P-Card vs. Credit Card: How to Choose the Right Corporate Payment Solution

P-Card vs. Credit Card: How to Choose the Right Corporate Payment Solution

Choosing between a P-card and a corporate credit card isn’t just a financial decision—it can directly affect how smoothly your business runs every day. Since both payment methods have their strengths, understanding their differences can help you choose the best fit for your business.

Companies often use corporate cards to manage general organizational expenses like travel, entertainment, and operational purchases because they offer flexibility and, in many cases, rewards or purchase protections. P-cards, on the other hand, are designed for procurement, providing detailed spend controls, automated approval workflows, and simplified reconciliation to improve operational efficiency—though they do require upfront planning, employee training, and ongoing oversight to prevent misuse.

This guide breaks down the key differences between P-cards and corporate credit cards so you can choose the right card and provider for your needs.

Download the free ebook: Choose the Right Procurement Technology With This Decision Matrix

What is a P-card?

A P-card, or purchasing card, is a type of corporate credit card designed specifically for procurement activities. Organizations issue these cards to authorized employees who need to purchase goods and services from approved vendors, allowing them to complete small or recurring purchases without creating separate purchase orders or processing individual approvals.

Think of P-cards as controlled payment tools: They simplify buying while keeping purchases compliant. Unlike standard credit cards, they include built-in restrictions and controls that limit where, when, and how much cardholders can spend.

How do P-cards work?

P-cards operate on familiar credit card networks like Visa or Mastercard, but with added layers of control. Your organization sets employee spending limits, approves merchant categories, and defines transaction restrictions based on your procurement policies.

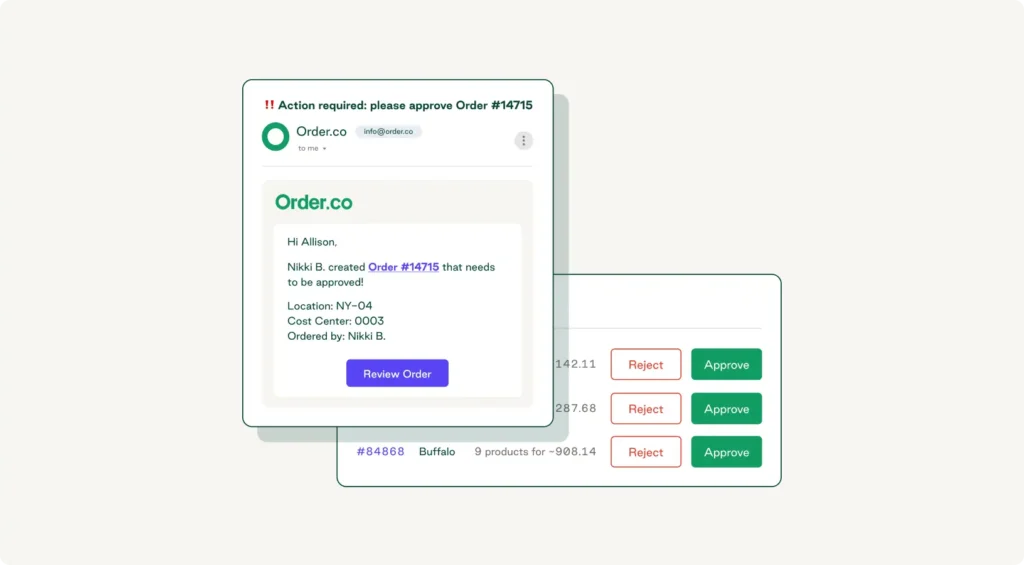

When an employee receives a P-card, they can make purchases within their assigned parameters. The system automatically declines any card transactions that fall outside those preset boundaries, and transaction data flows directly into your accounting system, often in real time. Employees submit receipts via an online portal or mobile app, and managers review those purchases according to established workflows.

What are the pros and cons of using a P-card?

P-cards make day-to-day procurement easier. They reduce administrative work by eliminating purchase orders for small transactions while using built-in spending controls to prevent policy violations before they occur. P-cards also offer enhanced visibility into spending patterns to improve budget management and enable faster reconciliation through automated transaction and receipt matching.

However, there are a few downsides to using a P-card:

- Implementation requires upfront investment and policy planning

- Some vendors charge processing fees or don't accept card payments

- Employee training is essential for program success

- Card misuse remains possible despite controls

What is a corporate credit card?

A corporate credit card is a payment card issued to businesses for various company expenses. These cards provide employees with a convenient way to pay for business-related purchases, such as travel expenses, client entertainment, and operational supplies.

Corporate credit cards often come with rewards programs, purchase protections, and expense management features. Approximately 27% of small businesses use credit cards for operational financing, while larger enterprises use them strategically to manage cash flow and earn rewards.

How do corporate credit cards work?

Corporate credit cards work through established credit card networks. Your business applies for a corporate card program, and the card issuer extends a credit line based on your financial profile. You issue cards to employees who need to make approved business purchases, and when they use those cards, the transactions appear on consolidated monthly statements. Most programs also provide online dashboards for real-time spending visibility.

The payment structure of corporate cards varies by program type. Some cards make companies liable for all charges, while others operate on an individual liability model where employees pay their balances and then seek reimbursement.

What are the pros and cons of corporate credit cards?

Corporate credit cards provide flexibility for varied business expenses and often offer rewards programs such as cash back, travel points, or other incentives. They can help companies build business credit and may provide purchase protections like extended warranties.

However, there are a few disadvantages to consider:

- Less restrictive controls increase the risk of misuse

- Reconciliation requires more manual effort

- Personal liability concerns can arise depending on the card structure

- Interest charges can add up if balances aren't paid in full each month

What are the main differences between P-cards and credit cards?

P-cards and corporate credit cards serve different purposes. Understanding their distinctions can help you deploy the right tool in the right situation.

| Feature | P-cards | Corporate credit cards |

| Primary purpose | Procurement and purchasing | General business expenses |

| Spending controls | Granular merchant, category, and transaction limits | Basic spending limits |

| Liability | Company liability | Company or individual liability |

| Approval process | Pre-authorized with controls | Pre- or post-purchase approval |

| Card reconciliation | Automated matching | Manual expense reporting |

| Use cases | Office supplies, maintenance, and small equipment | Business travel, entertainment, and flexible purchases |

| Rewards | Limited or none | Often included |

| Restrictions | Highly customizable | Minimal restrictions |

Control and restrictions

P-cards excel at providing detailed control over employee purchasing. Organizations can restrict cards to specific vendor types, set transaction limits, and establish daily or monthly spending caps. These controls operate at the point of sale, automatically declining unauthorized transactions.

Corporate credit cards offer broader flexibility with fewer built-in restrictions. While you can set overall credit limits, you typically cannot restrict purchases to specific merchant categories. This flexibility benefits employees who make varied purchases but requires stronger policy enforcement.

Spending controls

P-card spending controls operate at multiple levels simultaneously. You can set monthly limits per card, restrict purchases to specific merchant category codes, limit individual transaction amounts, and even restrict usage to certain days or times.

Corporate credit card controls focus primarily on total credit limits. You set a maximum spending amount per card, and employees can use their cards freely within that boundary.

Liability

P-cards typically operate under a corporate liability model. The company is responsible for all charges, regardless of whether the purchases were appropriate.

Corporate credit cards can use different liability structures. Corporate liability cards work like P-cards, where the company pays all charges. Individual liability cards make employees responsible for payment, with the company reimbursing approved expenses.

Reconciliation process

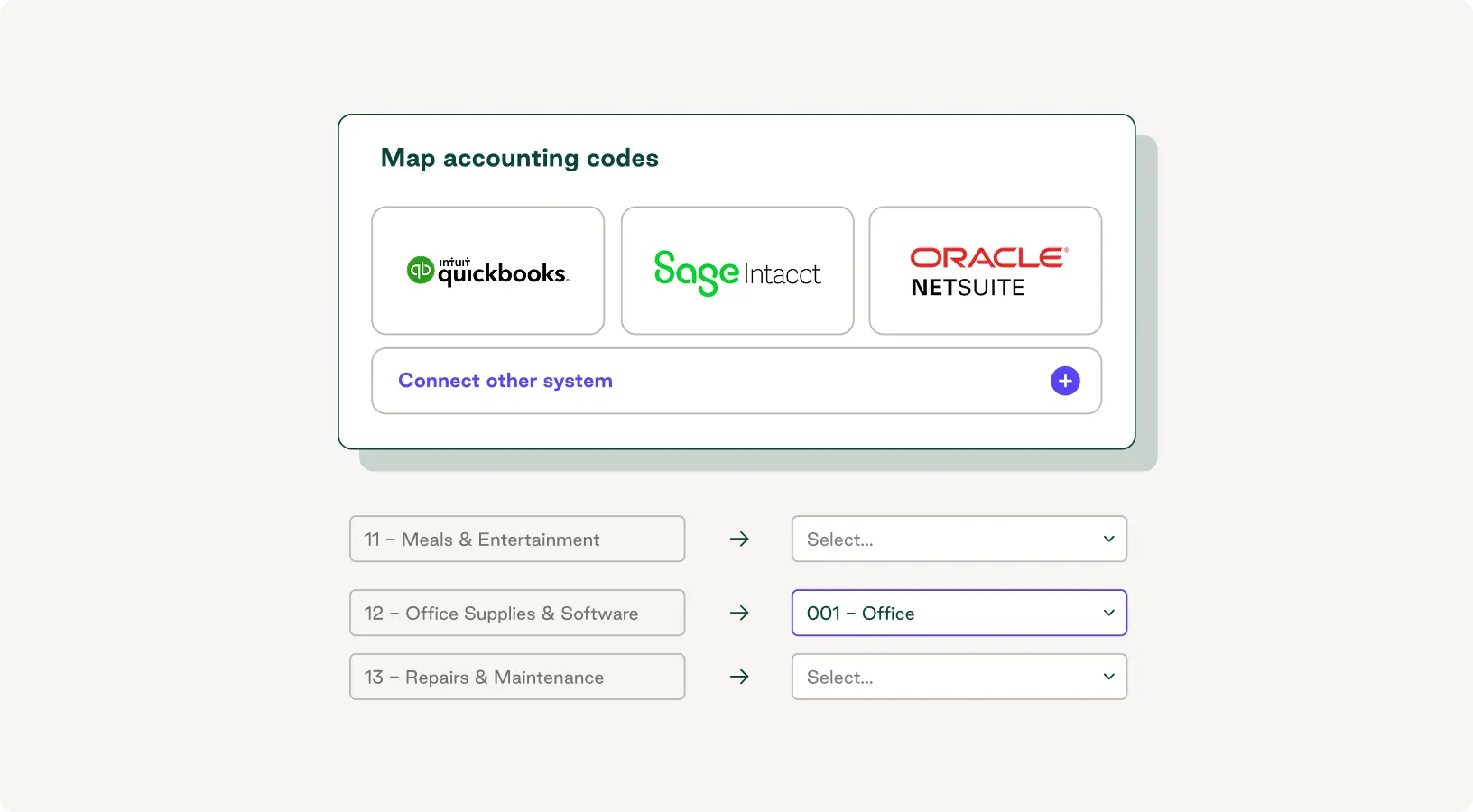

P-card reconciliation leverages automation and pre-purchase controls so transaction data flows directly into accounting systems, complete with pre-coded expense categories. Employees submit receipts through integrated platforms—such as spend management software—that automatically match them to transactions.

Corporate credit card reconciliation follows traditional expense reporting workflows. Employees compile expenses, categorize purchases, attach receipts, and submit reports for approval. This manual process consumes more time and introduces greater potential for errors.

Data and reporting

P-card systems automatically generate detailed spend analytics, which makes it easy to track purchases by department, vendor, category, employee, and time period. Since P-cards have real-time reporting capabilities, they're ideal for proactive spend management.

Corporate credit cards provide comprehensive transaction data, but they also require more effort to generate actionable insights. The variety of purchases and lack of pre-categorization mean finance teams must clean and organize data before analyzing it.

When should you use a purchase card vs. a credit card?

P-cards work best for routine, predictable purchases within defined categories. When you need strong spend controls and efficient procurement processes, purchase cards deliver superior results.

Corporate credit cards, on the other hand, are better suited for situations that require flexibility and convenience. When employees travel frequently, entertain clients, or make a variety of purchases, corporate cards provide the necessary adaptability.

What are the top P-card use cases?

You can use P-cards for many things, including:

- Office supplies and equipment: Purchase everyday items without generating purchase orders

- Maintenance and repair services: Pay for routine maintenance and minor repairs with immediate access to funds

- Low-value inventory replenishment: Reorder stock items and replacement parts efficiently

- Professional services and subscriptions: Manage recurring online purchases like software subscriptions and memberships

- Event and catering expenses: Purchase refreshments and rent equipment while staying within budget

What are the top use cases for business credit cards?

In addition to building business credit, you can use corporate cards for:

- Travel and entertainment expenses: Cover airfare, hotels, rental cars, and client entertainment

- Emergency purchases: Handle unexpected needs without authorization delays

- Large capital purchases: Accommodate furniture, major equipment, or bulk inventory orders

- Freelancer and contractor payments: Pay independent contractors or suppliers who accept card payments

- Cash flow management: Manage cash flow timing using payment grace periods

What to consider when choosing a card provider

The ideal card program for your organization depends on your priorities and core business objectives. To make the right decision, you need to weigh the relative importance of spend control, financial visibility, card rewards, and accessibility against your company's main goals and growth strategy.

How to choose the right P-card

To find the right purchasing card program, evaluate the level of spend control each option provides. The best P-card programs let you set multi-layered restrictions by merchant category, transaction amount, and daily or monthly limits.

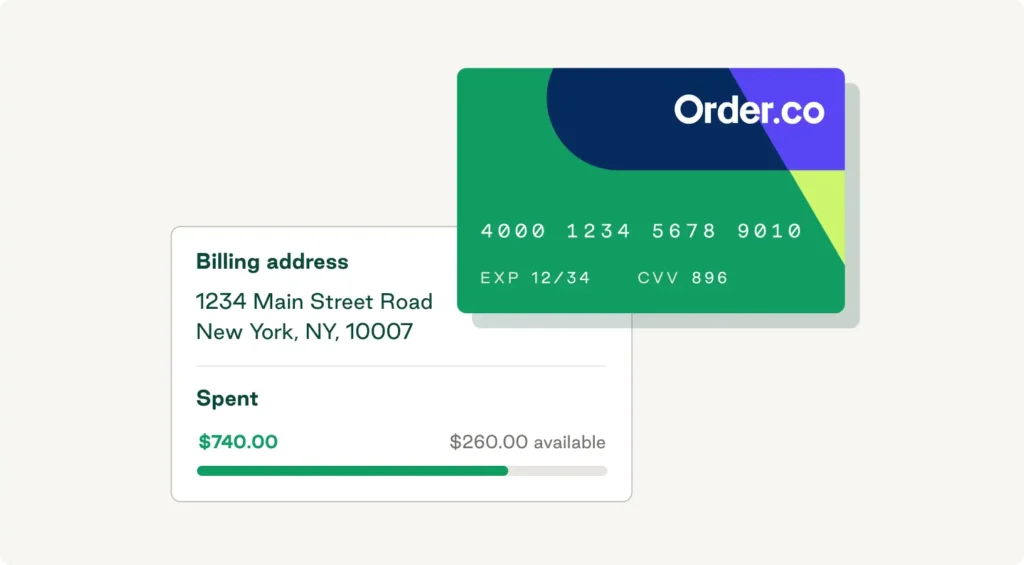

Order.co offers industry-leading P-card controls that adapt to your business needs. You can create custom spending policies for each department and adjust limits instantly.

Look for native integrations with your accounting software or ERP system. If you need real-time performance metrics, choose a provider that offers dashboards that show purchasing trends and policy compliance. Also consider the accessibility of the card program—these programs succeed when employees find them easy to use.

How to choose the right business credit card

The right corporate card should provide a rewards structure aligned with your purchasing habits. Analyze your spending patterns to determine whether cash back, travel points, or category-specific bonuses offer the most value.

Consider both credit limits and growth potential to ensure the card program can scale with your business. Expense management features—such as automated receipt matching, policy enforcement, and approval workflows—support scalability and simplify administration.

For accessibility and user experience, choose a provider that offers virtual card creation with customizable controls. For example, Order.co enables instant virtual card generation for subscription services and vendor payments.

Control spend with Order.co's cards

Order.co combines powerful P-card controls with corporate card flexibility in a single platform. It’s a complete spend management solution that adapts to your specific needs, whether you’re managing procurement purchases or tracking employee expenses.

With Order.co, you can manage all your business cards from one dashboard. Real-time spend tracking prevents budget overruns, and automated policy enforcement reduces administrative burden. The platform also integrates with existing financial systems to ensure seamless data flow.

Schedule a free demo to see how Order.co’s virtual business cards can help you strengthen spend control, reduce maverick spending, and lower purchasing costs.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business

"*" indicates required fields