business Credit Card

Capital on Tap’s Business Credit Card is a flexible, unsecured rewards credit card for businesses with fair-to-good credit. It offers 1.5% cash back on all card spending, a credit limit of up to $50,000, and variable APRs starting at 17.24%. With no annual, foreign exchange, or ATM fees, it can help you reduce your purchasing costs while you build a better credit score.

Secured business credit cards for fair credit

Secured credit cards provide a practical path to building credit for businesses that don't yet qualify for an unsecured card. They require an upfront security deposit, usually equal to your credit limit, and offer easier approval and credit-building benefits. In some cases, secured cards also provide better rewards than unsecured fair-credit alternatives.

Bank of America Business Advantage Unlimited Cash Rewards Secured

Bank of America’s Business Advantage Unlimited Cash Rewards Secured credit card helps build or repair credit while earning rewards—a rare benefit for a secured card. It has no annual fee, offers 1.5% cash back on every purchase, and provides flexible redemption options. The minimum security deposit is $1,000.

FNBO Business Edition® Secured Mastercard®

The FNBO Business Edition Secured Mastercard credit card provides fair-credit businesses with a high-limit secured option that scales with available cash. It has a $39 annual fee and access to Mastercard® Easy Savings automatic rebates. Your deposit (ranging from $2,000 to $10,000) is held in an interest-bearing account and directly determines your credit limit, subject to approval.

Corporate cards with no personal credit check

Corporate credit cards evaluate your company’s financial health—namely, your cash flow and banking history—instead of relying on personal credit. Since they don't typically report to credit bureaus, they won't help build your credit score. Instead, their main benefits are operational efficiency and spend control.

Ramp Corporate Cards

Ramp cards earn cash back on all purchases with no annual, transaction, or foreign transaction fees. They don't require personal guarantees or credit checks for qualifying businesses, instead determining eligibility based on your company's financial health and bank account activity. Ramp emphasizes automation, real-time spend visibility, and improved operational controls.

BILL Divvy Card

BILL’s Divvy Card is a no-credit-check corporate card with flexible rewards, advanced budgeting tools, and no annual fee. It features a line of credit from $1,000 to $5M based on business cash flow (may require underwriting), making it a highly scalable option for businesses with a fair credit score.

Like Order.co, BILL provides virtual corporate cards with customizable budgets and automated expense tracking. However, Order.co goes beyond what most corporate cards offer to deliver vendor-level visibility, AI-powered spend analytics, and automated solutions for every stage in the procure-to-pay cycle.

What should you consider when choosing a business credit card with fair credit?

Selecting the right business credit card for fair credit isn’t just about qualifying—it’s about finding a solution that aligns with your financial goals and growth objectives.

Here are some factors you should consider when evaluating different card options:

- Secured or unsecured: Unsecured cards are better if you want to avoid paying a security deposit and gain immediate access to a credit line, while secured credit cards offer easier approval and can help you maximize credit-building impact.

- Credit reporting: Cards that report to business and personal credit bureaus help you build your business credit score. Cards with no credit check typically report to neither but are more accessible.

- Fees: Depending on your spending habits, card fees may or may not be balanced out by financial benefits. Calculate whether the bonus rewards (for example, 1% cash back on all eligible purchases or 0% intro APR) justify any annual fees, transaction fees, or foreign exchange fees.

- Credit limit: Most fair-credit cards have an initial limit of $1,000–$5,000. Ensure this meets your cash flow and business needs, and check whether it's possible to increase the limit as your company grows.

- Extra features: Operational benefits can be more valuable than rewards. Look for employee cards, expense management tools, and accounting software integrations.

To make a smart decision, choose cards that match your priorities and growth trajectory. Are you focused on rebuilding credit? Or is operational efficiency a higher priority than immediate rewards?

How can business credit cards help you build credit strategically?

Payment history accounts for 35% of your credit score, making it the largest single factor. If you use business credit cards responsibly—making monthly payments on or before the due date—every on-time payment will strengthen your credit profile. Using a complementary tool like Order.co lets you automate payments and centralize spend tracking to ensure timely payments.

The percentage of available credit you’re using, known as “amounts owed,” is the next largest factor affecting your credit score (30%). By keeping card utilization low, you can maximize the credit-building impact.

Length of credit history also represents a significant portion of your credit score (15%). An older business credit card with a longer credit history strengthens your credit profile more than a new card, so keep accounts open even after you qualify for better options.

Align your credit strategy with Order's procurement tools

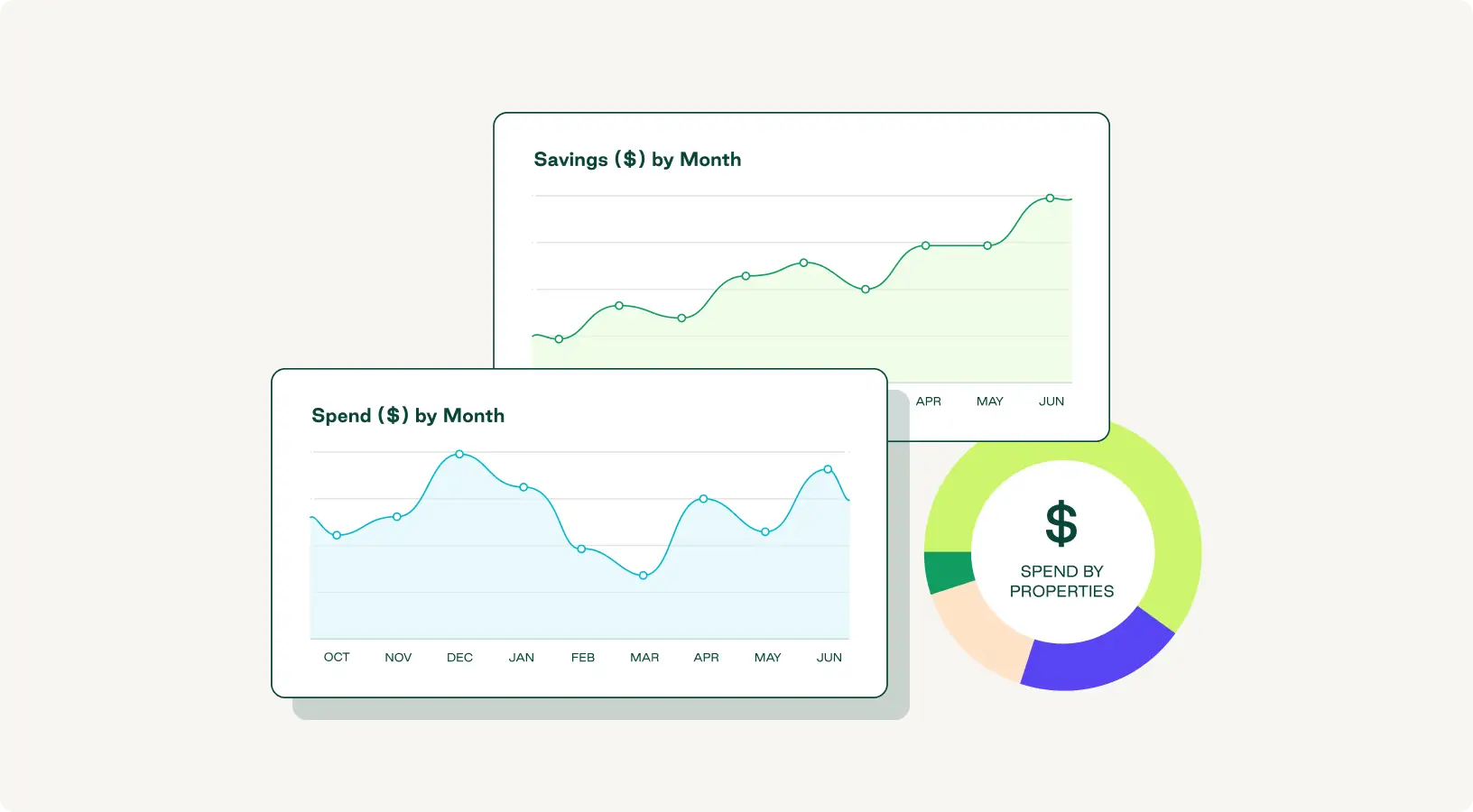

Building business credit through responsible card usage is important, but controlling company spend and managing vendor payments are equally critical. Order.co helps businesses tackle operational challenges that traditional credit cards can't address.

Order.co's virtual cards help prevent overspending and improve spend visibility with customizable controls, real-time spend analytics, and cardholder-level policy enforcement. You can also leverage Order.co’s procurement catalog to replace manual purchasing processes with automated approval workflows, providing total spending transparency for strategic decision-making.

Schedule a free demo to see how Order.co’s virtual cards can help your business operate with enterprise-level efficiency—even with a lean finance team.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your busines

"*" indicates required fields