Nonprofit Cost Management: Learn How to Optimize Your Budget

Nonprofit Cost Management: Learn How to Optimize Your Budget

Managing finances at a nonprofit organization presents unique challenges: limited funding sources, strict grant compliance requirements, and constant pressure to minimize overhead expenses while maximizing program impact.

The good news is that effective nonprofit cost management doesn't mean sacrificing your mission. With the right approach and modern tools, your nonprofit can optimize its budget, improve its financial health, and put more resources toward program services.

This guide covers practical strategies for nonprofit cost management, how to overcome common procurement bottlenecks, and which metrics matter most for demonstrating stewardship to funders and stakeholders. It also explains how purpose-built platforms can help your finance teams make more informed real-time decisions.

Download the free ebook: How Automation Can Solve Finance Teams’ Biggest Challenges

What is nonprofit cost management?

Nonprofit cost management is the strategic process of planning, monitoring, and controlling nonprofit expenses to maximize mission impact while maintaining financial sustainability. Unlike traditional for-profit financial planning, nonprofit cost management balances a variety of objectives that go beyond purely financial goals, including:

- Meeting program goals

- Satisfying donor expectations

- Maintaining tax-exempt status

- Demonstrating responsible stewardship of charitable funds

Effective cost management for nonprofits requires careful resource allocation regarding program costs, fundraising expenses, and operating expenses. Organizations with strong financial management systems are better positioned to weather economic uncertainty and sustain programs long term.

The ultimate goal is to create a sustainable financial model where every dollar spent supports your nonprofit's mission. This requires going beyond basic nonprofit accounting practices to include forecasting, cost allocation, and continuous optimization of expense management processes.

What are the unique cost challenges for nonprofit finance teams?

Nonprofit finance teams face distinct challenges that make cost management more complex and create inefficiencies that drain both time and resources.

Restricted funding and grant compliance

Many nonprofits operate with restricted funds tied to specific programs or initiatives. Although a recent report found that 88% of charities surveyed identified unrestricted funding as one of the most useful provisions a funder can make, only 67% of total funding was unrestricted, making flexible budgeting difficult.

To ensure compliance with each grantor's requirements while maintaining accurate financial reporting, nonprofit finance teams must track expenses against multiple funding sources simultaneously.

Limited administrative capacity

Nonprofits often operate with lean teams, and finance functions are no exception. CFOs and staff must juggle bookkeeping, financial statement preparation, compliance reporting, and strategic financial planning with minimal support.

Constrained administrative capacity makes manual procurement processes particularly burdensome, as purchase requests, approvals, and reimbursement workflows waste hours that could be spent on analysis and decision-making.

Pressure to minimize overhead

The misconception that low overhead equals efficiency puts pressure on nonprofits to underinvest in essential infrastructure, such as accounting software, professional services, and office space.

This creates a paradox where inadequate systems lead to inefficiencies that ultimately waste more resources than they save. IRS Form 990 reporting further intensifies scrutiny by making overhead expenses highly visible to funders and the public.

Procurement bottlenecks

Many nonprofits lack structured procurement processes, relying instead on ad-hoc purchasing that makes cost tracking difficult and prevents supplier consolidation. Without standardized workflows, organizations miss opportunities for tax-exempt purchasing, lose visibility into real-time spending patterns, and struggle to identify cost-effective alternatives.

How can nonprofits optimize procurement to manage costs?

Strategic procurement is one of the highest-impact ways to reduce nonprofit expenses while maintaining program quality. By implementing systematic approaches to purchasing, your organization can reduce costs and shorten workflow cycle times. Here are some practical steps you can take to make that happen.

Leverage tax-exempt status strategically

Nonprofits often overlook the savings potential of their tax-exempt status. To take advantage of this benefit, implement systems that automatically apply tax exemptions to eligible purchases and maintain digital copies of exemption certificates for all vendors.

Using spend management software designed for tax-exempt purchasing makes it easier to manage exemption certificates and track which transactions qualify for savings.

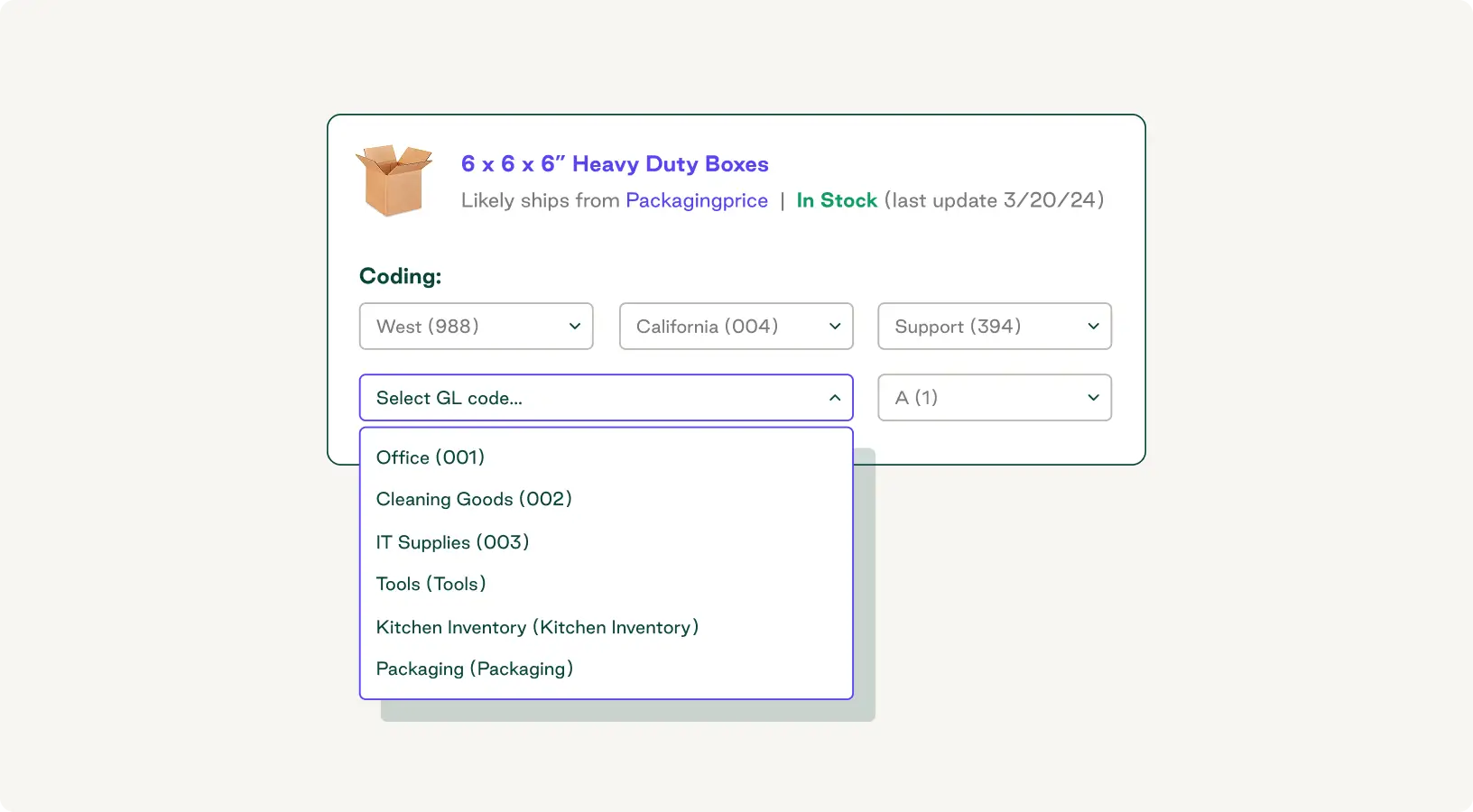

Implement structured spend coding

Accurate spend coding is essential for cost allocation, grant compliance, and meaningful financial reporting. To enable precise tracking of program expenses alongside fundraising and overhead costs, create a chart of accounts that aligns with IRS functional expense categories and your internal program structure.

Cloud-based accounting software like QuickBooks can handle basic categorization, but purpose-built nonprofit solutions offer multi-dimensional coding that lets you track expenses by program, funding source, and functional category at the same time.

Establish approval workflows based on spend thresholds

Set tiered approval requirements that balance control with efficiency. This might mean allowing managers to approve small purchases but requiring CFO or board member authorization for larger expenditures.

This approach to spend management improves business resiliency by preventing unauthorized spending without creating bureaucratic delays that frustrate team members. Document these policies clearly and embed them in your procurement platform to ensure consistent enforcement.

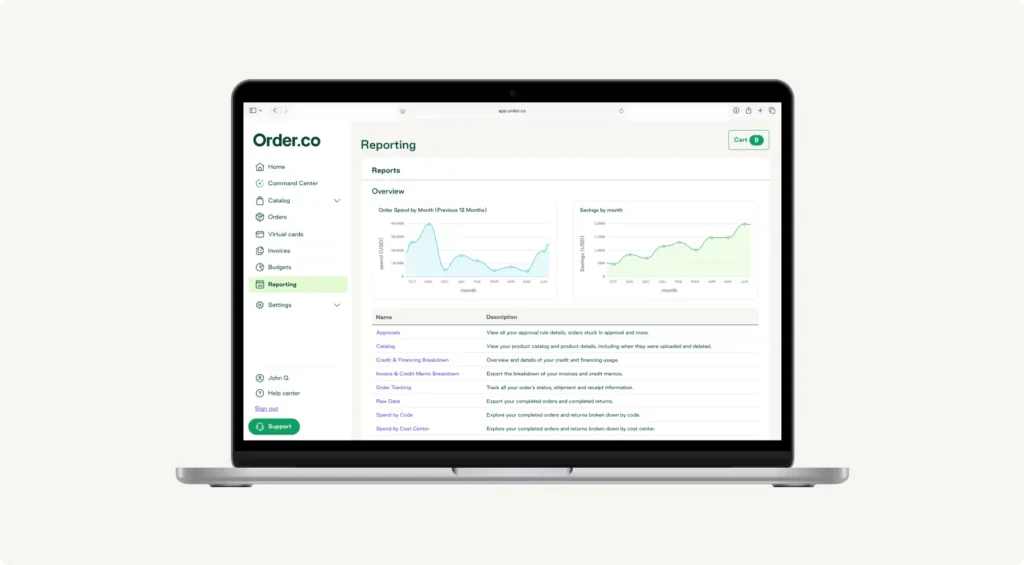

What tools and features does Order.co offer for nonprofit cost management?

Order.co provides purpose-built features that help nonprofits optimize budgets, maintain compliance, and gain real-time visibility into spending patterns.

Flexible budgeting workflows and approval controls

Order.co lets you create program-specific budgets with automated approval routing based on your organization's policies. Setting spending limits by program, funding source, or department ensures expenses stay within allocated amounts. When requests approach budget thresholds, automatic notifications alert stakeholders before overspending occurs, protecting grant compliance and cash flow.

The platform supports both restricted and unrestricted fund tracking so you can manage multiple funding sources within a single system. This eliminates the spreadsheet juggling and provides board members with clear visibility into how resources align with strategic initiatives.

Tax-exempt purchasing and automated GL coding

Order.co automatically applies tax exemptions to eligible purchases and stores digital exemption certificates for all vendors to capture savings that manual processes might miss. It integrates with your accounting software, ensuring accurate financial statements without duplicate data entry.

The platform's AP automation features include intelligent GL coding suggestions based on historical patterns and vendor categories. These features reduce the bookkeeping burden while ensuring expenses are properly allocated toward program costs, fundraising expenses, and operational fees. For organizations dealing with invoice overload, automated coding dramatically reduces processing time.

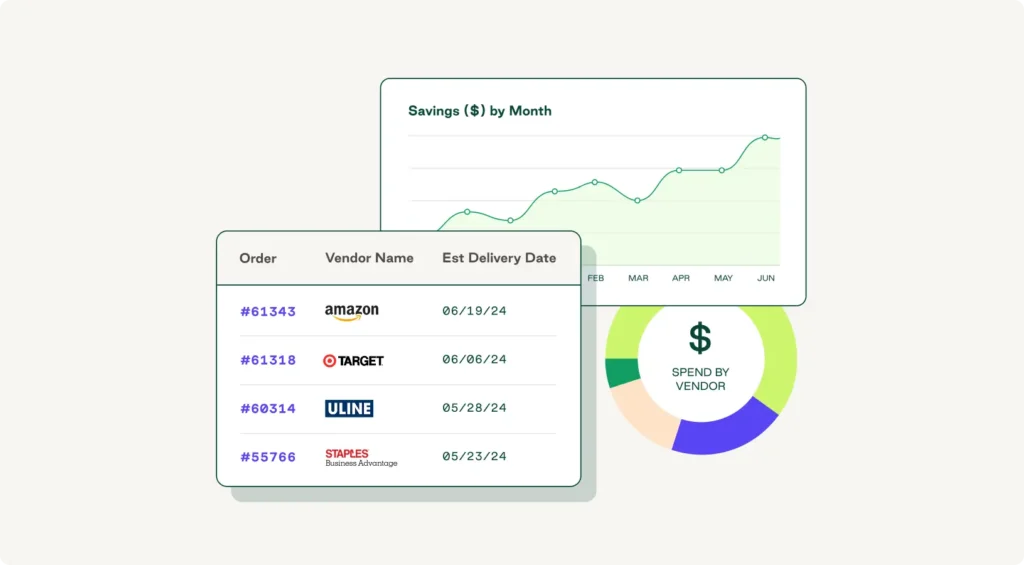

Custom reporting and analytics for real-time spend visibility

Real-time visibility enables nonprofit leaders to spot trends early and make informed decisions before small issues become major problems. Order.co provides instant insight into spending patterns with dashboards tailored to nonprofit financial reporting requirements. You can track metrics by program, compare actual versus budgeted expenses, and generate reports formatted for board meetings or grant submissions.

This flexibility supports both internal decision-making and external transparency requirements from funders and grantmakers. It also enables forecasting based on current spending trends, making it easier to anticipate future funding needs.

Automated line-level spend coding and AI sourcing recommendations

The Order.co AI Command Center uses machine learning to recommend optimal vendors and pricing for common purchases, identifying cost-effective alternatives that maintain quality while reducing expenses. The system learns from your organization's purchasing patterns to improve its recommendations over time.

The platform's invoice automation capabilities include line-level coding to automatically categorize individual invoice items according to your chart of accounts. This granular approach ensures accurate cost allocation for grant reporting while eliminating tedious manual categorization that consumes your finance team's time.

Which metrics should nonprofits track for cost management success?

Measuring the right metrics helps nonprofits demonstrate effective stewardship while uncovering opportunities to improve efficiency. To communicate impact to board members, funders, and other stakeholders, focus on the following key performance indicators:

- Cost per program participant or service unit: Divide total program expenses by the number of people served or services delivered. This metric directly connects spending to mission impact and helps justify budget allocation decisions to grantmakers. Tracking trends over time ensures your programs become more efficient as they grow.

- Budget variance by program and funding source: Monitor the difference between budgeted and actual expenses for each program and grant. Variances may indicate unrealistic planning, changed program needs, or procurement inefficiencies. Regular variance analysis enables proactive adjustments before compliance issues arise.

- Procurement cycle time: Measure the time from purchase request to order completion. Transforming your ordering process through automation shortens cycle times and reduces administrative overhead.

- Compliance rate: Track the percentage of purchases that follow established approval workflows and documentation requirements. High compliance rates (95%+) indicate effective controls and reduced audit risk, while low rates highlight areas for process improvement or additional team member training.

- Cost savings achieved: Record savings from supplier consolidation, tax-exempt purchasing, and other optimization initiatives. Quantifying these achievements demonstrates the ROI of better financial management systems and makes the case for continued process improvements.

- Accounts payable processing cost: Calculate the fully loaded cost (staff time plus software) to process each invoice. Organizations still relying on manual processes spend significantly more per invoice, representing significant waste that could go toward programs.

Get started with nonprofit cost management using Order.co

Nonprofit finance teams shouldn't have to choose between mission impact and financial sustainability. The challenges of restricted funding, compliance requirements, and limited administrative capacity are real—but modern spend management solutions address these obstacles while respecting nonprofits' unique needs.

Order.co helps nonprofit organizations optimize their budgets with:

- Automated workflows that reduce procurement cycle time and administrative overhead

- Real-time visibility into spending patterns across programs and funding sources

- Built-in compliance features for tax-exempt purchasing and grant requirements

- Intelligent automation that eliminates manual bookkeeping and coding tasks

- Flexible reporting designed for board members, funders, and internal decision-making

By combining strategic cost management practices with purpose-built tools, you can direct more resources toward program services while maintaining the transparency and stewardship stakeholders expect.

Schedule a demo of Order.co today to see how your nonprofit can benefit from faster processes, automated spend management, and centralized reporting.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields