Corporate Credit Card Fraud: How to Identify and Prevent It

Corporate Credit Card Fraud: How to Identify and Prevent It

Corporate credit card fraud is one of the costliest blind spots for businesses today. When employees misuse company cards, whether on purpose or by accident, the financial impact cascades far beyond the fraudulent charge itself.

But the challenge isn't just preventing fraud—it's detecting it. Fraudsters often count on businesses becoming too overwhelmed by receipts and transactions to notice small charges slipping through. However, with awareness and the right systems, you can catch issues early to dramatically reduce your exposure.

This guide covers the fundamentals of corporate credit card fraud, why it’s important, and how to address and prevent it within your organization.

Download the free ebook: Choose the Right Procurement Technology With This Decision Matrix

What is corporate credit card fraud?

Corporate credit card fraud is when someone uses a company-issued card without permission or against company policy, often resulting in significant financial losses. Unlike consumer credit card fraud, which typically involves external theft, corporate fraud generally stems from internal cardholders who have legitimate access to the card.

The financial impacts of business credit card fraud go beyond the stolen amount. On average, every $1 lost to fraud costs companies more than $5 due to chargebacks, fees, and expenses related to merchandise replacement.

What are the different types of corporate credit card fraud?

There are two main types of corporate credit card fraud: accidental misuse and intentional fraud. Understanding which kind of fraud has occurred helps you respond appropriately.

Accidental misuse typically involves honest mistakes, like using the wrong card or forgetting to cancel a trial subscription. Typically, you can resolve these issues through clear policies and better tracking systems.

Intentional misuse involves deliberate deception. Employees might charge personal items, split large unauthorized purchases into smaller ones to avoid approval workflows, or continue using cards after leaving the company.

| Example | Accidental misuse | Intentional fraud |

| Personal meal | An employee mistakenly uses a corporate card instead of personal funds to buy lunch | An employee or external individual deliberately charges personal dining to a company card |

| Subscription overlap | An employee forgets to cancel a free trial | An employee or external individual knowingly uses a corporate card for a personal gym membership |

| Miscategorization | An employee submits a personal expense as a business expense by mistake | An employee intentionally misclassifies personal shopping as office supplies |

| Double-charging | An employee accidentally submits the same receipt twice | An employee splits a large personal purchase into multiple small charges to bypass approval |

Why is it so important to prevent corporate credit card fraud?

Preventing corporate credit card fraud isn't just about saving a few dollars. Stopping fraud is especially vital because repeated issues can hurt your ability to establish a line of credit and may even lead to merchant account termination if chargebacks accumulate.

Consider the broader impact of credit card fraud:

- Cash flow disruption: Fraudulent charges consume working capital meant for operations, vendor payments, and payroll.

- Chargebacks and disputes: Repeated fraud can lead to increased chargeback rates, potentially resulting in merchant account restrictions.

- Reputational damage: Public incidents of fraud damage stakeholder confidence.

- Compliance violations: Some fraud scenarios create regulatory liability, especially for government contracts.

Recent data shows just how urgent preventative measures are. In 2024, the FTC received over 449,000 fraud reports, an 8% increase from the previous year. Weak internal controls play a major role: The Association of Certified Fraud Examiners found that 32% of fraud cases stem from inadequate controls, while 19% result from employees bypassing existing safeguards.

What are the warning signs of corporate credit card fraud?

Since corporate fraud often accumulates quietly until an auditor spots an anomaly, detecting fraud early requires vigilance.

Red flags indicating possible corporate credit card fraud include:

- Unexpected transactions: Charges at unusual times or in locations where your team doesn't operate

- Sudden spending spikes: Monthly spending that jumps dramatically or appears in unusual merchant categories

- Repeated chargebacks: Multiple disputed transactions that suggest either compromised data or employee testing

- Out-of-policy purchases: Charges at casinos, bars, or restricted merchants

- Missing documentation: Lost receipts or vague expense descriptions

Tracing fraud becomes even harder when multiple employees share the same card. User-specific options, like Order.co’s virtual cards, make it easier to track spending and prevent misuse.

What should you do if you suspect corporate credit card fraud?

If you suspect corporate credit card fraud, using a structured approach to investigate the issue can protect your company while preserving necessary evidence. Here’s a step-by-step approach to handling suspicious activity effectively.

1. Contact your credit card provider

Contact your card issuer immediately via phone or your online account portal. Ask them to freeze the affected account or deactivate the card to prevent further charges. Be sure you note the time of contact and the representative's name.

Most issuers can suspend charges within minutes, limiting your exposure. When you call, provide specific transaction details, ask about your card program's fraud protection liability coverage, and request card replacement if the physical card could be compromised.

2. Dispute the charges

Once the card is frozen, dispute the fraudulent transactions as soon as possible—you usually have a 30- to 60-day window. You'll typically need to fill out a dispute form and provide supporting documentation showing why each charge is fraudulent.

3. Document the suspected fraud

Thorough documentation is essential for effective investigation and potential legal or disciplinary actions. Gather transaction records from your card issuer, original receipts, expense reports, email communications, and comparative spending data showing variance from normal patterns.

4. Report fraud to the proper authorities

For serious cases, report the fraud to local police, the FBI, or the FTC. Reporting creates an official record and helps authorities coordinate an investigation. It also shows that your organization takes accountability seriously.

How can you prevent corporate credit card fraud?

When it comes to credit card fraud, preventing it is far cheaper and less stressful than cleaning it up. The best prevention approach combines clear policies, spending controls, active monitoring, and time-saving automation.

Develop and enforce a clear corporate credit card policy

A strong expense policy forms the foundation of a successful corporate card program. Specify:

- Who can hold a card

- Approved expense categories and spending limits

- Receipt and reporting requirements

- Approval workflows

- Consequences for violations

Communicate this policy clearly during onboarding and revisit it regularly.

Review financial statements often

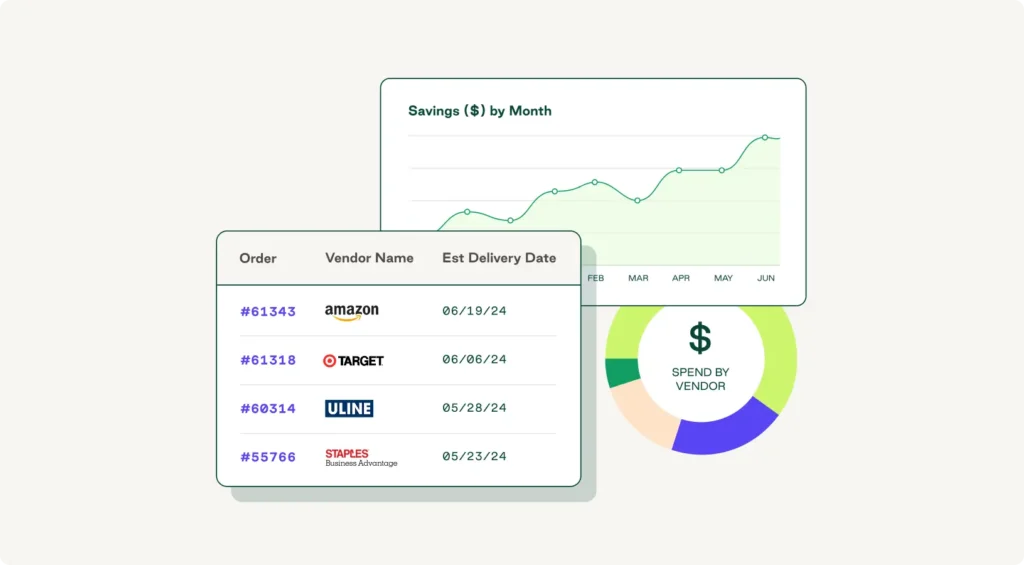

Monthly spend analysis can help you catch fraud patterns before they compound. Check financial statements regularly to compare current spending against historical baselines and identify unusual patterns. Require expense reports within 30 days and cross-reference card statements against submitted expense reports to catch duplicate submissions.

Use commercial credit card controls

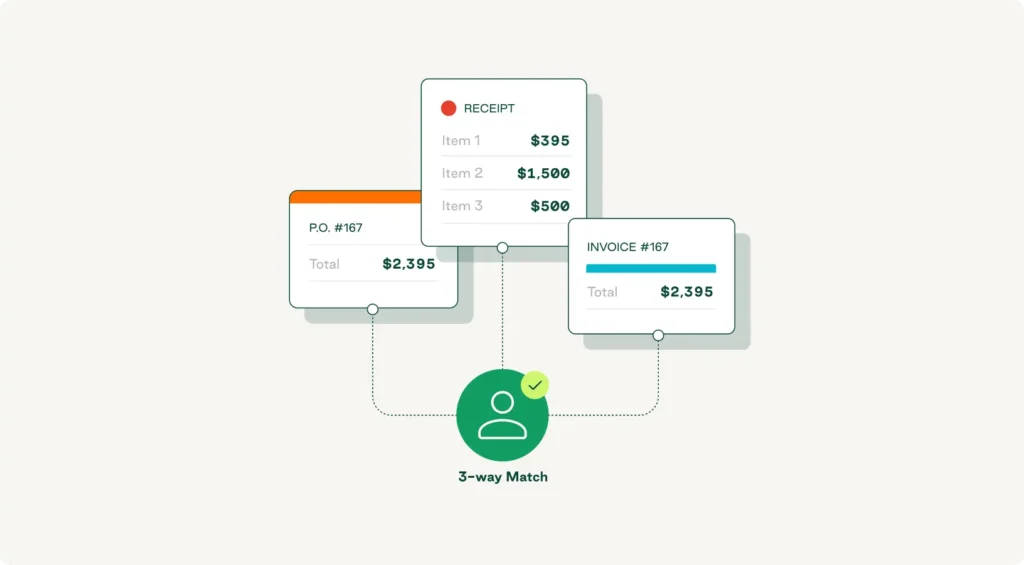

Corporate credit cards typically include some built-in controls to prevent unauthorized charges, though these are usually limited to broad credit limits or category restrictions. Specialized solutions, like Order.co's virtual cards, embed spend control at the transaction level for more detailed oversight. These vendor-locked cards integrate with Order.co's automated spend management tools to enable customizable approval workflows that automatically decline any purchase attempt outside the approved vendor.

Use business expense software

Modern tools like procurement management software make unauthorized spending harder and card reconciliation easier. Automation can:

- Capture receipts automatically

- Enforce approval workflows and policies

- Provide real-time reconciliation

- Create a fully auditable record

Educate your employees

Employees who understand security best practices are your first line of defense. Assign leaders to each department to ensure accountability, and be sure to train staff on proper card usage. Training should cover card usage policies, phishing and social engineering risks, data security, personal accountability, and suspicious requests.

Prevent corporate credit card fraud with Order.co

Managing corporate credit card risk is easier with purpose-built financial technology. Order.co combines individual card issuance, real-time spending controls, and vendor-locked virtual card technology to provide a comprehensive fraud prevention system—whether your team works together in one office or is distributed across the globe.

Order.co's virtual cards limit charges strictly to pre-approved vendors, proactively blocking misuse even if the card data is compromised. Embedded approval workflows ensure that no high-risk transactions slip through, while real-time visibility gives finance teams complete transparency.

Schedule a free demo to learn how Order.co’s virtual cards and custom catalog can help you combat corporate credit card fraud and optimize operational efficiency.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business

"*" indicates required fields