P-Card Guide: What Are Purchasing Cards & How Do They Work?

P-Card Guide: What Are Purchasing Cards & How Do They Work?

Organizations are facing increasing pressure to optimize the procurement process and reduce administrative costs. P-cards, or purchasing cards, address both these challenges while also tackling an even greater one—ensuring company spending aligns with internal and regulatory policies.

This guide provides a comprehensive breakdown of P-cards, how they work, and keys to successful implementation. It also explores practical techniques for driving the most value from your purchasing card program through advanced analytics and best-practice use cases.

Download the free ebook: Choose the Right Procurement Technology With This Decision Matrix

What is a p-card?

A P-card, also known as a purchasing card or procurement card, is a type of corporate credit card that helps you simplify your company’s purchasing activities. P-cards are typically assigned to a specific employee or department to facilitate faster and more cost-effective procurement of routine goods and services.

According to Mastercard, 96% of businesses fail to pay invoices on time. In a traditional procurement workflow, the process of creating purchase orders (POs) and processing invoices for small, high-volume purchases consumes significant time and resources.

A P-card replaces this inefficiency while enabling procurement leaders to enforce tighter financial controls for pre-approved purchases.

What is the difference between a credit card and a P-card?

While P-cards are technically a type of credit card, they serve a different purpose than most corporate credit cards.

Credit cards prioritize consumer rewards and flexible spending options, and liability often rests with the cardholder. A credit card or commercial card is typically used for business expenses related to travel and entertainment.

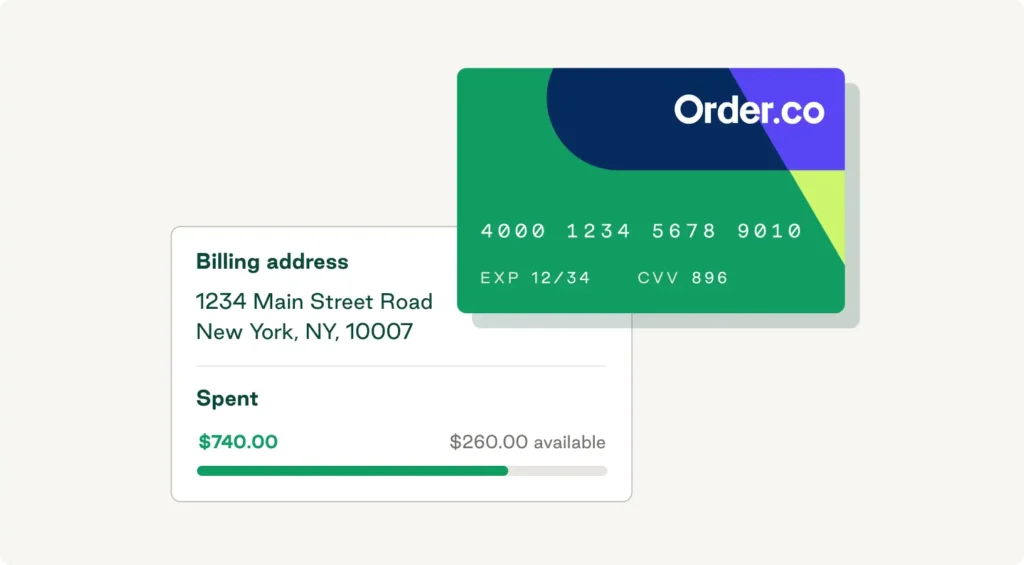

P-cards, on the other hand, come with pre-established granular controls, such as spending limits, merchant category codes, and purchasing frequency restrictions. They integrate with your procurement software platform to enable detailed reporting and automated expense categorization.

How do P-cards work?

P-cards operate on an existing payment network system and use advanced financial controls to improve purchasing efficiency, eliminate maverick spending, and increase spend visibility.

Here’s a quick rundown of how to use a standard P-card program:

- Set controls and parameters: Your procurement team sets specific rules and restrictions before issuance, including spend limits and allowed transaction types.

- Authorize staff: Your program administrator issues the P-card to an authorized employee and links it to your finance and procurement systems.

- Purchase goods and services: The employee uses their P-card to make approved purchases, which are processed through the standard credit card network.

- Approve purchases: The card issuer automatically checks purchases against preset controls and authorizes only those that meet the established parameters.

- Create automated reports: Your central procurement system automatically captures the transaction data, enabling efficient reconciliation and easy auditing.

- Make payments: Your organization pays the P-card issuer based on a consolidated invoice, just as you would a regular corporate credit card.

Another critical feature of P-cards is that they enforce compliance by automatically declining transactions outside your pre-defined parameters. This reduces unauthorized spending and saves time on approvals.

What are the most common purchasing card use cases?

You can use P-cards for a wide range of small business purchases across departments, reducing labor and paperwork without sacrificing compliance.

Some common examples of purchasing card use cases include:

- One-off expenses and services: P-cards eliminate the need for time-consuming formal POs when purchasing services and unique items, such as legal expenses and office party supplies.

- Software subscriptions: P-cards are useful for automatically paying monthly and annual subscriptions—such as your accounting software bill—and attributing those costs to the correct department.

- Marketing and advertising: Low-dollar marketing expenses, such as PPC campaigns or social media ad boosts, are ideal for efficient P-card management.

- Utilities and recurring invoices: P-card payment automation works well for reducing accounts payable administration associated with general overhead costs and small, recurring vendor invoices.

This is not an exhaustive list. You can use P-cards for just about any company expense, from staff travel and shipping fees to professional development programs and team meals.

Choosing a P-card provider: Essential controls and compliance capabilities

Selecting the right P-card provider ensures you get the functionality, robust controls, and compliance features you need.

While some procurement solutions provide secure but simple fraud prevention and payment processing, Order.co goes beyond basic P-card functionality to integrate advanced spend management and purchasing automation. With Order.co, you don’t just gain a new corporate credit card, but also a strategic tool for optimizing your entire purchasing process.

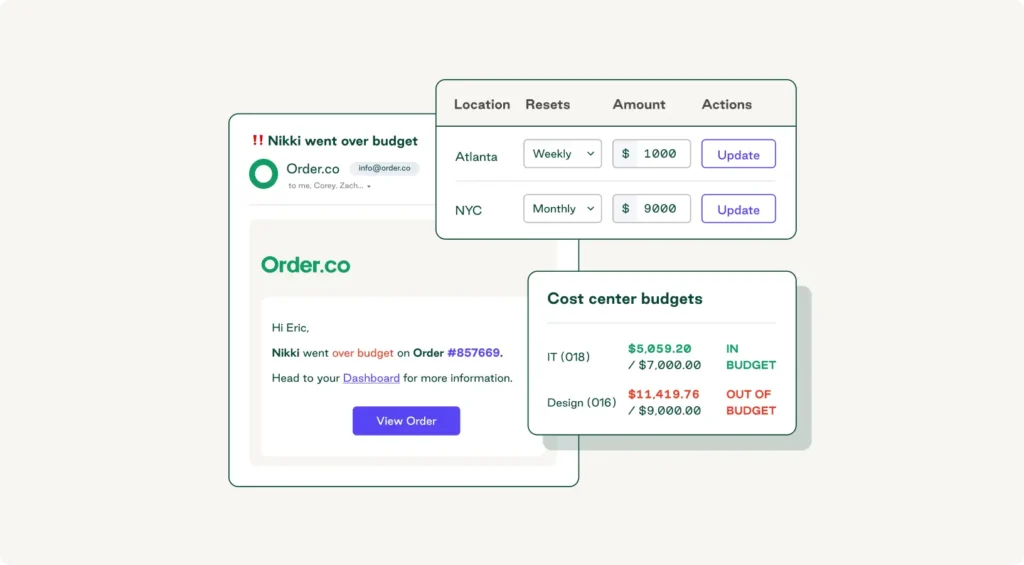

Spend controls

Effective spend limits prevent overspending and unauthorized purchases, helping each department stay within its allocated budget. Additional controls, such as vendor locking, also enable you to restrict where your team members place orders. A good P-card provider allows you to set granular limits that you can configure by criteria such as employee level, merchant category, and date.

