Imagine walking into the office on a Monday morning, and your desk is buried in invoices.

You spend the next week manually uploading each one. You barely have time for a coffee break because the piles never actually go away. You keep at it because that’s your job, and that’s how your company manages invoices. But you know that next week, next month, your desk will look exactly the same.

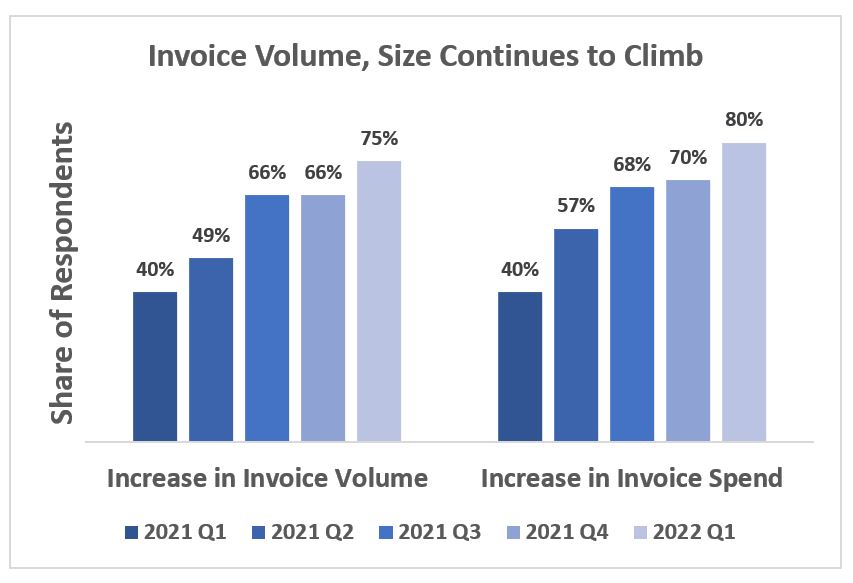

This is reality for thousands of AP professionals. Half of the respondents to a recent IOFM survey say they are working longer hours to keep up with the rising volume of invoices. According to the data, things won’t let up anytime soon. The same report showed that invoice volume increased 75% in Q1 of 2022 alone.

Download the free tool: Invoice Tracking Template

This Increase in volume and associated work are leading many accounts payable (AP) professionals to burn out, with one in four of these overworked individuals considering leaving the field as a result. Additionally, one in five AP professionals is approaching retirement age. In total, nearly 50% of the professionals surveyed are at risk of leaving the industry.

Growing a company is hard enough. Proper invoice management is a vital practice for your company and your valuable employees. Before we hop into how to fix invoice management at your company, let’s first get into what exactly invoice management is—or at least what it’s supposed to be.

What is invoice management?

Simply put, invoice management is a process by which a company receives, organizes, validates, pays, and records supplier invoices, in that order.

Seems easy, right? It is, but believe it or not, proper invoice management isn’t as common as one might think. If you’re not careful, poor invoice management can plague your company’s growth and bottom line. In truth, no industry is immune to this issue.

What is the manual invoice process?

The core problem with invoice management is not the invoices themselves. Companies have to purchase products—that’s a given. For many companies, even in today’s world, the problem with invoices is the manual process by which they’re managed.

Each invoice flowing into the company follows a process. They must be:

- Entered into the system

- Processed and coded

- Matched against purchase requisitions and purchase orders

- Approved and submitted for payment

- Tracked and reconciled at month-end

Ask anyone in finance— manual invoice management is a lot of work. Not only that, if you don’t keep the hundreds of paper invoices organized, like Donnie Brasco says, “Forget about it!”

The vicious cycle of poor invoice management

There is a vicious cycle when it comes to manual invoice management—especially as it relates to new and growing companies.

Growing companies buy a lot of products, especially those engaged in expanding locations. With those growth-necessitated purchases come corresponding invoices. The invoices are entered manually—given they’re not misplaced beforehand—to be approved.

After approval, payments are often made via paper checks through the mail. The payments are reconciled and recorded in a spreadsheet. The wealth of information contained in the purchasing process is ignored.

A new month of purchasing begins, and the cycle repeats itself.

The time and effort it takes AP teams and finance departments to facilitate improper invoice management takes away from the effort they could invest in strengthening their department and helping spur company growth.

Without sufficient effort focused on helping the growth of the company, it’s virtually impossible to gain traction. Nonetheless, the outdated manual invoice management process stays the same, and the cycle continues.

Top 5 impacts of manual invoice management

Manual processing can present a host of negative impacts for organizations. These are the five most damaging:

1. Poor visibility: Manual invoice processing relies on outdated data collection methods such as spreadsheets. These manual organization methods offer no options to dynamically search through or contextualize data. This lack of visibility makes it harder to find issues as they arise, and it also robs decision makers of access to valuable information for future planning and analysis.

2. Frequent errors: Everyone makes mistakes, and overworked AP staff are bound to make their fair share. Manual entry creates an average exception rate of up to 23%. As many as one out of every five invoices has an error that either requires research and remedy or never gets detected at all. Those exceptions can add up to considerable lost revenue and time.

3. Slower processing: AP clerks can only type so fast. A skilled clerk can process an average of 5 invoices per hour. For companies generating thousands of invoices per month, the headcount required to process everything in a timely manner is prohibitive. Additionally, the manual accounts payable process usually goes hand in hand with paper checks, which leaves suppliers waiting on snail mail to receive payments. Missing or delayed mail may generate late fees.

4. Higher processing costs: It’s expensive to perform manual data entry. Its expenses come from a variety of places:

- Increased labor cost

- Late payment fees

- Invoice exception costs

5. No scalability: The most pervasive problem with manual processing is the lack of scalability. With only so many hours in the day and so many people available to process, manual entry means the problem gets worse over time. For growth-minded companies, scalable systems are the key to success. That’s hard to accomplish if your AP team is constantly falling further behind.

AP automation can keep up with your company no matter how fast you scale.

What does good invoice management look like?

Manual invoicing can seriously weigh down the finance department. Fortunately, there’s a better way. Automated invoice processing software converts invoice management from a days-long, high-touch process to an instantaneous, touchless event. It can streamline every step of invoice batching, matching, and processing to reconcile thousands of invoices per hour. Here’s how it works:

Batching/receipt: Invoices flow into the organization from one of several channels (mail, email, or e-invoicing). Optical character recognition (OCR) scanners batch and digitize paper invoices, and invoice data is integrated into the system. Email and electronic billing go into the system automatically for validation and processing.

Reconciliation and matching: Formerly tedious processes such as invoice reconciliation and three-way matching between the purchase order, invoice, and purchase requisition happen automatically. These processes occur within the system at the time of invoice processing, eliminating the need for manual checking and re-checking of vendor payments against spreadsheets.

Approval: Invoice approval is automatically routed through approval workflows so any relevant stakeholders (for instance, finance or procurement) can sign off. The entire process happens within the system, eliminating the need for back-and-forth communication that slows down the process.

Payment: Using an integrated electronic payment method linked directly to accounting systems, the platform approves the invoice and issues an electronic payment directly to the supplier. This enables cost-saving early payment discounts.

Reporting and archiving: All centralized data is available for real-time reporting and analysis purposes. AP or other stakeholders have the ability to dynamically search for information by time period, vendor, category, department, or other search criteria.

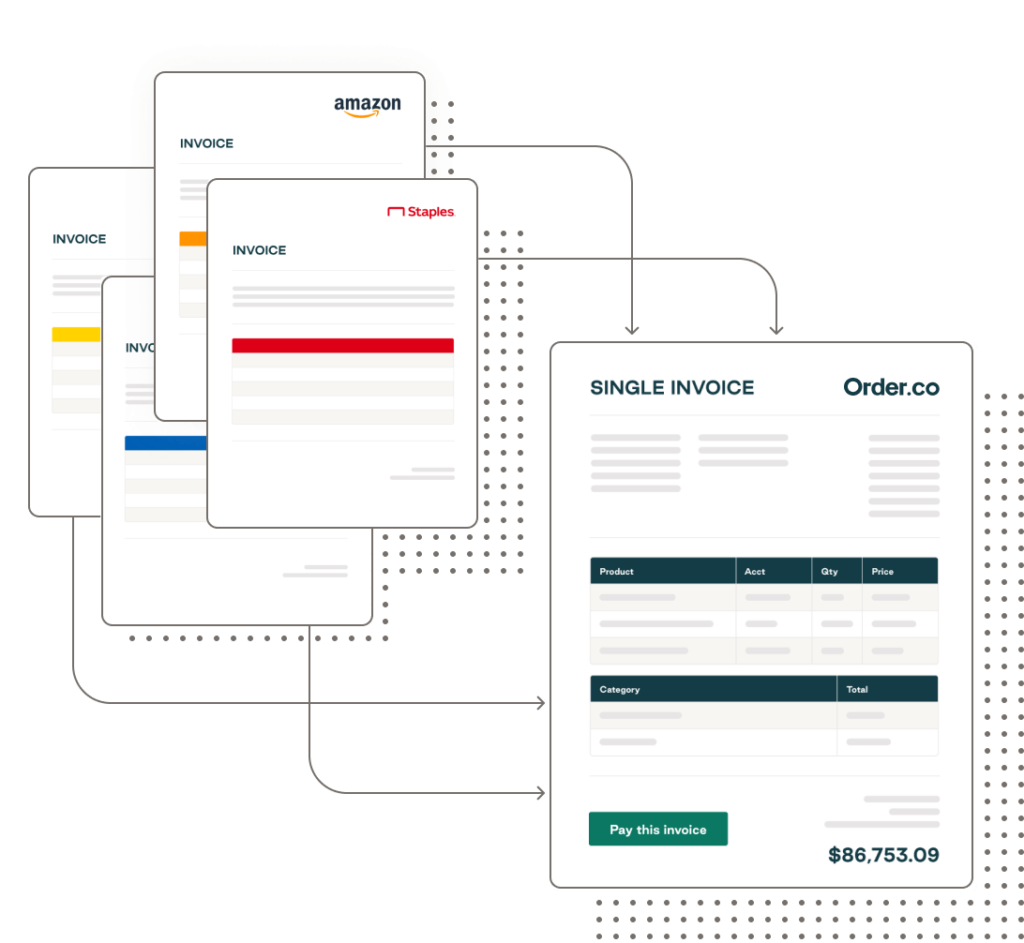

Invoice management software can help you achieve all this and more. The best platforms can also help consolidate billing and payment into a single, automated event, saving AP hundreds of hours of work in researching and paying vendors. Instead, a single click can pay them all.

Real-life examples of effective invoice management

Let’s get some real-life examples of how consolidated invoicing and proper invoice management drastically increase the productivity of finance teams and foster the exponential growth of companies.

Cutting down on the number of invoices your company has to process saves your team and company time and money. With consolidated invoices, companies can go from hundreds or thousands of invoices to just a few—or even a single invoice—every month.

Elliot Physical Therapy gets better process efficiency

Elliott Physical Therapy discovered the time and money they could save by using consolidated invoices and efficient invoice management. Finance Director Caroline Dodero calls it a “huge time saver” that “allows [Elliott PT] to focus on higher-level projects” rather than wasting numerous hours every week organizing hundreds of invoices. They are now able to pay 168 separate invoices with one click.

Clinton Management gets payments under control

Getting a call from a vendor who says your payment is late is just awkward. Clinton Management, a property management company based out of New York, suffered this exact problem. They were trying to manage hundreds of separate invoices, which led to backlogs and overdue payments. By consolidating their invoices and keeping track of their payments, they became the gold standard for both property and invoice management.

“Our vendors aren’t calling to ask where their payments are anymore,” explains Purchasing Manager Nadia Nizam. When you consolidate all your invoices into one, paper stacks go away, and you can see exactly whom you owe and ensure they are paid on time.

Free yourself from invoice management with Order.co

Order.co consolidates your invoices and automates many of the manual processes that bog down invoice management. The platform centralizes invoice management and brings you a competitive advantage, free from the chaos of keeping track of invoices. Never again will you ask, “Where did I put that invoice?” or “Did I pay that vendor yet?”

Establishing a good invoice management process is an essential part of scaling your business—without it, you’ll be stuck in the vicious cycle of invoice overload, with no clear way out. For companies looking to tighten up their invoice management system (and let their finance teams sleep better at night), that’s where we come in.

Order.co’s invoice automation features help some of the world’s fastest-growing companies streamline their invoicing and payment processes. Reduce manual entry, increase productivity, improve invoice management, and consolidate payments, all within one robust automation software tool.

Schedule a demo with one of our team members if you’d like to see exactly what Order.co can do for your business.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

The goal of a Finance team

When it comes to the word "Finance", most people—and some companies, as well— get overwhelmed. They think of complicated spreadsheets, calculations, budgets, you name it. And, the truth of the matter is, that can certainly be the case. But, for the sake of simplicity, let's break the role of your Finance team down to the brass tacks: the main function of a high-performing Finance team is planning for future growth. The way your Finance team can truly add value to your company is if they are able to access cash flow, identify financial strengths and weaknesses, and set your company up for growth and success in the future.

The problem with many Finance teams today is that they aren't able to plan for the future when they are stuck doing mundane tasks that can easily be automated. Companies want to grow, but their Finance teams are stuck doing tasks that chip hours away from their work every week—making strategic planning close to impossible. It's a classic Catch 22 of the Finance world, and we can to put a stop to it. We're here for two reasons, and two reasons only:

1.) To help your Finance team automate daily tasks

2.) To save your company time and money by allowing time to strategize growth

Let's go over 4 grueling, time-consuming tasks your Finance team probably hates doing, and learn how to automate them so your Finance team can get back to what you're really paying them to do: grow your business.

Grueling Task #1: Purchase Approvals

What happens if you give a teenager a credit card and send them to the mall? Rhetorical question. However, that is exactly how some companies run their purchasing process. Managers and employees with purchasing privileges are allowed to, in many cases, buy whatever they want—without them having to be approved by upper management. As a result, each month, companies get overloaded with invoices from purchases that they not only didn’t approve of, but that they didn’t budget for.

This creates what is called “rogue spend” or “maverick spend”—companies spending more than what is allotted for product purchases; the small purchases add up, and companies have no choice but to pay the “surprise” invoices.

And, the thing is, not even big, powerhouse companies are immune to a lack of an approval workflow and spend control. CorePower Yoga, before gaining full control over their finances and growing into a nationally recognized fitness brand, were spending upwards of $50,000 in unapproved spend every month—an issue that, put lightly, was “causing the Finance team a ton of headaches.”

How can I get my company to stop buying unapproved products?

It’s a simple solution—a one-click solution, in fact. Centralize your company’s purchasing process on a platform that allows you to “Accept”, “Reject”, or suggest a more cost-effective solution with a click of a button. Schedule a demo with Order today, and never spend another dollar without approval.

Grueling Task #2: Spend Analysis

Truth: Spend Analysis is a critical process if you want to grow your company.

Also truth: Many companies have no idea what they are spending.

Spend analysis and total spend control have essentially become a Holy Grail for some companies. They want it, they know they need to have it, but it is very difficult for them to achieve. For Finance teams in particular, spend control and strategic growth is an absolute priority. That being said, why is it so difficult for companies to have spend control and do proper spend analysis?

Truthfully, it all comes down to organization.

Many companies simply do not have an organized purchasing process. Without organized approvals, a transparent order process, and centralized payment system, it is impossible to know exactly what your company is spending at any given time. Order’s bi-monthly spend reports give companies like Elliott Physical Therapy the ability to look at how much they have spent, how much they have saved, and they can pace themselves in making smarter, more-informed business decisions. Finance Director for Elliot PT Caroline Dodero states that “having full visibility into each clinic helps [growth] tremendously.”

How can my Finance team keep track of our spending?

The best way for your Finance team to track spend: use a purchasing platform that gives you line-level, real-time spend visibility. Schedule a demo with Order today and stay on top of every dollar your company spends.

Grueling Task #3: Invoice Management

Your Finance team is supposed to strategically plan for the future—plain and simple. However, that’s not always what your team actually ends up doing. Aside from having to look at numbers all day, there is one thing that Finance teams have to do that is less than ideal: clean up messes.

Now, we’re not talking about the mess at your office’s coffee station. We’re talking about the messy stacks of invoices that are constantly coming in as though you worked at a Kinkos; so many invoices that your entire Finance team wastes hours and hours of their day by trying to organize vendor invoices and asking themselves: “Where did this invoice come from? Was this in our budget?”

If this sounds like your finance team, trust us, you’re not alone.

Finance and accounting teams spend hours shuffling through hundreds of receipts to make sure every product and purchase is accounted for. If you’re trying to open new stores and grow your business, your invoice overload may be 10x worse.

So, when we say “Invoice Management”, what does that mean? Well, good vendor management is when a company is able to pay all of their hundreds of invoices on time. Superior invoice management is only having to pay one invoice—with all of your purchases—once a month. When your finance team only has to pay one invoice every month instead of spending valuable time sorting stacks, it gives them more time to do other, more important things like planning for your company’s future.

How can my Finance team have better vendor management?

Only use one vendor of record. Pay all of your vendors in one monthly invoice—saving your Finance team the headache of hundreds of messy invoices every month. See Order in action today.

Grueling Task #4: Strategic Sourcing

A.K.A: keeping up with the constant pressures to cut costs and save as much money on products as possible. Nobody likes having to price shop; in fact, having your finance teams spending hours every week searching for the best prices on products could actually end up costing your company a lot more than they end up “saving” the company in the long-run.

Strategic sourcing, for many companies, is a bottleneck for not only the productivity of the Finance team, but for the company’s overall growth. Clinton Management, a New York City based property management company, had this exact realization; small purchases were adding up, and they had no idea where to start in order to find the best deals on products and services they used every day. Purchasing Manager Nadia Nizam explains, “We needed to find a way to save money wherever we could. Order finds us savings for all of our office supplies”—saving Clinton Management an average of $1,200 on products every month.

A simple and automatic strategic sourcing process is make or break for companies; the time and money savings of strategic sourcing can be used to give your Finance team more time to focus on how to reinvest that money for future growth. Whether you’re looking for the best prices on office tissues or laptops for the office, it helps to have all of the price-shopping done for you.

How your Finance team can find the best prices on products

Automate your strategic sourcing; utilize Order’s product substitution feature—suggesting high-quality products that are similar to those in your cart at checkout and save an average of 8% on your product purchases annually. Get started and save thousands—in one click.

There’s a lot of growing going on in the cannabis industry—and it’s not just the plants.

In the United States alone, the cannabis industry has only a very recent history with legalization. But, let’s face it: Marijuana has been popular far longer than it's been legal. Since its recreational legalization in Colorado and Washington in 2012, the cannabis industry has been growing like a weed—literally.

However, even today, getting a cannabis company off the ground comes with many different challenges. Regulations, licensing, competition, you name it. The cannabis industry is a promising one, but there are many hoops to jump through if you want to take your cannabis company from one or two backyard plants and grow into a multi-state cannabis powerhouse.

Of course, with great challenges, come great opportunities for cannabis in 2021.

Recent trends in the cannabis industry show that the many different uses for cannabis products are being not only normalized, but endorsed. This means an increase in sales, popularity, industry education, and—inevitably—competition. As more and more cannabis companies work to take advantage of the emerging market, the industry's weaknesses begin to reveal themselves.

At no fault of their own, cannabis companies are experiencing growing pains that many other industries don’t have to endure, and here are a few of them:

Cannabis problem #1: industry biases

Let’s face it: the biases against the cannabis industry are very real—socially, politically, and economically—even in 2021. A growing cannabis company, just like every other company, needs everyday products like computers, light fixtures, cleaning supplies, and office supplies. However, it's harder for some cannabis companies to easily access these products due to limited opportunities of partnerships—financially and commercially.

Businesses, product vendors, banks, and many different institutions refuse to work with cannabis companies for a number of reasons. Sure, the volatility of a new, highly regulated market may scare some businesses away from partnering with cannabis companies. However, to be frank, many businesses don’t want to be associated with cannabis companies because the industry itself isn’t “socially acceptable”—to their standards.

Vendors refuse to have relationships with cannabis companies due to the infancy and controversy of the industry; cannabis companies are struggling to grow because they don’t have strong vendor relationships due to the infancy and controversy of the industry. A catch 22 of the 21st century.

How to overcome cannabis industry biases

Purchase your cannabis company’s products through a reliable, centralized, and cannabis-friendly purchasing platform that “revolutionizes” your cannabis company’s growth—allowing for “almost instantaneous” expansion. All the vendors you need to grow your cannabis company—in one place.

Cannabis problem #2: unequal payment terms

As mentioned above, institutions—such as banks—do not offer cannabis companies the same accounting terms as they do companies in other industries for fear of financial risks and legal prosecutions. By receiving extended payment terms, such as Net 30, companies are able to have more cash on-hand to strategize for growth as opposed to paying for bills and products immediately.

We are able to split up our bigger bills and better forecast our payments. Instead of having a $300,000 bill at once, we can split up our payments so that they are easier to manage. -Neil Hesse, High Level Health

With Net 30 payment terms being unavailable to the cannabis industry, cannabis companies can kiss the idea of having cash on-hand to execute growth plans goodbye. That is, of course, unless cannabis companies can get Net 30 terms—without a bank note.

How to overcome unequal payment terms in the cannabis industry

Partner with a platform that allows you to have more cash on-hand to make smarter business decisions. “Forecast payments” with a purchasing system that grants your cannabis company Net 30 terms to execute growth plans in a highly restrictive, yet promising market.

Cannabis problem #3: disorganized operations

Organizing operations processes—from purchasing products to organizing invoices to making sure those payments are made on time—is a challenge for any new industry. It is especially a challenge for the cannabis industry because the cannabis industry itself can feel like the “Wild West” in some respects. It’s a contradiction really: a highly regulated industry that feels almost as though there are no established, efficient practices for cannabis companies to follow in order to grow.

To touch on one operations issue in particular, invoice control for cannabis companies seems to be a constant issue. High Level Health, before consolidating their hundreds of invoices into one monthly invoice, had no approval process for their purchases and were struggling to manage both their time and payments by trying to organize and pay over 400 invoices every month. A decentralized payment process took away from High Level Health focusing on doing what they were best at: growing—both their plants and their business.

Hundreds of invoices across all High Level Health locations—consolidated into one monthly invoice.

How to Overcome Disorganized Operations in the Cannabis Industry

Consolidate your monthly invoices into just one monthly invoice. With a centralized payment process across all of your locations, your cannabis company can “focus on making [your] business better, and not have to focus on a tedious payment process.”

The Bottom Line for Cannabis Companies

The potential for the cannabis industry is exciting; partner with a purchasing platform that specializes in helping you grow your cannabis company. Pay one monthly invoice across all locations. Take advantage of Net 30 terms to invest in your growth—not bank interest rates. Partner with a vendor that supports you, your cannabis company’s growth, and this budding industry.

All of your purchases. All of your payments. All on one platform. Ready to take your cannabis company to the next level? Schedule a demo with Order.co today!

Get started

Schedule a demo to see how Order.co can simplifying buying for your business.

"*" indicates required fields