How To Pick Procure-to-Pay Software (and 5 Tools to Consider)

How To Pick Procure-to-Pay Software (and 5 Tools to Consider)

Better systems are the key to better results, especially when your organization is on a growth track. A strong procure-to-pay system is one of the most effective ways to optimize your procurement process while maintaining full visibility and control over indirect spending.

But simply having a system in place isn't enough. To support real growth, you need modern tools that complement your processes by simplifying approvals, tracking spending, and providing real-time insight.

This guide explains what procure-to-pay software does, the business challenges it solves, and how to choose the right solution for your organization.

Download the free ebook: Choose the Right Procurement Technology With This Decision Matrix

What is procure-to-pay (P2P) software, and how does it work?

Procure-to-pay software is a digital solution that manages the entire purchase-to-pay process—from identifying a business need to paying suppliers. It connects requisitioning, purchasing, receiving, invoicing, and payment in one efficient workflow.

The traditional P2P process involves multiple departments, manual tasks, and paper trails. P2P software digitizes these workflows, giving you real-time visibility, fewer errors, and faster processing.

Core components of P2P software

Effective procure-to-pay solutions typically include four foundational capabilities:

- Requisitioning: Employees submit purchase requests through user-friendly forms or catalogs. The system routes these purchase requisitions through customizable approval workflows based on spending thresholds, categories, or departments.

- Ordering: Once approved, the software automatically generates purchase orders and sends them to suppliers. Many platforms support punchout catalogs, which let you shop directly from supplier sites while maintaining internal approval controls and spend management.

- Invoice matching: The system receives supplier invoices electronically and matches them against purchase orders and receipts. AI-powered invoice processing flags discrepancies before payment, reducing errors and fraud risk.

- Payment processing: After invoice approvals, the software triggers payments through various methods, including ACH transfers, virtual cards, or check printing. Each payment is logged with a complete audit trail, giving you visibility and control over cash flow.

Order.co's unified P2P suite combines all these capabilities in a single platform. Rather than stitching together separate software solutions for each function, you get end-to-end oversight of the P2P cycle through one intuitive, easy-to-use interface.

Typical integration flow with ERPs and vendor catalogs

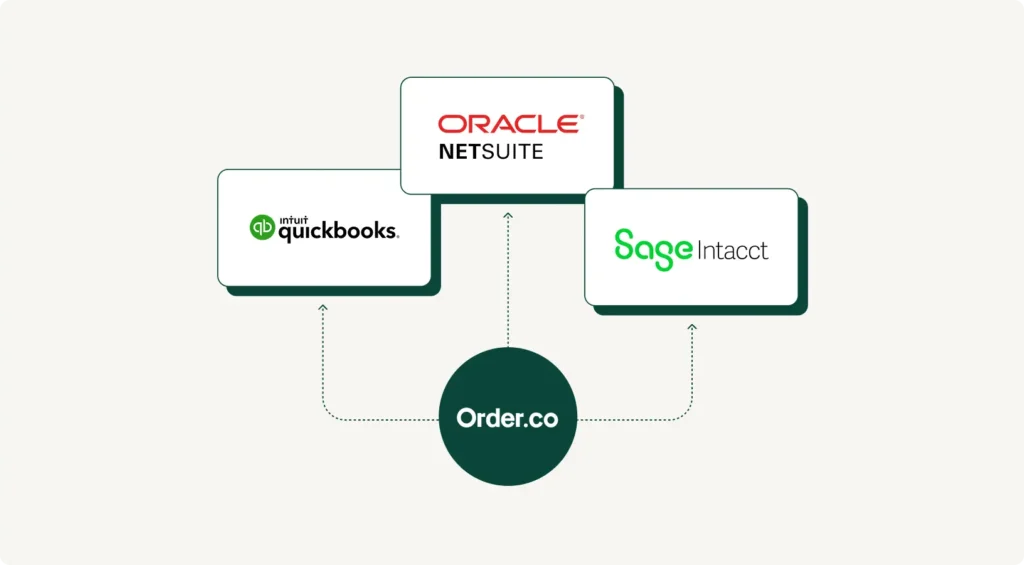

Modern procure-to-pay software doesn't operate in isolation. The most effective implementations connect seamlessly with your existing accounting and ERP systems, such as NetSuite, Workday, Oracle, and QuickBooks. These integrations keep data flowing in both directions, eliminating duplicate data entry while maintaining a single source of truth.

Punchout catalog integrations are just as important. They let your employees browse supplier catalogs directly within your P2P platform and add items to their carts while your approval workflows and spending policies remain active. Order.co provides plug-and-play connectors for major ERPs and punchout catalogs, reducing P2P implementation timelines from months to weeks.

What business challenges does procure-to-pay software solve?

Many organizations implement P2P software solutions to address specific operational pain points that manual processes can't effectively resolve. Here are the most common challenges—and how modern P2P platforms deliver measurable improvements.

Manual PO and invoice bottlenecks

Manual procurement slows every stage of the process. Traditional invoice processing can cost up to $16 per invoice, while automated processes reduce that cost to as low as $3 per invoice. That's an 81% reduction in processing costs, which translates to significant savings for organizations handling hundreds or thousands of invoices each month.

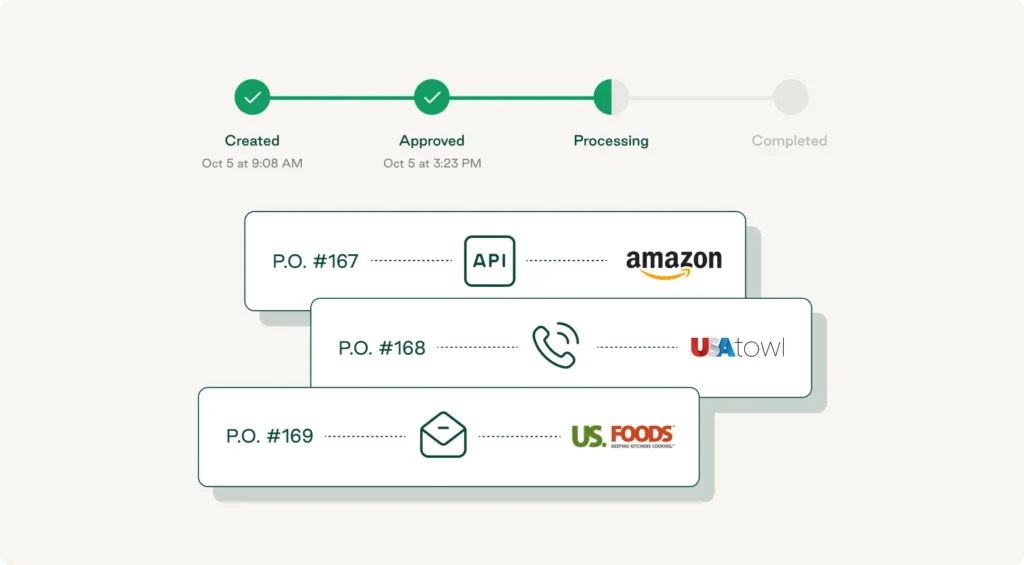

Order.co eliminates manual bottlenecks through intelligent automation. Purchase requests move through configurable approval workflows in hours instead of days. Once approved, the system automatically generates and sends POs to suppliers. When invoices arrive, AI-powered matching validates them against existing POs without the need for manual intervention.

Poor spend visibility and compliance gaps

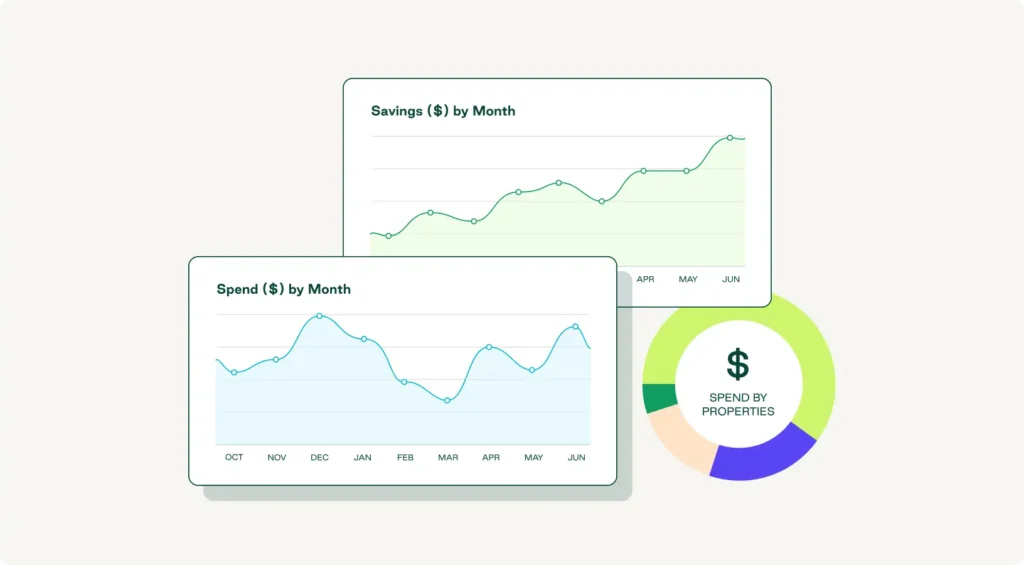

Without centralized procurement data, CFOs and finance leaders operate in the dark, and this opacity increases the risk of unauthorized purchases. Maverick spending can add an extra $0.12–0.18 per dollar spent, significantly impacting business spend efficiency and profitability.

P2P platforms provide real-time visibility through comprehensive dashboards that show exactly where money flows. Order.co can surface spending patterns by vendor, category, department, or project, and its built-in policy enforcement ensures purchases follow proper approval workflows. If an employee attempts a non-compliant purchase, the platform flags the order before it's transmitted.

Complex supplier onboarding and catalog management

Managing supplier relationships manually is tedious. Each new vendor requires you to collect forms and insurance certificates, plus set up payments. Keeping vendor catalogs current often means constant spreadsheet updates or chasing suppliers for pricing.

Order.co simplifies supplier management through structured onboarding workflows and automated catalog synchronization. Vendor-locked virtual cards add an extra layer of security, allowing you to issue single-use payment credentials that prevent unauthorized charges.

What should you consider when choosing procure-to-pay software?

Selecting the right procurement solution means looking beyond basic functionality. Here's what to prioritize during your evaluation.

End-to-end functionality vs. best-of-breed integrations

The first decision is whether to go with a comprehensive platform or a set of specialized point solutions. All-in-one platforms handle requisitioning through to payment in one interface, providing unified data, simple administration, and fast implementation. Best-of-breed tools let you optimize each function individually, but they often create integration complexity and potential data silos.

For most mid-market organizations, end-to-end procure-to-pay solutions like Order.co offer better value. They reduce vendor management overhead while providing you with fully integrated, automated workflows.

ERP and catalog integrations

When choosing P2P software, be sure to evaluate how each platform connects to your existing financial systems. Poor integrations can force manual workarounds that undermine automation's benefits.

Order.co provides pre-built integrations for NetSuite, Workday, Oracle, and other major ERPs. These connectors sync master data, purchase orders, invoices, and payment information in both directions, allowing you to avoid custom API development and deploy production-ready integrations in days.

Configurability, support, and time to value

You'll also want to consider platform configurability—how well the software can adapt to your unique business processes. Some solutions require working within rigid templates, while others let you configure approval workflows, form fields, reports, and user permissions.

To balance configurability with implementation complexity, consider your internal IT resources and whether you'll require vendor-led support. The best platforms deliver time to value in weeks, not months, with responsive assistance when you need it.

What are the 5 best procure-to-pay software tools?

The P2P software market offers solutions ranging from enterprise-grade platforms to nimble tools built for growing businesses. Here are five platforms that consistently deliver value across different organizational contexts.

1. Order.co

Order.co provides straightforward yet powerful procure-to-pay features enhanced with proprietary AI models. The system lets you order through a dynamic, curated catalog and offers next-level features, including AI product substitution, role-based permissions, extensive reporting, vendor-agnostic carts, capital advance financing, and complete transaction capture for catalog and off-catalog spend.

Key features and benefits:

- Unified requisition-to-payment workflows with customizable approval processes

- Pre-built ERP integrations for NetSuite, Workday, Oracle, and others

- Vendor-locked virtual cards for enhanced financial control and simplified reconciliation

- Real-time spend analytics with dashboards for improved spend control

- AI-powered three-way invoice matching

- Punchout catalog support for seamless supplier browsing

- An intuitive interface that encourages high adoption rates

Best for: Mid-sized businesses (50–500 employees) needing end-to-end spend management without extensive IT resources. Order.co is particularly valuable for companies requiring multiple vendor integrations and rapid time to value.

2. SAP Ariba

SAP Ariba delivers enterprise-scale procurement capabilities with deep functionality across strategic sourcing, procurement, and supplier management. This cloud-based system helps organize the buying process, control budgets, and manage cash flow through guided spending. As part of the SAP ecosystem, it integrates naturally with other SAP products.

Key features and benefits:

- Global supplier network connecting buyers with verified vendors worldwide

- Advanced sourcing tools for RFP/RFQ management and contract lifecycle management

- Comprehensive spend analysis and forecasting

- Support for complex, multi-entity organizational structures

- Extensive compliance and audit trail capabilities

Best for: Large enterprises (1,000+ employees) with complex procurement requirements, global supply chains, and existing SAP infrastructure. It's also a viable choice for organizations that want strategic sourcing capabilities alongside operational procurement management.

3. Coupa

Coupa helps enterprises manage a range of purchasing activities, from RFP development to invoice payments. The platform emphasizes real-time visibility and control across all spending categories and provides easy-to-use guided buying and submission workflows.

Key features and benefits:

- Comprehensive spend management covering direct and indirect procurement

- Community-driven intelligence for benchmark data and best practices

- Supplier relationship management with supplier performance tracking

- Mobile app for approvals and expense capture

- Extensive marketplace of pre-integrated suppliers

Best for: Mid-to-large enterprises seeking consolidated spend management across procurement and expenses. Coupa is a good choice for companies prioritizing data-driven decision-making through advanced analytics and KPIs.

4. Stampli

Stampli focuses on invoice management with "Billy," an AI assistant that automates routine accounts payable tasks. The platform recently expanded into full procure-to-pay capabilities.

Key features and benefits:

- AI-powered invoice capture and GL coding with OCR technology

- Three-way matching with 97–100% accuracy

- Centralized communication hub for all invoice-related discussions

- Pre-built ERP integrations for major financial systems

- Virtual card payment options

Best for: Organizations with high invoice volumes that want to modernize accounts payable first, then expand into full procurement. Stampli is also a solid option for companies seeking intuitive, low-training-required solutions with strong e-invoicing capabilities.

5. Procurify

Procurify is cloud-based procure-to-pay software that emphasizes budget control and spending visibility. It aims to make department-level budget management and automated approval workflows simple and transparent.

Key features and benefits:

- Department-level budget tracking with notifications and alerts

- Purchase order management with real-time status tracking

- Supplier portal for vendor collaboration and relationship management

- Mobile app for approvals and purchase requests

- Integrations with major accounting systems

Best for: Growing companies (100–1,000 employees) wanting to incorporate procurement discipline as they scale, as well as organizations focused on department-level budget accountability and financial control.

What ROI can you expect from procure-to-pay software?

Understanding potential return on investment helps you justify P2P software investments and set appropriate success metrics. While results vary by organization, certain patterns consistently emerge across implementations.

Comprehensive P2P platforms typically drive measurable improvements in efficiency, cost reduction, and compliance. By automating manual tasks, you can cut procure-to-pay cycle times and increase PO processing efficiency. This efficiency gain will allow your procurement team to handle growing transaction volumes without adding headcount.

Measure key metrics

To see how P2P software is impacting your organization, track these KPIs:

- Purchase order cycle time: Time from requisition submission to approved PO issuance

- Invoice processing cost: Total cost per invoice, including labor, exceptions handling, and late payment penalties

- Procurement staff productivity: Purchase orders processed per full-time employee

- Maverick spend percentage: Purchases made outside approved channels or contracts

- Supplier lead time: Average days from PO issuance to goods receipt

Benchmark improvements

When evaluating your potential ROI, consider a few improvements organizations often achieve within the first year:

- Process efficiency: 40–70% reduction in manual procurement tasks and administrative burden

- Cycle times: Up to 58% faster procurement workflows (such as requisition-to-PO and invoice-to-payment)

- Cost per transaction: 60–80% lower invoice processing costs compared to manual processes

- Compliance: Up to 60% reduction in maverick spending through automated workflows and policy enforcement

- Discount capture: Up to 37% annualized returns on available capital, helped by early payment discount capture utilization

Organizations implementing Order.co benefit from faster implementation timelines. Unlike typical 6- to 12-month enterprise deployments, mid-market companies often achieve production readiness in 4 to 8 weeks, significantly accelerating time to value.

Get started with Order.co procure-to-pay software

If you're ready to modernize your purchasing process, Order.co provides procure-to-pay technology built specifically for mid-market companies that need advanced capabilities without enterprise-grade complexity.

Order.co's AI-powered procurement solution can help you:

- Ensure budget compliance, enforce purchase policies, and optimize vendor selection automatically

- Improve supply chain management across multiple locations

- Reduce cost per invoice and associated invoice exception rates

- Consolidate invoices and payments to stabilize cash flow

- Surface procurement savings opportunities to improve your bottom line

- Gain real-time, line-level visibility into spending for better business decisions

See how AI is reshaping the way modern orgs manage procurement, spend visibility, and reconciliation. Schedule a demo of Order.co today.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields