In order to launch successful procurement initiatives, stabilize cash flow, and create savings, procurement organizations need to understand every facet of the P2P cycle from sourcing to settlement. Top procurement leaders use procurement analysis as part of a comprehensive strategy. It helps answer questions in a streamlined and automated way, which leads to better management of projects and an ample amount of cost savings.

In this article, we’ll offer a comprehensive look at procurement analytics: What it is and how it can improve your cost savings and time efficiency. We’ll also cover best practices you can incorporate into your procurement practice to see positive impacts right away.

Download the free ebook: The Procurement Strategy Playbook

What is procurement analysis?

Procurement analysis enables you to see what you're spending and where throughout your procurement department or business. It enables you to better control your costs and predict what to expect in the near future. It examines the data created in your procure-to-pay process and helps you extract and refine it to understand your spending.

Well-visualized procurement data can show you:

- What the company is spending for goods

- How those compare to market benchmark numbers

- Where to get the best deal on future purchases

- How to manage cash flow and improve your numbers over time

Procurement analysis brings a quantitative approach to procurement that draws on past performance and data analysis and integrates current market data to inform your future decision-making. The analysis is a bit more technical than a crystal ball, but when done correctly, it works like magic.

How spend analytics improves business outcomes

Procurement analysis isn’t just nice-to-have or a practice reserved for large corporations, because spending on outside vendors often accounts for 40-80% of a company’s total cost. That’s a significant expense, and one that must be closely monitored to avoid waste spending.

Building a robust procurement analytics process can significantly reduce waste and improve your near-term and long-term business decisions, no matter your size or stage.

- Improve your spend management

- Increase profitability

- Establish performance metrics

- Evaluate supplier performance

- Identify cash leaks and savings opportunities in real-time

7 best practices for saving on purchasing costs

If your company is experiencing the frustration of budget overruns and untrackable purchasing practices, it’s possible to increase your spend optimization and improve your bottom line quickly.

The 7 best practices used by procurement teams regardless of size and stage are:

1. Formalize your procurement spend process

The first step to saving money is to establish a standard P2P workflow. Formalizing the procurement function helps your stakeholders understand precisely how to get from requisition to payment. This also helps you set spending rules, create accountability in every step of the process, and forms the foundation of effective contract management.

For example, establishing a process was one of the first steps to savings for NY Kids Club. Using Order.co, they moved away from a cumbersome, email-based purchase order process and got a handle on spending across the company’s 19 locations. Automating the process helped them eliminate wasteful spending that sapped their cash flow.

2. Increase your procurement data visibility

To realize savings in your procurement spend, you need a granular understanding of where your money is going. Using a modernized, automated procurement analytics platform gives you complete visibility into your spending beyond simple “revenue minus expenses” accounting when you close the books. Complete data transparency allows you to analyze various data sets in every meaningful way: category, department, product type, supply base, tax nexus, geography, and more.

Once your spend data is extracted and refined, a P2P platform can gather it into helpful dashboards to better help you visualize how the data is working This allows you to surface actionable insights and improve your procurement strategy more easily.

3. Build strategic supplier relationships for sourcing goods

Vendor partnerships are beneficial for everyone, and they can help you realize significant cost reductions. By establishing relationships with preferred suppliers for high-volume and recurring purchases, you open the door to volume discounts and more flexibility in your purchasing.

Relying on strategic vendor partnerships also saves time by eliminating redundant work, reducing due diligence, and eliminating much of the negotiation and onboarding associated with bringing on a new vendor. When you have a solid supplier management process paired with a well-curated list of preferred vendors, you can take advantage of the best deals and do so with considerably less friction.

4. Stabilize your inventory and sourcing practices

Inefficient sourcing and inventory management can cost you money in various ways. For example, delivery delays and inventory shortfalls can stretch out production timelines. Rush orders can invite expediting fees, quality issues, and invoicing mistakes.

By reducing these friction points, you can save many hours previously spent putting out fires, all while stabilizing your cash flow. Using a centralized P2P system like Order.co, you gain visibility into inventory levels, expected consumption, average shipping timelines, and project management estimates so you can have what you need on hand and deliver on schedule.

5. Identify cash leaks with spend analysis

Once you have a formal process in place, it becomes easier to identify spending leaks in the workflow. Using a documented, repeatable process, you can begin to eliminate some of the most common money-wasting culprits, such as:

Non-preferred vendor use - When spending happens, it often occurs using whatever supplier the purchaser believes will work best or give them the best price. The problem with this is stakeholders have no visibility into negotiated partnerships that can save the company money.

Maverick spending - Even if you establish a preferred list of vendors and budget parameters, it’s useless unless your stakeholders can access them. Without information, they will typically “buy” first and ask questions later. By centralizing your procurement process, you eliminate the occurrence of one-off purchases, corporate card-based purchasing, and unplanned spending by giving everyone access to the game plan and guardrails for their purchases.

Over-ordering or duplication - If multiple locations or departments are ordering goods in a decentralized way, chances are you’re losing leverage on negotiating volume pricing. By centralizing the order and payment process, you can use advanced analytics to better understand the total cost of ordering across locations, improve your category management, and use strategic sourcing to save money.

What are cash leaks doing to your bottom line? Our free ebook will show you how to close those gaps for good.

6. Use AP automation to eliminate mistakes and busywork

Manual administration of your Purchase to Pay (P2P) process creates room for errors such as missed/late payments, over/underpayments, information mismatching, and erroneous data entry. These types of issues can generate late fees, stop orders, slow down closing activities, or create other costly outcomes.

By integrating supplier invoicing, reconciliation, and payment into an automated system, you remove this potential and create a process that is easier to use and track. It also dramatically reduces the Finance team’s time investment in repetitive processes and frees up your AP staff to take on more meaningful projects.

7. Get Order.co: Streamline your sourcing and payment process

To implement all these money-saving practices, you need a robust platform that brings your process, payments, and data under one roof. Using Order.co for as your P2P system, you can create a purchasing workflow that eliminates cash leaks and rogue spending, connects you with the best suppliers and pricing, allows speedy approvals, and simplifies your payment process with automated reconciliation and invoice batching.

If you’re ready to realize cost savings and boost revenue with powerful workflows and advanced analytics, schedule a demo to see the Order.co P2P platform in action.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

Imagine walking into the office on a Monday morning, and your desk is buried in invoices.

You spend the next week manually uploading each one. You barely have time for a coffee break because the piles never actually go away. You keep at it because that’s your job, and that’s how your company manages invoices. But you know that next week, next month, your desk will look exactly the same.

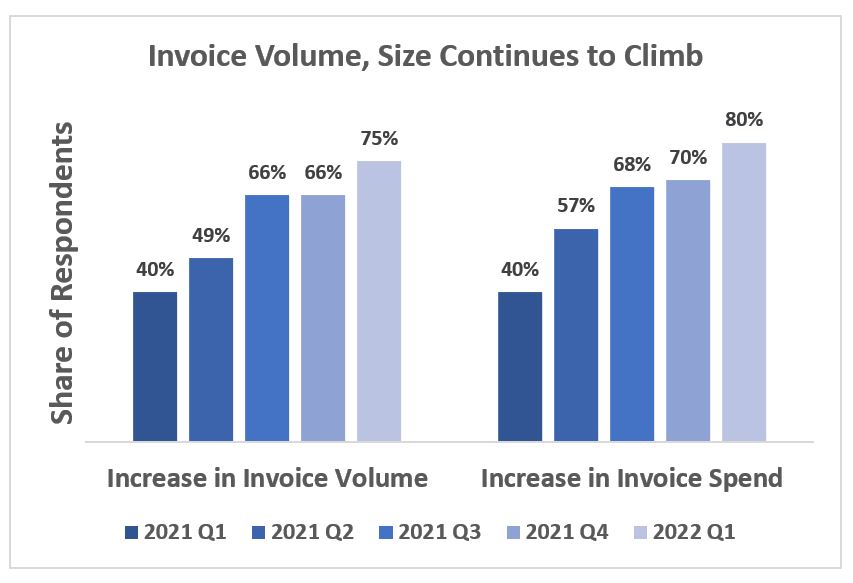

This is reality for thousands of AP professionals. Half of the respondents to a recent IOFM survey say they are working longer hours to keep up with the rising volume of invoices. According to the data, things won’t let up anytime soon. The same report showed that invoice volume increased 75% in Q1 of 2022 alone.

Download the free tool: Invoice Tracking Template

This Increase in volume and associated work are leading many accounts payable (AP) professionals to burn out, with one in four of these overworked individuals considering leaving the field as a result. Additionally, one in five AP professionals is approaching retirement age. In total, nearly 50% of the professionals surveyed are at risk of leaving the industry.

Growing a company is hard enough. Proper invoice management is a vital practice for your company and your valuable employees. Before we hop into how to fix invoice management at your company, let’s first get into what exactly invoice management is—or at least what it’s supposed to be.

What is invoice management?

Simply put, invoice management is a process by which a company receives, organizes, validates, pays, and records supplier invoices, in that order.

Seems easy, right? It is, but believe it or not, proper invoice management isn’t as common as one might think. If you’re not careful, poor invoice management can plague your company’s growth and bottom line. In truth, no industry is immune to this issue.

What is the manual invoice process?

The core problem with invoice management is not the invoices themselves. Companies have to purchase products—that’s a given. For many companies, even in today’s world, the problem with invoices is the manual process by which they’re managed.

Each invoice flowing into the company follows a process. They must be:

- Entered into the system

- Processed and coded

- Matched against purchase requisitions and purchase orders

- Approved and submitted for payment

- Tracked and reconciled at month-end

Ask anyone in finance— manual invoice management is a lot of work. Not only that, if you don’t keep the hundreds of paper invoices organized, like Donnie Brasco says, “Forget about it!”

The vicious cycle of poor invoice management

There is a vicious cycle when it comes to manual invoice management—especially as it relates to new and growing companies.

Growing companies buy a lot of products, especially those engaged in expanding locations. With those growth-necessitated purchases come corresponding invoices. The invoices are entered manually—given they’re not misplaced beforehand—to be approved.

After approval, payments are often made via paper checks through the mail. The payments are reconciled and recorded in a spreadsheet. The wealth of information contained in the purchasing process is ignored.

A new month of purchasing begins, and the cycle repeats itself.

The time and effort it takes AP teams and finance departments to facilitate improper invoice management takes away from the effort they could invest in strengthening their department and helping spur company growth.

Without sufficient effort focused on helping the growth of the company, it’s virtually impossible to gain traction. Nonetheless, the outdated manual invoice management process stays the same, and the cycle continues.

Top 5 impacts of manual invoice management

Manual processing can present a host of negative impacts for organizations. These are the five most damaging:

1. Poor visibility: Manual invoice processing relies on outdated data collection methods such as spreadsheets. These manual organization methods offer no options to dynamically search through or contextualize data. This lack of visibility makes it harder to find issues as they arise, and it also robs decision makers of access to valuable information for future planning and analysis.

2. Frequent errors: Everyone makes mistakes, and overworked AP staff are bound to make their fair share. Manual entry creates an average exception rate of up to 23%. As many as one out of every five invoices has an error that either requires research and remedy or never gets detected at all. Those exceptions can add up to considerable lost revenue and time.

3. Slower processing: AP clerks can only type so fast. A skilled clerk can process an average of 5 invoices per hour. For companies generating thousands of invoices per month, the headcount required to process everything in a timely manner is prohibitive. Additionally, the manual accounts payable process usually goes hand in hand with paper checks, which leaves suppliers waiting on snail mail to receive payments. Missing or delayed mail may generate late fees.

4. Higher processing costs: It’s expensive to perform manual data entry. Its expenses come from a variety of places:

- Increased labor cost

- Late payment fees

- Invoice exception costs

5. No scalability: The most pervasive problem with manual processing is the lack of scalability. With only so many hours in the day and so many people available to process, manual entry means the problem gets worse over time. For growth-minded companies, scalable systems are the key to success. That’s hard to accomplish if your AP team is constantly falling further behind.

AP automation can keep up with your company no matter how fast you scale.

What does good invoice management look like?

Manual invoicing can seriously weigh down the finance department. Fortunately, there’s a better way. Automated invoice processing software converts invoice management from a days-long, high-touch process to an instantaneous, touchless event. It can streamline every step of invoice batching, matching, and processing to reconcile thousands of invoices per hour. Here’s how it works:

Batching/receipt: Invoices flow into the organization from one of several channels (mail, email, or e-invoicing). Optical character recognition (OCR) scanners batch and digitize paper invoices, and invoice data is integrated into the system. Email and electronic billing go into the system automatically for validation and processing.

Reconciliation and matching: Formerly tedious processes such as invoice reconciliation and three-way matching between the purchase order, invoice, and purchase requisition happen automatically. These processes occur within the system at the time of invoice processing, eliminating the need for manual checking and re-checking of vendor payments against spreadsheets.

Approval: Invoice approval is automatically routed through approval workflows so any relevant stakeholders (for instance, finance or procurement) can sign off. The entire process happens within the system, eliminating the need for back-and-forth communication that slows down the process.

Payment: Using an integrated electronic payment method linked directly to accounting systems, the platform approves the invoice and issues an electronic payment directly to the supplier. This enables cost-saving early payment discounts.

Reporting and archiving: All centralized data is available for real-time reporting and analysis purposes. AP or other stakeholders have the ability to dynamically search for information by time period, vendor, category, department, or other search criteria.

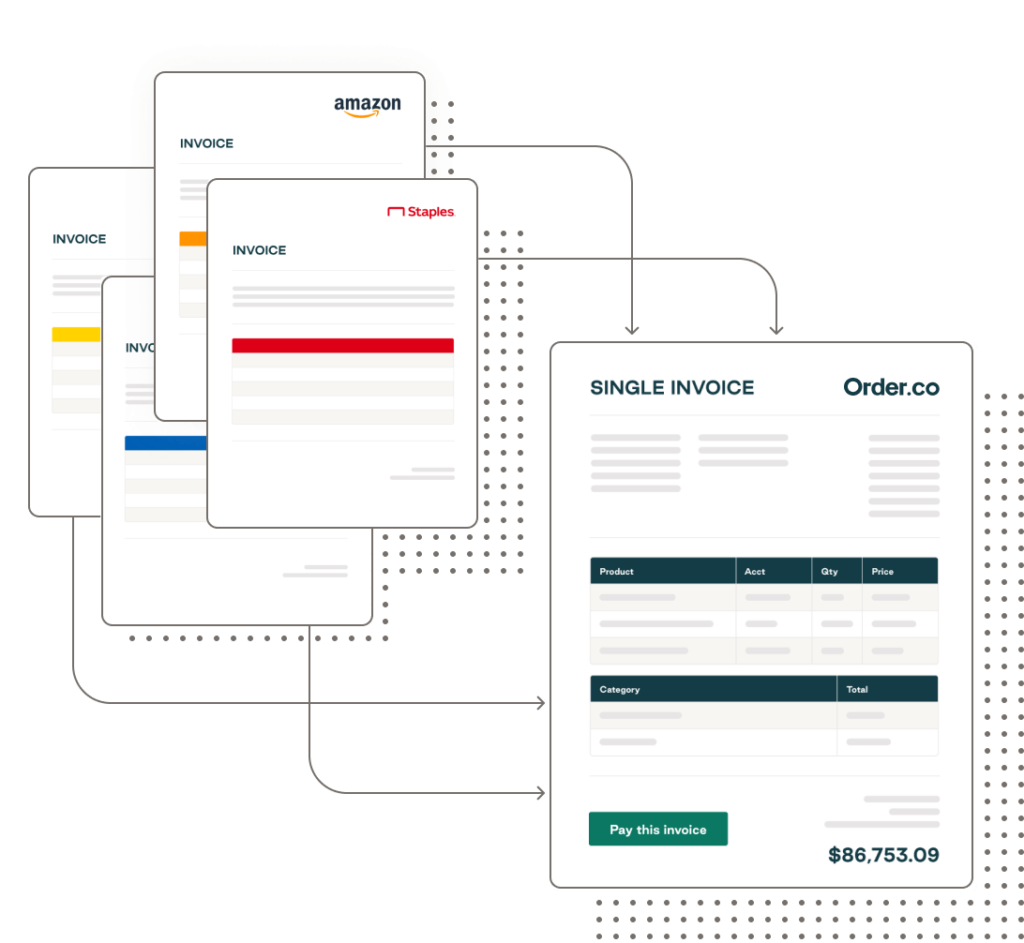

Invoice management software can help you achieve all this and more. The best platforms can also help consolidate billing and payment into a single, automated event, saving AP hundreds of hours of work in researching and paying vendors. Instead, a single click can pay them all.

Real-life examples of effective invoice management

Let’s get some real-life examples of how consolidated invoicing and proper invoice management drastically increase the productivity of finance teams and foster the exponential growth of companies.

Cutting down on the number of invoices your company has to process saves your team and company time and money. With consolidated invoices, companies can go from hundreds or thousands of invoices to just a few—or even a single invoice—every month.

Elliot Physical Therapy gets better process efficiency

Elliott Physical Therapy discovered the time and money they could save by using consolidated invoices and efficient invoice management. Finance Director Caroline Dodero calls it a “huge time saver” that “allows [Elliott PT] to focus on higher-level projects” rather than wasting numerous hours every week organizing hundreds of invoices. They are now able to pay 168 separate invoices with one click.

Clinton Management gets payments under control

Getting a call from a vendor who says your payment is late is just awkward. Clinton Management, a property management company based out of New York, suffered this exact problem. They were trying to manage hundreds of separate invoices, which led to backlogs and overdue payments. By consolidating their invoices and keeping track of their payments, they became the gold standard for both property and invoice management.

“Our vendors aren’t calling to ask where their payments are anymore,” explains Purchasing Manager Nadia Nizam. When you consolidate all your invoices into one, paper stacks go away, and you can see exactly whom you owe and ensure they are paid on time.

Free yourself from invoice management with Order.co

Order.co consolidates your invoices and automates many of the manual processes that bog down invoice management. The platform centralizes invoice management and brings you a competitive advantage, free from the chaos of keeping track of invoices. Never again will you ask, “Where did I put that invoice?” or “Did I pay that vendor yet?”

Establishing a good invoice management process is an essential part of scaling your business—without it, you’ll be stuck in the vicious cycle of invoice overload, with no clear way out. For companies looking to tighten up their invoice management system (and let their finance teams sleep better at night), that’s where we come in.

Order.co’s invoice automation features help some of the world’s fastest-growing companies streamline their invoicing and payment processes. Reduce manual entry, increase productivity, improve invoice management, and consolidate payments, all within one robust automation software tool.

Schedule a demo with one of our team members if you’d like to see exactly what Order.co can do for your business.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

The global fitness industry took a hit in 2020; however, even amidst the astonishing list of statistics that shows the true wake of the pandemic on the fitness industry, there are still signs that the fitness industry will continue to grow in the years to come.

Now, it’s no secret that the fitness industry was one of the most hard hit industries from the COVID-19 pandemic, but the fact that it is still predicted to be one of the fastest growing industries in the world is a testament to the resilience and responsiveness of the industry, the people that work within it, and the innovations in fitness technology. With the global fitness industry being worth more than $96.7 billion, the potential for the industry is exciting, but the high-growth itself can present issues of its own.

The fitness industry is much more than selling gym memberships; it’s more than scheduling group spin classes. To those who run these businesses, they understand the logistics behind it all—it can be overwhelming. The truth is that these fitness companies are not alone. It turns out that purchasing, vendor payments, countless invoices, and controlling expenditures are common problems for fitness companies—even some of the biggest names in the industry.

We sat down with clients and fitness giants SoulCycle, Solidcore, and CorePower Yoga, and they have a few words of wisdom to pass down to other fitness companies looking to grow in the most sustainable, efficient way possible.

Tip #1: Keep your vendor accounts organized

Like we said before, there’s a LOT more that goes into growing your fitness company than selling gym memberships. Gyms and fitness centers need a wide-array of supplies: equipment, office supplies, cleaning supplies, toilet paper, shampoo, towels, you name it. Too often, companies find themselves wasting hours and hours every week ordering these products because they have too many sites to order from. Forgetting passwords, using expired credit cards, and ordering duplicates of products are just a few of the many consequences that come from having unorganized vendor lists in the fitness industry.

Even Solidcore, a national HIIT pilates gym and fitness brand, once experienced the stress of ordering from countless vendor platforms. Like many fitness companies, Solidcore’s purchasing “was a mess” before using a centralized purchasing platform. An inside look on Solidcore’s entire purchasing process revealed that they struggled with having “multiple user accounts on Amazon, and also used Wayfair and many third party vendors for wipes, cubbies, sweat bags, etc”; Solidcore employees and managers were logging into accounts one at a time, sharing logins, and forgetting passwords. However, by using a platform that organizes all of their vendors in one place, Solidcore’s entire purchasing process is “simpler, and [they] have the ability to see all of [their] spend on the product, location, and aggregate levels,” explains Solidcore’s Charly Williams.

To say “unorganized” to describe many fitness companies’ purchasing process would be an understatement. So, what’s the best way to organize your company’s vendors? Keep them in one place.

Tip #2: Make sure you know how much you are spending—at all times

The best way to sustainably grow your fitness company? Know what you are spending. In fact, that’s a rule of thumb in any business. If you have no idea how much your company is spending on a monthly basis until the invoice comes in, sustainable growth is out of the question.

If this is you and your company, trust us—you’re not alone. SoulCycle, the indoor cycling fitness company, had this issue exactly. The spin class powerhouse revealed their biggest pain-points as they began to grow, and spend visibility was at the top of that list. Before using a centralized procurement platform, SoulCycle’s studios manually tracked company spend across all of their vendors to determine where they were in their monthly budgets—making for a “complicated” process to see exactly how much they were spending each month.

There are many reasons why spend visibility is important for a company’s growth, but for fitness companies in particular, just remember this: if you want to open more studios, open your books and make sure you know your numbers—down to every last cent. If you still don’t know what you’re spending because you have too many invoices or an overall disorganized purchasing process, look into using a platform that will track your spend for you.

Tip #3: Make a budget...and stick to it

A natural consequence of not adhering to tip #2: spending more than you should. Seems pretty obvious, right? If you want to grow your business, don’t spend more than you’ve budgeted for. There are plenty of growth strategies for companies to use to expand quickly, but if there’s no line in the sand on budget, viable growth and long-term success is an impossibility.

Let’s use CorePower Yoga for example; the fitness industry behemoth once had “no process or system to manage spend for each of [their] locations. Each location was making their own spend decisions and regularly going over budget,” says CorePower’s Facilities Management Specialist Stefanie Teintze. CorePower “had no visibility or control of spend, and invoice audits showed [they] were averaging close to $50k in unapproved spend monthly.” $50,000 in unapproved purchases—every month. Their budgets were essentially non-existent—given that they did not have enough visibility into their purchases to create one.

CorePower “had no visibility or control of spend, and invoice audits showed [they] were averaging close to $50k in unapproved spend monthly.”

Unfortunately, CorePower Yoga, before turning to a platform that gives them real-time spend visibility and budget updates, was not alone in spending more than they thought they were each month. Now, there are many different reasons why companies go over budget, but from what we’ve gathered, not knowing how much your company is spending consistently tops the list.

It’s pretty simple, really. If you want to grow your fitness company, you need to have a budget; in order to budget, you need to know what you’re spending.

A last word to the wise from CorePower Yoga

If you’re looking for one last piece of advice to help you take your fitness company to the next level, take it from Stefanie and “go for it!”

Get started

Schedule a demo to see how Order.co can simplifying buying for your business.

"*" indicates required fields

Ask any modern business decision-makers about the essence of trade accounts payable, and you'll soon realize that it's one of the greatest tasks they face. After all, businesses must pay their debts, and they cannot afford to get this wrong.

Managing invoices accurately and promptly is almost an art, and it’s the key to maintaining good vendor relationships. It's essential to understand the critical relationship between trade accounts payable and vendor relations and its impact on your company's bottom line.

In this article, we'll look at:

- What are trade accounts payable?

- How trade accounts payables are intertwined with procurement and vendor relations

- Managing the accounts payable process and its effect on profitability

- Why trade accounts payable matters

Download the free tool: Invoice Tracking Template

What are trade accounts payable?

Trade accounts payable (also called trades payable) refers to an amount that suppliers bill a company for delivering goods or providing services in the ordinary cause of business. When paid on credit, the company enters the billed amounts in the accounts payable module of their accounting software or balance sheet.

Any amounts owed to suppliers that the company immediately pays in cash are not part of trade account payables since they are not a liability. In the accounting system, businesses record trade accounts payables in a separate accounts payable account. They also credit the accounts payable account and debit whichever account closely represents the payment's nature, such as an asset or an expense.

It is worth noting that the classification of trade accounts payables is ‘current liabilities’ since they are payable within a year. When that's not the case, the business can classify the trades payables as long-term liabilities. Since long-term liabilities tend to have an attached interest payment, the accountant is more likely to classify them as long-term debt.

Trades payable vs. non-trades payable

One significant difference between the two is that you usually enter trades payable into the accounting system through a special module that automatically generates the required accounting entries. On the other hand, you typically enter non-trades payable into the system using a journal entry.

Trades payable vs. accounts payable

It's normal for some people to use the two phrases interchangeably, but they have a slight but important difference. Trades payable refers to the money you owe vendors for inventory-related goods — for example, business supplies or inventory. On the other hand, accounts payable include all your short-term debts or obligations, including trade payables.

How is trade accounts payable intertwined with procurement and vendor relations?

Traditionally, your procurement department is responsible for maintaining vendor relationships, including contract negotiations, the pursuit of discounting opportunities, compliance to terms, and repayment processes.

Still, it is essential to know that the trade accounts payable process also plays a crucial role in the daily business mechanisms to keep vendor relationships on a positive track.

Research reveals that 47% of companies pay one in ten invoices late, while 16% admit that they pay one in five invoices late. Only a paltry 5% of businesses assert that they always pay their obligations on time, whereas one in 12 firms never monitors its payments processes at all.

Late vendor payments risk causing disruptions in the supply chain and cash flow. Some of the causes of late invoice payments include lack of automation, slow internal processes, lack of capacity to manage invoice volume, and administrative error. Unfortunately, all these are mere excuses for poor performance. Besides, vendors shouldn't have to accommodate internal process flaws.

Supporting a strong, continuous supply chain

Business vendors are crucial to your company's success. Consider, for example, the retail and manufacturing sectors. Regular business relies on vendors to provide the necessary products, parts, and raw materials to complete their end offering. As such, these companies can't afford to lose their key vendors due to inefficient trade accounts payable processes resulting in late, lost, or faulty payments.

Automating your accounts payable workflow speeds up invoice processing and ensures your vendors receive payments accurately and on time. In return, vendors are likely to deliver goods swiftly and offer future discount opportunities.

47% of companies pay one in ten invoices late, while 16% admit that they pay one in five invoices late.

Profitability impact of trade accounts payable management

Just like other current assets or liabilities, trade accounts payable have a significant impact on your profitability. The single most critical thing you can ever do to maintain good vendor relations is pay your bills on time. Unfortunately, accounts payable management can get hectic and unwieldy. As your business grows, so does its suppliers and the invoices you have to pay.

Good vendor relationship management requires a mutually beneficial relationship between you and each supplier or vendor. A positive relationship is a win-win for all parties. Vendors will cut you good deals, suggest new and better products, and work with you on delivery policies and times.

It is prudent to cultivate good supplier relationships because they also mean increased company efficiency. To do this, always ensure that you:

- Pay your bills on time.

- Don't cut off suppliers without a valid reason.

- Keep open lines of communication.

- Elicit trust with all of your vendors and suppliers, regardless of how many you have.

In return, a good vendor could respond by offering you their best trade credit terms possible, hence maximizing your profitability.

One critical metric in any business's financial management process is its cash flow, which comes from business operations like financing and investing. It's worth noting that you generate profit from sales after paying all expenses.

Inadequate monthly cash flow means you won't have enough cash at hand to pay your bills on time, which means trouble with your suppliers. Often, vendors offer cash discounts if businesses pay within a specified number of days, like three months. That discount can have a significantly positive effect on your profitability.

Now, imagine getting cash discounts from all of your vendors and having enough cash on hand to take them. It will result in a significant effect on your net profit margin.

Why accounts payable management matters

The accounts payable management process focuses on ensuring that you pay your bills timely without choking cash flow. It further ensures you have sufficient liquidity to fund process optimization, investment opportunities, and product innovation to reduce your ongoing costs.

It's critical to optimize your accounts payable management, particularly for small business owners who rely heavily on their working capital compared to larger companies. Below are some reasons why accounts payable matter:

- Accurate and efficient workflows in your trade accounts payable system provide transparency and accuracy in your cash flow tracking and planning.

- Better cash flow management allows for more accurate budgeting.

- Effective management provides actionable insights that you can leverage to enhance contract negotiations and strategic sourcing. It also allows you to build stronger vendor relationships that give you access to better discount payment terms.

How do you audit trade payables?

The best practice to follow is to review the recorded cash disbursements subsequent to the corresponding balance sheet date. It allows you to determine which period to apply the related payables and whether it belongs to the previous one. Identifying unrecorded trade accounts payable enables you to manage all your current liabilities. You can also make payments on time to safeguard your vendor relations.

Trade accounts payable is among the essential tasks to get right. The risks of failure are too significant to leave to chance. A poor trade accounts payable process can damage your vendor relations and open you up to fraud risk.

Order.co helps finance and operations teams spend less time placing and managing orders. Peloton, Hugo Boss, XpresSpa, SoulCycle, and WeWork all use Order.co to:

- Place orders from one cart and approved catalog automatically across every vendor.

- Track real-time spending.

- Make actionable purchasing decisions.

Order.co automates your purchase orders, tracks delivery issues, saves you money, offers spend tagging and visibility, consolidates billing and vendor transactions, and unifies all your trade accounts payable data under one platform. To get started, schedule a free demo today.

Get started

"*" indicates required fields

Procure-to-pay (P2P) is the process an organization uses to source, negotiate, purchase and pay for goods and services. A powerful, effective procure-to-pay (P2P) cycle is critical for your business.

As Forbes Councils Member Peter Nesbitt notes, the way companies spend money has changed dramatically over the past several years. Businesses no longer rely on a top-down model for purchasing and spending. As a result, P2P cycles and technology have changed dramatically.

A well-crafted procurement process is an enablement tool for teams. It reduces friction in the supply chain and speeds the delivery of products to market. But the traditional procurement model—driven by manual processes and limited visibility—is no longer sufficient for driving growth.

Download the free ebook: The Procurement Strategy Playbook

Using technology to optimize procure-to-pay (P2P)

Thanks to next-generation P2P technology, meeting your financial goals and tracking your spending at scale are easier. These systems enable classification and analysis capabilities critical to managing business spending and reducing costs. They reduce value-sapping maverick spending, improve your functionality, and ensure your accounts payable team is focused on the right tasks to create value.

We’ll discuss:

- The components that make up the procure-to-pay process

- Best practices for increasing operational efficiency

- How to implement next-generation technology

What are the steps in the procure-to-pay cycle?

The procure-to-pay process includes all the steps necessary to purchase materials and services for your organization. It begins with a purchase request and follows a predictable (and trackable) path to invoice approval and payment.

The 7 steps of a P2P process:

- Identify needs: In the initial steps of the process, a stakeholder identifies a product or service they need. Depending on the need, they may outline requirements for the procurement department.

- Requisition materials: The stakeholder submits a purchase requisition. Department heads and Finance sign off and approve that requisition so that Finance or Procurement can move forward with the purchase.

- Source the materials: Effective sourcing is critical to ensure that you have a solid supplier who will offer your business the best possible deal on your goods.

- Create a purchase order: Upon approval of the purchase and sourcing, the Purchasing team or stakeholder submits a purchase order to begin the transaction. This is routed to the supplier for fulfillment.

- Receive the goods: Once fulfillment is complete, accounting conducts the three-way matching process to ensure the ordered goods and actual deliveries align. The financial team will ensure that no discrepancies exist that could cause problems with the process.

- Approve the invoice: Once reconciled, Procurement teams approve the vendor invoice for AP processing.

- Pay the vendor: The vendor gets paid for their services based on the terms of the contract. Post-payment, the accounting team may implement contract management and analysis. This is part of the supplier lifecycle management process.

Best practices for your P2P cycle

Rather than just checking the boxes, routing the request, and moving forward without attention to detail, take the time to optimize your P2P process. Ensure the best tools and processes—namely, procure-to-pay software—are in place to manage your P2P cycle effectively.

The best P2P management practices usually include:

- A documented intake or requisition process

- An approval process with a standard list of approvers

- Budgetary review through finance or procurement

- A strategic sourcing program to identify the best suppliers

- Negotiating and contract prerequisites for each purchase

- Purchase order review and shipment reconciliation process

- Centralized vendor payment and contract management

Procure-to-pay software increases the effectiveness of a well-executed purchasing process. It simplifies the overwhelming process of managing the sourcing, purchase, and payment of goods and services.

Using software is the best way to create a scalable solution that grows along with your company. Even better, P2P software often results in net savings well above the investment in automation.

P2P software automates many repetitive tasks that bog down your purchase-to-pay process, including:

- Vendor sourcing and selection

- Purchase requisition and purchase order approvals

- Invoice approval and invoice processing

5 goals to strive for in your P2P cycle

These best practices improve the procure-to-pay process flow and realize better cost savings for your organization. Identifying your desired outcomes of a program—whether its streamlining operations, increasing cost savings, creating scalability, or improving inventory management—helps you make decisions about your program.

1. Increase visibility in your purchasing process

Visibility is critical in tracking the success of your procure-to-pay cycle. It enables your stakeholders to track each purchase through the process. It also creates an audit trail and a source for data reporting.

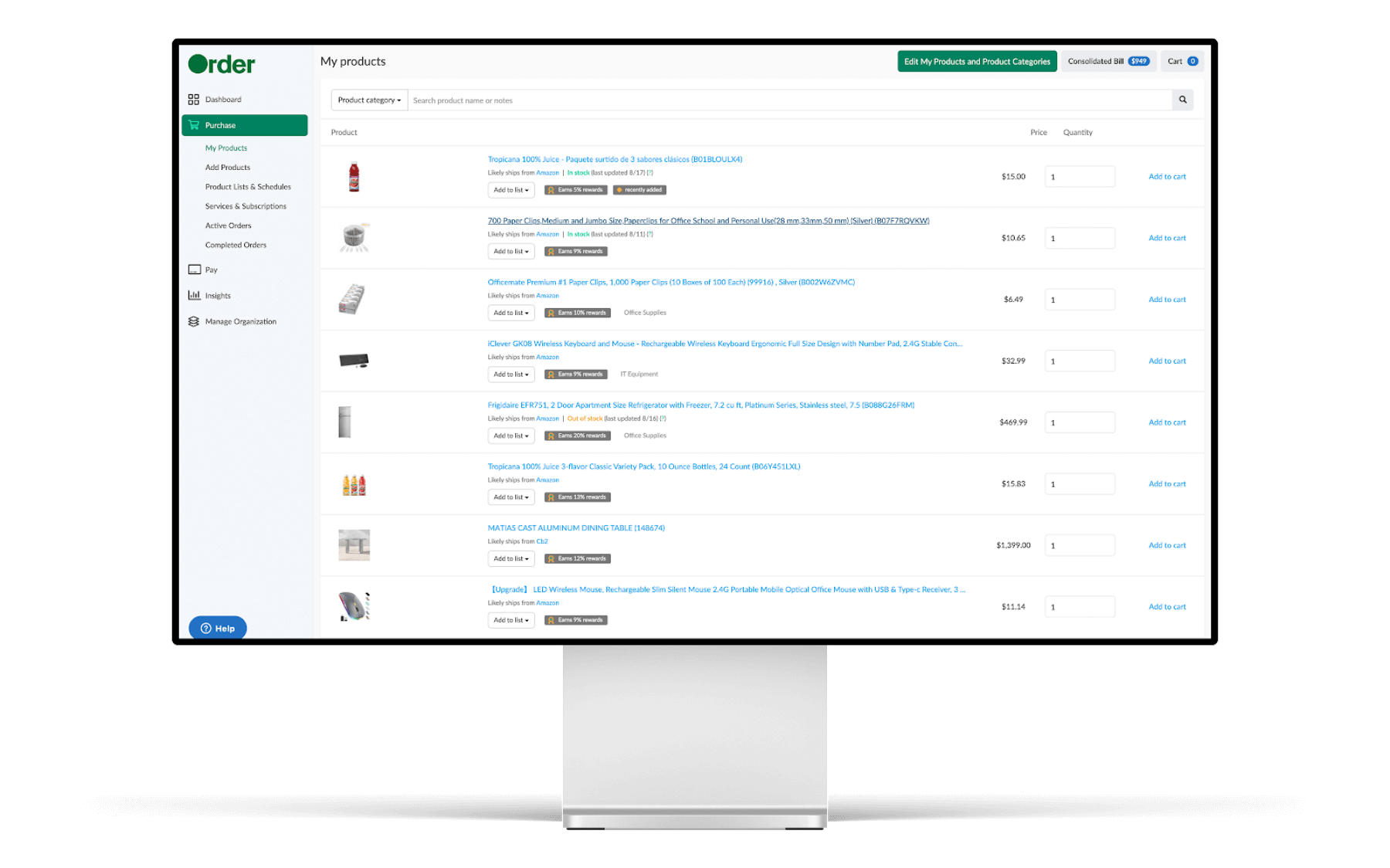

Order.co provides real-time spend data, coded down the line, product, user, or location level. This data helps your finance team make critical decisions about your purchases. This next-generation visibility—which offers insight into the latest changes in your inventory, availability, and purchases—helps your finance team and other decision-makers see and adjust to changes in your procurement function. It ensures that you’re buying what you need, with competitive pricing and high levels of compliance.

2. Automate the accounts payable department

Automation has become increasingly common across many industries, and the procure-to-pay cycle is no exception. Automating your accounts payable function can result in as much as a 60% increase in productivity and an 83% reduction in purchase order processing time.

Order.co automates many of the steps involved in the P2P cycle. It also helps organizations implement strategic sourcing to ensure the best sourcing for high-volume or high-cost goods. This automated sourcing has helped many clients save an average of 8% on their procurement costs.

3. Use a dynamic system to manage the payment process

Vendor payments are a critical part of your P2P process. Optimizing the payment process with the right workflow reduces payment errors, eliminates time-consuming research and corrections, and ensures payments align with business needs and cash flow.

A dynamic procure-to-pay solution allows businesses to manage payments according to changing business considerations, consolidate payments into a single invoice, and reduce the time spent handling the accounts payable process.

4. Optimize ordering and logistics

Transparency is crucial to maintain effective ordering processes. It ensures you have the right items coming in at the right times.

An effective P2P process helps you optimize your ordering across your organization. It also provides insights into standard pricing, total cost, and other critical metrics for maintaining inventory control without sacrificing cost efficiency.

Order.co allows organizations to order the goods they need across departments or locations, providing continuity and cost efficiency.

5. Coordinate and manage delivery schedules.

Monitoring delivery schedules through an automated notification system helps you better plan inventory receipt and distribution. It also increases supply chain resiliency, allowing the business to respond to changes in availability, delivery status, and quantity without disruption to normal operations.

How technology software enables P2P

Maintaining an effective procure-to-pay cycle with a manual process becomes more complex as the business grows. By implementing technology, you can automate repetitive tasks and reduce the errors associated with processing purchases and tracking deliveries on a spreadsheet.

Using P2P software, businesses can automate much of the process, including:

- Purchase requisition and purchase order creation

- Purchase approvals

- Vendor sourcing and e-procurement

- Delivery tracking and reconciliation

- Three-way matching

- Invoice coding, processing, and approval

- Supplier lifecycle management

Using software to drive the procure-to-pay process also gives your business access to powerful analytics and robust reporting tools that improve the procurement function, save money, and increase efficiency.

Order.co streamlines your P2P cycle

Digital transformation has revolutionized the P2P cycle. With a procure-to-pay solution like Order.co, businesses have the power to implement total spend management, eliminate inefficiencies, and protect the bottom line—all while allowing locations to quickly and easily order the supplies they need. Schedule a demo of Order.co today to get started.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

Are you paying six figures for your procurement solution system and still using emails and spreadsheets to conduct purchases? You’re not alone.

Many businesses invest in a procure-to-pay solution, only to be disappointed when procurement inefficiencies like high spend and time delays remain unresolved.

Failure to automate and streamline purchase and supply chain systems affects spend management. Manual and siloed systems make it difficult to track expenditures across the company. These systems are prone to errors, inconsistencies, and duplications that inflate spending. Companies using such systems also lose opportunities to negotiate on bulk orders, foregoing direct savings.

While a procure-to-pay solution has many benefits, a company must choose the right system based on its needs, objectives, and stakeholders. This article highlights the main pitfalls companies fall into when investing in a procure-to-pay solution. It covers what to do to avoid these problems and ensure the successful implementation of the right procurement system.

In this article, we’ll dive into:

- Why a procure-to-pay solution can fail

- The best procure-to-pay solutions of 2022

- How to best implement P2P software

Download the free ebook: The Procurement Strategy Playbook

Why do procure-to-pay solutions fail?

The most common culprits in a failing procure-to-pay process are lack of visibility and lack of process. Establishing a repeatable review, approval, and documentation process allows organizations to capture vital information on each purchase and integrate that data into the accounting and reporting process.

No management validation

Like any other important organizational decision, purchase-to-pay solution systems must have the approval of the company management. Unfortunately, many companies do not prioritize supply chain processes.

As such, related technology upgrades can encounter opposition from the top. Failure to convince senior managers of the need to change supplier management systems results in a lack of validation and cooperation when implementing new processes. Instead, they stick to old systems.

Poor onboarding processes

The managers, employees, and vendors who use P2P systems determine their success or failure. Without proper training, sensitization, and support, your colleagues can sabotage a new P2P system.

Additionally, a Tungsten report shows it’s normal for employees and suppliers to resist change—especially if new solutions are introduced without sufficient preparation.

Poor user interfaces

Many employees and suppliers fail to use their procure-to-pay solution because of complicated software, poor system interfaces, and bad user experience. Most of the creators of SaaS programs tend to be technical professionals concerned with the complexities of different systems. If left to create a P2P system on their own, such professionals are less likely to consider the technical and knowledge gaps of the intended users.

Lack of automation and integrated systems

In many large organizations, different departments and external suppliers have independent operating systems and tools in place. Various departments manage requisition, sourcing, procurement, and accounts payable processes. Furthermore, departments might work with different suppliers that use their own independent systems.

Many departments, vendors, and suppliers insist on sticking to their established processes in scenarios such as when introducing a new ERP system. The widespread use of paper invoices and manual systems further exacerbates this.

Unless all the departments and vendors involved streamline their processes and use a unified automated system, enforcing a single P2P solution is practically impossible. Non-integrated systems ruin the essence of purchase-to-pay solutions because they create room for confusion, delays, and inflated purchases.

Spend visibility and reporting challenges

The unintegrated and manual systems discussed above make tracking spending difficult and prevent access to real-time data. Such outdated systems and processes mean that reports must be obtained from diverse sources and compiled later.

Many procurement systems lack built-in reporting functionality and spend visibility. This limits employees’ use of the system and forces them to generate reports manually. Such systems make it difficult to get accurate, real-time data or conduct analyses.

Companies also sometimes avoid procure-to -pay software that has an automated system and produces auto-generated reports because of pricing factors.

Top procure-to-pay tools of 2022

If you’re looking for the right solution to automate your procurement process, check out these top-rated options. To learn more about each, read our full review of today's top 7 procure-to-pay tools.

Order.co

Order.co combines simple, intuitive design with powerful back-end features to create a platform everyone in your organization will value. It offers purchasing through a streamlined catalog with dynamic spend permissions and guidelines. Order.co is great for companies of any stage or size, with capabilities to support multiple locations using centralized, automated functionality.

PRM360

PRM360 gives buyers using the platform for e-procurement a visible, streamlined process. It features real-time reporting on bid processes and automated payment solutions for quick, spend-optimized procurement. The platform is best for mid-market and enterprise customers.

Coupa

Coupa is one of the largest solutions for enterprise customers looking to automate the procurement process. The platform offers a guided buying process with vendor management, inventory management, and other features. Coupa is a component of the Coupa digital management suite for end-to-end enterprise resource planning (ERP).

Zycus

Enterprise users choose Zycus because of its compliant, guided buying options. The tool uses an AI engine to enable and automate the procurement process. It offers robust integrations that allow users to extend the platform for controlling and monitoring spend and risk.

JAGGAER

Billed as the world’s largest independent spend management tool, JAEGGER serves clients across all market segments with procurement management and processing. The tool integrates with other top-quartile business management tools to enable automated P2P.

The keys to the successful implementation of procure-to-pay software

Despite the challenges some companies face when buying and implementing their procure-to-pay solution, the ability of these systems to reduce maverick spending and save time cannot be ignored.

In order to select and properly implement the right P2P system for your company, bear the following things in mind:

Start with a needs analysis

A SaaS or SAP solution will only work if it addresses your company’s needs. Knowing your current purchasing process and P2P process helps determine whether you need a sourcing system, purchasing tools, vendor management system, or a full P2P system. It also reveals budgetary issues, gaps in business processes, supplier relationships, strategic sourcing, and spend management.

Knowing the current problems and the proposed procurement system’s potential solutions gives you more leverage when bringing your management and team on board. Moreover, a needs analysis enables you to identify the best individuals for implementing your new procurement solution and helping the team adjust.

Move to a pilot phase and continuous evaluation

Based on your needs analysis, choose a user-friendly system that fits the capacities of your organization, employees, and vendors. Then conduct a pilot phase to test whether your software solution is feasible and compatible with your transaction needs and lifecycle. Once implemented, you will also need to evaluate your P2P solution periodically to ensure that you are reaping the intended results and conducting data-backed optimization.

Continue with stakeholder education and involvement

Apart from conducting a pilot phase, also educate and involve your employees and the vendors or suppliers who will be using your P2P solution. Involving all the relevant teams helps you get important user feedback and suggestions for the system.

Training and providing necessary information through videos, handbooks, and FAQs reduces challenges for colleagues, vendors, and suppliers as they adapt to the new system. This empowers them to adopt and implement your P2P management solutions quickly.

Choose full automation and integration of purchase requisitions

If you really want to reduce inefficiencies through a procure-to-pay suite, opt for an automated and integrated solution. Access to data will make it easier for your employees to avail reports upon request. Ensuring every department in your company and external team uses the same procure-to-pay software will fast-track its implementation and improve your procurement processes.

Automation should include a mobile approach to allow all relevant stakeholders to access the system anywhere they have an internet connection. This reduces delays in decision-making and approval of requisitions. In addition, your automated P2P solution provider should advise on the best way to migrate and store your data when transitioning to the new system. Given the sensitivity of data, ensure migration and storage are secure.

When done correctly, automation and integration enhance transparency and cut out bureaucratic delays. It facilitates timely payments and deliveries while giving employees time to focus on other important duties.

Appoint a P2P system manager

A good procurement system is only as efficient as those managing it.

Unless you appoint specific people to be accountable for properly implementing your P2P system, you will end up with poor implementation and blame games amongst employees and different departments.

If your organization has no supply chain department, allocate this task to the finance team or outsource management services, preferably from your procure-to-pay solution service provider. Alternatively, hire an in-house team or form a department tasked with handling all your e-procurement matters, depending on your needs.

Plan compliance and policy reforms

Regardless of how well you prepare your employees, vendors, and suppliers, you will still encounter some form of resistance during the implementation of your new procure-to-pay solutions. Some suppliers and vendors might insist on using their own system, while your employees may struggle to adapt to the new way of doing things.

This calls for compliance and policy reforms compelling everyone to adhere to your new contract management and procurement process. If anyone comes with a non-purchase order invoice, refer them to the new invoicing and three-way compliance requirements.

If you compromise on this, you risk failure and the possibility that your P2P system might never be used. The best way to introduce these reforms is to communicate them to all the relevant stakeholders and employees at least three months before they come into action.

Start looking for the spend management system that fits your needs

Choosing a needs-based procure-to-pay solution and involving both your team and external stakeholders ensures the success of your new procurement management system.

Order.co is a user-friendly, intelligent spend management system that works for your entire organization by:

- Giving your finance and operations teams full visibility into tracing and managing all their purchasing needs

- Providing other departments with easy traceability of their spending

- Allowing users to make purchases and pay for goods on one platform

The time to automate your process and close cash gaps is now. Begin by choosing the right software to enable your organization. Check out our guide, Choose the Right Procurement Technology, to start your search.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields