The 5 Best Credit Cards for Nonprofits (2026 Expert Guide)

The 5 Best Credit Cards for Nonprofits (2026 Expert Guide)

For nonprofits, every dollar counts. Your organization must balance financial transparency with maximizing resources, all while ensuring there’s enough working capital to pay invoices by their respective due dates.

Most likely, you’ve heard of Mastercard and Visa. These credit cards can help nonprofits improve cash flow management, earn financial rewards, and simplify expense management. But traditional cards don't offer the controls and visibility you need to manage spending or ensure purchasing complies with internal policies.

This guide compares five of the best credit cards for nonprofits—their fees, rewards, bonuses, and benefits—to help you select a card that’s right for your organization.

Download the free ebook: Choose the Right Procurement Technology With This Decision Matrix

What are the best credit cards for nonprofits?

There’s no one-size-fits-all credit card for nonprofits, but there are a few clear benefits top card issuers provide. The best business credit cards offer a combination of low fees, high-value rewards, and spend management features to help you maximize your return on business expenses.

Note: The information below is accurate as of October 2025.

1. Best for total spend control: Order.co

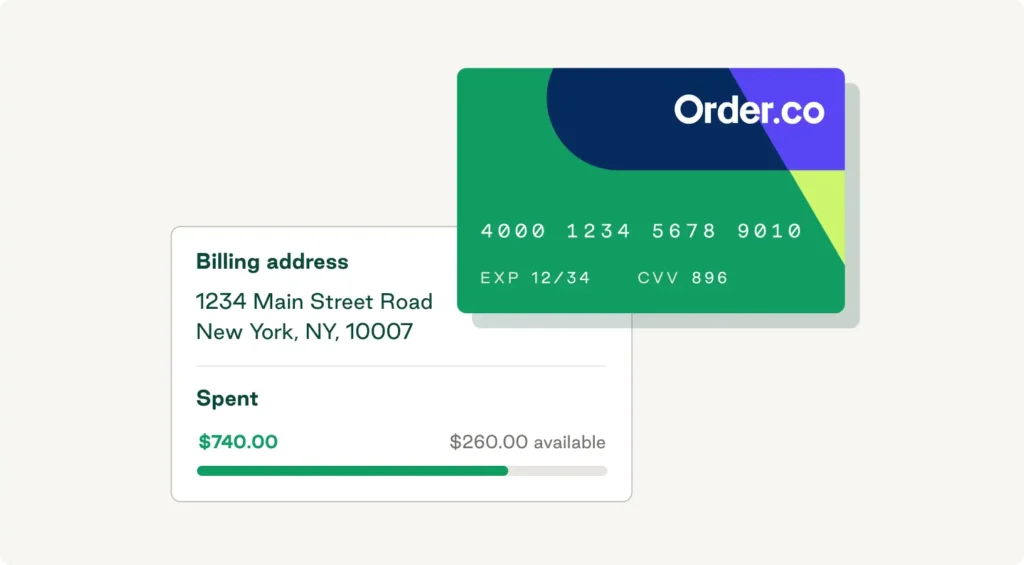

Order.co’s virtual cards help you increase purchasing efficiency, maximize spend control, and optimize approval workflows. The cards are ideal for recurring or service-based expenses—such as software, subscriptions, rent, and utilities—and offer up to 2% cash back depending on how much your business spends. You can configure each card with user-specific limits to increase compliance and eliminate maverick spend.

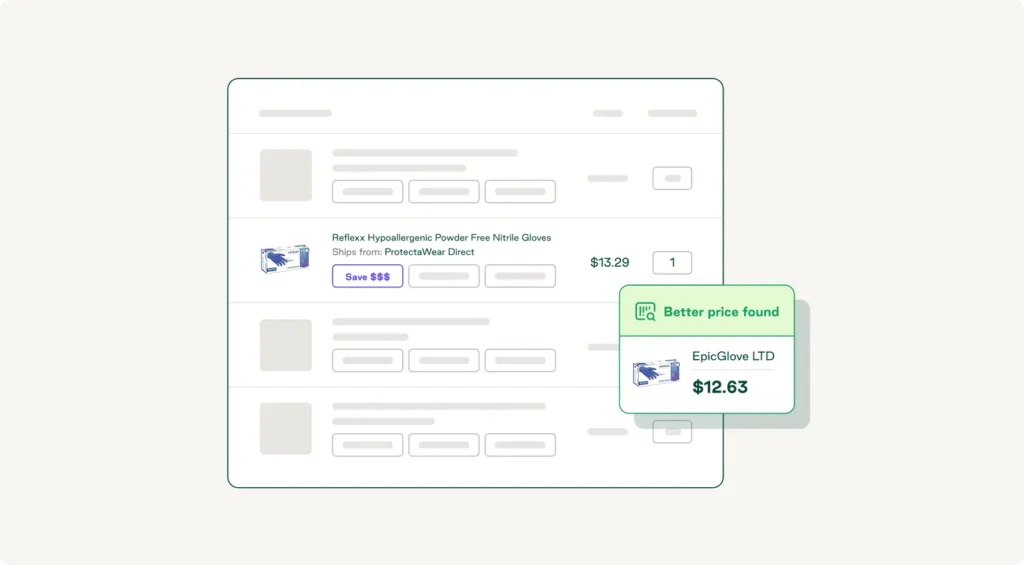

In addition to virtual cards, the Order.co purchasing catalog delivers significant savings on physical goods. Using cost-effective AI sourcing, the platform searches across a vendor network of 30,000+ suppliers to deliver an average of 5% in hard dollar savings. By consolidating purchasing through the catalog, you maintain consistency, control, and visibility across all procurement activities. The software integrates seamlessly with most major accounting and ERP systems, and every purchase is precoded to your general ledger, drastically reducing time spent on manual credit card reconciliation.

Unlike other credit card issuers, Order.co provides end-to-end procurement management for nonprofits, with added features like:

- Centralized purchasing: Create a custom catalog of pre-approved products to ensure purchasing compliance and eliminate rogue spend.

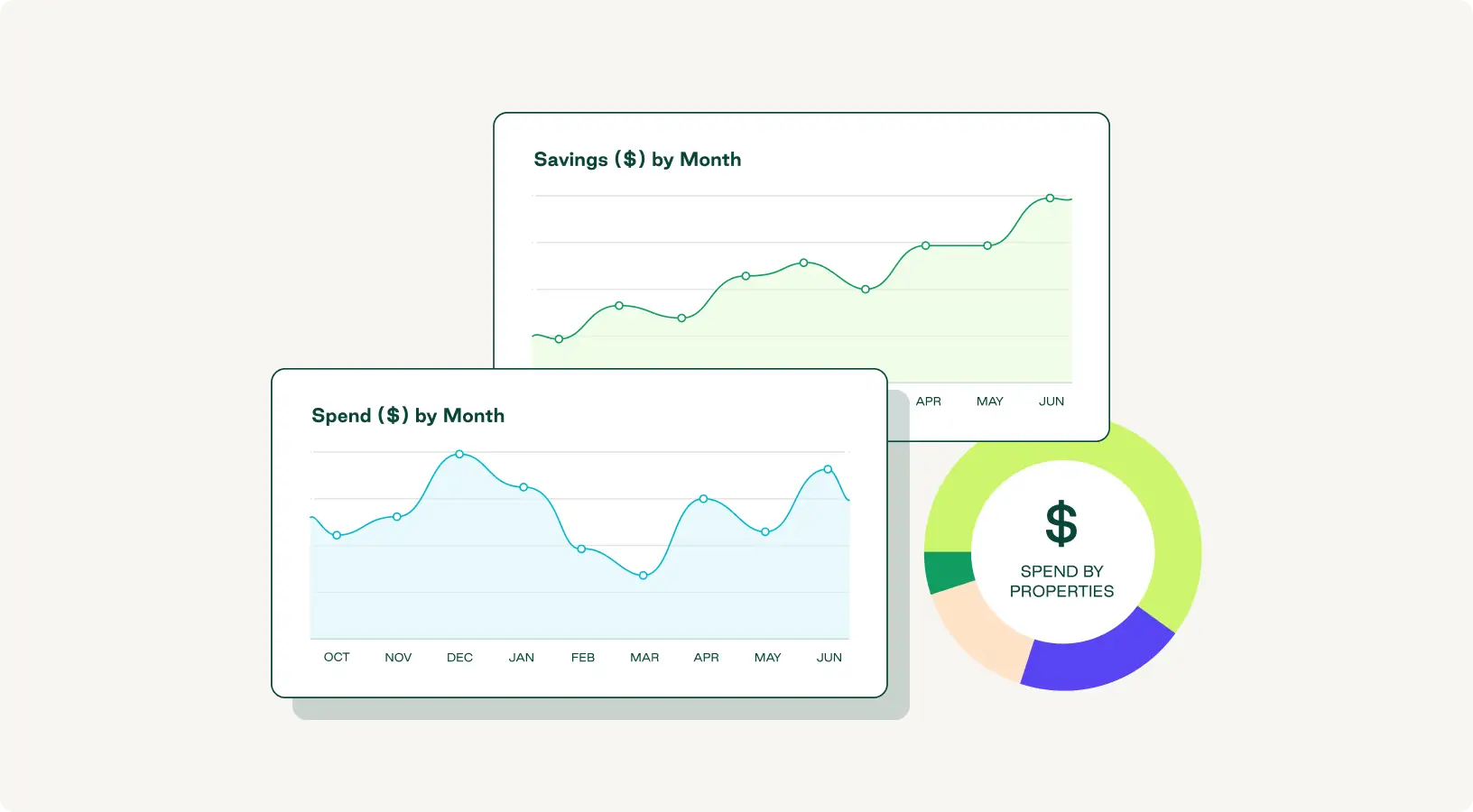

- Real-time spend analysis: View live spend performance data with granular insights to discover cost-saving opportunities and purchasing trends.

- AP invoice automation: Improve AP efficiency and accuracy with faster approval workflows, automated expense coding, and three-way invoice matching.

- Vendor management: Centralize vendor information—including supplier details, contract terms, and approved products—to save time and strengthen relationships.

2. Best for no annual fee: American Express Blue Business Cash Card

The American Express Blue Business Cash Card is an optimal choice for nonprofits that want a low-cost corporate credit card with a simple cash rewards structure. It features no annual fee, 2% cash back for the first $50,000 spent each year, and Expanded Buying Power that enables you to spend above your credit limit.

Key features:

- Annual fee: $0

- Welcome bonus: $250 statement credit after you spend $3,000 within the first three months

- Intro APR: 0% for 12 months after account opening on all eligible purchases

- Variable APR: 17.24%–27.24%

- Credit score required: Good to Excellent

3. Best for no personal guarantee: Brex Card

Brex Card is a corporate credit card that simplifies receipt matching and expense management. You can apply for a Brex Card with an Employer Identification Number (EIN) only, making it a strong choice for nonprofit leaders who want to avoid personal liability for the organization’s debt. Creditworthiness is determined by your organization’s cash flow, funding, and spending patterns rather than the personal credit history of individual employees.

Key features:

- Annual fee: $0

- Welcome bonus: 10,000 bonus points after you spend $3,000 within the first three months

- Intro APR: N/A, charge card

- Variable APR: N/A, charge card

- Credit score required: Personal credit scores do not factor into the application process, though some sources indicate a specific minimum amount of bank reserves may be necessary based on the account

4. Best for automated expense management: Ramp

Ramp is an all-in-one corporate credit card and expense management platform that supports financial operations for a wide range of enterprises, including nonprofits. It provides tools for managing purchases across multiple teams without relying on personal credit or manual processes and integrates with other finance systems like QuickBooks, Sage, and Microsoft Teams.

Key features:

- Annual fee: $0

- Welcome bonus: None

- Intro APR: N/A, charge card

- Variable APR: N/A, charge card

- Credit score required: Personal credit scores do not factor into the application process—however, organizations must have at least $25,000 in cash in a US business bank account

5. Best for specialized spending: Ink Business Cash Credit Card

Chase's Ink Business Cash Credit Card offers a tiered cash-back program that’s especially helpful for standard and category-specific nonprofit expenses. It features no annual fee; 5% cash back on the first $25,000 spent each year in combined purchases across office supplies, internet, cable, and phone services; 2% cash back on the first $25,000 spent each year on dining and gas; and 1% cash back on all other purchases.

Key features:

- Annual fee: $0

- Welcome bonus: $900 bonus cash back after you spend $6,000 within the first three months

- Intro APR: 0% for 12 months after account opening on all eligible purchases

- Variable APR: 17.24%–25.24%

- Credit score required: Good to Excellent

What are the benefits of having a nonprofit credit card?

Nonprofit credit cards offer many perks for nonprofit organizations, particularly those that need to maintain meticulous financial records for board members, donors, and grant reporting. Beyond simple convenience, credit cards can help nonprofits:

- Manage expenses: Corporate cards enable you to separate organizational spending from personal expenses, improve bookkeeping accuracy, and centralize spend reporting.

- Earn rewards: Many card issuers provide rewards in the form of cash back, points, or hard cost savings you can reinvest into your nonprofit’s programs.

- Centralize spending: Features like real-time reporting and spend analytics are especially useful for nonprofits, as they simplify the process of categorizing expenses for tax filings and grant compliance.

- Improve cash flow management: Credit cards provide a grace period between purchases and payments, which provides flexibility to cover unexpected costs and align expenses with incoming revenue.

Nonprofits often need to make a little go a long way. A well-chosen credit card can help you drive more value from every transaction and maintain the working capital necessary to keep operations running smoothly.

How to choose the best credit card for your nonprofit

No two credit card structures are exactly alike, and the one that best suits your organization depends on your unique spending habits and business needs.

To determine the best credit card for your nonprofit, follow these steps:

- Analyze your spending patterns: Assess your organization’s typical expenditures to identify your largest spending categories and determine which type of rewards program—tiered category bonuses or a flat-rate cash back—will be most beneficial.

- Compare card fees: Weigh hard savings against potential rewards of cards with and without annual fees to work out which offers better value in the long term. Consider any hidden fees, such as foreign transaction fees (if your organization operates internationally), late payment fees, and fees for additional employee cards.

- Evaluate rewards, bonuses, and redemptions: Compare the rewards programs and welcome bonuses of different card offerings. Some nonprofits may benefit from travel rewards or flexible rewards points, while cash back structures may be more practical for others.

- Review spend controls and visibility: If multiple employees or departments make purchases, a centralized spend management solution with built-in virtual cards like Order.co’s procure-to-pay software can provide greater value than straightforward credit cards. Look for features like individual spending limits for employee cards, real-time transaction monitoring, and integrations with your accounting software.

- Consider personal liability: Decide whether your nonprofit organization’s leaders are willing and able to provide a personal guarantee for a credit card. If not, limit your search to cards that don't require one.

Ultimately, the credit card you choose should improve your financial flexibility, deliver rewards or hard savings that reduce your total purchasing costs, and simplify your accounting process with enhanced spend visibility and reporting capabilities.

How do you apply for a nonprofit credit card?

Applying for a nonprofit credit card is usually a simple, straightforward process. Before you apply, speak to your board members, finance team, and other stakeholders to secure organizational buy-in and gather necessary documentation.

The nonprofit credit card enrollment process typically follows these steps:

- Collect required information: Most application processes require you to provide your EIN (also known as a Federal Tax Identification Number) and your organization’s legal name, address, and phone number. In some cases, you may also need to provide information about your directors, structure, and trading history.

- Provide financial documentation: For most credit card applications, you’ll need to submit documents that demonstrate your organization’s financial position—for example, your most recent Form 990, audited financial statements, current bank statements, and credit history.

- Assign an authorized officer: Most card issuers require you to designate a board member or authorized officer who will be responsible for the account. If the credit card requires a personal guarantee, your authorized officer will also need to provide personal information and may be subject to a personal credit check.

- Complete the application: The final step is filling out the application form online or in person, ensuring all information is accurate and complete to avoid application processing delays.

After submitting your application, you’ll typically need to wait 5–10 days for it to be reviewed and approved by the card issuer. However, non-physical cards sometimes offer instant approval for online applications. With Order.co, you can generate virtual cards instantly—complete with vendor-specific limits, automatic GL coding, and real-time spend visibility.

Get started with Order.co virtual cards

With Order.co's virtual cards and AI-powered spend management software, you can optimize your purchasing process, eliminate maverick spending, and improve cash flow management.

In addition to virtual cards, Order.co helps nonprofits:

- Boost financial visibility: Access data-driven insights with real-time spend reporting, analytics dashboards, and vendor performance tracking.

- Increase purchasing efficiency: Simplify and speed up the entire procurement cycle with automated purchasing, configurable approval workflows, and custom vendor catalogs.

- Unlock hidden cost savings: Leverage AI-powered sourcing tools and advanced analytics to consolidate spend and uncover cost-reduction opportunities.

Book a free demo today to learn how Order.co can help your nonprofit save time and money with better spend controls and more efficient purchasing workflows.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business

"*" indicates required fields