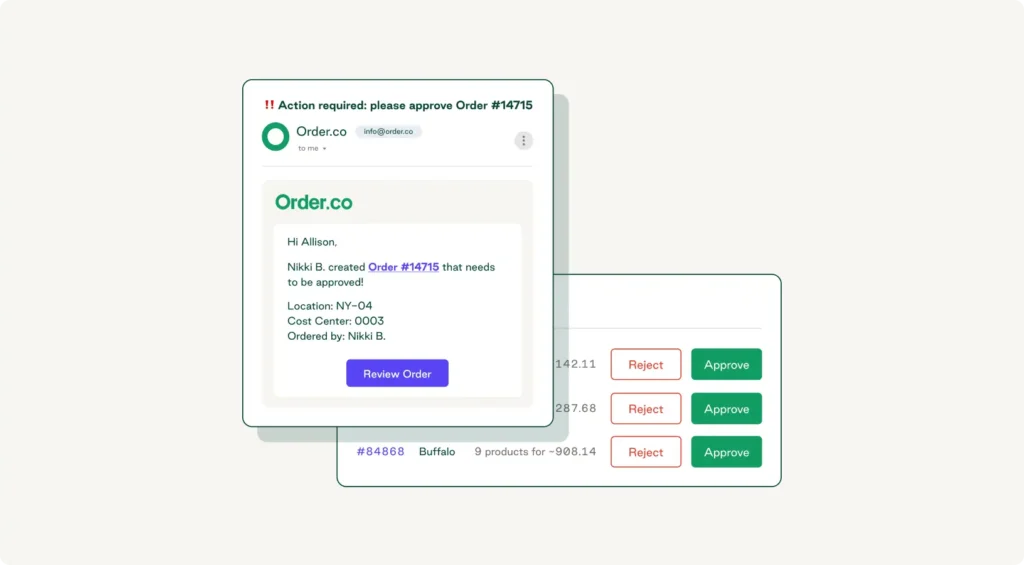

Approval workflows

Approval workflows help prioritize higher-value purchases, ensuring they’re approved quickly by the correct team member without impeding routine transactions. The best P-card providers offer highly configurable approval chains that automatically route purchases based on details like dollar value, product category, or vendor.

Documentation and receipt management

Automated documentation and receipt management features massively reduce administrative burden while increasing data accuracy. A quality P-card solution automatically captures and centralizes all your P-card purchasing data—including receipts—to simplify reconciliation and spend reporting.

Audit trails

Comprehensive and accessible audit trails are essential for staying compliant and maintaining financial visibility. The right P-card solution records every approval, policy change, and transaction in a centralized system equipped with detailed reporting capabilities.

Considering these aspects of spend management will help your team make an informed decision about corporate card or procurement card use.

Implementing an effective P-card governance framework

Your P-card program’s success hinges on the governance framework that supports it. Without clear policies, a robust training program, and continuous monitoring, you’ll struggle to maximize its benefits and mitigate risks.

Develop comprehensive P-card policies

P-card policies are the nuts and bolts of your governance framework. They need to be well documented, easily accessible, and regularly updated to align with changes to your company's spending rules.

Comprehensive P-card policies should clearly cover:

- Eligible purchases: What can and can’t be purchased using a P-card

- Spend limits: Budget controls for how much can be spent, by whom, and when

- Employee responsibilities: Card management expectations for P-card usage, receipt processing, and compliance

- Approval hierarchies: Assigned parameters, approvers, and deadlines for different transaction types

- Discrepancy procedures: How exceptions and unauthorized or incorrect charges are handled

- Non-compliance consequences: What happens when one or more policies are violated

It’s also important to establish policies around card issuance and termination. There should be a clear process for approving P-card usage and cancelling an employee’s access when they no longer need it.

Train cardholders and approvers

A robust P-card training program is essential for ensuring policy adherence. Training should be user-specific and cover policy requirements, system navigation, and supporting documentation processes. As policies change, it's essential to update your training program to maintain compliance.

Follow best practices for monitoring and reporting

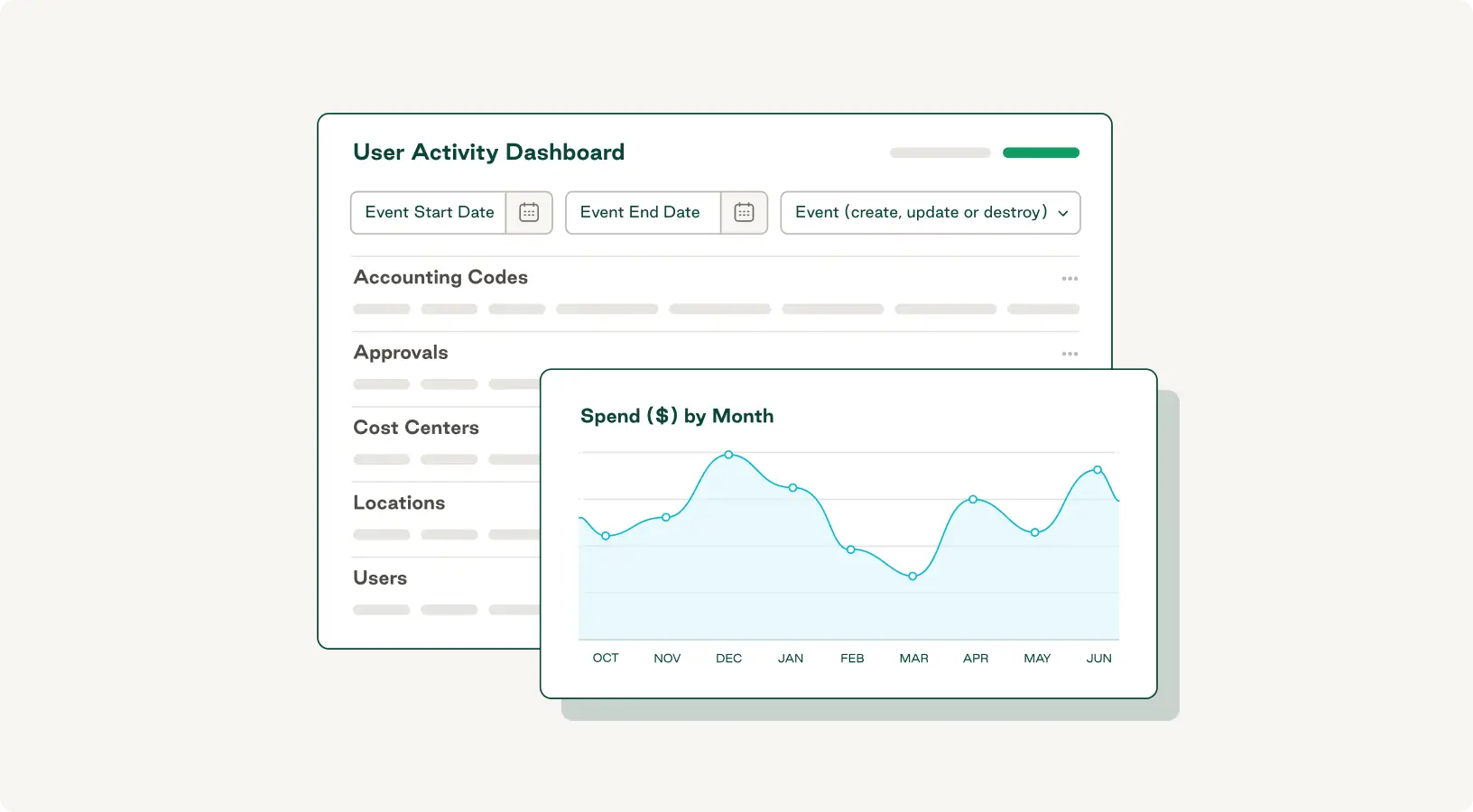

To get the most out of your P-card program, implement effective monitoring and reporting through regular spend analysis, compliance monitoring, and performance tracking. This allows you to continuously identify areas for improvement and ensure the goals of your P-card program are being met.

What success metrics and KPIs should you measure a P-card program by?

The core benefits of implementing a P-card program include improved process efficiency, reduced accounts payable costs, and better risk management. To gain a holistic understanding of your program’s success, track specific KPIs that directly relate to these outcomes. Focus on metrics like procurement cycle time, total PO volume, reconciliation speed, and approval cycle time to monitor efficiency gains and time savings.

According to one study, P-cards can save companies an average of $63 per transaction. To measure how much they're saving you, monitor:

- Transaction processing costs: Compare the cost of processing traditional PO-based invoices with P-card transactions.

- Early payment discounts: Monitor whether you’re capturing more early payment discounts from vendors because of your P-card program’s faster payment cycles.

- Admin costs: Quantify the reduction in administrative overheads for finance and procurement teams due to automated reconciliation and documentation.

Measuring compliance and risk management is more complex, but still achievable. For quantifiable results, track the number of attempted or actual policy violations after implementing your P-card program. You can also measure the number of audit findings directly linked to P-card activities, instances of fraud and fraud resolution times, and receipt submission compliance rates.

How to maximize P-card program value through data analytics and AI

Faster workflows and reduced overspending are just the tip of the iceberg—P-cards can also provide useful insights through data analytics and AI. Here’s how to get the most value from your purchasing card program.

Set up automated policy violation alerts and interventions

Modern P-card payment solutions like Order.co’s virtual purchasing cards integrate with AI-powered spend management software to automatically detect policy violations and notify the appropriate employees.

Establish automatic alerts and interventions for off-policy spending, unusual purchasing patterns, and missing or late receipt submissions to reinforce compliance across your organization.

Use spend analytics to optimize supplier relationships

Squeeze the most value from your P-card program by regularly analyzing aggregated spend data to identify preferred suppliers, consolidate purchases, and negotiate better terms based on detailed spend history. You can also track vendor performance to ensure your spending aligns with vendor agreements and expectations.

Identify cost savings opportunities through pattern analysis

A major benefit of AI-powered tools like Order.co is that they enable you to uncover hidden cost savings by automatically analyzing large P-card transaction datasets to identify spending patterns.

Leverage your P-card’s reporting and analytics features to detect duplicate payments and maverick spending, forecast future purchasing needs, and benchmark your internal spending against industry averages.

Learn more about the benefits of Order.co's P-cards

Curtailing off-policy spending is one of the best ways to reduce procurement costs and improve efficiency across your entire procure-to-pay cycle. With Order.co’s advanced virtual P-cards and spend management software, you can:

- Gain real-time visibility into all transactions and approvals

- Accelerate the reconciliation process with automated workflows

- Maximize spend control and compliance across all departments

- Access extended payment terms and consolidate vendor invoices

- Centralize all your expense management data for simplified auditing

Book a demo today to learn how Order.co’s procurement cards deliver real-time spend visibility and simplify reconciliation across your entire organization.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields