What Is a Consolidated Invoice and How Does It Reduce AP Costs?

What Is a Consolidated Invoice and How Does It Reduce AP Costs?

As organizations grow, they often struggle with an ever-increasing flow of invoices—each with different billing dates, payment terms, discounts, penalties, and preferred payment methods. Managing this complexity can quickly drain teams' time and resources.

But there’s a simpler, better way to handle overwhelming purchasing and payment processes: consolidated invoicing. Consolidated invoicing gets you out from under piles of individual invoices, allowing you to make just one monthly payment.

Read on to learn how consolidated invoices work, their biggest challenges and benefits, and the security and compliance requirements you need to understand before implementation.

Download the free tool: AP Ledger Template

What is consolidated invoicing?

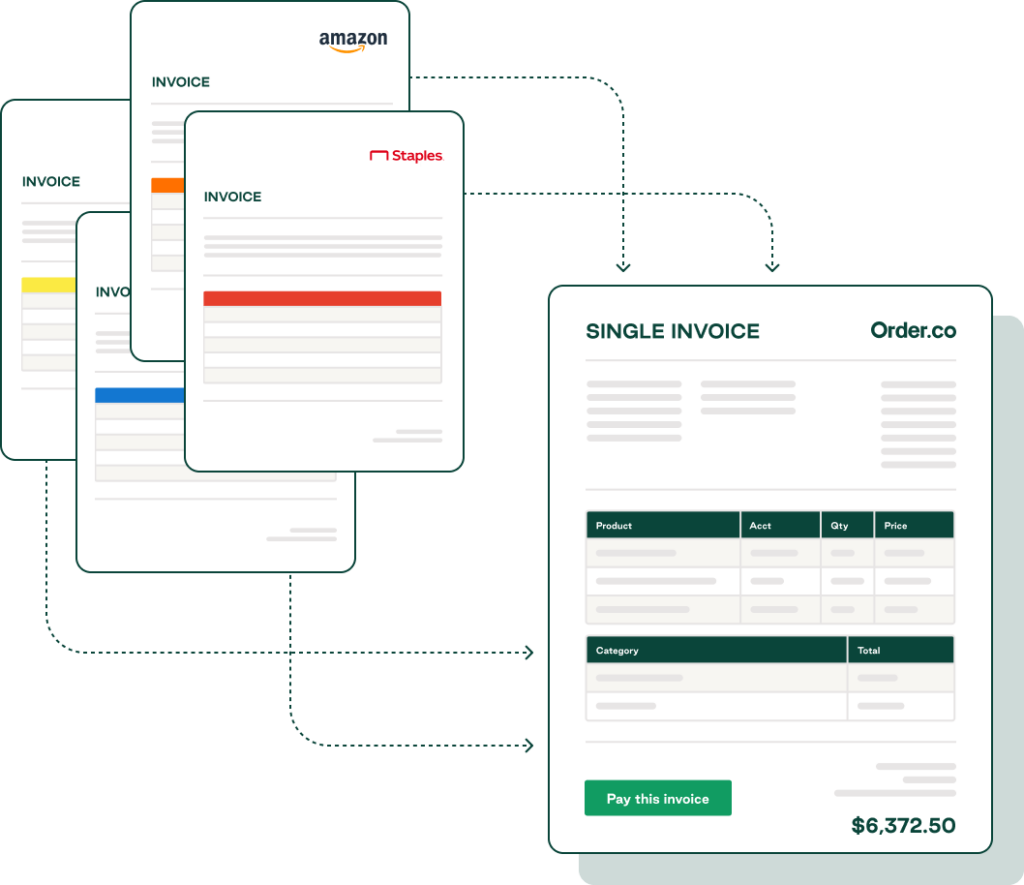

Consolidated invoicing means using a third-party procurement management solution to combine multiple vendor payments into a single transaction. Rather than paying invoices separately, you receive one invoice per billing cycle to simplify your accounts payable process.

Order.co takes this further by automatically aggregating charges from dozens or hundreds of vendors, reconciling them against purchase orders, and providing detailed reporting. You not only pay less frequently but also gain full visibility and control over your spending.

What are the biggest invoice challenges buyers and vendors face?

Without a consolidated invoicing solution, buyers and vendors tend to face a standard set of invoice-related challenges. Late and duplicate payments, processing backlogs, and multiple invoices from the same vendor can easily lead to inefficiencies and higher costs.

Late or missed payments

Delayed payments can result in fees, interest, and potential loss of preferred contract terms. Yet late payments are common, with 44% of mid- to upper-midsized companies reporting that a quarter or more of their invoices are delayed each month. These late payments create a cascade of problems, including damaged vendor relationships, increased borrowing costs, and potential supply chain disruptions.

Duplicate payments

Duplicate payments can be just as costly as missed ones, leading to unnecessary expenses and administrative headaches. Centralized systems flag potential duplicates for review and correction before they cause problems.

Processing backlogs

Time-consuming manual invoice processing typically means a mountain of paperwork that never seems to shrink. An automated, centralized invoice consolidation system takes the weight off your AP team’s shoulders, reducing countless hours of processing to a short monthly review and approval of a single invoice.

Multiple invoices from a single vendor

Vendors traditionally send individual invoices for every purchase order. This type of fragmented invoicing makes it hard to track spending across locations, pay invoices promptly, and stay on top of budgets. Invoice consolidation remedies this by combining all invoices into a single payable summary.

What are the benefits of invoice consolidation?

Invoice consolidation, especially in combination with centralized purchasing, helps simplify financial processes, maximize cost efficiencies, and reduce uncertainties across the buying cycle.

Accelerated payables

Consolidated invoicing allows AP and Finance to follow a single, repeatable process for every transaction. Turning tedious processing tasks over to automation and AI saves teams time and boosts productivity.

Better cost efficiency

While digitized invoice processing means transactions can occur 24/7, consolidated invoicing allows payments to be made with the touch of a button. These improvements increase cost-efficiency significantly, dropping the average processing cost per invoice from as much as $13.11 to as little as $3.12 for best-in-class teams.

Automated recording and reports

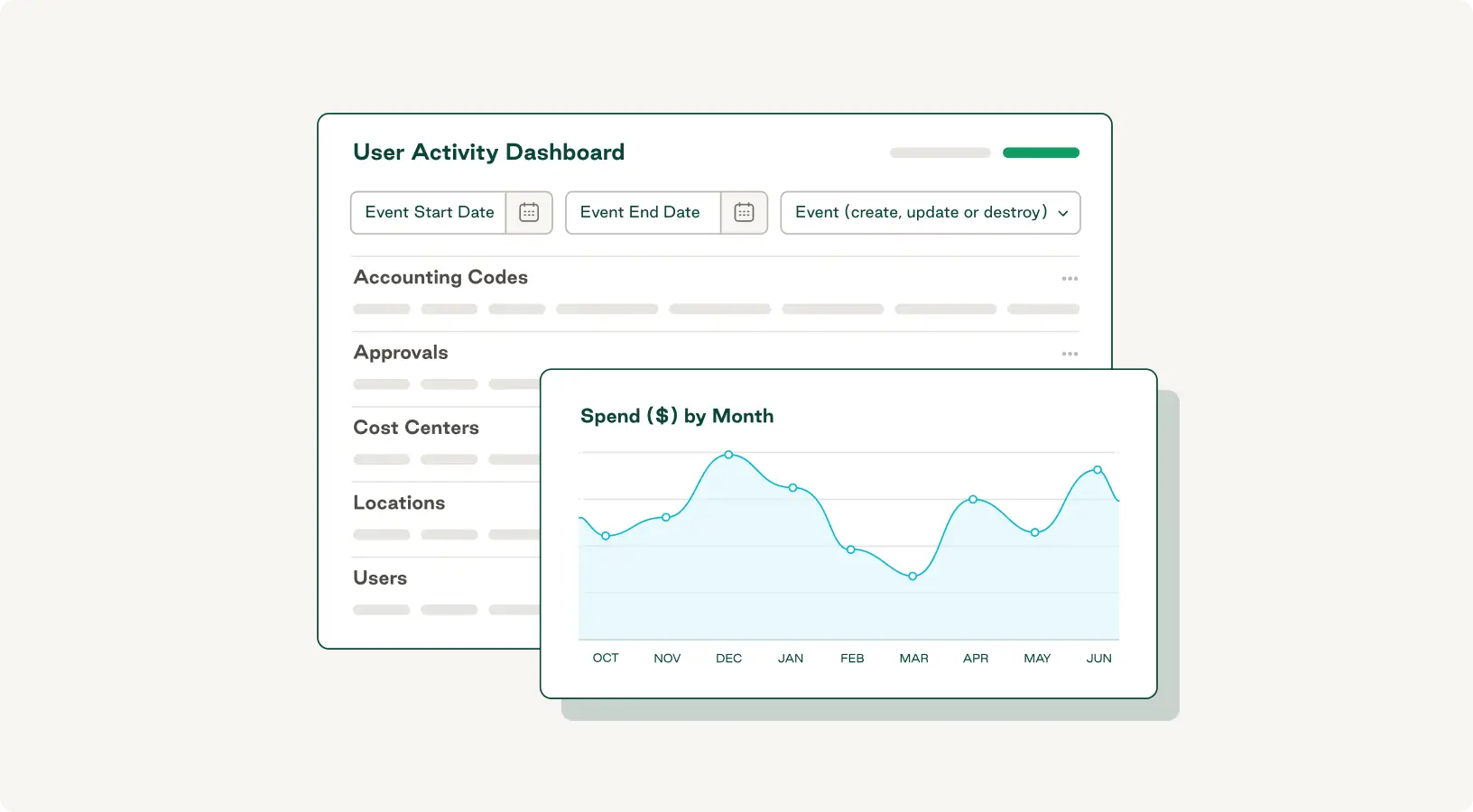

Consolidated invoicing starts with centralizing all vendor transactions within one platform. Centralization allows you to create automated workflows for tasks like approvals, invoice matching, and payments, making it easier to verify accuracy and report on spend data.

Universal net terms

Some platforms can extend universal net terms, giving all orders within a billing cycle the same due date. This simplifies cash flow management and reduces the need to track multiple payment deadlines across vendors.

On-time payments for vendors

Consolidated invoice systems mean vendors benefit from more timely payments instead of waiting 30, 60, or 90 days. Consolidated invoicing ensures vendors are paid promptly, strengthening supplier relationships.

Security and compliance considerations when consolidating invoices

Security and compliance are critical when implementing consolidated invoicing, especially given the involvement of sensitive financial data and increasingly strict regulatory requirements.

Here are some key factors to keep in mind.

Data protection measures

Modern platforms use enterprise-grade security measures, including end-to-end encryption, secure data transmission protocols, and protected storage. These systems record timestamps for all transactions and store data in encrypted, secure locations to prevent tampering.

Comprehensive audit trails

Regulatory compliance requires detailed documentation of financial activity. Effective consolidation platforms maintain complete audit trails showing who approved each transaction, when payments were made, and how accounting entries were recorded.

Role-based access controls

Proper access management ensures only authorized personnel can view, approve, or modify financial data. Consolidation platforms should provide granular permission settings that align with your organization's approval hierarchy and segregation of duties requirements.

Compliance requirements

Data privacy compliance is essential for any platform processing vendor and financial information. Public companies must also meet Sarbanes-Oxley (SOX) requirements, which include maintaining accurate financial records, implementing proper internal controls, and ensuring management certification of financial statements.

How is a consolidated invoice generated?

Consolidated invoices are generated through a systematic process that begins with vendor identification and spend aggregation and ends with the recording and documentation of all relevant payment data.

The consolidated invoice generation process uses the following structured workflow:

- Customer and vendor onboarding: The system identifies your organization as the customer and maps all approved vendors within your procurement network. It sets each vendor up with specific terms, payment schedules, and approval requirements that guide the consolidation process.

- Purchase aggregation: Throughout the eBilling period (typically monthly), all purchases from approved vendors are captured and aggregated within the consolidation platform.

- Vendor payment processing: The consolidation service pays each vendor according to its individual payment terms, ensuring suppliers are paid on time while buyers receive a consolidated bill.

- Invoice compilation and approval: At the end of the billing period, the system combines all transactions into a single comprehensive invoice, which then proceeds through your pre-defined approval process.

- Payment collection and recording: Once approved, you make a single payment to the consolidation service provider. The transaction is recorded in your general ledger with appropriate coding and documentation to maintain audit trails and ensure accurate financial reporting.

How to create a consolidated invoice in Order.co

Order.co makes it easy for managers to consolidate monthly orders into one invoice for fast, efficient payment.

1. Log in to Order.co to view all orders processed within the system.

2. Select ‘Pay’ from the left-hand menu.

3. Review all invoices within the Pay menu and verify details like:

- Cost

- Line items

- Payment due date

- Payment status (paid, unpaid)

4. Pay individual invoices using the action item in the right-hand column, or select ‘Pay Multiple Invoices’ via the button at the top right of the screen.

5. Consolidate and process invoices you'd like to pay using a single payment by selecting them on the consolidation screen. You'll receive standard net terms for all selected invoices, vendors will be paid immediately, and transactions will be automatically recorded—no more missing payments or hunting for invoice information.

Measuring the impact of consolidated invoices

Tracking the right metrics is essential for understanding the true value of consolidated invoicing. Establish baseline measurements before implementation and monitor these key performance indicators to quantify improvements:

- Cost per invoice: Calculate total processing costs—including staff time, system costs, and error correction expenses—divided by the total number of invoices.

- Processing time improvements: Track metrics like invoice receipt-to-approval time, approval-to-payment processing time, and total cycle time from vendor submission to payment completion. Include exception handling times for complex transactions that require manual review.

- Error rate reduction: Monitor error categories such as duplicate payments, incorrect amounts, mismatched purchase orders, and vendor information discrepancies. Track error resolution time and the cost of correction activities.

- Vendor relationship metrics: Note on-time payment percentages, vendor satisfaction scores, and payment dispute resolution times. Measure vendor adoption rates of electronic invoicing, self-service portal usage, and integration completion rates.

- Return on investment: Compare total implementation and operational costs against quantified benefits, including cost savings, productivity improvements, and risk reduction value.

How does consolidated billing work for companies?

Companies and vendors love the consolidated billing process for its simplicity and efficiency. Here are a few case studies that demonstrate how consolidating payments drives results.

Clinton Management

Even as this full-service management firm excelled at managing residential, commercial, and retail units, overseeing spend remained a challenge. Using Order.co, Clinton Management got its spend and payment processes under control:

- The company consolidated over 109 vendors to dramatically decrease invoice volume

- With more visibility, it was able to generate over $1,200 in monthly savings

- Using a vendor-agnostic approach helped automate 100% of offline vendor ordering

Clinton now pays all invoices with one click. Nadia, the Director of Purchasing, is thrilled with the results: “Our vendors aren’t calling to ask where their payments are anymore. Our AP Manager doesn’t have to cut a single check. Order.co makes his life so much easier.”

Physical Rehabilitation Network (PRN)

Physical Rehabilitation Network (PRN) provides industry-leading care to patients across 140+ locations, but its manual, decentralized purchasing process was inhibiting growth and wasting time. Order.co helped PRN establish an automated purchasing and payment process that could scale:

- All of the company’s locations can make purchases through a single central platform

- PRN consolidated 85 vendors, simplifying processes and generating savings

- With consolidated billing and AP automation, it pays hundreds of monthly invoices with one click

Facilities & Purchasing Coordinator Liz notes that with all invoices consolidated, she has much more time to focus on growing the business.

SoulCycle

While fitness and life balance are primary goals for SoulCycle's 350k+ members, the spinning studio needed a trainer of its own to help with invoices across its 93 locations. Order.co helped the company get its procurement process into the best shape of its life:

- SoulCycle was able to optimize and automate orders from over 50 vendors

- The company now earns over $7,200 in rewards for the purchases it makes

- With consolidated billing, it now pays 1,500 invoices with one quick payment

Operations manager Sarah says that reporting that previously took “five to six hours a month” is much faster now that she submits one monthly invoice for the whole company. “I can be self-sufficient—meaning able to add products, users, or locations on my own. I can also get a report without waiting for someone to provide me with the data. Ninety percent of the things I need to do, I’m able to do at the moment.”

Simplify your payments with Order.co’s consolidated invoicing

Order.co makes it easy to centralize dozens or hundreds of invoices in one user-friendly platform, enabling you to pay for all your purchases with just a click.

Schedule a demo to see how Order.co’s consolidated invoicing can accelerate your AP workflow by combining your vendor bills into a single weekly or monthly statement.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields