Vendor Payment Automation: Improve Process Efficiency & Cut Costs

Vendor Payment Automation: Improve Process Efficiency & Cut Costs

Traditional payment processes are time-consuming and expensive, opening the door to late payment fees and fractured supplier relationships. Valuable work hours get eaten away by the repetition of mundane tasks like chasing down paper invoices, manually routing approvals, and performing endless data entry.

Vendor payment automation flips the script on processing and paying supplier invoices. Where manual systems drain company resources, automated software solutions drive efficiency and unlock opportunities to improve cash flow management.

This guide answers essential questions about vendor payment automation, exploring how it works, the benefits it delivers, and strategic best practices for successful implementation.

Download the free tool: Invoice Tracking Template

What is vendor payment automation?

Vendor payment automation is the use of technology systems to improve the speed and efficiency of capturing supplier invoices, approving and sending payments, and reporting on historical spend.

According to Ardent Partners’ 2024 State of Epayables downloadable report, the average accounts payable (AP) team spends $9.40 and nearly 10 days processing each invoice. On top of that, manual invoice processing has a high error rate that can result in missed or late payments that weaken supplier relationships.

By automating critical workflows within the vendor payment process, you can drastically reduce the time and cost of managing supplier invoices and capitalize on savings opportunities such as early-payment discounts.

How does vendor payment automation differ from AP automation?

Although 49% of AP departments currently use automation, the tools used vary widely in functionality and purpose.

Vendor payment automation focuses specifically on automating the end-to-end process of paying supplier invoices. Accounts payable automation, on the other hand, refers to the use of technology to transform the entire accounts payable lifecycle, from invoice receipt to month-end reconciliation.

In simple terms, vendor payment automation targets the critical last mile of the AP process—ensuring vendors are paid accurately, on time, and with minimal administrative cost to your organization.

Key components of an automated vendor payment system

An automated vendor payment system is the software that enables workflow automation. Different systems vary in complexity, cost, and functionality, but there are a handful of key features every good solution should have.

Essential components of automated vendor payment systems include:

- Centralized vendor management: A digital database containing all your supplier details, banking information, payment preferences, and contract terms

- Automated approval workflows: Configurable, multi-level matrices and controls that automatically route invoices to the appropriate stakeholders for approval

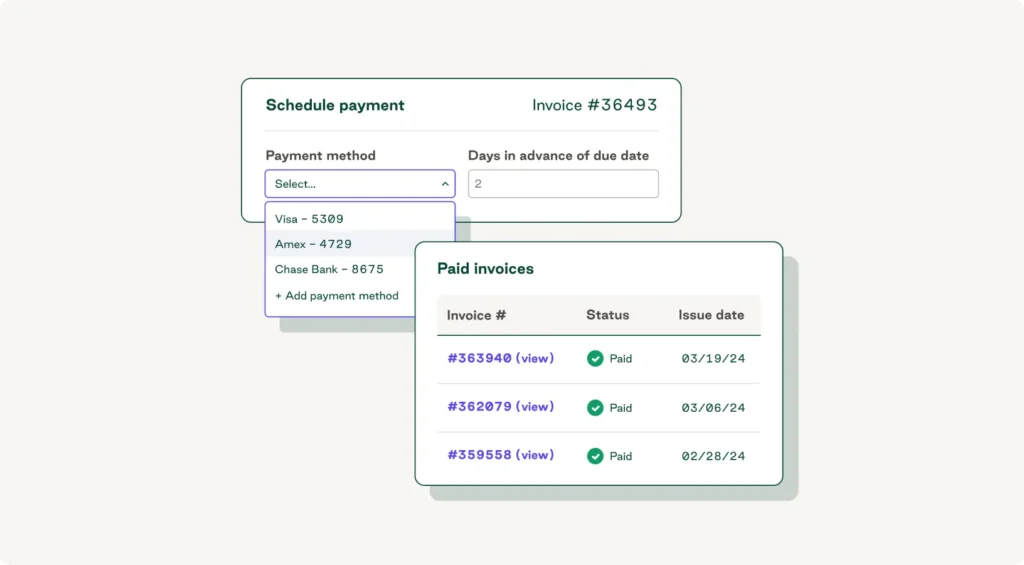

- Payment processing and scheduling: The ability to automatically pay suppliers using their preferred method and schedule payments to optimize cash flow

- Accounting and ERP integrations: Real-time, two-way connections with your financial software for fast, error-free payment reconciliation

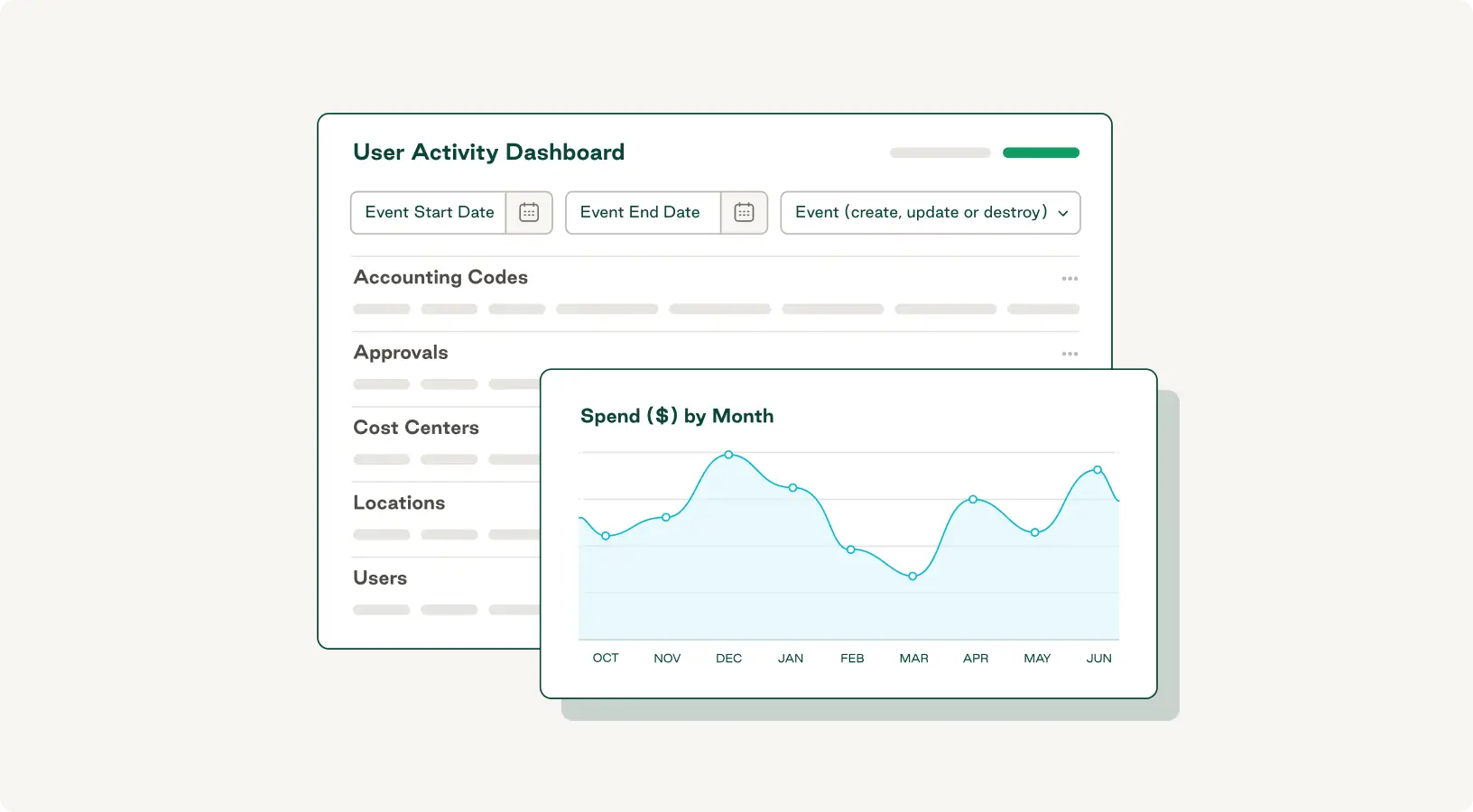

The best vendor payment automation software also provides advanced reporting functionality and live spend performance dashboards to help you analyze spending patterns, monitor ongoing vendor performance, and identify opportunities to optimize workflows further.

What are the benefits of vendor payment automation?

Automating vendor payments transforms invoice management from a resource-draining liability into a powerful strategic lever by enabling faster processing, reducing costs and delays, and strengthening cash flow and supplier relationships.

Faster, more predictable payments

Automated solutions ensure your vendors get paid on time, eliminating the delays and confusion caused by manual payment approval routing and data entry errors.

When the team at First Learning partnered with Order.co to optimize their invoice management workflows, they went from processing hundreds of invoices weekly to just 16 per month. By replacing paperwork and manual processing with automation software, the company now pays all invoices by their due dates, and its finance team no longer worries about canceled deliveries due to late payments.

Improved working capital management and cash flow

More control over payment timing means more control over working capital. With automated payment scheduling, you can align invoice payments with your cash flow strategy to retain cash longer or pay early to capture vendor discounts.

Stronger vendor relationships and early-pay discounts

Manual vendor payment processes can create friction through human errors and delays that lead to late or missed payments. This means greater fee frequency, reduced negotiation leverage, and increased vendor frustration.

Vendor payment automation software builds trust with your suppliers through improved visibility and more reliable payments. It also enables you to capture early-payment discounts that directly improve bottom-line performance.

Reduced late-payment fees and processing costs

The hard costs of manual invoice management are significantly higher than those of vendor payment automation. Automated systems replace time-consuming manual tasks with one-click solutions.

In one automation case study, industry-leading patient care company, Physical Rehabilitation Network, achieved 99% spend visibility and saved an average of $3,000 per month on AP processes by using Order.co to eliminate manual data entry, manual routing, and late-payment fees.

What are the best practices for implementing vendor payment automation?

A tool is only as useful as the person wielding it—and automation systems are no different. To get the most value from your vendor payment automation software, follow these best practices.

Creating effective approval matrices and controls

Leverage the software’s configurable approval rules to minimize the time spent routing invoices and resolving discrepancies. Establish approval matrices that define who is responsible for approving specific cases and set controls that prevent teams from acting against company policies.

Order.co offers customizable, granular approval workflows that prevent missed or late payments by ensuring every invoice is routed to the correct approver and every exception is dealt with quickly and efficiently.

Managing vendor onboarding and enablement

A smooth onboarding process minimizes friction, supports healthy supplier relationships, and improves the efficiency of vendor management. The best solutions also enable digital payments using the payment methods preferred by suppliers.

With vendor centralization tools, such as Order.co’s automated catalog creation, you can scale your vendor network without sacrificing time or money.

Ensure easy integration with your financial systems

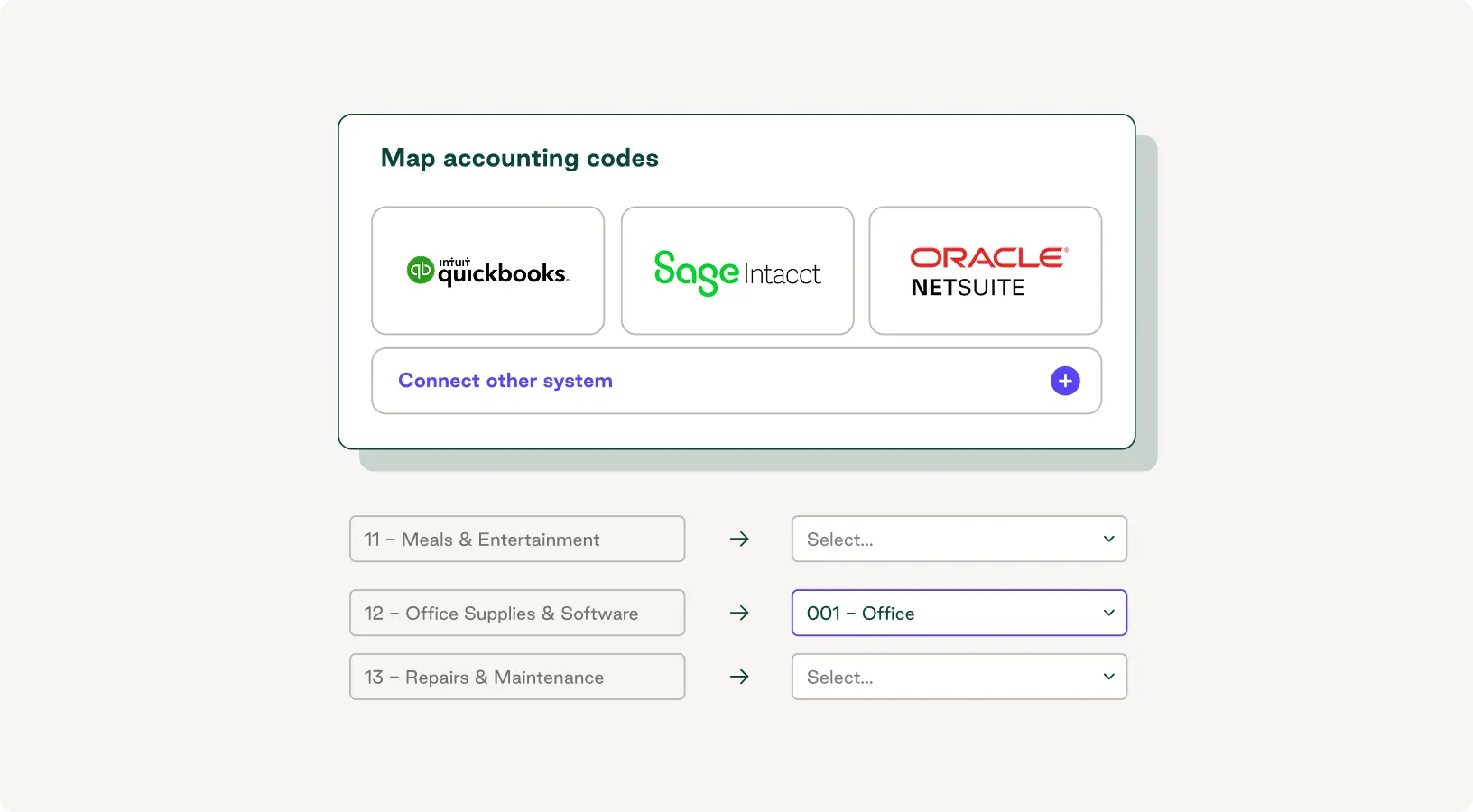

Accounting integrations are essential for fast, easy reconciliation. Invest in a platform that provides reliable two-way connections with your chosen financial software or ERP system to save time on setup, minimize manual work, and keep your accounts payable ledger accurate and up-to-date.

Order.co offers seamless integrations with industry-leading accounting systems, including QuickBooks Online, NetSuite, and Sage Intacct. The platform's three-way matching functionality enables you to instantly compare invoice data with the original purchase order and goods receipt note to avoid slowdowns in payment processing.

Avoiding common pitfalls in payment automation projects

Your implementation project has the best chance of success when you proactively address the most common automation challenges and bottlenecks. These include slow user adoption, high exception rates, and a suboptimal balance between controls and flexibility.

Prioritize change management and user adoption planning

Change management is an excellent defense against poor adoption rates. Assign key stakeholders from each department to communicate the new ways of working and establish user-specific training programs. Put extra emphasis on how automation will make tasks easier for each employee.

Manage exceptions and edge cases effectively

An automated system works best when it’s empowered by strategic human thinking. Configure your controls to flag and route exceptions, but don’t expect even the smartest tool to understand the intricate nuances of every case.

Assign a knowledgeable team member to resolve discrepancies, such as disputed invoices and one-off payment types, to prevent further delays or issues.

Maintain controls while enabling efficiency

Automating vendor payment processes should make it easier for your team to do the right thing (and harder to do the wrong thing). Implementing strict role-based permissions that enforce company policies is the most effective way to achieve this.

Be proactive in adjusting user permissions and approval rules to prevent bottlenecks in your vendor payment lifecycle.

Measuring the ROI of an automated invoice-to-pay process

To track how effectively your vendor invoice automation solution works, focus on quantifying these three core benefits:

- Hard cost savings and efficiency gains: Calculate your cost-per-invoice before implementing automation—including labor, materials, and fees. Track the reduction after the new system is live to identify the dollar value of your ROI.

- Vendor satisfaction and relationship improvements: Measure the reduction in vendor inquiries about late payments and the increase in early-payment discounts captured since implementation.

- Fraud prevention and risk reduction: Identify enhanced controls that prevent fraud and minimize risk—such as vendor authentication portals, audit trails, and automated exception flagging—to better understand how much more secure your new processes are.

You can also use your software’s reporting dashboard to track hidden cost savings. Order.co, for example, lets you generate granular reports to break down spend by user, vendor, and location, helping you identify reduced spend and forecast future costs.

Order.co for vendor payment automation

Manual processes are the enemy of efficient workflows, compliant invoice management, and healthy supplier relationships. Order.co is an effective end-to-end solution for optimizing the vendor payment lifecycle to drive more value from your AP workflows.

With Order.co, you get access to powerful invoice management features that help you:

- Centralize supplier information and simplify vendor onboarding

- Automate invoice processing and approval workflows

- Instantly share invoice data with your existing accounting automation software

- Monitor spend performance in real time with live reports and dashboards

- Eliminate manual data entry, late payment fees, and invoice errors

Schedule your personalized demo to see how Order.co can automate vendor payments and transform your accounts payable process.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields