Cards built for control, growth, and simplicity.

Empower your team to instantly manage payment with virtual cards, while finance keeps full control, total visibility, and accelerates reconciliation.

The tool your finance team needs to drive results

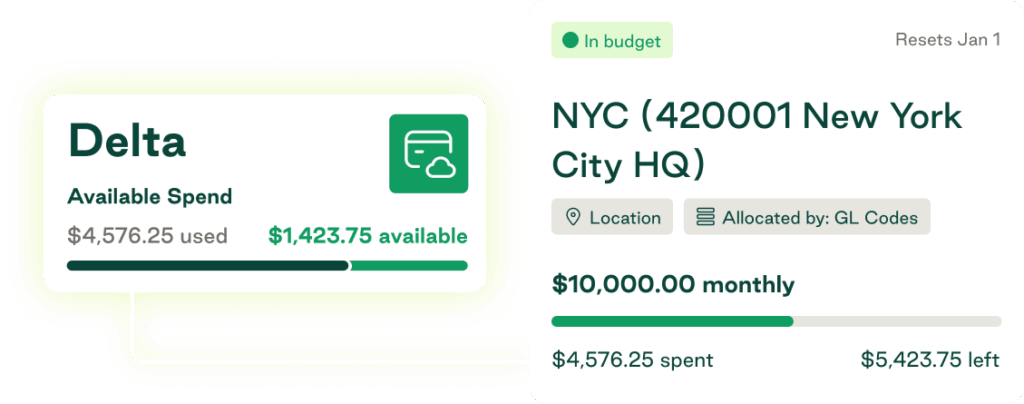

Control spend at the source

Set budgets and limits on every card so purchases stay aligned with policy before orders are placed

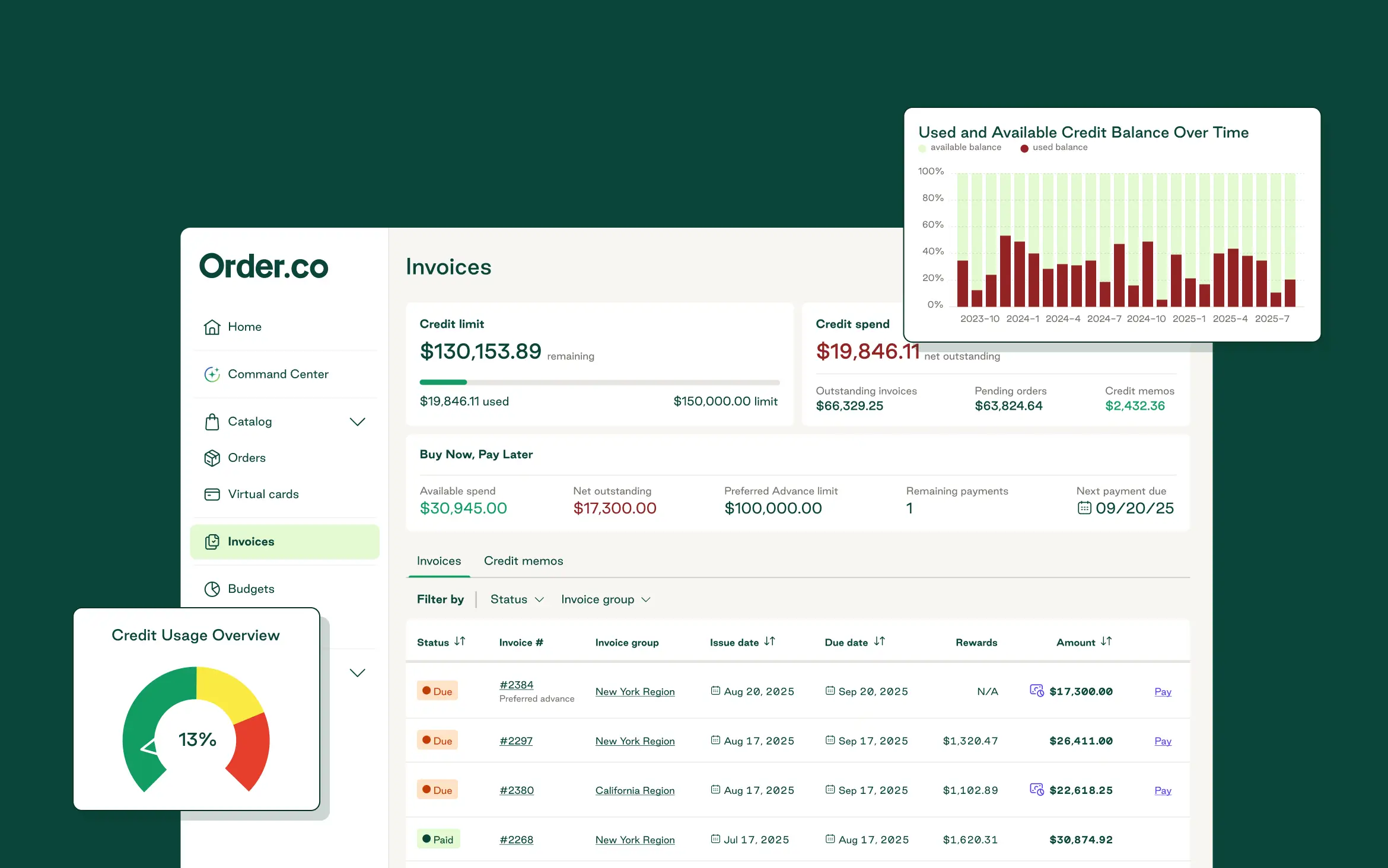

Maximize your float

Unlike most virtual card providers, Order.co provides greater credit limits and keeps more cash in your hands.

Close books faster than ever

Automated expense categorization and reconciliations enable finance teams to wrap up reporting in hours, not days.

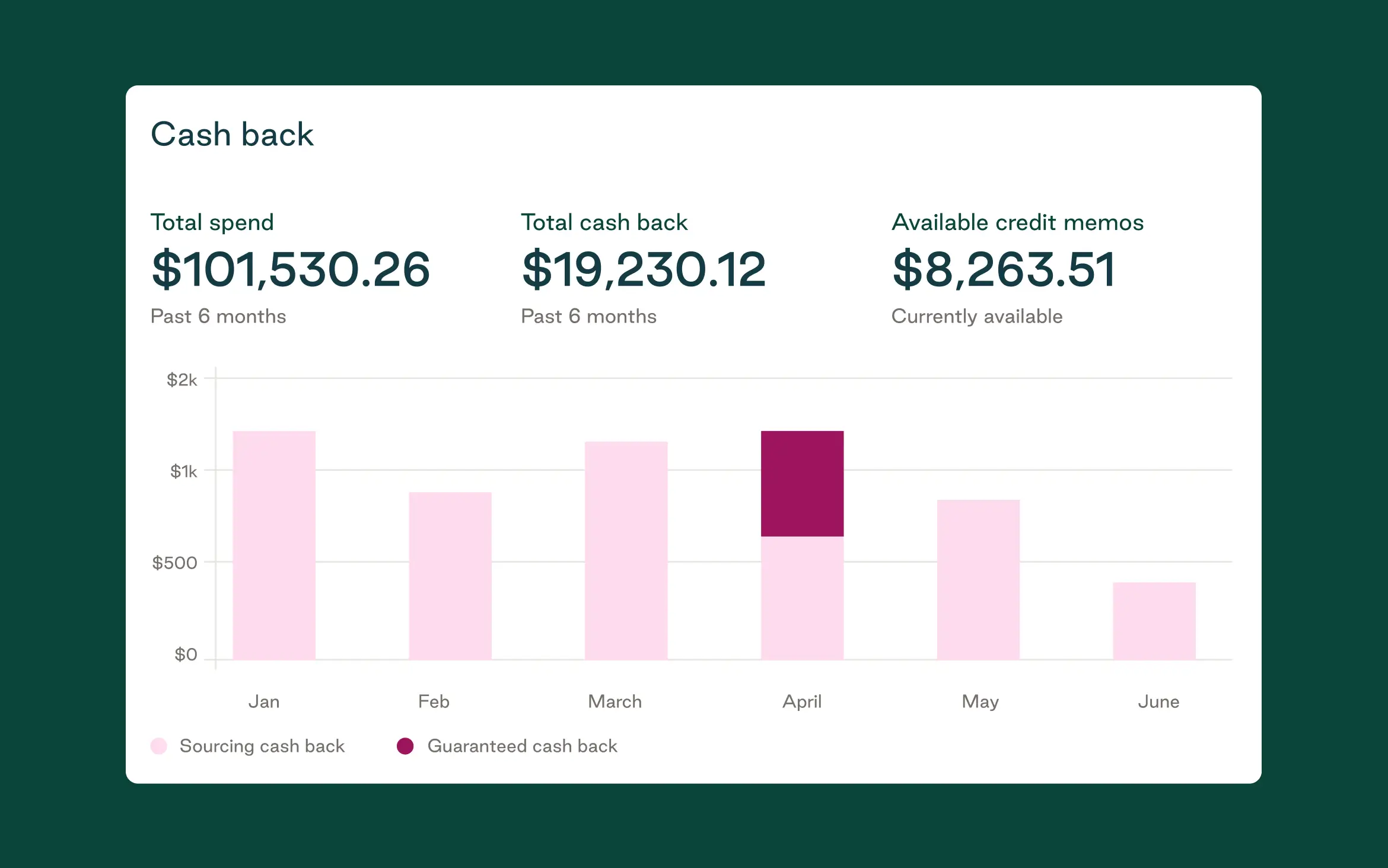

Unlock 5% hard dollar savings

From cash-back rewards to smarter sourcing, Order.co finds savings you can measure in real dollars, not just time.

Not all cards are created equal.

See where other card providers fall short and how Order.co delivers what they can’t.

Virtual corporate cards.

Real business impact.

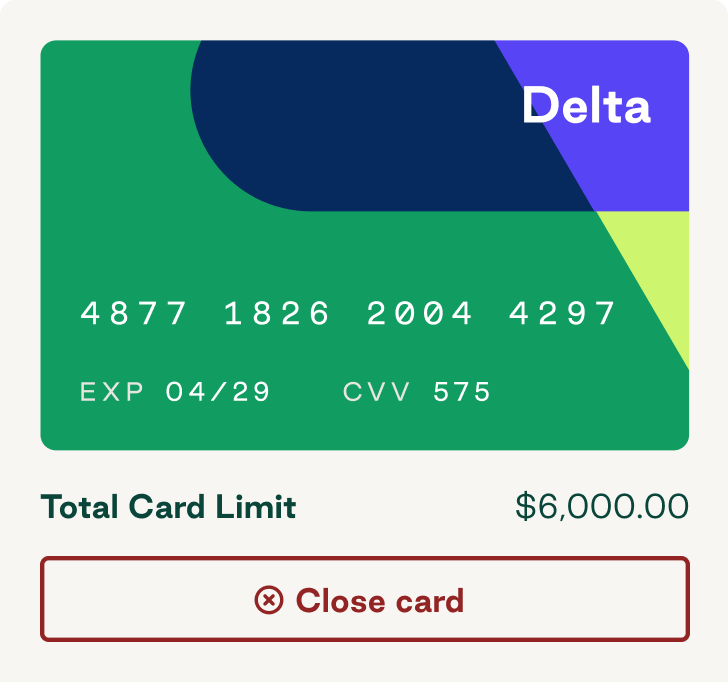

Safe & secure payments

Complete control over where and how money is spent with vendor-locked cards you can turn on or off instantly.

Fast & flexible credit

Fast credit approvals, simple underwriting, and flexible limits that grow with your business.

Precise & powerful control

Virtual cards tied directly to budgets, with detailed reporting that gives you full visibility and control over every transaction in real time.

Removery Scales Procurement and Financial Operations Across 130+ Studios

300+

26

$100K

Easy and instant.

Stop juggling with physical cards, long wait times for approvals, and the risk of uncontrolled spending. Instantly issue virtual cards that simplify spending and give you real-time oversight.

Purchases that reconcile

themselves

With Order.co, every transaction is automatically coded and reconciled,

eliminating manual data entry, reducing errors, and giving your finance

team more time to focus on strategic priorities.

From launch to scale, Order.co’s credit keeps up

Start with higher credit limits from day one and scale seamlessly as your business grows. Order.co’s flexible underwriting and trade-insurance-backed credit make it possible.

Ramp, Brex, Divvy. They’re good tools, but you deserve more.

More working capital

Other cards only give full 30-day float on day-one purchases, and hidden billing rules further limit your cash flow. Get true net 30 on every purchase — with up to 37 days to pay, so your cash flow actually works on your schedule.

More purchasing control

Don’t just set spending limits or restrictions for vendors. Control every item purchased, so everything your team buys aligns with your brand standards, budget, and operational needs 100% of the time.

More cash back

Unlock hard-dollar savings that go beyond what other platforms promise. AI sources the best vendor at the best price, so businesses save an average of 5%, plus countless hours previously spent on purchasing and AP tasks.

A platform that does it all.

Order.co goes beyond spend and expense management. With procurement, finance automation, and AI working together, your team can save time, cut costs, and scale like never before.

Business credit cards serve their purpose, but you deserve more.

More spend control

Control starts with budgets and approvals and goes even further with custom catalogs of approved products. Gain visibility into every purchase and ensure product aligns with policy, spend limits, vendor preferences, and brand standards.

More purchasing efficiency

Everything you need for purchasing is in one place — no manual POs or juggling multiple vendors or websites. From shopping and placing orders to tracking delivery, all procurement happens in a single platform.

More time back for finance

Streamline bookkeeping and automate payments. Every purchase is precoded to your GL and appears on a consolidated invoice that syncs to your accounting system. No more chasing receipts, reconciling credit card statements, or coding expenses.

More hard dollar savings

AI sources more cost-effective suppliers from a 30,000+ vendor network, so customers realize hard dollar savings of 5% on average, plus countless hours of resources previously spent managing purchasing and finance tasks.

A platform that does it all.

Order.co goes beyond what traditional business credit cards can offer. With procurement, finance automation, and AI working together, your team can save time, cut costs, and scale like never before.

Ramp, Brex, Divvy. They’re good tools, but you deserve more.

More working capital

Other cards only give full 30-day float on day-one purchases, and hidden billing rules further limit your cash flow. Get true net 30 on every purchase — with up to 37 days to pay, so your cash flow actually works on your schedule.

More purchasing control

Don’t just set spending limits or restrictions for vendors. Control every item purchased, so everything your team buys aligns with your brand standards, budget, and operational needs 100% of the time.

More cash back

Unlock hard-dollar savings that go beyond what other platforms promise. AI sources the best vendor at the best price, so businesses save an average of 5%, plus countless hours previously spent on purchasing and AP tasks.

A platform that does it all.

Order.co goes beyond spend and expense management. With procurement, finance automation, and AI working together, your team can save time, cut costs, and scale like never before.

Business credit cards serve their purpose, but you deserve more.

More spend control

Control starts with budgets and approvals and goes even further with custom catalogs of approved products. Gain visibility into every purchase and ensure product aligns with policy, spend limits, vendor preferences, and brand standards.

More purchasing efficiency

Everything you need for purchasing is in one place — no manual POs or juggling multiple vendors or websites. From shopping and placing orders to tracking delivery, all procurement happens in a single platform.

More time back for finance

Streamline bookkeeping and automate payments. Every purchase is precoded to your GL and appears on a consolidated invoice that syncs to your accounting system. No more chasing receipts, reconciling credit card statements, or coding expenses.

More hard dollar savings

AI sources more cost-effective suppliers from a 30,000+ vendor network, so customers realize hard dollar savings of 5% on average, plus countless hours of resources previously spent managing purchasing and finance tasks.

A platform that does it all.

Order.co goes beyond what traditional business credit cards can offer. With procurement, finance automation, and AI working together, your team can save time, cut costs, and scale like never before.

Learn more about turning corporate

virtual cards into a strategic advantage

Frequently asked questions

Can’t find the answer you’re looking for? Reach out to our team!

Virtual cards provide transaction-specific security and control for online vendor payments, acting as secure proxies that protect core financial information. Each card locks to the vendor after the first use, and you can set specific dollar limits or expiration dates to prevent unauthorized spending and subscription overcharges.

If a card is compromised, you can delete it instantly without affecting other transactions. Virtual cards also support real-time budget tracking, giving finance teams better visibility and control over spending.

Virtual cards differ from physical corporate cards in several key ways. Unlike physical cards, which are often shared among team members and have limited controls, virtual cards let you set spending limits for exact amounts, total budgets, or specific timeframes. You can create them for single-use or recurring payments and set them to expire automatically, providing greater security and flexibility.

Virtual cards are digitally generated and not directly linked to a primary bank account or physical card. Since every card is independent, you can delete or recreate them as needed without affecting other payments if one gets lost or compromised.

Yes, virtual cards can be used for employee expense management. You can assign Order.co's virtual cards to specific vendors and use them for single transactions or recurring payments, with all activity visible directly in the platform.

You can also set individual spending limits and expiration dates, and the vendor-locking feature ensures each card can only be used at its approved merchant. These controls reduce the need for expense reimbursements, simplify administrative work, and deliver real-time visibility into employee spending.

Order.co's virtual cards help businesses control spending by restricting payments to approved vendors and capping spend amounts. You can create individual vendor virtual cards with specific transaction limits, expiration dates, and maximum charge amounts, or set program-level spending limits to enforce overall budgets.

All transactions sync instantly with business budgets, providing real-time visibility and preventing overspending. You can track every transaction, delete cards immediately if needed, and receive automated notifications for added security and oversight.