Accounts Payable Management: Strategies, Best Practices & Tips

Accounts Payable Management: Strategies, Best Practices & Tips

Manual AP processes can lead to late payments, long month-end reconciliations, and duplicate invoices slipping through the cracks. These aren't just operational headaches—they also impact cash flow, accuracy, and vendor relationships.

This guide explains how to transform accounts payable from a transactional burden into a strategic advantage. You’ll get a clear look at modern accounts payable management, common challenges and practical solutions, and the ways technology can make your operations smoother and more efficient.

Download the free ebook: How Automation Can Solve Finance Teams’ Biggest Challenges

What is accounts payable (AP) management?

Accounts payable management is how your company handles the money it owes. It covers the full end-to-end process of recording, approving, and paying suppliers and vendors—spanning from the moment an invoice arrives to when the payment is reconciled.

At its core, AP management ensures three things:

- Accuracy: Every invoice is validated, coded correctly, and matched to purchase orders and receipts

- Timeliness: Payments go out when they're due—not too early (draining cash) or too late (damaging relationships)

- Compliance: All transactions are properly documented, approved, and audit-ready

According to the Ardent Partners State of ePayables 2025 Report, businesses using accounts payable automation tools have 65% faster invoice processing times than the industry average. That kind of time savings directly improves your ability to balance cash flow and keeps vendor relationships strong.

Benefits of strong accounts payable management

Strong AP management maintains the flow of goods and services your business depends on while protecting working capital. It's where vendor relationships, financial reporting, and cash flow optimization intersect.

Key benefits of efficient AP management include:

- Improved cash flow visibility and control: Knowing exactly what you owe and when allows you to make payments that preserve working capital while capturing early payment discounts that reduce total purchasing costs.

- Reduced operational costs: Using automated AP management minimizes time-consuming manual tasks, reducing human errors, improving staff productivity, and driving down cost-per-invoice.

- Stronger vendor management: Making consistent, timely payments builds supplier trust and negotiating leverage. Optimizing your AP workflow also supports better vendor collaboration and onboarding.

- Faster month-end close: Automating invoice matching and GL coding significantly reduces reconciliation time, shortening close cycles but keeping everything accurate.

- Reduced fraud and compliance risk: Three-way matching catches duplicate payments, coding mistakes, and fraudulent invoices before they hit your books.

Common challenges (and how to solve them)

Effective accounts payable management isn’t just about knowing what you’re up against—it's about tackling those challenges with practical solutions that improve data accuracy, operational efficiency, and fraud protection.

Manual data entry and processing errors

Error rates are significantly higher when data is entered manually, impacting GL accuracy and vendor payments. Incorrect GL coding creates inaccurate journal entries during the close process, while payment errors strain relationships and trigger time-consuming reconciliations.

The fix: Implement an accounting automation platform like Order.co to automatically capture invoice data and route it to the correct approvers through predefined approval workflows.

Invoice approval bottlenecks

Manual invoices take longer to approve, making it harder to meet Net 30 or Net 60 payment windows. Delays can not only trigger late fees and hurt supplier goodwill but also extend days sales outstanding (DSO) and tie up working capital.

The fix: Deploy digital approval routing with automatic escalation. When invoices automatically flow to approvers based on amount thresholds and department codes, approval times can drop from 20.8 days to 2–3 days.

Lack of spending visibility

Without real-time dashboards, AP departments can't see committed—but not yet invoiced—spend. This "dark spending" creates cash flow surprises and makes accurate forecasting impossible, leading to unnecessary borrowing or missed investment opportunities.

The fix: Centralize purchase orders, receipts, and invoices in a single accounts payable system. This gives you real-time visibility into committed spend, not just paid invoices.

Duplicate payments and fraud exposure

A recent AFP fraud survey found that 65% of businesses experienced attempted or actual payment fraud in 2022, and manual processes make catching these schemes incredibly difficult.

While duplicate payments drain cash directly, fraud losses can cost hundreds of thousands of dollars and trigger expensive audits and remediation efforts.

The fix: Implement automated three-way matching to compare every invoice against purchase orders and receiving records. Maintain anaccounts payable ledger to track transactions as they occur and flag anomalies early.

Best practices for accounts payable management

To build a resilient and efficient accounts payable process, you need the right systems in place—supported by automated workflows and effective controls. Here are some useful strategies for optimizing your AP management operations.

Standardize invoice workflow and routing

Create a consistent process for how every invoice enters your system, gets coded, routed for approval, and scheduled for payment processing. This eliminates the "invoice treasure hunt" that forces AP staff to chase down approvers.

Key elements of a standardized invoice workflow include:

- Central invoice intake point (email, portal, or EDI)

- Automated data extraction and GL coding suggestions

- Rule-based routing (by department, amount, or vendor)

- Escalation triggers for overdue approvals

Pro tip: Take advantage of Order.co's free accounts payable template to ensure consistency and reduce training time for your team.

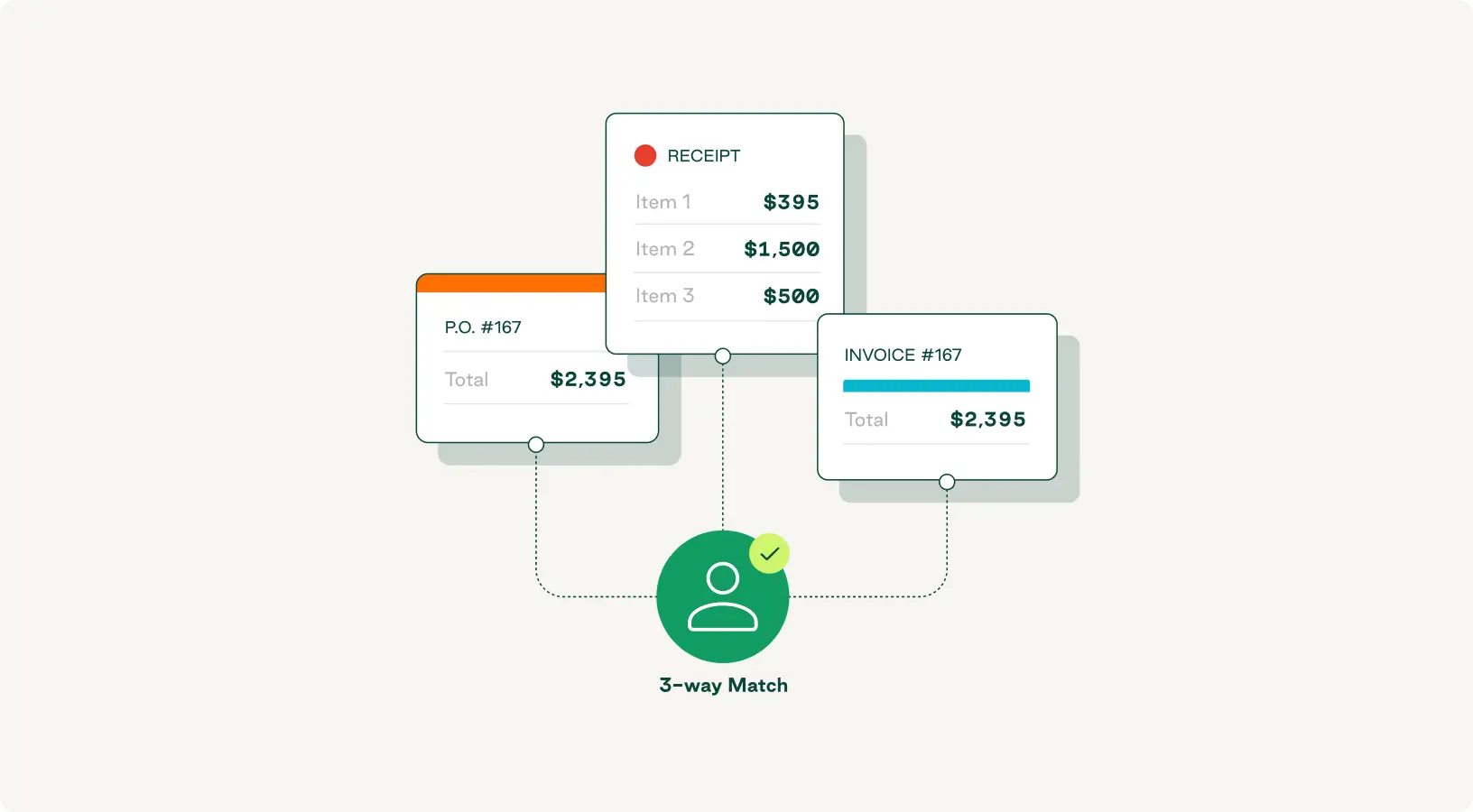

Implement 3-way matching

Three-way matching compares purchase orders, receiving records, and invoices before payment. When all three align, payment gets approved automatically. When they don't, discrepancies get flagged for review.

This process catches pricing errors, quantity discrepancies, and fraudulent invoices before money leaves your account. To begin implementing it, start with high-value purchases where the ROI is the clearest, then expand to smaller transactions as your workflow matures.

Enforce internal controls and access segregation

Separate invoice approval authority from payment execution authority. The person who approves an invoice shouldn't also cut the check or initiate the ACH transfer. This prevents a single person from creating fraudulent vendors, approving fake invoices, and sending payments to themselves.

Core duties to segregate include:

- Invoice receipt and data entry

- GL coding and account assignment

- Approval and authorization

- Payment execution

- Reconciliation and exception handling

Require dual approval for invoices above certain thresholds (e.g., $25,000) to create a second review checkpoint for high-value transactions.

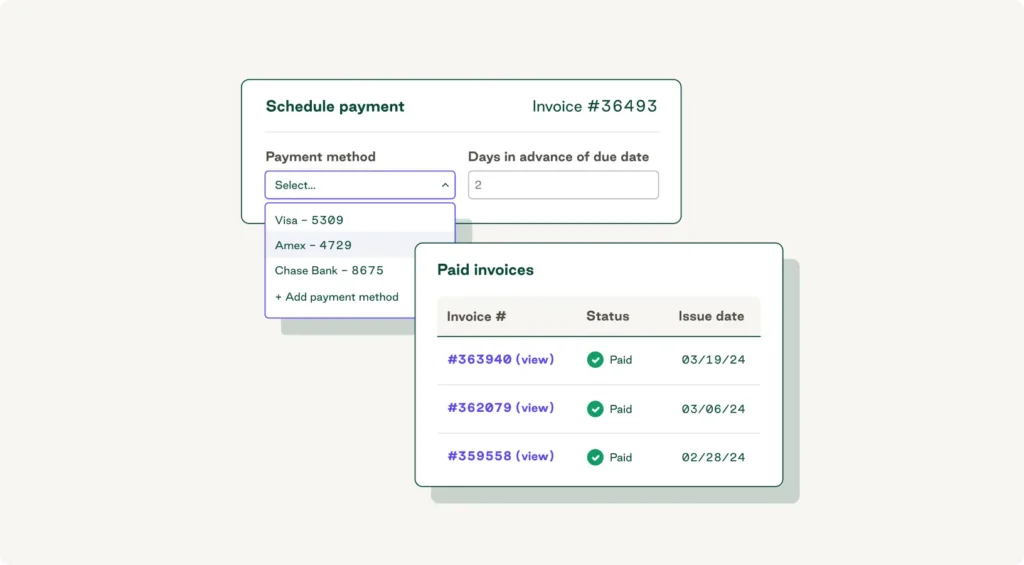

Prioritize invoices and optimize payment timing

You don't need to pay every invoice the moment it's approved. Strategic payment timing preserves working capital while protecting vendor relationships.

Use this payment prioritization framework as an example:

- Pay immediately: Invoices with early payment discounts worth 2%+ annually

- Pay on due date: Standard Net 30 or Net 60 terms from strategic suppliers

- Pay slightly early: Smaller vendors where relationship goodwill matters

- Negotiate extended terms: Large recurring expenses where suppliers may accept Net 90

This approach balances cash preservation with vendor satisfaction. You can learn more about quantifying these gains in the Order.co guide to AP automation savings.

Strategies for successful accounts payable management

To ensure successful AP management, you need to balance maintaining working capital and supplier satisfaction with keeping data accurate and easily accessible in a centralized system.

Balance cash flow versus vendor relationships

Finding the sweet spot between cash preservation and supplier satisfaction is a central strategic challenge for AP teams. Push payment terms too aggressively, and critical vendors may deprioritize your orders or raise prices. Pay too quickly, and you're essentially giving suppliers an interest-free loan.

Segment vendors by criticality. Your top 20% of suppliers—those providing mission-critical goods or services—deserve different treatment than commodity vendors. Instead of blanket terms, negotiate dynamic discounting agreements. This lets you pay early when cash flow allows and default to extended terms during tighter periods.

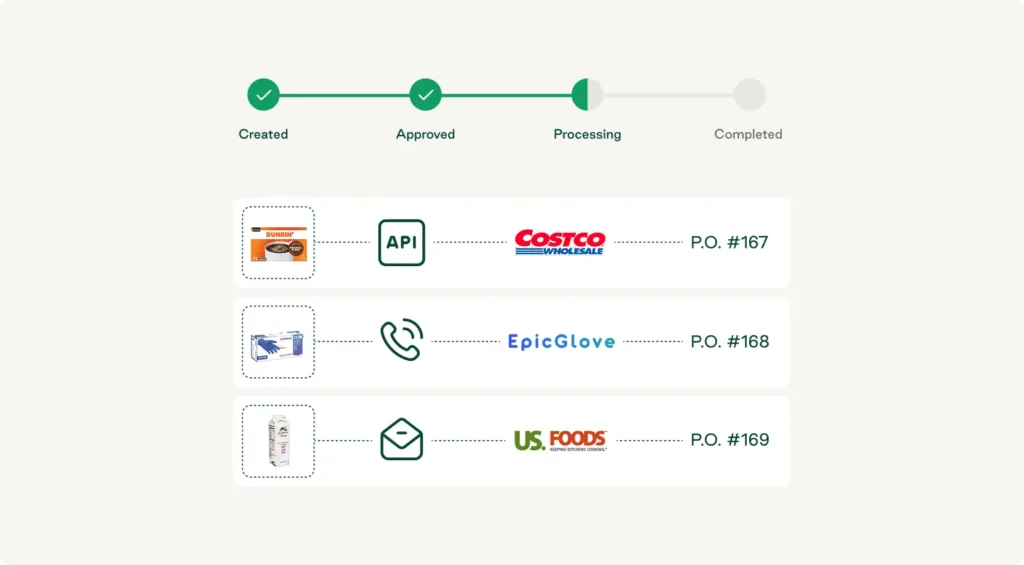

Centralize and simplify P2P workflows

The procure-to-pay (P2P) cycle covers everything from purchase requisitions to final payments. When these processes live in disconnected systems—requisitions in email, POs in the ERP, invoices in shared drives—you end up with data silos, duplicate work, and approval chaos.

A unified P2P platform connects purchase requests, PO creation, invoice management, three-way matching, and payment execution, thus eliminating manual handoffs between purchasing and accounting teams.

Use these milestones to create a practical implementation roadmap:

- Map your current P2P process and identify handoff points

- Select a platform that integrates with your existing ERP/accounting system

- Start with one vendor category or department as a pilot

- Measure cycle time, error rates, and processing costs before and after

- Expand systematically based on results

Remember: The goal isn't just efficiency—it's creating an auditable paper trail from initial need to final payment that satisfies internal controls and external auditors.

Tools and capabilities that power modern AP management

Modern AP management requires AP automation software that handles routine tasks, provides real-time visibility, and integrates seamlessly with your existing financial systems.

Use this table to identify essential AP management features:

| Feature | What it does | Business impact |

| Invoice automation | Extracts invoice data and suggests GL codes | Reduces manual data entry and eliminates errors |

| Three-way matching | Validates supplier invoices against POs and receipts | Prevents duplicate payments and detects fraudulent invoices |

| Approval workflows | Automatically routes invoices based on predefined rules | Shortens approval process time and enforces policy adherence |

| ERP/accounting software integration | Syncs invoice data, GL codes, and payment statuses | Eliminates double entry while ensuring data consistency |

| Spend analysis dashboards | Provides real-time visibility into committed, invoiced, and paid amounts | Enables accurate cash flow forecasting |

How Order.co simplifies accounts payable management

Order.co centralizes accounts payable management in a single platform built for modern finance teams. It can help you adopt best-practice AP strategies at scale with powerful features like:

- Flexible approval workflows: Build approval chains based on amount thresholds, departments, or custom rules. When approvals stall, automatic escalation keeps the process moving.

- Seamless ERP integration: Eliminate double entry with native connections to tools like NetSuite, QuickBooks, Sage Intacct, and more.

- Automated invoice consolidation and matching: Automatically consolidate invoices from multiple vendors and match them against purchase orders and receipts.

- Pay on your terms: Optimize payment timing and payment method to preserve working capital.

- Intelligent GL coding: Let machine learning suggest GL codes based on vendor history and past coding decisions so all your AP team has to do is review and confirm.

- Unified spend visibility: Use real-time dashboards to see committed spend, pending invoices, and scheduled payments for accurate cash forecasting.

Schedule a demo to learn how Order.co centralizes AP management with automated matching, approvals, and pay-on-your-terms flexibility.

Frequently asked questions about accounts payable management

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields