Business success demands effective decision-making, on-time reporting, and accurate data entry. Still, sometimes errors enter the system—and poor invoice processing is a primary reason.

Users may not discover inaccuracies caused by an incorrectly processed invoice until they prepare the accounts payable (AP) trial balance. This leads to late reporting and delayed decisions. If no one discovers the errors, executives might make decisions based on inaccurate reports.

Accuracy in accounts payable trial balance is crucial. It positively impacts working capital to improve operational control and future planning. To demonstrate how your business can ensure an accurate trial balance and improve processing (so you can reap the rewards of control and planning), we discuss:

- AP invoice processing and AP trial balance preparation

- The value derived from improved invoice processing

- Nine common causes of inefficient, multi-site processing

- How accounts payable trial balance errors impact your vendors

- The solution for first-time-right trial balances and how Order.co helps you deliver them

Download the free ebook: How Automation Can Solve Finance Teams’ Biggest Challenges

What is an accounts payable trial balance?

The accounts payable trial balance—also called the accounts payable trial balance report—is a listing of the end balance in the chart of accounts. It includes subtotals for partial and unpaid invoices appearing on each general ledger (GL) account.

The AP trial balance enables accounting to post payable liabilities to the general ledger. Accurate and comprehensive inclusion of those payable liabilities helps the business reconcile initial journal entries, bookkeeping records, and sub-ledger balances with bank statements and other documents. The amounts are later totaled and posted to the correct general ledger account. They eventually appear as current liabilities on the balance sheet.

Trial balance and invoice processing: The main points to consider

The C-suite creates business success by ensuring all external and internal actions deliver intended results efficiently and accurately. Every aspect of corporate finance significantly impacts outcomes, particularly the AP process. While accounts payable is only part of the overall accounts structure, effective invoice processing is a valuable subtask to prioritize.

Invoice processing improves when your accounts payable account is accurate, fully inclusive, and timely. Therefore, accuracy and transparency become the norm across the entire accounts payable processing system. Together, they enable greater accuracy to support C-suite decision-making.

Here are some common positive outcomes of accurate accounts payable:

- Operations maximize working capital

- Companies allocate funds to spur growth versus maintaining current operations

- Vendor relationships improve

- Accounting team members work more efficiently

The value of improved invoice processing

Accurate invoice processing determines overall control of the accounts payable process. It enables AP teams to make the best use of cash and available credit within an accounting period.

Accuracy and timeliness, in many instances, come from adopting a comprehensive, automated AP system that offers validation and tracking for accounts payable, accounts receivable, expense account data, etc.

The gold standard is an automated AP system that handles daily transactions and produces the required management and financial reports for that accounting period, including the trial balance report.

9 Common pitfalls of multi-site AP processing

Businesses with several sites, functions, and divisions often create accounting process silos. Each site, function, and division has a separate bookkeeping system to record and account for its procurements and payments. This may extend to separate order approval, procurement, and accounts receivables processes.

Individual procurers in each location may have the same preferred vendors for products and services as other procurers. However, if they order separately, it duplicates efforts and robs the company of leverage.

Redundant and siloed ordering affects the business in several ways:

- Multiple invoices matching each order and delivery

- Maverick spend and budget waste

- Missed opportunities for bulk discounts

- Poorly negotiated terms and conditions

- More complex invoice processing

- Increased invoice exceptions and errors

- Potential for procurement fraud

- Higher overall spending and overhead

- Weakened cash position and credit access

Problems of interim trial balance reports

Beyond ineffective and decentralized purchasing, each site or function often prepares separate financial statements up to a predetermined level. For example, they may:

- Balance the accounts payable and receivable ledger accounts

- Produce separate (balanced or unbalanced) AP trial balance reports

- Have separate operating and P&L Accounts

Bookkeeping entries, account balances, and any supporting documentation go to the head office. They’re then summarized for the accounting period. After reconciliation, the AP teams use the balances to create an overall trial balance report before posting it to the general corporate ledger. Alternatively, the approved reporting system may require each site or silo to prepare basic bookkeeping figures to be aggregated at the corporate level.

A major and common problem for head office-based accounts payable processing teams is that any errors in the interim AP trial balance reports are difficult to locate once they extend to the corporate level. One silo’s accounts payable trial balance may appear accurate because its debits and credits balance out. An error within an account number may have gone unnoticed.

Alternatively, an error of commission in one liability account may be balanced by an error of omission in another. The net result is that the errors may remain invisible until a vendor’s invoice amount is underpaid, overpaid, or missed.

The immediate result of such mistakes is more research and corrections work for AP. This wastes time and creates inaccuracies in finalized financial reporting. Miscalculated payable liabilities in the general ledger are concerning since the executive team may base decisions on faulty reports.

The downstream effect of inaccuracies in any AP trial balance reports is payment delays for vendor invoices. A vendor that has accepted orders, shipped products or services to separate sites, and submitted accurate invoices should have a reasonable expectation of timely payment. Failure to pay because of internal AP errors may lead to delivery suspensions or renegotiation of credit agreements.

A balanced trial balance may still not be accurate

Balanced AP trial balance reports are a prerequisite for producing accuracy across siloed departmental and corporate general ledgers. However, balanced trial balance reports may still have equalizing errors of omission or commission concerning debits and credits.

AP trial balances may also have errors of principle, such as if a clerk incorrectly posts a vendor’s invoice for services or materials to a capital acquisition account. This can result from something simple like a misunderstood product code or mistyped account number.

Therefore, a trial “balance of balances” is not a guarantee of accuracy. As a result, it cannot be relied upon to prove there are no unbalanced journal entries or that the financial statements will be accurate.

How Order.co helps accounts payable trial balance reporting

Accurate and timely reporting is essential for businesses to achieve and maintain financial control and for the C-suite to make valid decisions. Improving preparation starts with making improvements in AP invoice processing.

The goal is for AP processing to be simple and accurate. That helps ensure trial balance reports are accurate before you enter data into the general ledger and publish the balance sheet.

By implementing a procurement solution like Order.co, businesses automate and streamline many of the processes that lead to more accurate invoices and AP trial balances, such as:

- Avoiding the nine pitfalls common to multi-site procurement and processing

- Increasing visibility to improve capital efficiency

- Improving vendor relationships through timely, accurate payments

- Operating a transparent, automated system—from product sourcing to invoicing and payment

To learn more about improving your AP processing with Order.co, request a demo.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

The ability to manage cash can be the difference between life and death for a company. Exerting control over inflows and outflows with diligently managed accounts payable days is an important practice to keep your business stable, protect the company’s future growth, and maintain employee confidence in the company’s short- and long-term objectives.

Smart cash-flow maintenance also helps to maintain good relationships with suppliers, opening avenues for discounts and easier negotiations. Regardless of industry, having good contacts is the best way to increase investment in your business interests.

Let’s look at the days payable outstanding (DPO)—also known as Accounts Payable days (AP days)—measurement and how it impacts cash flow.

First, let’s review the accounts payable process and how DPO fits in.

Download the free tool: Financial Audit Preparation Checklist

What are accounts payable?

Accounts payable (AP) are accounts in a general ledger that represent a company’s commitment to paying off short-term debts owed to suppliers or creditors after purchasing goods or services on credit instead of with cash up front. The company can acquire what it needs now, and pay suppliers within an agreed-upon time frame (usually Net 30 to 90).

On a balance sheet, accounts payable are listed under the company’s current liabilities, because goods were bought on credit. The debts have to be paid on time to avoid default.

Like any other liability account, accounts payable will have a credit balance. When an account payable is paid, accounts payable will be debited and cash will be credited. The credit balance in accounts payable should be the same amount as the vendor invoices that have been recorded but have yet to be paid.

The AP department in an organization is responsible for tracking and verifying invoices, communicating with suppliers, and making the scheduled payments.

Under the accrual method of accounting, expenses are reported when they are incurred, not when they are paid. The company that receives the goods or services on credit has to report the liability no later than the date they were received. That date is used to record the debit entry to an expense or an asset account.

The accounts payable process

The accounts payable process ensures that the transactions listed in your accounting system are accurate and legitimate. The most important information exists in the following documents:

- Purchase orders issued by the company

- Receiving reports issued by the company

- Invoices from vendors

- Supplier contracts and other agreements

The accounts payable department is responsible for the following monthly activities:

- Processing accurate and legitimate vendor invoices

- Accurate recording in the appropriate general ledger accounts

- The accrual of obligations and expenses that have yet to be completely processed

What are accounts payable days (days payable outstanding)?

To better keep track of payments, companies can fall back on a reliable formula to help them pay bills and other obligations on time.

Accounts payable days, also known as days payable outstanding (DPO), is a financial ratio that shows the average number of days an organization takes to pay its bills to suppliers.

A low DPO may be considered a healthy DPO, but this isn’t always the case. They can then use the cash they have on hand to make short-term investments, increasing their working capital and freeing up cash flow.

At the same time, a too-high DPO value may signal an inability to pay bills on time. It can indicate a general cash shortfall. Each business should aim for a DPO that best suits its context. If the number of payable days changes, it could indicate that the payment terms with suppliers have changed.

If a company is paying its suppliers quickly, it may mean that the suppliers are demanding fast payment terms, either because short credit terms are part of their business models or because they feel the company is too high a credit risk to allow longer payment terms.

Days payable outstanding formula

Companies calculate DPO by multiplying the average accounts payable (the total of the beginning accounts payable and the ending accounts payable) by the number of days in an accounting period. This formula reveals the total accounts payable turnover.

That number is then divided by the cost of goods sold (COGS). Also known as cost of sales, COGS is the cost of acquiring or manufacturing the products that a company sells during a period. The ratio indicates how well the company manages its cash outflows.

DPO and the cash conversion cycle (CCC)

DPO value plays a role in calculating the cash conversion cycle (CCC). This is a metric that expresses the amount of time that a company takes to convert inventory investments and other resources into cash flow from sales.

While DPO focuses on the company’s current outstanding payables, the CCC (also known as the net operating cycle or simply cash cycle) follows the entire timeline. This extends from when the cash is converted into inventory, expenses, and accounts payable through to sales and accounts receivable, and then back into cash in hand when received.

Public companies reference DPO in their annual financial statements, income statements, and balance sheets.

How DPO is used

A well-run accounts payable process affects every level of a company’s cash position. Paying bills on schedule helps to develop a relationship with suppliers and improves your credit rating. Suppliers may also deliver better privileges, such as higher discounts, in return.

A company’s DPO metric can be used to demonstrate credit worthiness to potential lenders or credit-based suppliers.

It’s important to find the right balance in determining the right number of accounts payable days for your business. We covered the dangers of a higher ratio in the previous section. But keeping DPO low restricts the amount of cash available to reinvest in future opportunities.

In contrast, increasing accounts payable days demonstrates to creditors that the company is not in a position to borrow cash for short-term capital. A weaker company may face liquidity issues.

AP automation technology can help you manage your DPO so you can maximize your working capital while maintaining good vendor relationships.

Firsthand insights from AP automation technology adopters

Whatever the state of your company, having a clear system to pay vendors at the right times is a vital component of any business. Order.co can help companies with tasks such as organizing payment schedules, easily creating informative reports, and tracking payment variances to avoid exceptions and delays.

Order.co also automates the ordering process, freeing up more time for important day-to-day operations. Automated, proactive delivery tracking provides timely updates about the status of your shipments. Customers can complete orders 95% faster than before they began to use Order.co.

Our users have seen transformative effects on their businesses since they started using Order.co. These organizations are using our automation to streamline their processes, speed up order fulfillment, and optimize supply spending.

Here are a few case studies:

Zerocater

Before implementing Order.co, Zerocater needed one or two business days a month just to record payments and manage invoices. With our platform in place, the number of invoices they needed to complete decreased considerably—from 200 invoice payments to Amazon each month to just three or four. This reduction made it easier to track spending and wade through the ordering process. (More than 80% of our clients pay just one invoice per week or month.)

The Zerocater team also took advantage of Order’s real-time analytics features to add substantial visibility to their budgets. Their managers can see where every dollar goes and handle issues proactively.

SoulCycle

In their previous system, managers at SoulCycle had to jump through several unnecessary hoops to complete transactions. Each vendor site had its own rules and logins to keep track of. Users had to manually track transactions and its effect on their monthly budgets. This made payment reconciliation a long and challenging process.

Once the company began using Order.co, everything changed. Orders were fulfilled faster since employees could place orders from one approved catalog into one cart shared across every vendor. Reporting on expenses went from a five to six-hour monthly exercise to a fast single payment with one consolidated invoice.

BLANKSPACES

BLANKSPACES’ purchasing process was time-consuming, disjointed, and difficult to parse. Each month, purchases went unrecorded. Miscommunications between locations were common. But after working with Order.co, the purchasing workflow became simpler in a matter of minutes.

Acquiring supplies became much more cost-effective. The pre-established vendor network included with Order.co made setting up accounts payable schedules a breeze. In the words of facilities manager Elizabeth Nowlin, “Once we’ve added a product to Order.co, we know everything has been taken care of.”

Visibility and process are the first critical steps in attaining a successful DPO. By implementing a software system, you can optimize the procure to pay process and keep cash flow in check. To learn more about using Order.co to streamline your most important AP tasks, request a demo.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

When it comes to your company’s financial health, revisiting the basics can bring new perspectives to current problems. Consider a sports analogy:What do the world’s most famous coaches make their players do in the off season? Practice the fundamentals. Coaches have their teams practice rookie-level drills because it trains their minds and bodies to react with cat-like reflexes. They solidify the fundamentals to the point they're instinctual.

The same concept applies to any profession, whether you’re a novice or an expert. Even if you know the fundamentals, there is a reason for the adage, ‘Use it or lose it.’

That is why we are going back to the basics in this article to re-examine T-accounts.

Download the free tool: Financial Audit Preparation Checklist

What is an accounts payable T-account?

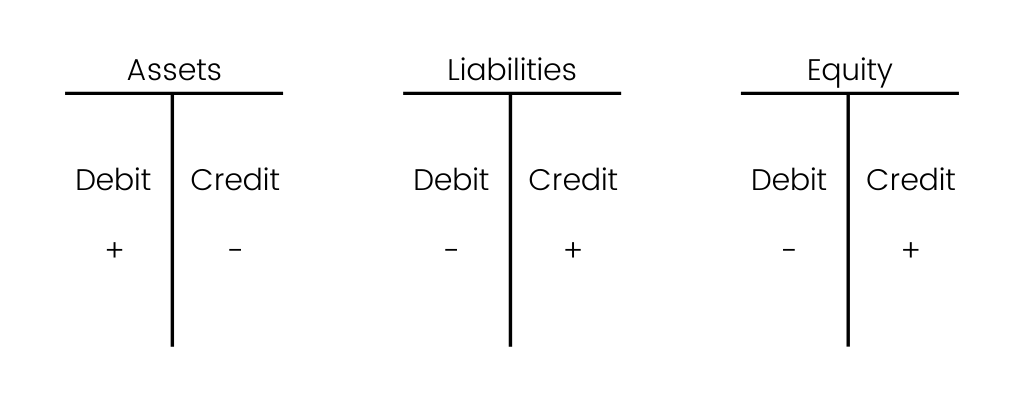

A T-account is named for the visual presentation of double-entry bookkeeping. The left side of the ‘T’ is where a debit is recorded in the general ledger, and the right side is for credits. Each account — whether it’s accounts payable, accounts receivable, payroll, assets, etc. — will have its own T-account setup. The account title sits above the top bar of the ‘T.’

In double-entry bookkeeping, each accounting entry affects at least two of the company’s accounts. When a debit is entered onto the left side of one account, it sends a credit to the right side of another account. The reverse is also true. If you enter a transaction on the credit side in one account, there will be a corresponding entry on the debit side of another account. In this way, debits and credits increase or decrease the corresponding accounts to keep the books balanced.

Examples of accounts payable T-account

T-accounts are a useful visual representation of many types of balance activities. Some common types of T-account representations are:

Assets: Cash transactions, accounts receivable, physical inventory, hard assets like furniture, or technical assets such as computers and phones

Liabilities: Accounts payable, loans, and notes payable

Revenue: Receipt of payment from customers for goods or services

Expenses: Costs incurred to run the business such as rent, supplies, insurance coverage, incidentals, travel, and utilities

Equity: The conversion of company funds into financial instruments, such as shares sold as part of employee stock purchase plans (ESPP) or incentive shares

T-Accounts and their role in accounting systems

The most common method for bookkeeping is the double-entry accounting system of T-accounts. For the balance sheet to be balanced, a business transaction entered into the system must take away from one account and add the same amount to another and vice versa. The most common reason for balance sheet discrepancies is a ledger account entry erroneously placed on the debit side or credit side of the wrong account.

The idea of an accounts payable T-account gets a little confusing for even the most seasoned professional bookkeepers. When using a T-account, you must ensure the correct figure is applied to the correct side of the ‘T.’ It’s common to think of a debit entry as a subtraction to an account and a credit entry as an addition to an account. But this is not always the case:

- Entering a debit (left side) transaction to cash accounts, accounts receivable, or asset accounts like inventory and PP&E increases the account. When you enter a credit (right side) into these accounts, it decreases the amount.

- For the liabilities or shareholders’ equity accounts, debit entry decreases the amount and a credit increases it.

- Income statements also rely on the accuracy of the accounts payable T-account journal entry to reflect accurate figures.

- Accounts that track expense accounts, revenue accounts, gains, and losses use the debit/credit method in the same way as accounts receivable. A debit transaction increases the revenue accounts and a credit entry decreases it. Conversely, a debit will decrease the amount for expense accounts, whereas a credit will increase it.

Case in point: If your business issues common stock, you debit the cash account and credit the shareholders’ equity account to reflect this. But if an employee leaves before their shares are fully vested, they forfeit their shares and you record it as a debit to the shareholder’s equity account and a credit to the cash account.

How do AP T-accounts help spend management?

T-accounts allow a business to easily track its spending. You can see journal entries over a given period of time and view business transactions. But a T-account doesn’t necessarily help your business make wise decisions regarding managing its spending intelligently.

Accounting software tracks your company’s balance sheet and income statements. But it can only give you dynamic figures that provide superficial insight into ways to improve spend management.

The biggest problem with every fast-paced business is identifying areas that are leaking cash unnecessarily. Obvious signs in your financial statements — such as the accounts payable figure being much higher than the accounts receivable — stand out. But without 100% visibility into your spend management, you’ll be left high and dry on how to curb your spending. Worse yet, you may find some balances inflated or deflated, painting a picture that may not reflect reality. Working capital, cash flow, and your bank account suffer as a result.

Streamlining accounts payable

Streamlining your accounts payable and accounts receivable processes may sound like a daunting task, especially when you work with a significant number of vendors. But eliminating maverick spend means finding ways to gain clarity on your company’s balance sheet. Simplifying your procurement process across different accounts with vendors is the first step toward reducing the time spent on the short-term process. This will significantly reduce money spent in the long term.

To help you understand what we mean, let’s take a look at the story of one of our customers, [solidcore]. As a health and wellness company, [solidcore] was expanding quickly with increasing demand for their products and services. In one year, they doubled the number of locations from 25 to 50. With such explosive growth comes a lot of chaos if you’re not properly prepared.

At first, [solidcore] held multiple accounts across multiple vendors and multiple users. Spend tracking was chaotic. The accounts payable department recorded receipts in the general ledger one by one, leading to a backlog. Without a proper purchasing management system, company executives couldn’t get real-time, accurate data on their cash flow, current assets, and expense accounts.

Since implementing Order.co, [solidcore] streamlined a process that once took at least two days and tons of back-and-forth emails for its 25 locations. Today, the process takes about four hours across all 50 locations. Now [solidcore] can see their spending at the product, location, and aggregate levels. With standardized processes steadily implemented in a more reliable manner, the company has much more transparency in its working capital and bank account balance than ever before.

Since implementing Order.co, [solidcore] streamlined a process that once took at least two days and tons of back-and-forth on emails for 25 locations. Today, the process only takes about four hours across all 50 locations.

Use Order.co to streamline accounts payable

Whether refining the fundamentals or digging deep to find innovative ways to streamline your accounts payable process, expertise requires your eyes to stay on the prize—but on potential hindrances, too. The figures on your company’s financial statements tell only a small part of the story even though they reflect the bigger picture.

Using the Order.co platform, many basic tasks such as reporting and visualization, invoice reconciliation, and spend analysis happen automatically within the platform. It takes the guesswork out of managing spending across locations and gives accounting professionals granular insight into every dollar flowing into and out of the organization.

Order.co offers growing businesses the most comprehensive and user-friendly accounts payable management & automation available. We invite you to request a free demo to learn more.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

To allow for more growth opportunities, accounting and finance teams must work together to explore 'creative' accounting systems that shift current assets around. Depending on the techniques used, some methods are merely exploiting legal loopholes. Others toe the line between 'creative' and downright fraudulent. Far more often, though, an inflated accounts payable balance sheet results from incongruities in record-keeping and inefficient accounting systems.

Regardless of the underlying cause or intent, the bottom line is this: if your company's balance sheet is not portraying an accurate picture, you're shooting in the dark. Your finance team can't turn insights into action if the big picture is incomplete. When your business isn't growing, it's stagnating. To help you avoid this potentially lethal pitfall, we're going to dive into an in-depth exploration of:

- How to recognize inflation on your balance sheets

- How errors and different regulations can cause inflation

- The business risks of inflation

- How Order.co can help solve inflated financial statements.

Recognizing inflated financial statement

As an equity shareholder or potential investor, understanding how to recognize inflated balance sheets is an invaluable bit of knowledge. The formula for calculating the inflated percentage is:

Inflation Level = (Goodwill - Brand Value) / Brand Value

Goodwill assets

Goodwill assets are usually the result of a company acquiring another business. Businesses consider them intangible assets under the long-term asset account. If the acquiring company pays more than the company's fair value, that is the target company's goodwill value. However, if the acquiring company pays less than the fair value, it has 'negative goodwill.'

Brand value

Simply put, the brand value is the purchase or replacement value of a brand. There are several ways to approach calculating brand value, which leads to it being a highly speculative figure. Regardless of the technique used, your accounts payable, accounts receivable, cash flow, long-term debt, short-term debt, and company assets will be examined in-depth. From there, analysts will apply various financial ratios and compare the results to your competitors.

Corporations with inflated balance sheets

It's a surprisingly common practice for mega-corporations to use legal loopholes to inflate their balance sheets. For example, Tesla recently came under fire from critics when their accounts payable and other short-term liabilities ballooned to more than $3 billion. That's an increase of $425 million from Q1 of 2020. By increasing the amount it owed to its suppliers, Tesla was able to show a higher cash account balance and push forward with larger projects.

Sometimes, entire industries are notorious for inflating balance sheets. One such industry is banking. Unlike their tech or pharmaceutical counterparts who have high-valued intangible assets that make them unique, the banking industry is a near-perfect competitive environment. Many people point to Bank of America when examining the banking industry and this practice.

Ways an accounts payable balance sheet can be inflated

Theoretically, there are countless ways to manipulate a company's assets. However, there are two ways that are the most common. The first is exaggerate earnings on the income statement. This is done by inflating the current period's revenue and cash flow, deflating expenses, or both. The second is the exact opposite of the first. A company's revenue is deflated, and the expenses are inflated.

Those approaches are examples of purposeful, legal manipulation to frame a company's total assets over a period of time in the desired way to attract investors and appease shareholders. But other ways that a company's financial statements can be inflated have less to do with framing and more to do with circumstance.

Changing regulations and standards

In 2016, the Financial Accounting Standards Board updated its lease accounting standards. Under the new standards, companies must record leases of more than 12 months for property or equipment on their balance sheets and liabilities. Previously, GAAP-accepted standards allowed leases to be classified as financing or operating leases. Only capital leases were required to be recognized on balance sheets.

Now, both types of leases are required to be recognized. This change means that the balance sheets of some companies will show inflated assets and liabilities but without any real change in their equity.

Errors in the accounts payable balance sheet

This is the most common reason for an inability to see a company's assets clearly. Errors involving transposed numbers in accounts payable, accounts receivable, or the general ledger can snowball quickly, leading to long-term problems. Often, data is misclassified; common instances include confusing long-term liabilities with short-term liabilities and vice versa.

For companies that lack a consistent accounting system, errors of omission are the most common problem. Take, for example, the case of BlankSpaces. As this small business expanded into new locations, their processes became much more chaotic as each new location had separate purchasing processes. This led to purchases of office supplies being lost or never recorded and other accounting inconsistencies. Each location had a separate credit card for purchases, and far too often, purchases were entered under the wrong credit card.

All the chaos meant their accounts payable balance sheet was consistently incorrect, inflated in some areas, and deflated. BlankSpaces is not alone when it comes to this type of stumbling block. Luckily, their AP department realized quickly that they were headed for disaster if they didn't find a way to shape all locations into a more cohesive unit.

With Order.co, they could eliminate using multiple credit cards and consolidate all accounts payable under one umbrella. Additionally, because Order.co has already established partnerships, they're saving additional time and money by not dealing with annual memberships.

Risks associated with inflated financial statements

There are a plethora of issues that can result from inaccurate bookkeeping and a bad account payable balance sheet. An inflated income statement may help in one area but lead to higher taxes, thereby canceling any perceived benefit. An accurate reflection of your current assets, accounts payable, and accounts receivable plays a fundamental role in forecasting, budgeting, and developing key performance indicators. But there is much more risk involved when your company's balance sheet is off. And, it goes far beyond bad forecasting.

Wasted time

time spend of staying on top of their accounts payable balance sheet was slashed from 8 hours to 20 minutes on average once they streamlined their workflow with Order. This represents a 96% reduction in time spent in that area so they could focus on attending to more important matters.

Reputation damage

While reputation is everything regardless of the business, a small business relies on this much more than a larger business. Why? Because most new small business customers come from word-of-mouth referrals. If word gets out that your small business is 'cooking the books,' customers may view that as a sign that your business is not trustworthy.

But it's not just your reputation with customers that's on the line. Inaccurate financial statements could mean traditional lenders turn you down or offer unfavorable payment terms for loans. Is potentially restricting access to the working capital you need to grow worth the risk?

Lastly, if your company issues statements of earnings to shareholders, you're really not going to want to have to say the company made significant errors. Issuing restatements that correct errors will cast doubt on your company's ability to get things done right.

Potential legal violations

A flawed accounting system can lead to serious headaches with more than just your shareholders and lenders. If your financial statements falsely convey an inflated valuation, you may find yourself in hot water with regulatory bodies. This is perhaps the number one reason to ensure you're always on top of bookkeeping issues and have accounts payable balance sheets you can trust.

Reduced valuation

If you're creatively managing your current assets to reduce your valuation, this could harm your ability to secure the working capital you need to grow in the future. Inflated current liabilities could make it appear as though your company is deeper in debt than it really is. An erroneous cash flow statement screams that you lack liquidity.

Poor spend management

An often-overlooked drawback of an inaccurate accounts payable balance sheet and other financial statements is that it can increase your debt levels unnecessarily. Unfavorable payment terms for loans, increased cost of goods sold, and inaccurate liquidity are all potential side effects of bad bookkeeping. Additionally, your reports will contain erroneous data that skews quarterly performance metrics or how actual spending compares to the budget.

Faulty ROI results

One of the most powerful arguments for automating your AP process is to capture the transformation's ROI accurately. You can evaluate the returns from accounts payable automation through measurable cost reductions and rebates. It is one reason why the results will be evident much sooner than most other forms of technological transformation happening across businesses today.

Streamlining spend management

Whether you have a new company that is just getting started or an established company looking for ways to integrate automation with legacy technology, you must make a solid plan to streamline your spend management and improve your accounts payable balance sheet processes. Using automated end-to-end financial tools will help mitigate the risks involved with manual, flawed accounting systems.

At the absolute minimum, your AP department should be looking for these features:

- Templates for commonly ordered products

- Tools that reduce labor spend on account payable and accounts receivable reconciliation by a number of days every month

- Ways to capture discounts by paying before the due date

- Tools that lower the cost of goods sold and office supplies by helping you negotiate better deals

- Ability to boost transparency company-wide

- Tools to increase liquidity and working capital

- Reports and dashboards so you can see current liabilities, total liabilities, cash flow, due dates, your accounts payable balance sheet, and other financial metrics in real-time

That is where Order.co comes in. Recruiting new talent, exploring new markets, and maximizing purchase power all depend on transparency in your financial data. Greater accuracy from the accounting department will give your finance team the tools they need to make more informed plans for growth. Seeing the big picture is impossible when pieces are missing.

None of the risk, all of the reward

We understand the challenges you face when running a lean and agile business. Internal and external stakeholders may be hesitant to change established accounts payable balance sheet and spend management processes. Concerns about ROI, integration abilities, and ease of adoption can be at the top of the concerns list.

But these concerns are exactly the reason Order.co is different from other spend management platforms. The return on your investment starts rolling in from the very start because there is no initial investment. Our strategic partnerships lift the responsibility of integrations off your shoulders and onto ours. Once it's customized to your business' needs, adoption is as simple as point and click. Schedule your free demo today!

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

![[eBook] How Automation Can Solve Finance Teams’ Biggest Challenges](https://www.order.co/wp-content/uploads/2022/09/finance-and-automation-ebook-640x480.jpg)