5 Best Virtual Cards for Businesses (& How to Choose the Right One)

5 Best Virtual Cards for Businesses (& How to Choose the Right One)

Payment fraud and expense management are daily struggles for modern businesses. Traditional corporate cards leave finance teams chasing receipts, wrestling with overspending, and dealing with fraud risks that can shut down operations overnight.

Virtual cards are the solution to these problems. These digital payment tools generate unique virtual card numbers for specific transactions, vendors, or time periods, dramatically reducing fraud exposure while providing finance teams with real-time visibility into company spending.

This guide highlights five of the best virtual card solutions for businesses, explains which card features matter most, and details exactly how to choose the right platform for your organization's needs.

Download the free ebook: The Procurement Strategy Playbook for Modern Businesses

Why does choosing the right virtual card matter for your business?

The right virtual card platform directly impacts your bottom line. A recent survey of procurement leaders from large companies found that over 90% either already use, intend to use, or are interested in virtual cards for vendor payments.

Virtual cards eliminate manual processes that drain your finance team's resources. With automated reconciliation through software integrations and digital wallet functionality, transaction-level data flows directly into your accounting systems, enablinginstant reconciliation through native ERP integrations.

In 2024, US consumers suffered over $12.5 billion in fraud losses—up 25% from 2023. Virtual cards counter this threat through unique card numbers that you can freeze or delete instantly. Each virtual credit card number adds an extra layer of security compared to sharing physical card numbers for online transactions.

You can also set virtual cards with precise spending limits, restrict purchases to specific merchants, and receive real-time alerts when budgets approach thresholds. This prevents budget creep and keeps spending appropriate across departments.

What are the best virtual cards to consider?

Here are five of the best virtual card platforms for modernizing your payment processes, covering everything from subscription management to multi-currency support.

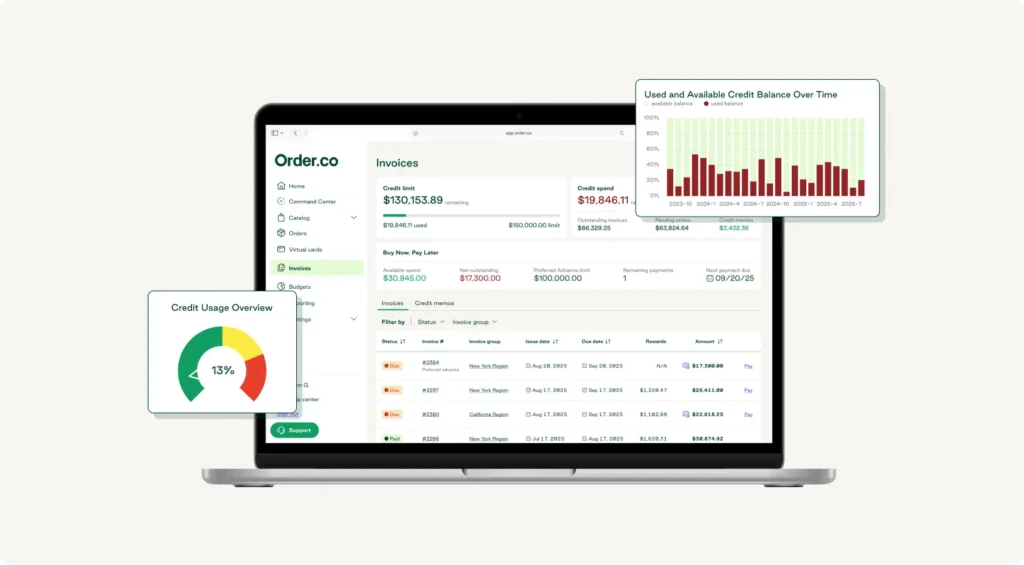

1. Order.co: Best for unlimited cards with granular spend controls

Order.co is a powerful spend management platform that provides unlimited virtual cards paired with sophisticated spend controls. Unlike card providers that charge per card or limit issuance, Order.co lets you create as many cards as needed for different vendors, departments, campaigns, or projects.

Key features and benefits:

- Instant virtual card issuance for immediate payment needs

- Unlimited virtual card issuance with no per-card fees

- White-glove onboarding and dedicated customer support

- Single-use card options for one-time purchases or free trials

- Vendor-locked virtual cards that prevent unauthorized merchant charges

- Granular spending rules, including merchant restrictions, transaction limits, and expiration date controls

- Advanced approval workflows that help enforce policy compliance

- Native ERP integrations that automatically sync transactions

Order.co's platform seamlessly connects spend management with working capital management, giving you complete visibility from requisition through reconciliation.

2. Ramp: Best for automated savings insights and reimbursements

Ramp combines virtual cards with AI-powered spend management that automatically identifies savings opportunities. The platform analyzes spending patterns and identifies vendor alternatives, duplicate subscriptions, and opportunities to negotiate better rates.

Key features and benefits:

- AI-driven insights identifying cost-saving opportunities

- Automated expense reimbursements that sync with accounting software

- Per-transaction cash back rewards for business purchases

- Built-in receipt matching to eliminate manual expense reporting

- Real-time spend notifications through a mobile app

3. Brex: Best for startups seeking high-limit cards with rewards

Brex targets fast-growth startups with virtual credit cards that offer higher limits based on cash balances rather than credit score requirements. The platform offers various rewards on common business expenses with no annual fee charges.

Key features and benefits:

- High credit limits without requiring personal guarantees or a credit check

- Rewards program offering up to 7x points on select categories

- Integrated expense management with automated categorization

- Travel booking with corporate rate negotiations

- No foreign transaction fees

4. Bill Spend & Expense: Best for end-to-end accounts payable automation

Bill provides comprehensive accounts payable automation extending beyond virtual cards to include invoice management and bill payments.

Key features and benefits:

- Virtual cards with customizable spending rules and budgets

- Complete accounts payable workflow automation

- Vendor management with payment history tracking

- Automated three-way matching

- Integration with 100+ accounting and ERP systems

5. Airbase: Best for businesses seeking multi-currency support

Airbase specializes in global spend management, offering robust multi-currency support for companies with international operations. The platform manages foreign exchange rates while helping companies keep spending under control.

Key features and benefits:

- Multi-currency virtual cards for international vendor payments

- Competitive exchange rates with a transparent fee structure

- Global expense management with country-specific policy enforcement

- Automated expense reimbursement

- Real-time budget tracking across departments and currencies

What key features do the best virtual cards have?

Understanding what to look for in a virtual card makes it easier to find the right fit. And if you're comparing virtual cards vs. purchase cards, the following features can help you decide.

Customizable spend rules and merchant restrictions

Top platforms let you set precise parameters for each virtual card. You can establish spending limits (daily, weekly, monthly, or per-transaction), restrict purchases to specific merchant categories, whitelist or blacklist particular vendors, and set expiration dates for time-limited projects.

This granular control prevents unauthorized spending. For example, you could issue a virtual card for marketing campaigns with a $5,000 limit, valid only for use with specific advertising platforms. This approach also works well for managing subscriptions, as it allows you to set recurring limits for SaaS tools or online shopping platforms.

Real-time transaction monitoring and instant alerts

The right platform should provide immediate visibility as transactions occur. This includes instant notifications when cards are used, real-time dashboards to track budgets, and alerts when spending nears limits. Whether purchases take place online or in-store with contactless payments, you stay fully in control.

Automated reconciliation and export capabilities

Top platforms automatically categorize purchases, match receipts to charges, and export data to accounting systems. Look for features like one-click reconciliation, GL coding that maps transactions to the right accounts, receipt capture via mobile apps, and scheduled exports. Much like comprehensive spend management software, this kind of automation is crucial for modern finance.

API access and native ERP integrations

The ideal virtual P-Card solution should communicate seamlessly with your existing financial technology stack. Seek out platforms with pre-built integrations for major accounting systems like NetSuite, SAP, or Oracle, plus robust APIs for custom connections. Native ERP integrations ensure transaction info flows automatically without manual data entry.

How to choose the best virtual card for your business

Selecting the right platform requires evaluating your business's specific needs. Start by assessing your current pain points, such as reconciliation delays, spending control issues, or fraud concerns.

The following process can help you find the best card option for your company:

- Evaluate transaction volume: Some card providers charge per transaction or per card, while others let you issue unlimited cards. If you need dozens or hundreds of virtual cards, going with a platform that offers unlimited issuance will be significantly more cost-effective. Also, think about how many payment methods you really need when weighing virtual cards vs. physical cards.

- Consider integration needs: Your platform should work with your existing accounting software and ERP systems. Native integrations save you from manual data entry and keep everything flowing smoothly.

- Assess control levels: Different businesses require different control levels. A startup might get by with basic limits, while an enterprise will want more advanced controls, such as approval workflows, the ability to issue virtual debit cards, or prepaid card functionality.

- Look at total cost: Total cost isn’t just the monthly fee. Transaction fees, foreign charges, and card issuance costs all add up. It’s also smart to consider the return on investment from faster reconciliation and reduced fraud.

How do you apply for a virtual credit card?

Getting started with virtual cards is generally pretty simple, as most card issuers follow a similar pattern regardless of whether they're Visa, Mastercard, American Express, Capital One, or another major card provider.

Begin by creating an account and completing business verification. You'll usually need your legal entity name, tax ID (EIN), business address, and incorporation documents. Some virtual card providers may request financial statements if you’re seeking higher credit limits. Many also use alternative underwriting methods in addition to (or in place of) traditional credit scores, looking at your organization's bank account balance and monthly revenue patterns. This can make approval faster and easier than with a traditional physical credit card.

Approval times vary, but some platforms can approve established businesses within minutes. Once approved, you should be able to start issuing virtual cards immediately through the platform or mobile app. Be sure you also connect your accounting software, configure spending policies, set up user roles, and create card templates for common use cases. Most providers offer onboarding support to help you get everything running.

Get started with Order.co virtual cards

Choosing the best virtual card platform comes down to finding one that gives you the features you actually need—granular spend controls, real-time monitoring, automated reconciliation, and seamless integrations—while addressing your unique needs.

Order.co offers unlimited virtual cards with sophisticated spend control rules, instant reconciliation via native ERP integrations, and a white-glove onboarding team to help ensure immediate ROI. Whether you need cards for online purchases, in-store contactless payments through Apple Pay or Google Pay, or recurring subscriptions, Order.co provides the functionality and flexibility to support how you work.

Beyond virtual cards, Order.co provides:

- Complete procure-to-pay automation connecting requisitions, approvals, purchases, and payments

- Advanced approval workflows with multi-level routing and policy enforcement

- Vendor management tools, including performance tracking and payment history

- Working capital optimization through strategic payment timing

- Comprehensive analytics dashboards for clear spend visibility

- Dedicated customer success managers offering ongoing guidance

Protect your finances and reduce fraud risk with Order.co's best-in-class virtual cards—schedule a demo today to see how you can benefit from unlimited spend controls and seamless integrations.

FAQs

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields