How B2B Virtual Cards Increase Payment Efficiency & Spend Control

How B2B Virtual Cards Increase Payment Efficiency & Spend Control

Paying vendors doesn't have to be complicated, but for many finance teams, it is. Between juggling multiple suppliers, chasing down approvals, and reconciling endless transactions, managing business payments can quickly become a headache.

B2B virtual cards make it simpler. These digital payment tools provide tighter control over spending, faster approvals and payments, and automatic reconciliation—plus they keep your money safer than traditional credit cards or checks.

This article explains what B2B virtual cards are, how they work, and the ways they can make life easier for finance teams. It also covers the benefits driving their popularity and details what to look for when selecting a virtual card provider.

Download the free ebook: Choose the Right Procurement Technology With This Decision Matrix

What are B2B virtual cards?

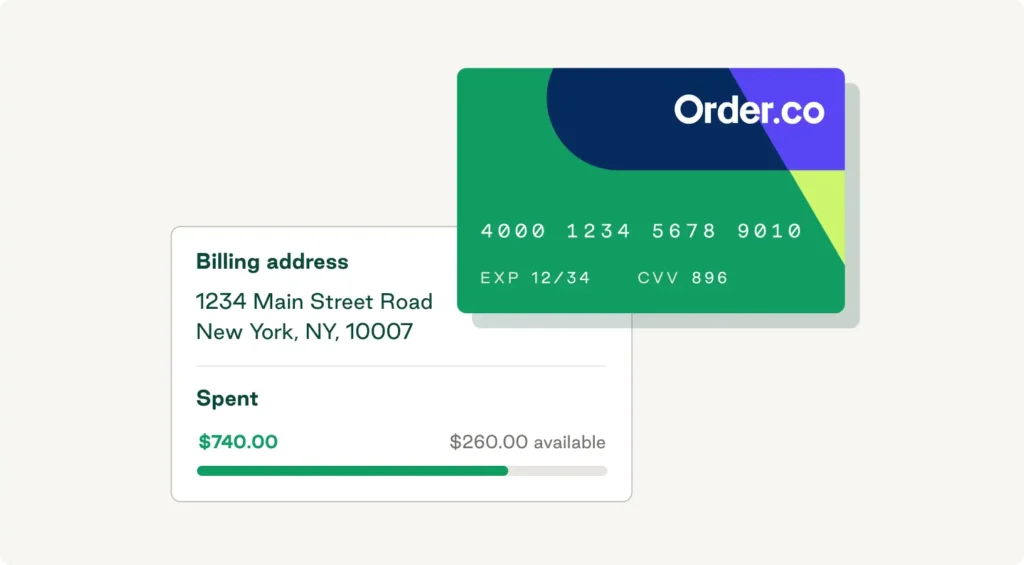

B2B virtual cards are digital payment cards built for business use. Unlike physical corporate cards, they exist in digital form only and can be created instantly for a single purchase or individual vendor. You can configure each virtual card number with specific spending limits, expiration dates, and merchant restrictions to provide unprecedented control over company spending.

The B2B virtual card market is growing fast—projected to quadruple from about $14.65 billion in 2025 to $61 billion by 2032—indicating that businesses are moving away from traditional payment methods.

What are the different types of virtual cards?

Virtual cards come in different types to suit different business needs. Many organizations use more than one type of virtual card, depending on the purpose or payment scenario.

Common virtual card types include:

- Single-use virtual cards: Cards that generate a unique card number for a single transaction. Once the payment is processed, the number becomes invalid, making these cards ideal for one-time purchases.

- Multi-use virtual cards: Cards that allow multiple transactions within set parameters. Organizations might create a multi-use card for a specific vendor or recurring monthly expenses.

- Vendor-locked virtual cards: Cards that automatically restrict themselves to the first merchant where they're used. This functionality, offered by platforms like Order.co, ensures each card can only be used with its intended vendor to prevent rogue spending.

- Departmental cards: Cards tied to specific teams or projects. Department cards help finance teams track spending and manage budgets for different parts of the organization.

How do virtual cards work?

Virtual cards work through a straightforward digital process. When an organization needs to make a payment, the finance team or authorized employee requests a card through their payment platform.

The system instantly generates a unique 16-digit card number, along with an expiration date and security code. The requester can set parameters, such as spending limits, an expiration timeframe, and sometimes merchant category codes, to restrict where the card can be used.

Once the card is ready, the employee or accounts payable team shares the details with the vendor to make the payment. All purchase details then show up on the company's consolidated statement, cutting out much of the manual reconciliation work that comes with traditional payment methods.

What are some top use cases for virtual cards in B2B transactions?

B2B virtual cards are flexible tools that give you more control over spending while keeping a clear view of where your money goes. Here are some ways you can use them.

Procurement for goods and services with pre-approved spending limits

Virtual cards work well in procurement scenarios where employees need to make purchases while maintaining strict budget controls. Finance teams can issue cards with exact spending limits that match purchase order amounts, eliminating delays while ensuring employees don't overspend.

Subscription management for SaaS and recurring payments

Virtual cards solve subscription sprawl by allowing you to assign a unique card to each service. This provides clear visibility into all active subscriptions and makes it easy to cancel by closing the corresponding card.

Departmental or project-specific budgets for better expense control

Issuing dedicated cards for each cost center gives you real-time visibility into spending patterns. Department heads can monitor their team's expenses without seeing unrelated financial data.

Payments to gig workers, freelancers, and contractors

One-third of cross-border payments take more than one business day to settle. Virtual cards offer a faster alternative, giving contractors immediate access to funds while maintaining a clear audit trail and preventing unauthorized spending.

Travel and entertainment expenses with preset budgets

Virtual cards allow you to issue travel-specific cards with preset budgets aligned to trip itineraries and company policies. Employees get the flexibility they need to cover necessary travel expenses without exceeding approved amounts.

Benefits of virtual cards for business payments

Virtual cards provide you with the control and visibility to effectively manage company spend, boost accounts payable efficiency through fast automation, and uncover strategic insights from detailed reports. They also help reduce credit card fraud and minimize security risk.

Enhanced security

Just 5% of businesses reported fraud involving virtual cards in 2024—much lower than the rates for checks and ACH payments. This dramatic security improvement stems from the fact that single-use and vendor-locked cards are generally useless to fraudsters, even if card details get compromised.

You can also set spending limits and expiration dates to prevent unauthorized charges. If a data breach occurs, the damage remains limited to that specific card rather than exposing your entire credit line.

Greater control and transparency

Virtual cards transform spend visibility from a monthly reconciliation exercise into a real-time management tool. You can see exactly where your money is going the moment transactions occur.

Granular controls let you restrict spending by merchant category, set transaction limits, and define validity periods. These parameters automatically enforce your spend control policies without requiring you to manually review every transaction.

Faster reconciliation

Reconciling traditional credit cards can eat up a lot of your finance team's time—and mistakes are common. In fact, 29% of organizations cite human error as their top spend management challenge, while 28% say they waste time on reconciliation.

Virtual cards eliminate most manual reconciliation work by automatically capturing transaction details at the point of purchase. Each card links to a specific vendor, project, or employee, making expense categorization instantaneous.

Process efficiencies

Approximately 80% of CFOs and treasurers plan to increase their use of virtual cards for B2B payments, with card usage projected to double.

Virtual cards remove the delays that come with p-card approval processes and check-cutting. Employees gain instant access to funds when needs arise, keeping operations moving smoothly without bottlenecks.

Enhanced data and reporting

Virtual cards generate rich transaction data that powers better business intelligence. Every payment includes detailed merchant information, timestamps, and purchasing context that you can’t get from manual methods.

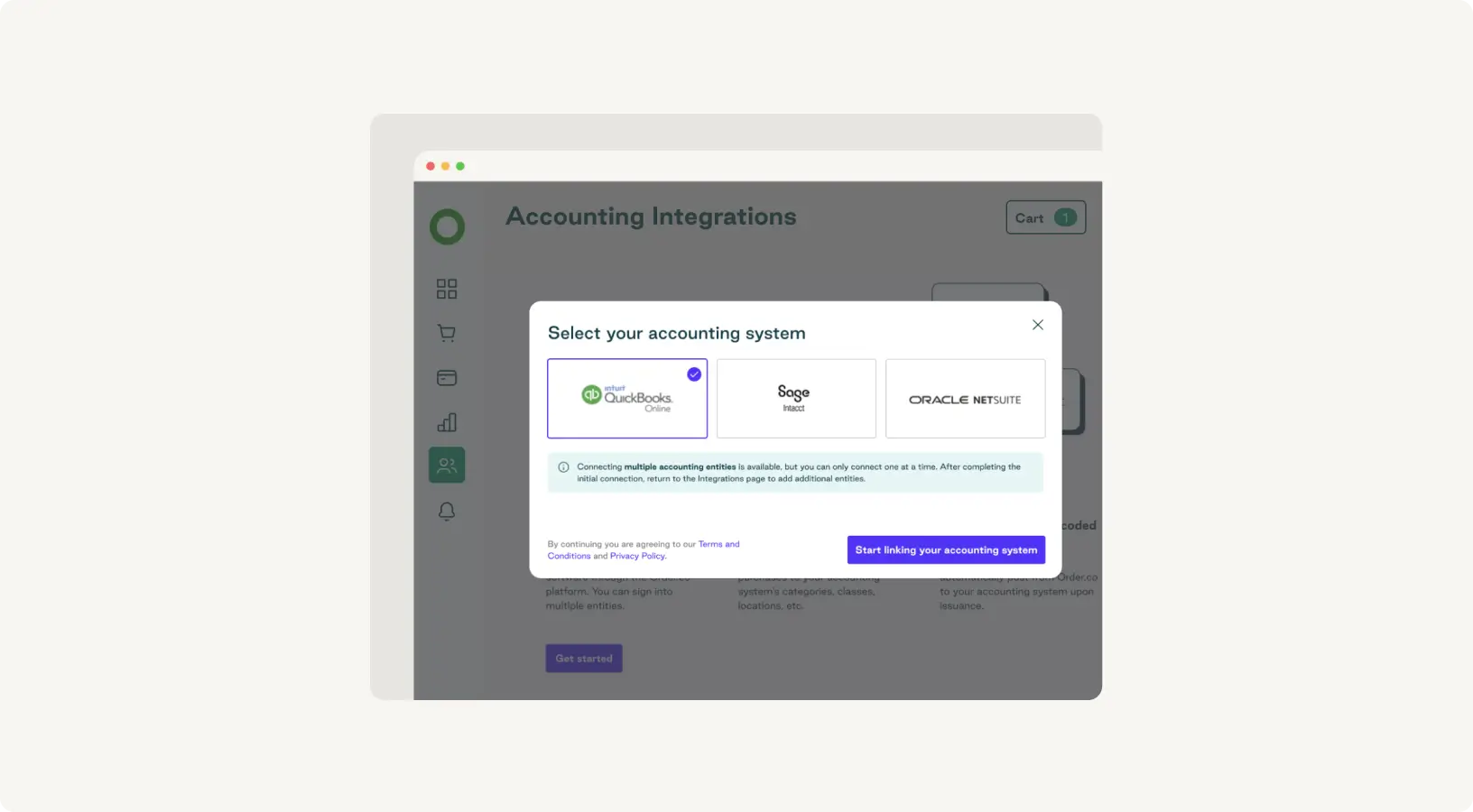

When integrated with spend management software, you can generate custom reports instantly instead of spending days compiling data from different sources.

What to look for in a B2B virtual card provider

Selecting the right virtual credit card provider means looking at a few key factors:

- Security features: Look for card issuers offering vendor-locked cards that automatically tie to specific merchants after the first use, single-use options for maximum protection, and comprehensive fraud monitoring to keep your payments safe.

- Integration capabilities: Make sure the cards fit seamlessly into your existing workflows. Strong providers offer native integrations with accounting systems, expense management platforms, and ERP solutions to eliminate manual data entry.

- Spending controls and customization: Check whether you can set granular spending limits, restrict cards by merchant category, define custom expiration dates, and assign user permissions. These controls help prevent unauthorized purchases, reduce the risk of overspending, and give finance teams confidence that every transaction aligns with company policy.

- Reporting and analytics: Look for real-time spend visibility, customizable dashboards, detailed transaction histories, and export options for deeper analysis. Consolidation and centralization become crucial for organizations managing payments across multiple vendors and categories. Platforms like Order.co consolidate all virtual card transactions into a single system, providing unified visibility and control.

- Credit integration offers additional financial flexibility. Some providers combine virtual cards with business line of credit options, giving organizations access to working capital when needed while maintaining spending controls.

Try Order.co's B2B virtual cards

B2B virtual cards solve the payment headaches and inefficiencies you face every day. With Order.co, you get vendor-locked cards that automatically restrict each card to its first merchant, eliminating unauthorized use even if card details are compromised.

Beyond virtual cards, Order.co consolidates all business payments into a centralized platform, enabling real-time spend visibility, detailed reporting, and robust compliance controls. You gain the flexibility to pay for purchases outside traditional product catalogs while maintaining strict governance.

Ready to transform your business payment processes? Book a demo to see how Order.co's virtual cards can simplify your operations while enhancing security and control.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business

"*" indicates required fields