Limitations of ERP: 5 Key Challenges and How to Solve Them

Limitations of ERP: 5 Key Challenges and How to Solve Them

Enterprise Resource Planning (ERP) systems promise to bring order to complex operations and business functions. In reality, they often miss the mark. High implementation costs, rigid workflows, and integration nightmares can quickly turn a supposed advantage into a significant liability. For finance and procurement teams managing multiple vendors and locations, these challenges hit particularly hard.

In this guide, you'll learn about the five most common ERP limitations, how they show up in procurement operations, and practical strategies to overcome them.

Download the free ebook: The Procurement Strategy Playbook for Modern Businesses

What is ERP—and why do businesses use it?

ERP software serves as a centralized platform for managing core business processes, including finance, procurement, project management, customer relationship management (CRM), human resources, and supply chain management. By consolidating data and workflows into a single system, enterprise resource planning gives teams a unified source of truth across different departments.

Finance teams adopt ERP systems for compelling reasons: greater visibility into purchasing patterns, stronger spend controls, improved operational efficiency, and better compliance management. The goal is straightforward—eliminate data silos, automate manual processes, and gain real-time insights into key business performance metrics.

However, that promise doesn't always hold. As your organization’s specific needs evolve and procurement becomes more complex, the very systems designed to provide flexibility can become rigid constraints.

What are the main limitations of ERP systems?

While there are many benefits of ERP systems, they come with inherent limitations that can impact agility and efficiency. For finance and procurement management teams responsible for managing vendor relationships, multi-location operations, and spend control, understanding these constraints is essential.

High implementation and ownership costs

The financial burden of ERP systems extends far beyond the initial price tag.Research shows that ERP implementations experience average cost overruns of 189%, turning what seemed like a manageable investment into a budget-busting project.

The initial costs of ERP implementation include software licenses, hardware infrastructure, consultant fees, customization work, data migration, and training programs. Over time, expenses continue to accumulate through system maintenance, annual license renewals, additional user licenses, and support fees.

Complex, lengthy deployment process

ERP deployments are notoriously time-consuming. Typical implementations take a few months to a year, and for larger organizations, timelines can stretch even longer. Meanwhile, your business keeps moving, meaning the system may already feel out of step by the time it goes live.

These projects also demand significant internal resources. Core team members must dedicate a considerable portion of their working hours to implementation, pulling top performers away from their regular responsibilities. Not surprisingly, 67% of ERP projects run past schedule, extending timelines and compounding costs.

Limited customization and rigid workflows

Most on-premise and cloud-based ERP systems rely on standardized processes that may not align with how your business actually works. Customization is possible, but custom code is expensive to develop, hard to maintain, and can be problematic during system upgrades.

That leaves you with a difficult choice. You can either adapt your business processes to fit the new system's modules or invest heavily in custom work that creates long-term headaches. And when you're managing diverse supplier relationships or operating across regions, this rigidity becomes particularly problematic.

Integration issues with legacy systems

Few organizations run on a single piece of software. Legacy systems, specialized applications, and departmental tools still play a role. When your procurement system doesn't connect cleanly with your ERP, you end up with problems like duplicate data entry, manual reconciliation, and conflicting reports.

API limitations, incompatible data formats, and different update schedules all contribute to integration difficulties. These technical challenges translate into real business problems, such as delayed reporting, inefficient workarounds, and increased error rates.

Scalability constraints for growing companies

As transaction volumes increase, additional users come online, and business complexity grows, systems that once worked well can begin to struggle. Over time, traditional ERPs designed for specific processes become less effective.

When systems can’t scale, growth slows. Adjusting to fit system limits allows operational inefficiencies to creep in and more agile competitors to gain ground.

How do ERP limitations impact procurement teams?

Procurement teams operate at the intersection of finance, operations, and vendor management—making them particularly vulnerable to ERP shortcomings. Finance teams need connected end-to-end procurement, yet traditional ERPs often make buying and spend management feel more fragmented.

Vendor management complexities

Vendor master data that isn't shared effectively across business entities can result in duplicate vendor records, inconsistent payment terms, and scattered purchasing history. This fragmentation weakens your ability to negotiate and use total spend effectively.

For organizations practicing centralized purchasing, these issues cut even deeper. You can't realize the benefits of consolidated spending when your ERP gets in the way of unified vendor management.

Purchase order and automation limitations

Traditional ERPs often treat purchase order creation as a rigid, form-based process. Manual PO creation takes time and invites errors. When team members have to navigate complex interfaces just to generate a PO, procurement becomes a bottleneck rather than an enabler.

Automation also often lags behind modern needs. Integration with your procurement automation strategy becomes challenging when the ERP lacks robust APIs or imposes restrictions on external system access.

Invoice consolidation and payment processing issues

Three-way matching—reconciling purchase orders, receiving documents, and invoices—becomes cumbersome when ERP systems lack intelligent automation. For organizations already struggling with AP automation challenges, the ERP often contributes to the problem rather than solving it.

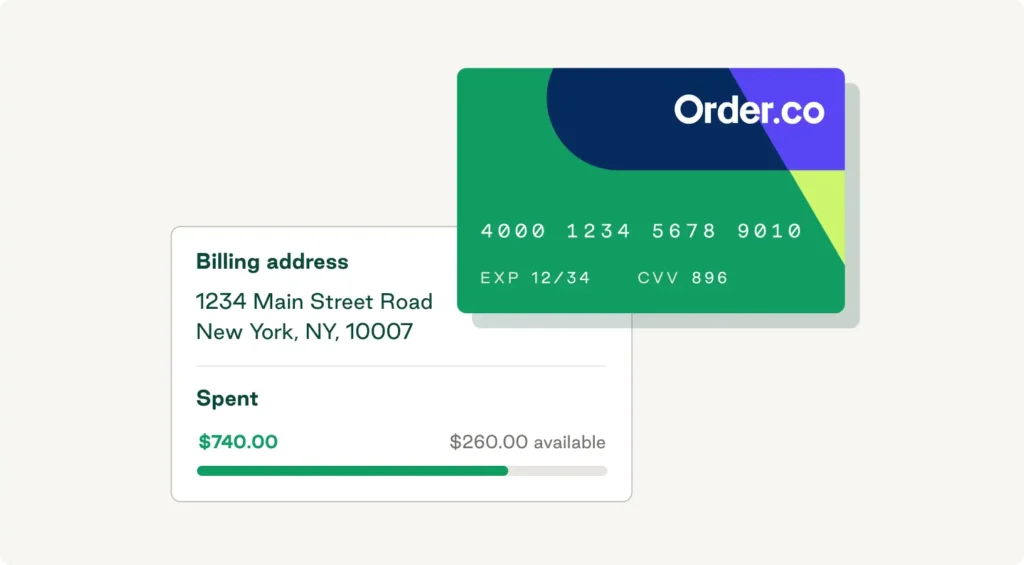

Payment processing presents another challenge. If your ERP doesn't support flexible payment options or modern payment methods like virtual cards, you can miss out on opportunities to improve cash flow and strengthen spend controls.

Spend visibility and reporting challenges

Complete spend visibility is foundational to effective procurement management. Yet this is an area where many ERP systems fall significantly short. Even within the system itself, data silos can create surprising blind spots, making it nearly impossible to achieve a holistic view of organizational spending.

Many ERPs offer static, predefined reports that don't address procurement's business needs. For mid-market companies in particular, these visibility challenges create strategic disadvantages—you can't optimize what you can't see.

What security and compliance risks do ERP systems present? (And how to overcome them)

Beyond operational limitations, ERP systems introduce real data security and compliance risks. Their biggest strength—a single system that connects financial, operational, and employee data—can also be a weakness. When everything lives in one place, that system becomes a high-value target.

Data breach and security vulnerabilities

ERP systems store vast amounts of sensitive information, making them prime targets for cyberattacks. Security vulnerabilities can arise from unpatched legacy systems, outdated infrastructure, and insufficient user access controls.

Reducing risk starts with strong security controls, including:

- Role-based access restrictions

- Regular security audits and penetration testing

- Timely system patches and updates

- Multi-factor authentication

- Encryption for data at rest and in transit

Vendor lock-in and business continuity risks

ERP vendor relationships can create long-term dependency. Over time, that vendor lock-in creates risks that include escalating licensing costs, limited negotiating leverage, and a reduced ability to adopt new technologies.

To mitigate these risks, it's essential to negotiate contracts with clear exit clauses and data portability provisions. Many teams also reduce exposure by taking a hybrid approach that pairs the ERP with specialized solutions that handle procurement and P2P more effectively. Understanding your P2P implementation timeline can also make transitions smoother.

Regulatory compliance challenges

With regulatory demands continuing to evolve, ERPs that lack built-in controls, can't produce clean audit trails, or struggle to adapt can quickly create compliance challenges.

A practical way to address regulatory challenges is to plan for compliance from the start. That means configuring appropriate audit trails, enforcing policies through approval workflows, and establishing clear data governance frameworks.

How Order.co addresses common ERP gaps

While ERP systems provide a solid foundation, they aren't designed to handle every nuance of modern procurement and spend management. Order.co fills the critical gaps ERPs leave behind, delivering the flexibility, speed, and control finance and operations teams need.

Centralized supplier and product data across systems

Order.co ensures consistency between systems for all your supplier catalogs and approved products while giving your teams the flexibility to purchase how they prefer. You can buy directly within your ERP from pre-approved items or seamlessly browse and order through Order.co's intuitive interface. Either way, orders automatically flow through your existing ERP approval workflows without manual data entry or duplicate processes.

This unified approach eliminates catalog inconsistencies, reduces maverick spending, and ensures every purchase adheres to your negotiated contracts and compliance requirements.

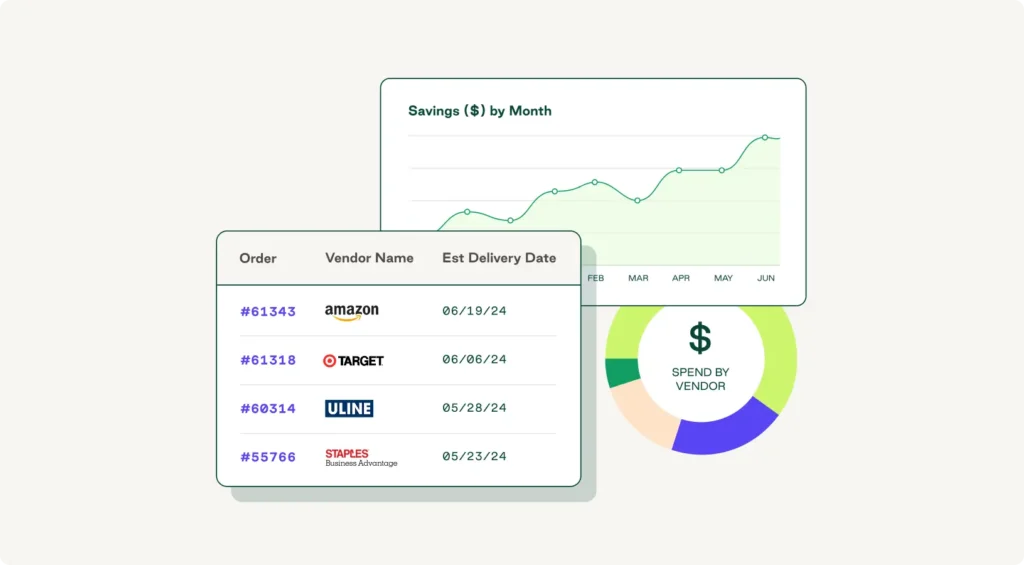

Real-time spend data synced to your ERP

The platform solves visibility challenges by providing real-time spend insights that sync directly to your ERP. Procurement transactions flow automatically into your existing financial systems, eliminating duplicate data entry and keeping records consistent. Finance teams can see spending as it happens, not after the fact.

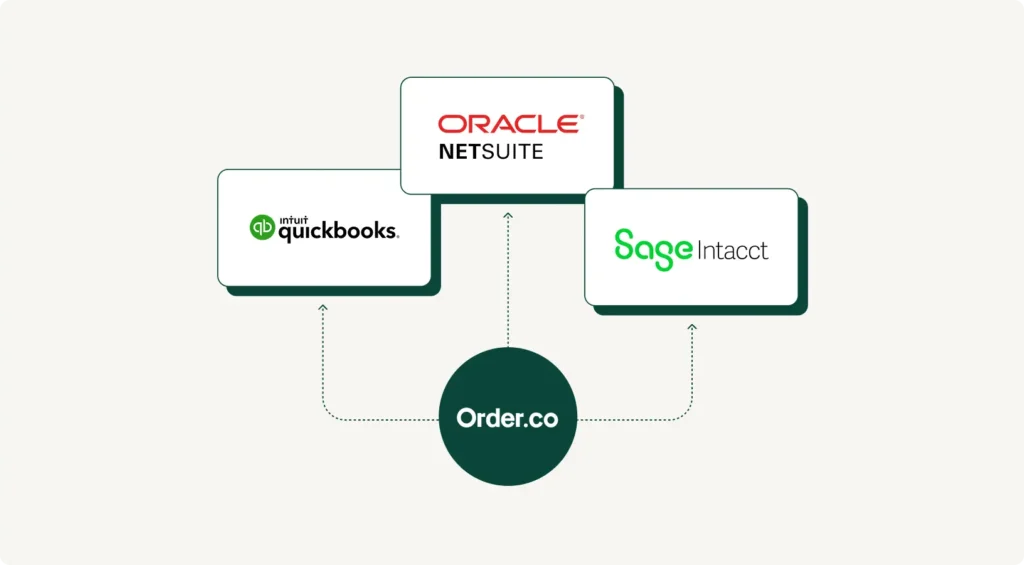

Plug-and-play connectors for rapid P2P acceleration

Order.co's plug-and-play connectors remove much of the complexity from implementation. Pre-built integrations with major ERP platforms mean you can connect systems in days rather than months. For mid-market companies, that speed makes a difference—adding modern procurement software capabilities without disrupting daily business operations or overloading IT.

Schedule a free demo to see how the Order.co AI-powered procurement platform can help you automate spend controls, sync real-time data, and reduce manual P2P work.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields