Why Your Organization Needs Invoice Automation [Beginner’s Guide]

Why Your Organization Needs Invoice Automation [Beginner’s Guide]

Using manual invoice processing is like entering a daily race that's impossible to win. Even the most efficient AP clerk can only process about five invoices per hour, and the steady stream of paperwork and constant risk of duplicate entries can quickly overwhelm entire departments.

Yet many businesses hold off on invoice automation projects due to concerns about upfront time and resource investments. In reality, invoice automation is well worth it. Automated systems can process hundreds of invoices in the time it takes to handle just a few manually—while also preventing errors, reducing late fees, and improving efficiency across every stage of procurement.

This guide covers the basics of invoice automation, the most common challenges to adoption, and practical ways to overcome issues using the right tools.

Download the Free Tool: Invoice Tracking Template

What is invoice automation?

Invoice automation refers to the use of digital tools, such as cloud-based accounts payable (AP) invoice automation software, to enhance the accuracy, efficiency, and timeliness of an organization’s invoicing workflows. It seeks to centralize and accelerate the process of receiving, managing, and paying supplier invoices.

Traditional AP workflows, on the other hand, rely on time-consuming manual processes that often result in high error rates and missed or late payments. Vendor invoices are delivered as paper documents or email attachments containing electronic files, requiring labor-intensive human intervention to correctly process, verify, and pay.

Invoice automation solutions attack the problems of manual AP workflows at their core. By automating repetitive tasks and minimizing the need for human intervention, they ensure discrepancies are quickly identified and addressed so suppliers are paid on time every time.

5 key stages of the invoice automation process

Invoice automation works across the entire invoicing process, from receipt to payment. Here’s how it can improve each stage of your invoice management workflow.

Receipt of invoices

Automated AP software centralizes and digitizes the invoice capture process.

Supplier invoices may arrive by email, supplier portal, or via a direct integration with a vendor's accounting system or ERP system. Automation software monitors all sources, ensuring no invoice gets lost or overlooked.

Data capture and extraction

Once an invoice is received, the system automatically captures relevant data—such as line item details, vendor information, and costs—and extracts it from the document, regardless of formatting.

Since this is typically the most time-consuming and error-prone task in manual invoice processing, automating it is one of the biggest benefits of modern invoice processing tools.

Validation and matching

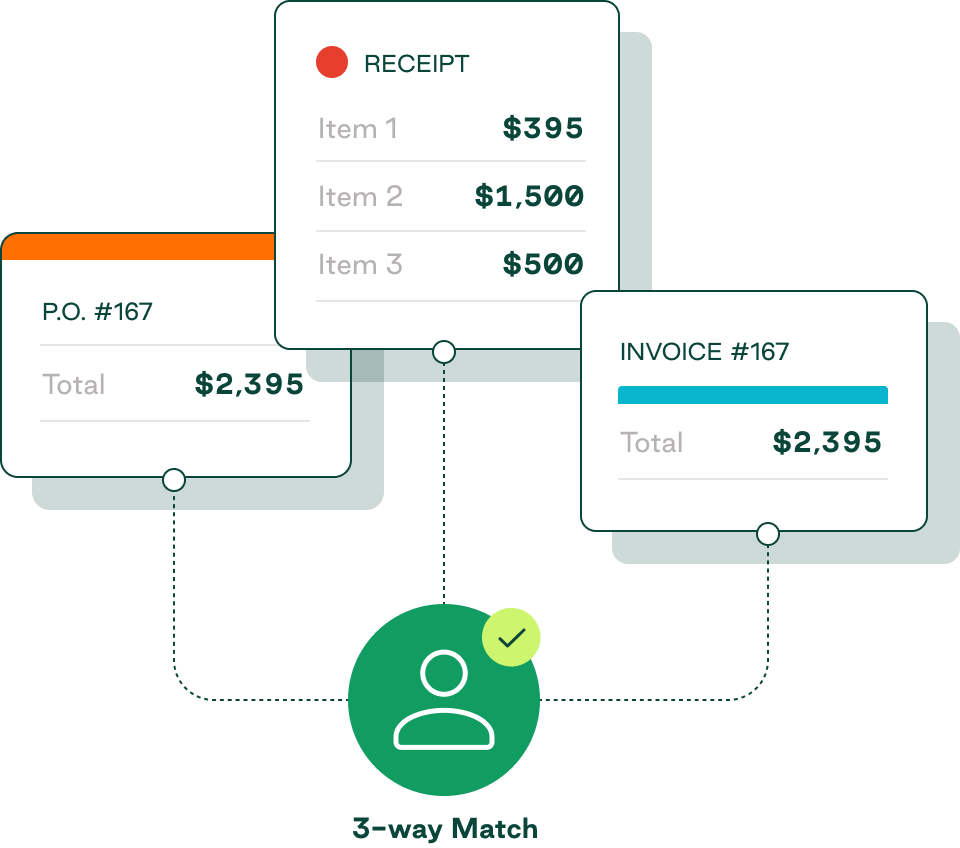

To shorten processing time and ensure invoice accuracy, AP automation systems automatically validate extracted invoice data. They check for duplicate invoices, verify the mathematical accuracy of costs, and confirm vendor authenticity.

Next, they further validate invoice data through automatic two-way or three-way matching, which compares the details of the invoice against the corresponding purchase order and goods receipt note.

Approval workflows

If there are any discrepancies during the validation and matching process, the invoice approval software automatically flags the invoice and routes it to the appropriate user (according to a set of pre-defined business rules) for review.

Within the automated system, you can configure rules based on different aspects, including invoice value, department, vendor, and exception type. This saves time by identifying the correct approver while also establishing a time-stamped audit trail for every action.

Approvers receive notifications whenever an invoice requires their attention, and they can instantly reject or approve it from their computer or mobile device.

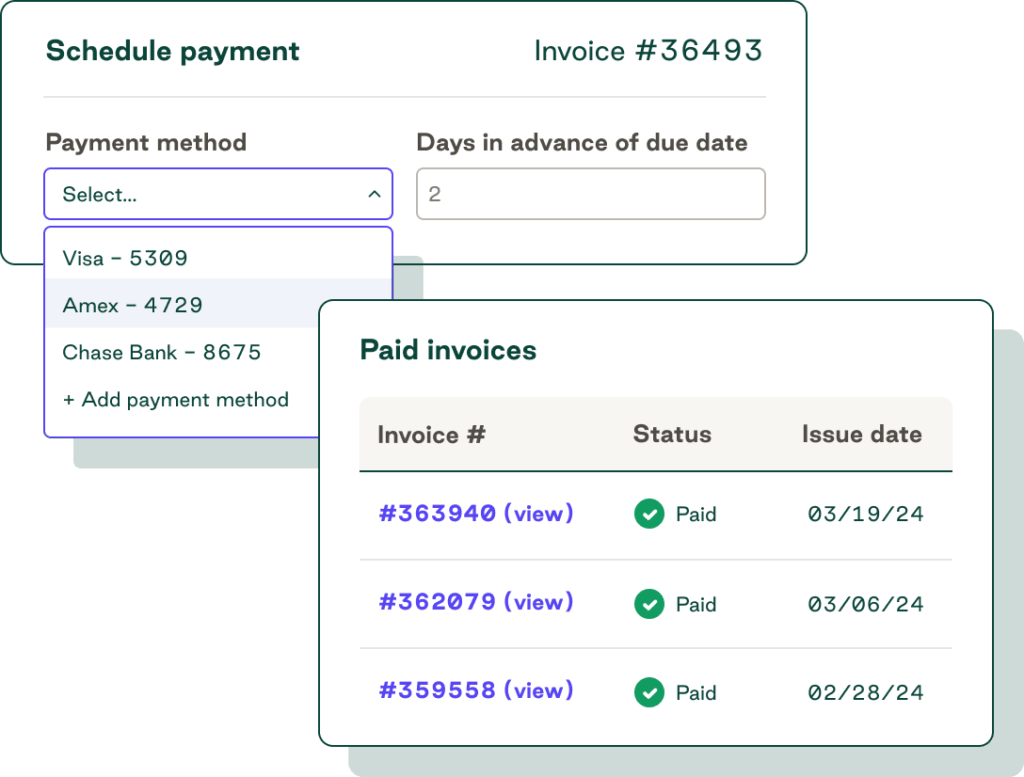

Payment scheduling

Once an invoice has been approved and validated, the system will automatically schedule its payment based on the vendor’s terms—for example, Net 30 or Net 60.

The primary benefit of this feature is that it helps you avoid late payment penalties while capturing early payment discount opportunities. Additionally, you can schedule payments for their due dates rather than as soon as they’re approved to help sustain and optimize cash flow.

The top invoice processing tasks to automate

Invoice automation offers efficiency gains across the entire accounts payable process, but some tasks offer more significant time-saving and cost-reduction benefits than others.

Four of the most crucial invoice processing tasks to automate are:

- Data extraction: Automating invoice data extraction eliminates hours of tedious data entry work, freeing up your accounts payable team to focus on more value-adding activities.

- Three-way matching: Invoice reconciliation is significantly faster and more accurate when performed by an automated invoice system. Automation reduces the time necessary to complete a three-way match from minutes to seconds.

- Exception routing: Automation sends discrepancies directly to the person authorized to resolve them as soon as they’re identified, eliminating the need for staff to investigate or chase approvals manually.

- Payment scheduling: Automatic payment scheduling can transform your AP process from functional to strategic, leveraging supplier data and cash flow forecasts to prevent costly late fees and take advantage of valuable early payment discounts.

Download our free invoice tracking template to stay on top of your expenses all year.

Benefits of automating invoice processing

Invoice automation delivers clear, measurable benefits for accounts payable teams. By transitioning from manual processes to automation, you gain:

- Complete access to invoice data: Automation centralizes and manages invoice information the moment it arrives, saving finance teams time by consolidating vendor data such as supplier name, purchase order information, and payment details.

- Timely payments: Manual accounting processes fall prey to lost invoices, duplications, late payments, and errors in three-way matching. Automation software eliminates these issues and speeds up invoice processing to enable early payment discounts.

- Increased productivity: Manual data entry and invoice processing are time-consuming, with some studies estimating that more than half of teams spend over 10 hours per week processing invoices. This traps AP in a constant cycle of error correction, research, and frustration, while automation frees teams to focus on higher-value work.

Common concerns in invoice processing automation

Many companies forgo the long-term benefits of automation to avoid the immediate pain of implementation. While it’s true that automation requires upfront effort, a software-based system quickly pays for itself. Yet 56% of teams have only partially automated invoice processing, and 82% still manually key every invoice.

Companies clinging to manual invoice processing tend to do so because of one or more of these five obstacles:

- No procurement policy: Good procurement thrives on clear rules and expectations. Without a well-communicated procurement policy, organizations face an uphill climb to maintain spend control and invoice accuracy. This leads to maverick spending, hidden charges on corporate cards and expense reports, and costly cash leaks.

- Outdated manual processes: Paper invoices, manual data entry, and physical document storage increase workload and introduce errors. Paper-based processes also make it hard to track spending patterns and analyze financial data, preventing scaling. Digitizing records and vendor information is essential to simplify AP operations.

- Lack of an approval process: Effective invoice approval begins before anyone places an order, as every purchase must follow the procurement policy and receive departmental approval first. Even when businesses have designated approvers, they need the transparency of a digital approval process to centralize data and keep requests moving.

- Data gaps and silos: When everything is manual and paper-based, accounting ends up with invoices that don’t match purchase orders or receipts. This complicates reconciliation and increases the risk of double payments, missed payments, and procurement fraud. Three-way matching can ensure accuracy, but it’s nearly impossible without digital data if you’re managing hundreds of invoices.

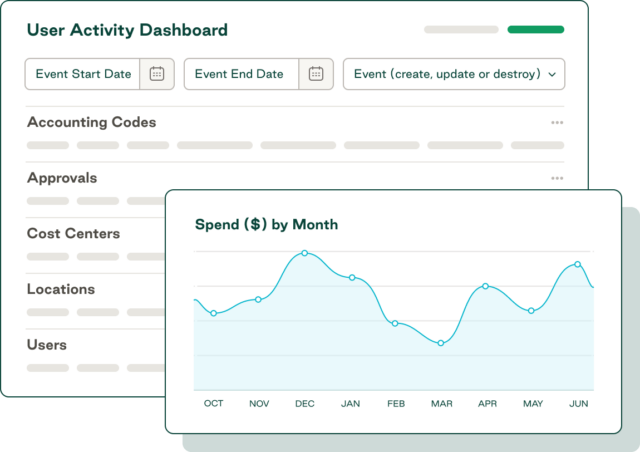

- Limited reporting and analysis: Without robust reporting and spend analysis, organizations struggle to identify spending patterns, spot process bottlenecks, and detect areas prone to fraud or inefficiency. Automation reveals opportunities for increased cost savings, enhanced risk management, and improved operations.

Measuring the impact of invoice automation

Implementing an automated invoice solution is all well and good, but how do you prove the value of your investment once it's live?

Here are some useful metrics for tracking the success of your automation project.

Cycle time reduction

Invoice cycle time measures how long it takes to approve an invoice for payment after receipt. Specifically, it tells you how efficiently (or inefficiently) your team is processing invoices.

To measure cycle time in days, subtract the invoice receipt date from the final approval date. After a successful implementation, you can expect to see a reduction of several days or even weeks.

Accuracy and exception rates

The fewer exceptions and processing errors, the less time you’ll spend reconciling discrepancies. Measure the percentage of invoices processed without manual correction by dividing the total number of invoices by the number of invoices with exceptions and then multiplying by 100.

Cost savings and ROI

To put a true dollar value on your investment, measure cost savings by calculating the following financial benefits of your new invoice automation system:

- Reduced labor hours spent manually processing invoices

- Captured early payment discounts that were previously missed

- Reduced late payment fees paid to vendors

For a specific ROI figure, calculate the returns of your investment as a percentage using the formula:

ROI = [(Total Financial Gain – Total Cost of Investment) / Total Cost of Investment] x 100

Automate invoice processing and liberate your AP team with Order.co

Order.co takes the burden of invoice processing and payment off your AP team’s shoulders. With an automated purchase-to-pay workflow, curated catalogs, AI-powered substitution features, and scalable accounts payable automation and reporting, you can spend less time on research and manual tasks and more on driving savings and creating value.

Take control of payments and turn your accounting function into a strategy for growth. Schedule a demo to see Order.co's invoice automation features for yourself.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields