Accounts Payable Automation Explained: How It Works & Key Features

Accounts Payable Automation Explained: How It Works & Key Features

Picture your accounting department at the end of every month—is it calm or chaotic?

If your staff is scrambling and cash reconciliation is always a nail-biter, your accounts payable (AP) workflow may be broken. Accounts payable automation is the best way to avoid month-end madness while bringing visibility and efficiency to accounting processes.

Automated accounts payable workflows help you identify issues in advance and access information that drives good decision-making. They let you scale your department without adding headcount, reduce errors by automating manual tasks, and accelerate financial operations from approvals to payments.

To help you understand AP automation, this article answers the following questions:

- What is accounts payable automation?

- How does the AP automation process work?

- What are the benefits of automating AP workflows?

Download the free ebook: How Automation Can Solve Finance Teams’ Biggest Challenges

What is AP automation?

AP automation means using technology to handle accounts payable tasks like invoice coding and matching, vendor payments, and month-end reconciliation. A smooth accounts payable process can help reduce errors, improve operational efficiency, and ensure timely payments. It also simplifies invoice management, approvals, and procurement operations.

Traditional vs. automated AP processes

Traditional AP processes rely on manual tasks and lack a centralized data source for visibility, verification, or auditing. The dependence on manual data entry increases the risk of errors, resulting in a 50% higher invoice exception rate compared to automated AP workflows. This can lead to missed deadlines, duplicate payments, and other costly mistakes.

AP automation software provides a unified platform that automatically collects and cleanses invoice data from different sources. It uses automated payment scheduling to help prevent cash flow deficits and ensure on-time or early payments, strengthening supplier relationships and improving overall AP efficiency.

How AP automation works

AP automation replaces time-consuming manual tasks with faster, smarter, and more accurate workflows. AP software synthesizes data from multiple sources to transform your accounts payable process into a valuable business asset.

To learn more about automating your AP workflow for greater efficiency and savings, check out our Finance Automation Guide.

Vendor onboarding and data management

AP automation software simplifies supplier onboarding with automated workflows that ensure all compliance, security, and operational requirements are met. It centralizes vendor and product data to provide real-time visibility into supplier performance, item availability, and contract terms.

Some AP systems—including Order.co’s vendor management software—also provide automatic catalog creation for fast and easy eprocurement.

Approval routing and workflows

Automated workflows route captured invoice data to the appropriate department or individual based on highly customizable approval rules. Automations automatically send notifications to approvers whenever an invoice is ready for review.

This flow directly addresses a major flaw of traditional invoice approval routing, where invoices get stuck on an employee’s desk or in their email inbox, resulting in late or missed payments.

Invoice capture and validation

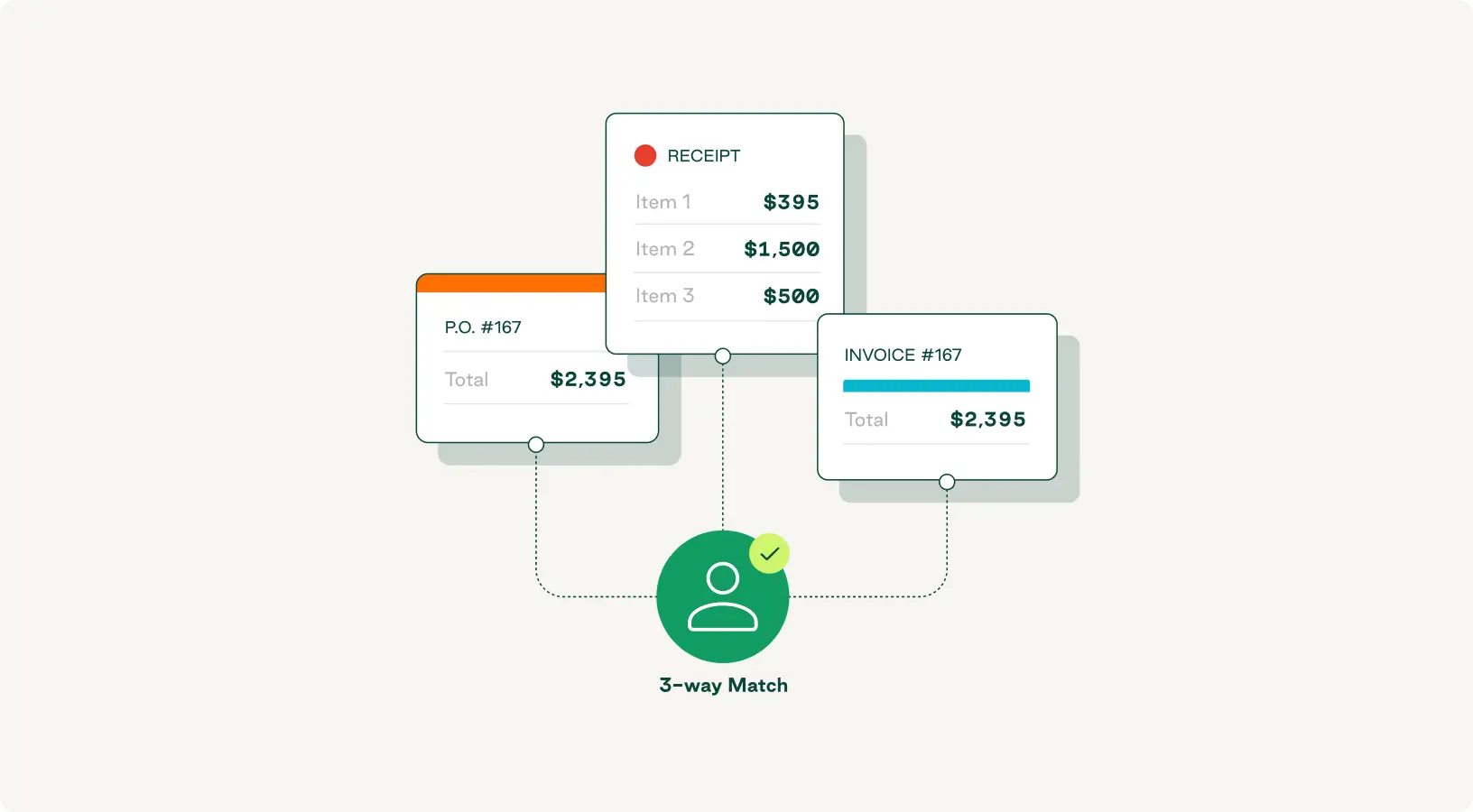

When an invoice is received, AP automation software automatically standardizes its formatting, extracts and codes essential data, and validates it by matching it against existing purchase orders and goods receipts.

Software automatically flags discrepancies for review by your AP team, helping optimize invoice processing efficiency and serving as a critical first line of defense against potential fraud or compliance issues. Advanced systems like Order.co can even prevent them altogether.

Payment execution and settlement

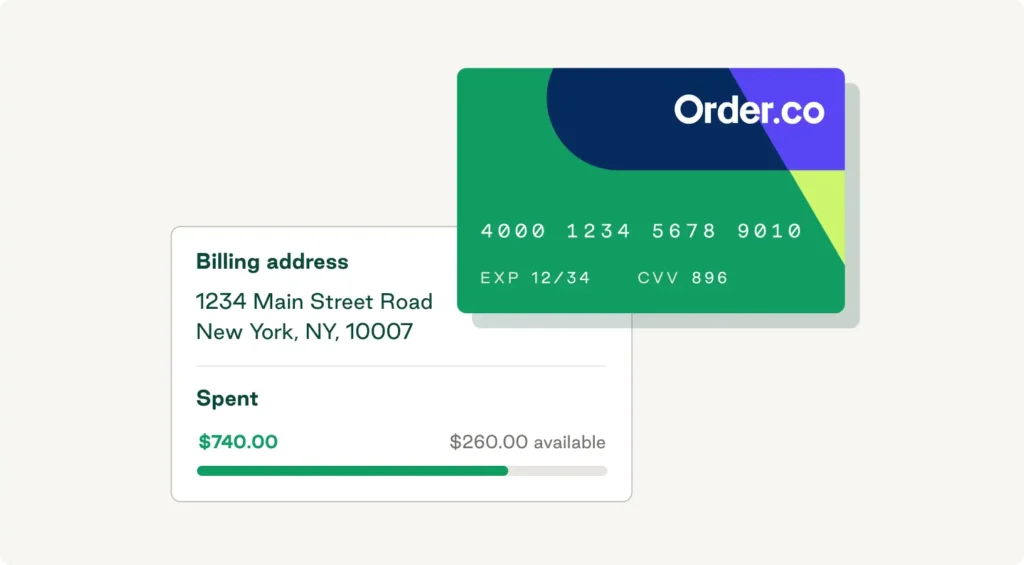

Modern AP systems support a wide range of digital payment methods, from bank transfers and checks to more advanced solutions like virtual credit cards.

You can schedule payments based on various factors—such as vendor terms and early payment discount opportunities—and your AP automation software will trigger payments on those predefined dates to ensure timeliness.

Reconciliation and reporting

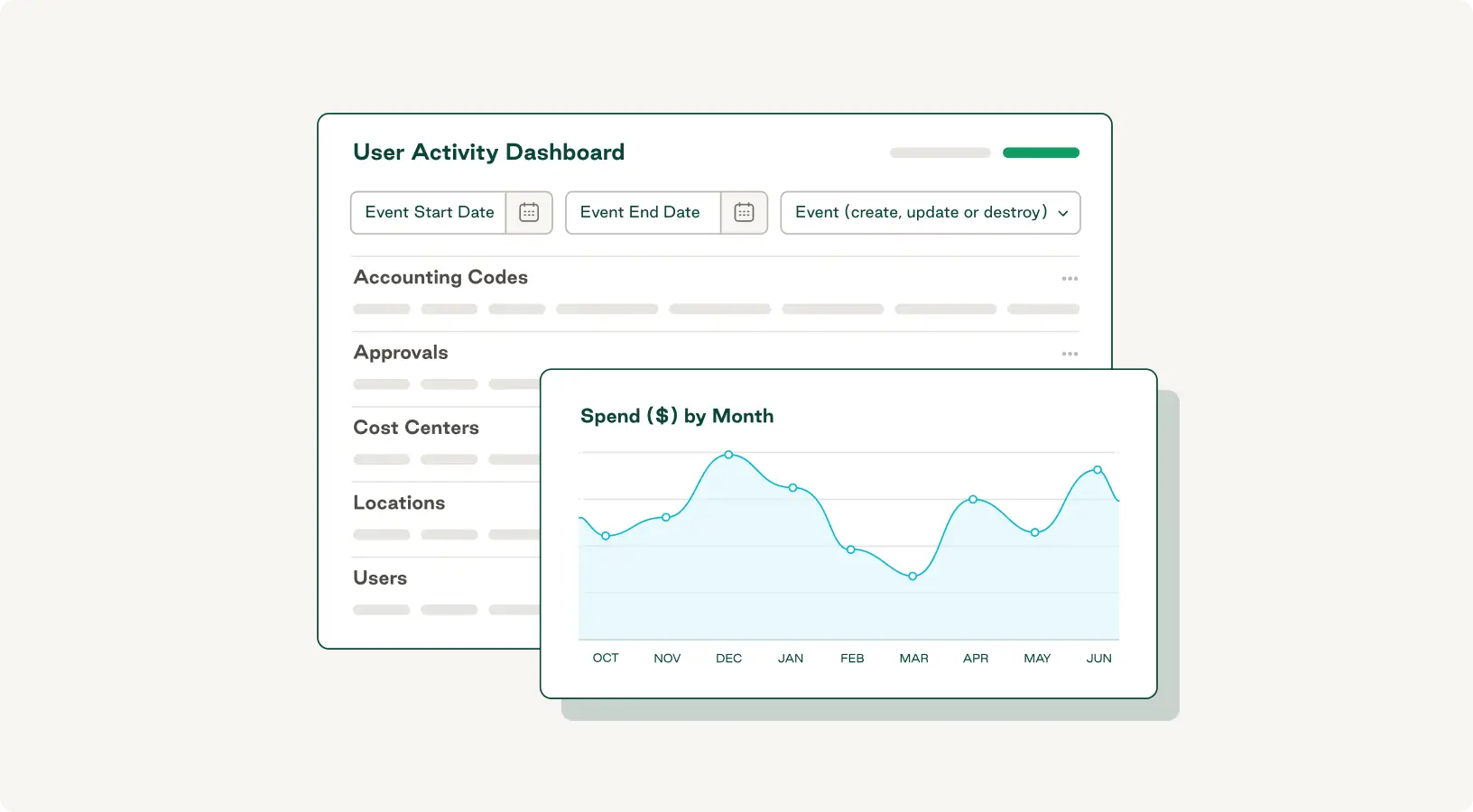

Robust reconciliation and reporting functionality strengthens financial accuracy, improves spend visibility, and supports compliance requirements. Software that integrates with your accounting or ERP systems can automatically categorize expenses and match payments with your financial data to provide a clear audit trail for tax purposes.

With AP automation, all invoices and approval records are stored securely in a centralized database. Dynamic dashboards and live reports present this data visually for a complete view of invoice statuses, spend performance, and cash flow.

The top AP tasks to automate

AP automation drives efficiency across the entire accounts payable process. However, certain accounts payable challenges, when managed correctly, offer more significant opportunities for substantial returns on investment.

Three best-practice AP tasks to automate include:

- Data capture: By leveraging machine learning and artificial intelligence, AP automation software automatically extracts, formats, and codes relevant invoice data from your suppliers to significantly reduce invoice processing times and error rates.

- Approval processes: Automated approval workflows mitigate three of the biggest accounts payable risks—payment deadlines, cash flow, and vendor relationships—by speeding up the entire AP cycle and enforcing robust financial controls.

- Virtual card issuance and payment runs: AP automation solutions use optimized payment runs and virtual credit cards to maximize savings by enabling early payment discounts and avoiding late payment penalties.

The benefits of automating these processes are supported by a recent PYMNTS survey of 412 financial executives: 73% reported that AP automation improves cash flow and increases savings, while 85% cited accurate, efficient, and simplified processes as key advantages.

The benefits of AP automation

AP workflow automation takes the stress out of processing invoices and lets your AP team focus on higher-level projects that drive value. It also offers several other benefits, including error reduction, risk mitigation, and increased profitability.

Preventing overpayment

Traditional AP processes are complicated and lack safeguards that prevent overpayment. This disrupts working capital for business expansion and jeopardizes timely payments essential to strengthening vendor relationships.

Accounts payable automation solutions introduce electronic invoicing and digital purchase orders. With fewer paper invoices and manual processes, your AP department gains increased visibility, accuracy, and control.

Improving your business's credit score

Early payments and favorable cash ratios indicate your business can manage its finances and will likely repay future debts. A simplified payment process reduces late payments, which boosts your creditworthiness and improves access to loans or favorable supplier terms.

Creating positive vendor relationships

Your business relies on suppliers to process purchase orders and deliver goods on time and in the agreed-upon volume and condition. Paying vendors promptly motivates them to keep providing consistent service and can unlock discounts. Automated AP systems help you track invoices, schedule payments, and manage approvals, ensuring you pay only for goods received as ordered while strengthening supplier relationships.

Reducing financial fraud

Fraud—through false billing, fraudulent checks, overpayments, or manual entry errors—is difficult to detect without proper data. Automating your AP tasks improves fraud detection by routing invoices automatically, extracting and validating invoice data, and maintaining electronic audit trails.

Increasing profitability

Automating your AP workflow can help you eliminate fees and control overhead costs, which boosts overall profit. Managing an automated system also requires fewer AP staff, reducing hiring costs while allowing you to scale your operations.

Creating better audits

Electronic AP systems provide full visibility for auditors, linking invoices to purchase orders, approvers, and payments. Accounts payable automation prevents bottlenecks caused by manual data entry and lengthy paperwork reviews, simplifying the audit process.

The ROI of AP automation and performance metrics to track

Manual AP is expensive, but the true cost is often hidden in numerous small cash leaks that quickly add up.

Three of the biggest contributors to spend inefficiency include:

- Invoice processing: Processing invoices manually is expensive, costing as much as $15 to $40 each. Faster processing reduces per-invoice costs, and accounts payable software can handle thousands of invoices simultaneously, lowering overall expenses.

- Errors and penalties: Human errors, such as missed or duplicate payments, reduce the integrity of your AP processes and can result in penalties that drain cash flow. Automation minimizes these errors by replacing manual tasks with accurate and reliable workflows.

- Wages: Companies posting hundreds or thousands of invoices per month often need to expand headcount to keep up. Automation allows your team to meet processing demands while creating time to tackle more strategic projects.

To measure the ROI of an AP automation system, start by establishing baseline metrics for your current manual processes. Common examples include:

- Average cost per invoice

- Invoice processing cycle time

- Days Payable Outstanding (DPO)

- Invoice exception rate

- Early payment discount capture rate

- Labor hours spent on manual data entry

After implementation, use your findings to calculate additional metrics, such as error reduction, cost savings per invoice, and time savings per approval, to get detailed insights into automation's impact.

How to get buy-in for AP automation

While the cost of implementing software is often cited as a concern, automation generally creates far more savings than expenses. Here’s how to improve adoption and gain executive support.

1. Find and engage a champion

Build a solid business case for automation and introduce it to at least one receptive manager or department head. Equip your champion with the insights and data necessary to advocate for the software to other executives or decision-makers.

2. Workshop the savings

Highlight the measurable benefits of automation in your business case. Outline the total cost of continuing with manual processing and contrast it with the expected savings an AP solution could deliver.

3. Bring solutions ready to evaluate

Take a “three bids and a buy” approach to sourcing accounts payable automation software. Research the best options for invoice automation, detail the costs involved, and weigh them against the total value automation can provide.

Automate your AP workflow with Order.co

The time is right to reap the benefits of a fully automated purchasing and AP workflow. With Order.co, buyers get the goods and supplies they need, while AP focuses on driving business impact instead of just processing invoices.

Order.co has all the features necessary to automate and digitize your AP workflows:

- Centralized purchasing for stakeholders

- Automatic line-level GL coding for purchases

- Three-way invoice matching for processed orders

- Electronic payment of approved invoices

- Integrations and exports for better data visibility

Book a demo today to see how Order.co can simplify and automate your AP processes.

FAQs on AP workflow automation with Order.co

Here are answers to some common questions accounting and finance teams often have about automating AP workflow processes.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields