Accounting for Nonprofits: An Essential Guide for 2026

Accounting for Nonprofits: An Essential Guide for 2026

Managing finances for a nonprofit organization comes with unique challenges that go beyond simply tracking dollars and cents. Unlike for-profit organizations, which focus on maximizing shareholder value, nonprofits need to demonstrate transparency to donors, maintain compliance with regulatory requirements, and make sure every dollar advances their mission.

Accounting for nonprofits isn't just about accurate and efficient bookkeeping—it's about building trust and making informed decisions that amplify your organization's impact.

In this guide, you'll get a clear look at what makes nonprofit accounting different, how fund accounting works, which financial statements matter most, and how modern tools can help you manage your finances more effectively while keeping your donors and board members in the loop.

Download the free ebook: How Automation Can Solve Finance Teams’ Biggest Challenges

What is nonprofit accounting?

Nonprofit accounting is how nonprofits track and report their income, expenses, and assets—but with a twist. Instead of measuring profits, it relies on fund-based principles that focus on accountability, ensuring every dollar is used according to donor intentions and your organizational mission.

The main goals of nonprofit accounting are simple:

- Maintain transparency with stakeholders using clear reporting

- Ensure responsible use of funds

- Support mission-driven operations through accurate financial data

According to the Nonprofit Finance Fund 2025 State of the Nonprofit Sector Survey, 36% of nonprofits ended 2024 with an operating deficit—the highest in 10 years—making accurate financial tracking more important than ever.

How nonprofit accounting differs from for-profit accounting

The biggest difference between nonprofit and for-profit accounting lies in what's being measured and reported. While for-profit businesses track equity—representing ownership stakes and shareholder value—nonprofits track net assets, which represent the resources available to fulfill the organization's mission.

In the nonprofit sector, organizations prioritize accountability over profitability. Every financial decision must answer the question: "How does this advance our mission and honor donor intent?"

This creates some unique accounting rules and practices:

- Donor restrictions shape everything: If a foundation donates $50,000 specifically for an environmental education program, the nonprofit can't legally redirect that money to cover overhead expenses, even if the organization desperately needs it.

- Public accountability through Form 990: The IRS mandates that most tax-exempt nonprofits must file Form 990 each year. This public document discloses financial information, governance practices, and executive compensation. Nonprofits that fail to file for three consecutive years automatically lose their tax-exempt status.

- Different performance metrics: While for-profit companies focus on profitability ratios and earnings per share, nonprofits track metrics such as program expense ratio (the percentage of total expenses dedicated to mission work versus overhead) and cost per outcome achieved.

What is fund accounting?

Fund accounting is the cornerstone of nonprofit financial management. Rather than treating all money as one big pool, nonprofits must separate their resources into distinct funds based on donor restrictions and intended use.

You can think of fund accounting as creating virtual envelopes within your organization's bank account. The three primary fund categories are:

- Unrestricted funds: These have no donor-imposed designations. You can allocate unrestricted funds toward any expenses listed in your budget—from staff salaries and rent to office supplies and fundraising costs.

- Temporarily restricted funds: Also known as “net assets with donor restrictions,” these funds come with conditions you meet either by time or purpose. For example, a $25,000 grant designated for purchasing playground equipment becomes unrestricted once you buy the equipment, meaning you can use any remaining funds for general purposes.

- Permanently restricted funds: These typically take the form of endowments where the principal must remain invested indefinitely. With permanently restricted funds, only the interest can be used for specific purposes, such as scholarships or research programs.

This structure helps build transparency and trust by creating a clear audit trail showing exactly how your nonprofit used its donor-restricted funds. It also makes budgeting easier and more accurate, as staff members can quickly see which resources are available for immediate needs versus committed to specific projects.

Key financial statements for nonprofits

Nonprofits rely on four core financial statements to demonstrate accountability and guide strategic decision-making:

- Statement of Financial Position: Essentially the nonprofit version of a balance sheet, this report provides a snapshot of what your organization owns, owes, and is worth at a specific point in time. It details your assets minus your liabilities—your net assets—to reveal the resources available to support your mission.

- Statement of Activities: Comparable to an income statement, this tracks all your revenue against your annual program, administrative, and fundraising expenses. It shows how your net assets change over the fiscal year and tells you whether you're operating within your means and building reserves.

- Statement of Functional Expenses: This breaks down spending by both nature (salaries, rent, supplies) and function (program services, management, fundraising). Donors pay close attention to your Statement of Functional Expenses because it shows how much money is going directly toward your mission.

- Statement of Cash Flows: This statement categorizes cash in and out across operating, investing, and financial activities, with particular emphasis on how donor restrictions impact liquidity.

One of the most common mistakes nonprofits make is misclassifying shared costs across different programs or functions. For instance, if a program director's salary should be split between multiple programs but is charged entirely to one, it distorts the true cost of each initiative.

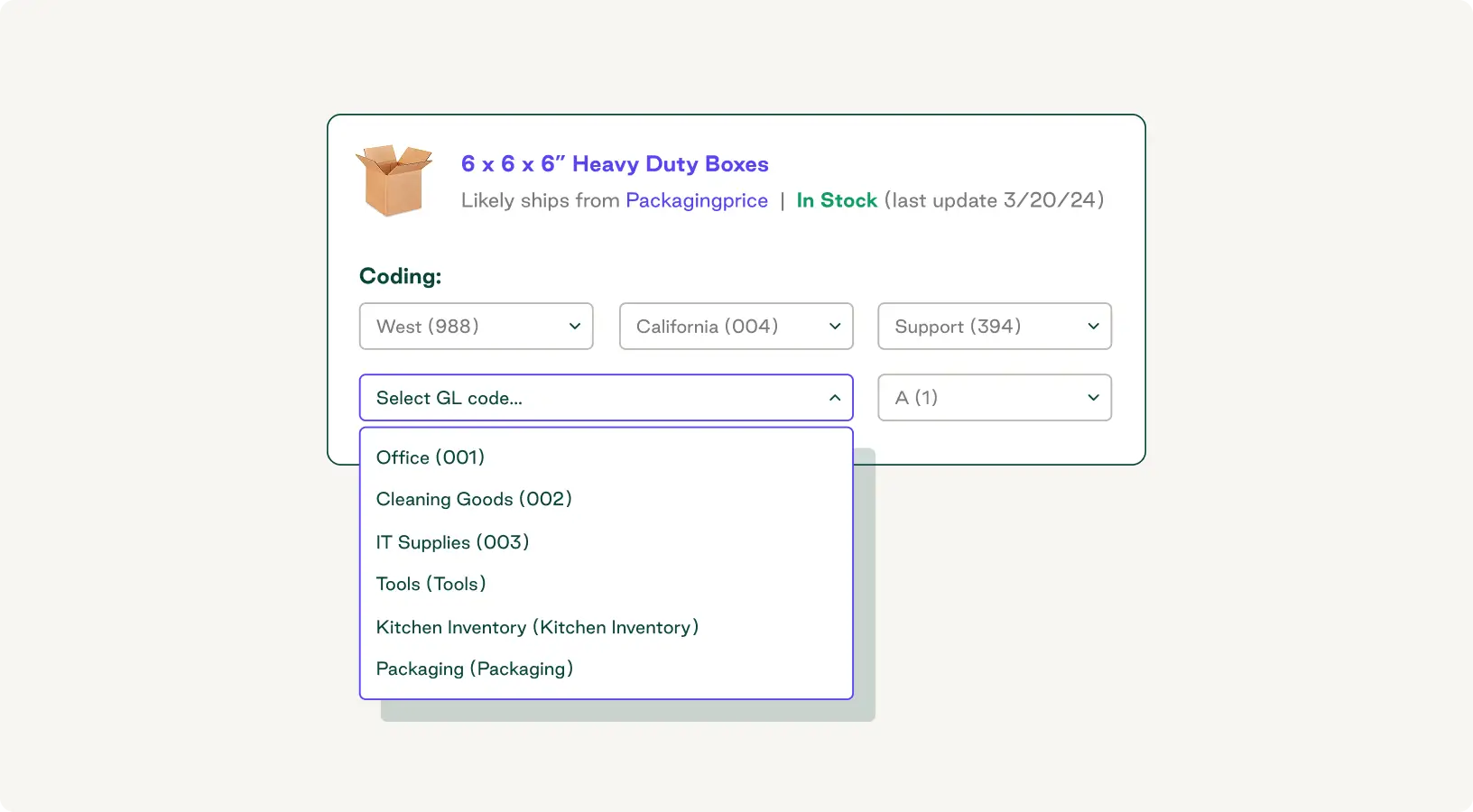

Ensuring accurate reporting starts with clean procurement records. Tools that tag spend correctly from the beginning—like proper coding in youraccounts payable ledger—make reporting more accurate and keep your organization audit-ready.

When every purchase, invoice, and payment is properly documented and categorized, your financial statements reflect reality. AP automation software supports this visibility by centralizing vendor payments and automating expense coding, allowing you to focus more on your mission and less on paperwork.

How to do nonprofit accounting

Effective nonprofit accounting follows a clear process that starts with establishing proper internal controls and documentation procedures. Setting up a fund accounting system that separates restricted from unrestricted funds will help you track donor designations accurately.

Your accounting workflow should follow these steps:

- Record all financial transactions promptly, attaching proper documentation (receipts, invoices, grant agreements)

- Categorize expenses by both nature (what you purchased) and function (program, administrative, or fundraising)

- Perform regular bank reconciliations to catch discrepancies early

- Track donor restrictions and appropriate fund allocation when conditions are met

- Complete month-end close consistently to ensure accurate period reporting

The key is building systems that support accuracy before the numbers even reach your general ledger. When your AP workflow includes proper approvals, coding, and documentation from the start, your accounting team spends less time hunting down information and more time analyzing results.

Recommended nonprofit accounting software

The right software can simplify fund tracking and financial reporting dramatically.

Here are several popular options:

- QuickBooks Nonprofit: Offers familiar accounting functionality with built-in fund accounting capabilities, making it easy for organizations transitioning from for-profit accounting practices. It tracks donor restrictions, generates nonprofit-specific reports, and integrates with many fundraising platforms.

- Aplos: Combines accounting with donor management features. Designed specifically for nonprofits and churches, its interface makes fund accounting intuitive, and it includes templates for required financial statements.

- Blackbaud Financial Edge NXT: Serves larger nonprofits needing robust functionality. It supports complex fund structures, grant management, and sophisticated reporting requirements.

- Wave: Provides free accounting software suitable for very small nonprofits with straightforward needs. While less feature-rich than paid options, it covers basic income and expense tracking without subscription costs.

While these tools manage your financial records and produce statements, they primarily record what has already happened. Order.co complements them by helping you control how your nonprofit spends money in the first place, integrating with your accounting software to deliver cleaner books.

Managing nonprofit finances more effectively with Order.co

Good accounting lays the foundation of a nonprofit’s financial health—but real efficiency comes from controlling how money flows out of your organization before transactions hit your books.

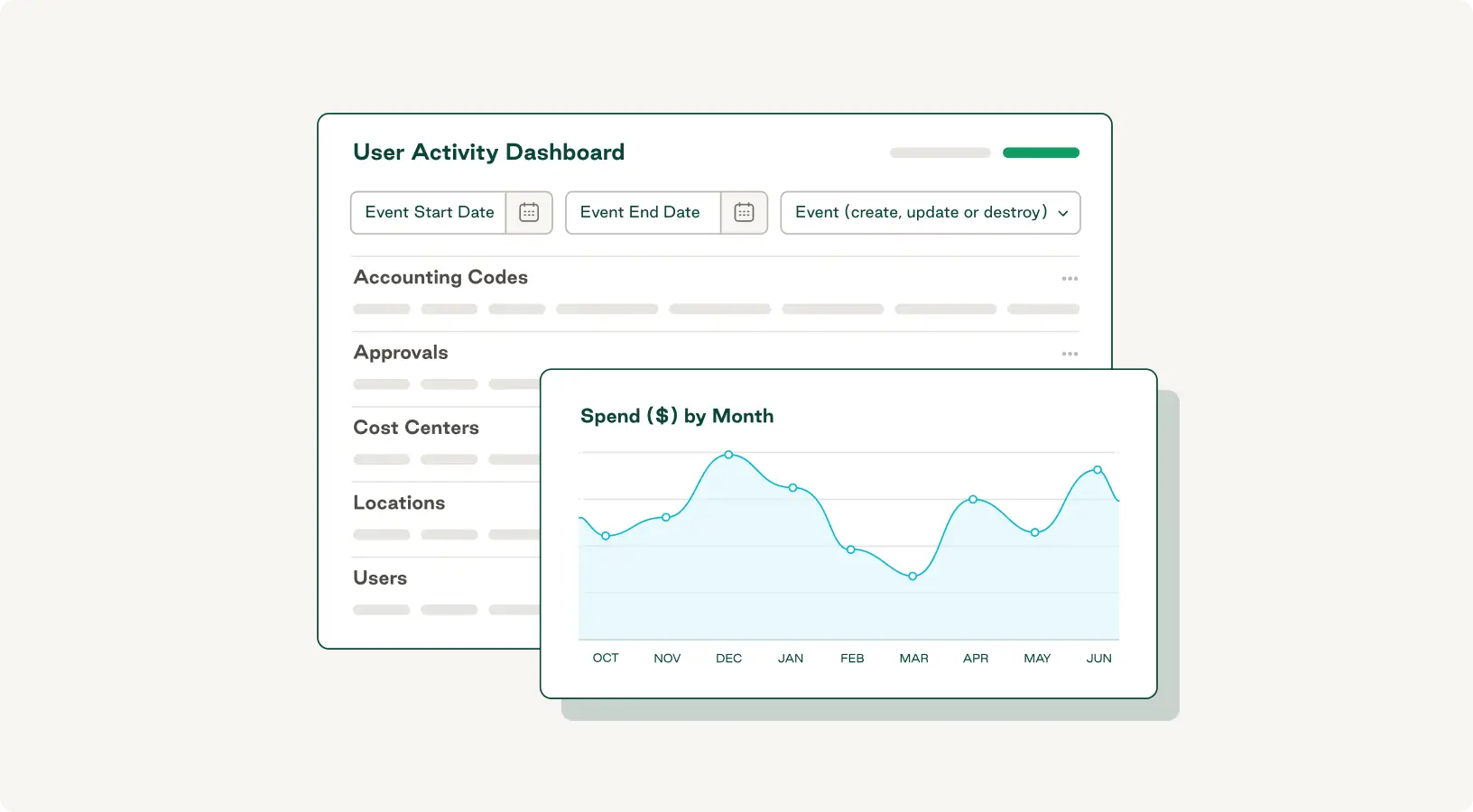

AP automation lowers processing costs by reducing manual data entry, improves accuracy and audit readiness with clear audit trails, and supports greater compliance through role-based approvals and spending limits. For nonprofits managing multiple grant-funded programs, tagging expenses by funding source from day one prevents last-minute scrambles during reporting periods.

When your accounting automation integrates seamlessly with your general ledger, you gain real-time visibility into spending patterns to spot opportunities for AP automation savings. With Order.co, your nonprofit can maintain financial control through better purchasing decisions, centralized vendor payments, and improved budget tracking across departments and programs.

Request a demo to see how Order.co automates expense coding and reporting to help your nonprofit maintain clear, audit-ready financial records.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields