Are Virtual Cards Safe? Benefits, Risks, and Best Practices

Are Virtual Cards Safe? Benefits, Risks, and Best Practices

If you're concerned about online payment security, you're not alone. Virtual cards offer a safer way to pay by providing unique card numbers, spending controls, and real-time monitoring—though they're not without limitations.

In this guide, you'll learn how virtual cards protect your financial information, how their safety compares to physical cards, which potential risks you need to watch out for, and best practices for secure usage.

Download the free ebook: The Procurement Strategy Playbook for Modern Businesses

What is a virtual card, and how does it work?

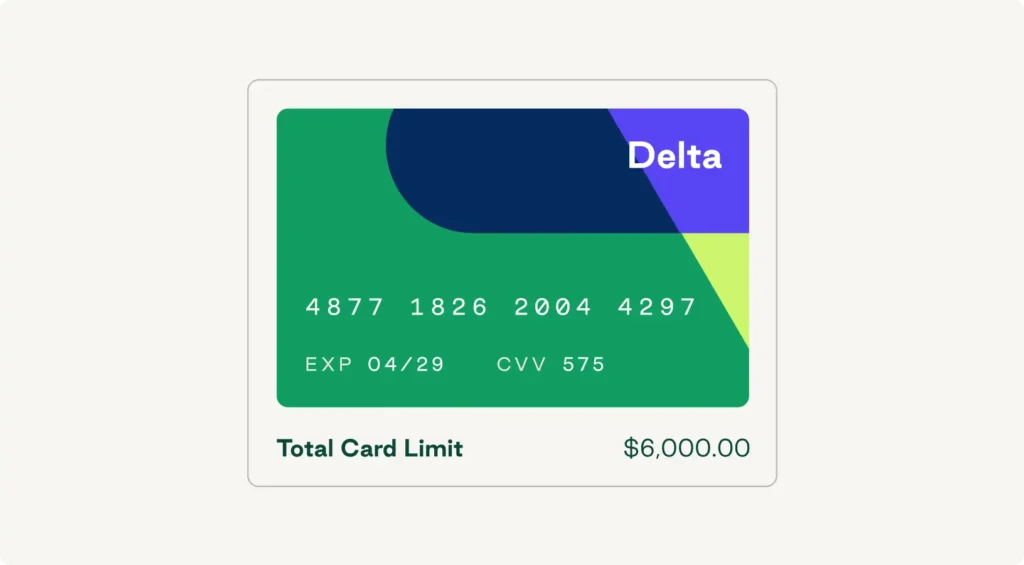

A virtual card is a digital payment method that generates unique card numbers for online transactions, eliminating the need for a physical card. When you create a virtual card, your card provider issues a valid card number, expiration date, and security code that links to a designated funding account, such as a business account or your actual credit card account.

How temporary card numbers protect your real account

Temporary card numbers mask your real credit card information during online shopping. Since each virtual card number is unique and disposable, fraudsters can't use a virtual card to access your primary account details or make unauthorized charges beyond the card's preset limits.

With merchant losses from online payment fraud expected to exceed $362 billion globally between 2023 and 2028, virtual cards are essential for helping reduce risk. Even if a hacker intercepts your payment information, using a virtual card ensures they gain access only to a single-use or limited-use card number.

Setting expiration dates, CVVs, and usage limits

Virtual card providers allow you to customize security features for each card. You can set specific expiration dates—from a few hours to several months—so the card automatically becomes invalid after the intended use, and each virtual card also comes with its own unique CVV or security code.

Spending limits are another powerful functionality of virtual cards. You can program exact dollar amounts, restrict usage to specific merchants, and limit the number of transactions. If a virtual card number falls into the wrong hands, any potential damage is capped by your predetermined parameters.

Integration with digital wallets and mobile apps

Modern virtual cards work seamlessly with digital wallets like Google Pay and Apple Pay. Many providers also offer browser extensions that automatically generate virtual card numbers at checkout, letting you manage cards in real time from your smartphone.

What are the security benefits of virtual cards?

Virtual cards provide enhanced security by limiting exposure of sensitive financial information through data masking. They also enable greater oversight and control through configurable spending rules.

Data masking and fraud prevention

Card-not-present fraud cost US businesses $10.16 billion in 2024—a problem virtual cards are designed to tackle. Through data masking, virtual cards replace your actual account number with a randomly generated one that can't be traced back to your account.

Even if a merchant where you made an online purchase experiences a data breach, the stolen information is worthless since it's unique and restricted.

Programmable spend controls and merchant restrictions

Virtual card programs reduce risk further through automated spending control. You can create vendor-locked virtual cards that work only with specific merchants, meaning that if someone gets a hold of your virtual card number, they won't be able to use it anywhere else.

Real-time monitoring and automated alerts

Real-time monitoring offers instant visibility into every card transaction as it occurs. Most virtual card providers send automated alerts for attempted purchases, allowing you to quickly identify and block unauthorized charges. Modern spend management software can link virtual card monitoring with your accounting systems for complete oversight.

Are virtual cards safer than physical cards?

Here’s a quick comparison of the safety factors of virtual cards vs. physical cards:

| Factor | Virtual cards | Physical cards |

| Security | Unique numbers protect your main account; merchant restrictions and spending limits keep fraud damage contained | Same card number used repeatedly; vulnerable to skimming, theft, and data breaches |

| Fraud prevention | Single-use or limited-use numbers; instant deactivation without affecting the main account | Stolen cards require full replacement; all merchants must be updated |

| Convenience | Instant generation; no waiting for physical delivery; ideal for remote transactions | Sometimes required for in-person purchases; can be lost or damaged |

| Use cases | Online shopping, recurring payments, vendor management, and subscription services | In-store purchases, restaurants, and hotels that require a physical card at check-in |

| Monitoring | Real-time alerts and tracking; detailed digital records | Standard statement reporting; delayed fraud detection |

| Cost control | Programmable limits per transaction or vendor; prevents overspending | Manual tracking required; harder to enforce budgets |

What are the limitations and risks associated with virtual cards?

While virtual cards offer superior security for online transactions, they do have some limitations. For example, you may not be able to use them for in-person purchases, as some merchants require physical cards at the point of service.

In-store and refund compatibility issues

Virtual cards' biggest limitation is their incompatibility with in-store purchases. Most brick-and-mortar retailers can't process virtual card numbers without a physical card present, though some digital wallets enable in-person contactless payments.

Refund processing can also present challenges. If you deactivate a single-use virtual card after a purchase and later need to return the item, the merchant may struggle to credit the expired card.

Provider fees, eligibility, and card management overhead

Some virtual card providers charge fees for card generation, monthly services, or each transaction, which can add up for high-volume users. Additionally, not all consumers or businesses qualify—some credit card issuers may require certain credit scores or business credentials. Since managing multiple virtual card numbers can also become increasingly complex, comparing virtual cards vs. purchase cards can help you choose the right solution.

Potential attack vectors despite virtualization

Virtual cards reduce risk, but they aren't immune to all fraud. If you voluntarily enter your virtual card details on a fake merchant site, the card's security features cannot prevent that transaction.

Additionally, if your account credentials for the virtual card provider become compromised, a hacker could generate new virtual cards or modify spending controls. This makes strong password protection and two-factor authentication essential.

Best practices for safe virtual card use

To maximize virtual card security, it helps to set clear rules around card creation, vendor assignment, and spending limits. Following a few best practices can decrease your risk of security breaches and unauthorized spending.

Define clear spend limits per vendor

Rather than leaving limits open-ended, create virtual cards with exact dollar amounts that match expected purchase values. Setting appropriate spending limits for each virtual card helps prevent both fraud and budget overruns.

With instant virtual card issuance, you can generate cards on demand and apply precise controls. This is particularly useful for managing marketing campaigns where multiple team members need separate cards.

Continuously monitor transactions

Enable push notifications for every transaction so you know about charges right away. For business use, assign ownership of card monitoring and have a clear process for reviewing charges that don't match expected vendors.

Real-time oversight helps you catch unauthorized charges within minutes, allowing you to deactivate compromised cards before additional fraudulent transactions occur.

Choose a reputable virtual card provider

Look for providers with strong encryption, reliable authentication methods, and proven track records in payment security. The best virtual card programs also offer comprehensive fraud protection, easy card deactivation, and responsive customer support.

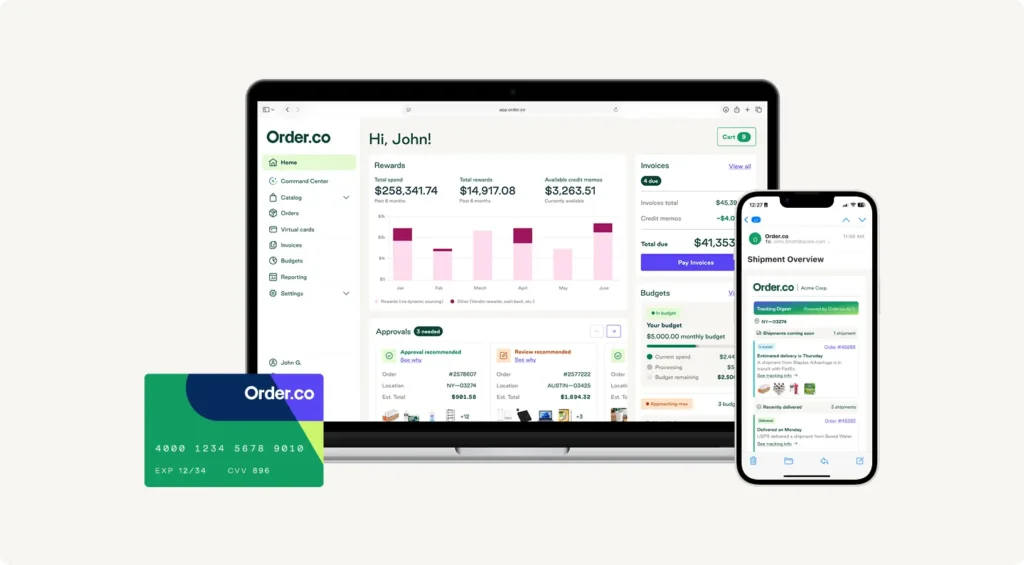

Order.co virtual cards deliver enterprise-grade security with unlimited card generation, granular spending controls, and seamless integration with accounting systems.

How to get started with Order.co virtual cards

If you're new to virtual cards, understanding what a virtual P-card is can clarify how Order.co virtual cards improve on traditional purchasing card programs—combining fraud protection with powerful spend management tools.

Step-by-step card generation in the Order.co dashboard

Creating a virtual card in Order.co takes seconds, simply:

- Log in to your dashboard

- Click "Create Card"

- Set your parameters—including spending limit, expiration date, and vendor restrictions

The platform will then generate a unique virtual card number instantly, complete with CVV and billing details. The dashboard provides a centralized view of all active cards, allowing you to monitor spending, adjust limits, and deactivate cards with a single click.

Key Order.co features: Unlimited cards, custom controls, and accounting integrations

Order.co provides comprehensive virtual card capabilities designed for modern businesses, including:

- Unlimited card generation: Create dedicated payment channels for every vendor, project, or team member at no additional cost per card

- Merchant-specific restrictions: Lock each card to approved vendors to prevent unauthorized use, even if card numbers become compromised

- Custom spending limits and expiration dates: Set rules that match your exact needs to enable precise cash flow management without sacrificing security

- Direct accounting software integrations: Automatically sync transaction data and eliminate manual reconciliation work

- Real-time alerts and detailed reporting: Gain complete control over business spending without sacrificing convenience

Schedule a demo to see how Order.co virtual cards deliver secure spending with real-time fraud protection, customizable limits, and seamless accounting integrations..

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields