Procure-to-Pay Automation: Process, Steps & Benefits

Procure-to-Pay Automation: Process, Steps & Benefits

Better systems drive better results. A well-automated procure-to-pay (P2P) process doesn't just save time—it keeps spending visible and helps uncover opportunities to cut costs, improving your organization's bottom line.

But what does an effective P2P cycle actually look like? And how can procure-to-pay automation ensure spending stays under control as you grow?

Download the free ebook: The Procurement Strategy Playbook for Modern Businesses

What is procure-to-pay (P2P) automation?

Procure-to-pay automation is the use of automated systems to identify, request, and pay for the products and services your business needs. Instead of relying on manual tasks—such as purchase requisitions, invoice reconciliation, and vendor payments—P2P automation handles workflows automatically. This provides procurement teams with faster processes, fewer errors, and easier access to purchase data, approvals, and spending insights.

Examples of procure-to-pay automation

Procure-to-pay automation solutions transform theoretical efficiency gains into measurable results. Here's how automation improves each stage of the P2P workflow:

- Requisition management: Automated intake forms route requests to the right approvers instantly, eliminating email chains and manual tracking. Intelligent routing ensures requisitions reach decision-makers within seconds, not days.

- Approval workflows: Rules-based automation enforces spending thresholds and hierarchies automatically, eliminating the need for manual intervention. When a $5,000 purchase requires CFO sign-off, the system routes it automatically while processing smaller purchases immediately.

- Purchase order generation: Once approved, P2P systems auto-populate PO data from requisitions, eliminating re-keying errors. AI-powered procure-to-pay systems can cut PO creation time by up to 70%.

- Supplier communication: Automated PO transmission replaces phone calls and messy email orders. Suppliers receive standardized, error-free POs through integrated portals.

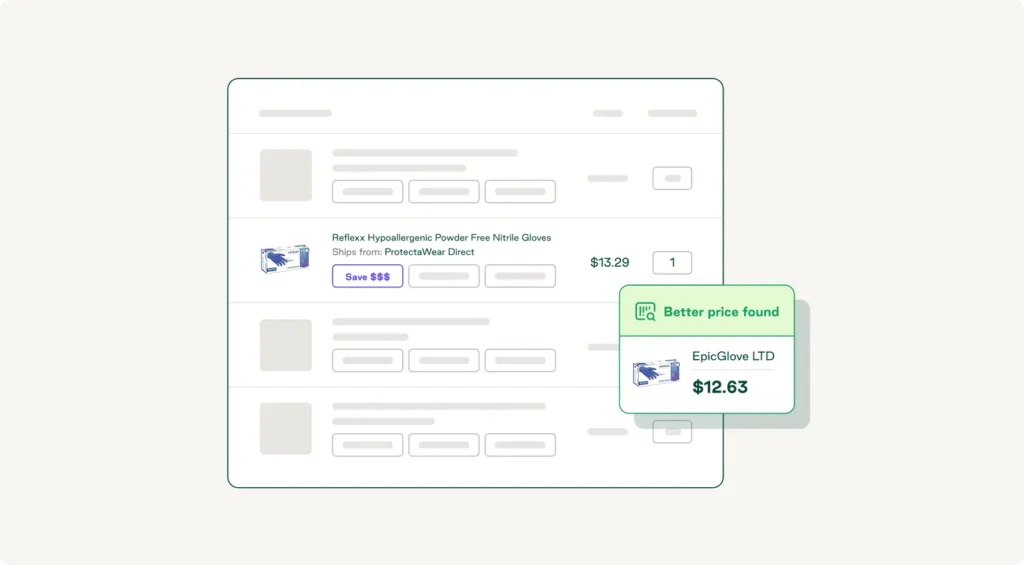

- Invoice matching: P2P systems like Order.co automatically scan incoming invoices and match them to POs and receipts. The procure-to-pay technology flags discrepancies for review rather than holding up the entire payment queue.

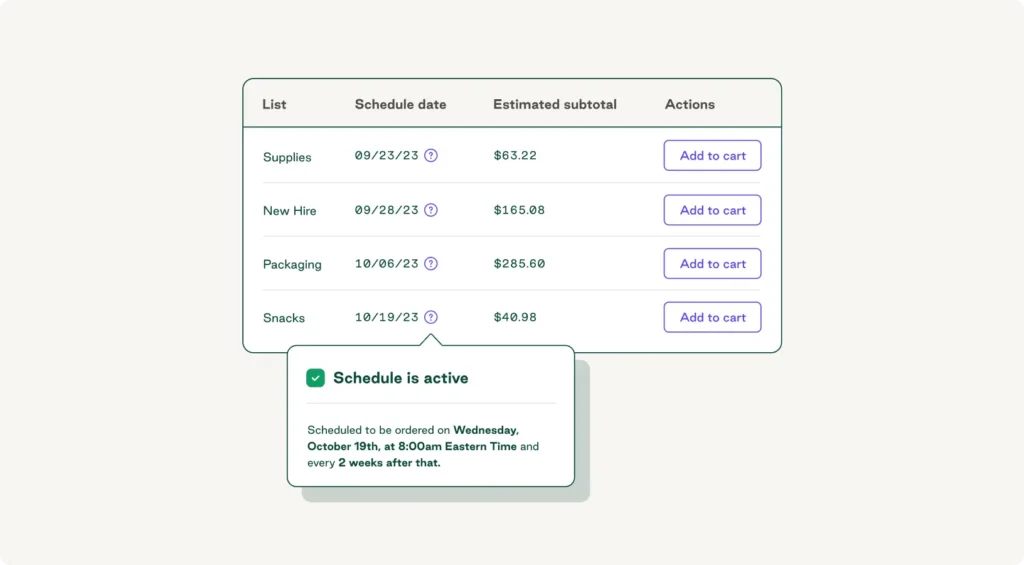

- Payment processing: Automated systems schedule payments, prioritize invoices, and optimize timing to improve cash flow while avoiding late fees.

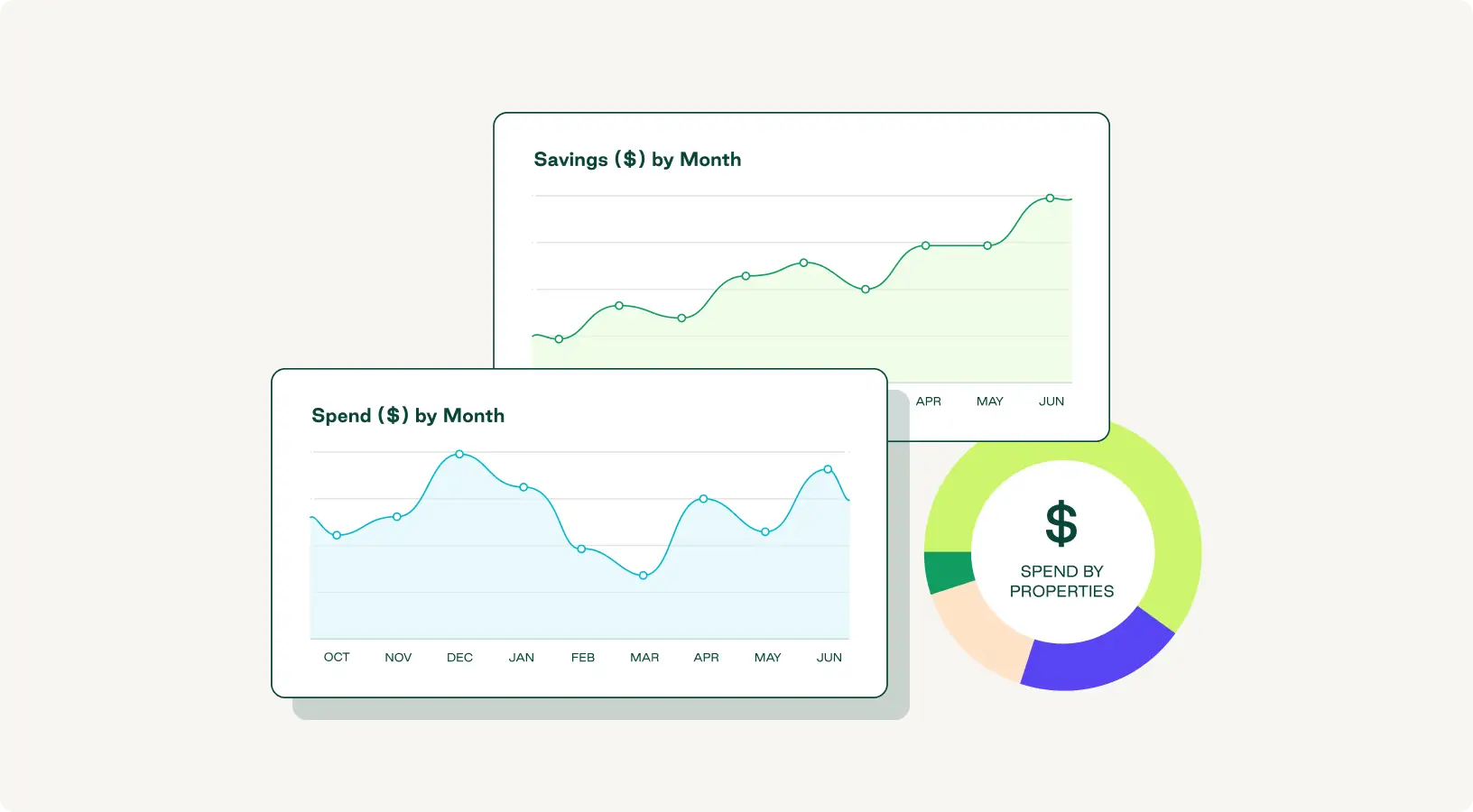

- Spend analytics: Real-time dashboards surface spending patterns, vendor performance, and budget utilization, eliminating the need for spreadsheet gymnastics and month-end reconciliation marathons.

7 Steps for procure-to-pay automation

Software solutions speed up the P2P process, reduce maverick spending, improve strategic decision-making, and increase stakeholder satisfaction.

Here's how to take control of your procure-to-pay cycle using automation:

1. Identify needs with guided requisitioning

Automating the purchase-to-pay process begins with smart intake forms that guide users through needs identification. Intelligent catalogs suggest preapproved items, flag budget constraints, and recommend alternatives based on past purchases. This eliminates the guesswork of manual purchasing processes while maintaining compliance from day one.

2. Submit automated requisitions

Digital forms autofill requester information, cost centers, and delivery addresses. Template-based requisitions speed up recurring purchases, while dynamic forms adjust fields based on purchase category. Automation captures all necessary information up front, preventing the time-consuming approval delays that can occur with manual processes.

3. Accelerate approval routing

Rules-based workflows route requisitions to the appropriate approvers based on amount, category, or department—without manual handoffs. Approvers receive notifications and can approve with a single click. Automated escalation ensures requests don't get stuck in inboxes, cutting approval cycle times from days to hours.

4. Generate purchase orders instantly

Once approved, automation converts purchase requests into purchase orders without requiring manual data entry. Automated procurement solutions validate supplier information, apply contract terms, and transmit POs electronically. This reduces errors and speeds up processing compared with manual PO creation.

5. Perform 3-way matching and invoice approval

Automation revolutionizes end-to-end accounts payable processes by scanning invoices, extracting line-item data, and matching it against POs and goods receipts. The system flags exceptions—such as price variances, quantity mismatches, or missing documents—for human review, while automatically approving perfect matches.

6. Optimize payments

The automated invoice management system then routes approved invoices for payment. It consolidates payments to reduce transaction fees, optimizes timing for early payment discounts and cash flow, and automatically maintains a complete audit trail.

7. Enable real-time spend analysis

The P2P system feeds every transaction into centralized dashboards, eliminating the need for manual data compilation. Automated analytics surface spending trends, identify cost-saving opportunities, and track KPIs in real time. This allows finance teams to spend less time wrestling with data and more time making strategic decisions.

Best practices for automating your procure-to-pay process

The following best practices can help you improve business processes, maximize outcomes, and get the most out of your purchasing and payment workflows.

Standardize approval workflows

Automation enforces consistency and prevents bottlenecks by removing variability from approval processes. A well-documented procure-to-pay process:

- Gives employees quick access to what they need

- Ensures purchase and budget oversight through enforced rules

- Reduces risk by automatically validating supplier compliance

- Provides finance teams with real-time visibility into spend

Automation removes the guesswork from approval routing. Systems apply the same logic to every purchase, ensuring nothing falls through the cracks. Requestors see approval status immediately, approvers get real-time alerts wherever they are, and the process scales effortlessly as transaction volumes grow.

Integrate contract management into approvals

Clear contract management reduces errors, speeds up approvals, and keeps purchases compliant. Documenting procurement policies ensures a smooth process and less friction for stakeholders.

Consider including these approvers in your process flow:

- Internal department lead

- Legal

- Security

- Finance

Incorporating departmental procurement strategy requirements at the intake stage helps requests start off on the right foot before they even enter the pipeline, preventing bottlenecks and ensuring high-quality purchases every time.

Leverage automation to scale P2P

Manual procurement processes often collapse under the pressure of growth. As organizations expand, purchase volumes often rise faster than procurement headcount. Procurement automation bridges that gap.

Modern procure-to-pay software options handle far more transactions without needing proportional staffing increases. According to Ardent Partners' 2024 AP Metrics That Matter report, best-in-class organizations with high automation achieve invoice processing costs of $2.81, compared to the average of $9.87—a 71.5% reduction. These savings compound as transaction volumes grow.

Procurement software uses process automation to free teams from repetitive tasks like data entry, three-way matching, and payment processing. Staff can redirect that energy toward higher-value activities that drive real business impact, including supplier relationship management, contract negotiation, and strategic sourcing.

How does procure-to-pay automation software work?

Modernprocure-to-pay solutions create centralized, automated workflows that cover every step, from requisition to payment. They integrate with existing ERP and accounting systems, routing approvals based on configurable business rules and processing documents through intelligent automation.

Integration architecture

P2P platforms connect procurement with accounts payable, general ledger systems, and supplier networks. API-based integrations enable real-time data flow, eliminating manual data transfers and keeping your entire P2P workflow accurate and up to date.

Approval-routing engines

Rules-based logic automatically determines approval paths based on purchase amount, category, department, or custom parameters. Notifications keep approvals moving, while automated escalation prevents bottlenecks when approvers are unavailable.

AI and machine-learning capabilities

Intelligent P2P software uses AI to analyze procurement data, predict trends, optimize purchasing decisions, and identify anomalies that might signal fraud or compliance issues. These tools include:

- Natural Language Processing (NLP) for extracting information from contracts and unstructured documents

- Machine learning models that learn from historical data to improve matching accuracy

- Predictive analytics for forecasting demand, provider performance issues, and potential payment delays

Emerging AI applications

AI can also help you reduce invoice processing time, increase compliance rates, and improve the vendor management process through more efficient workflows and enhanced data accuracy. Advanced systems can:

- Flag duplicate invoices or potential fraud by analyzing payment patterns

- Recommend suppliers based on performance history and contract terms

- Predict invoices likely to encounter matching issues

- Identify cost-saving opportunities, such as bulk ordering discounts

With these capabilities, P2P automation transforms procurement from a transactional function into a strategic advantage. In fact, the accounts payable automation market is projected to reach $1.9 billion by 2025, driven largely by AI innovations.

How Order.co's P2P automation improves efficiency and savings

Manual procure-to-pay processes harbor hidden costs that erode profitability. Beyond obvious process inefficiencies, organizations often face maverick spend, duplicate payment risks, and late-payment penalties.

Order.co addresses these hidden costs while delivering measurable efficiency gains. By centralizing purchasing, the automated procurement system ensures compliance with company policies while eliminating friction from everyday procurement tasks.

With Order.co, you can:

- Automatically stay within budgets, purchasing guidelines, and approved vendor lists

- Improve supply chain management across multiple locations with consolidated catalogs

- Reduce invoice volume, invoice processing costs, and exception rates through intelligent matching

- Stabilize and improve cash flow by avoiding late payments with automated scheduling and flexible terms

- Surface cost-saving opportunities through real-time spend analytics

- Gain line-level visibility for strategic spend management across your entire organization

If you’re ready to learn how automating procurement with Order.co can help you achieve these outcomes, schedule a demo of the platform today.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields