Making money is the primary goal of any company—but earning is only half the battle. The other half is reducing expenditures that eat revenue. While overhead spending of up to 35% of annual revenue may be considered normal, this percentage is only relevant in relation to net profit. If you’re only looking at 5% profit after all is said and done, you need to rethink your spending strategy.

One of the first areas to look? Identify the inefficiencies in your process. No matter how much money your teams bring in, you can’t outrun a process that’s creating cash leaks.

Download the free ebook: How Automation Can Solve Finance Teams’ Biggest Challenges

Accounts payable (AP) is one of the best areas to start improvements. Traditional AP departments limp along with expensive challenges such as invoice exceptions, data entry errors, ineffective fraud prevention, lost cash, inefficient data storage, and slow processing.

Companies are turning to automated accounts payable procedures to eliminate redundancies and improve organizational efficiency. As of 2019, the AP automation market was worth $1.9 billion—and at a compound annual growth rate (CAGR) of 11%, the sector is projected to reach a valuation of $3.1 billion by 2024.

Demand for controlled user access, which helps reduce payment-related fraud, is one of the primary catalysts for this growth. However, the sector faces challenges such as a lack of awareness of AP process automation and digital literacy skills. As digital literacy and awareness of AP automation increase, the growth will only continue.

In this article, we will look at some key aspects of the AP process:

- How the traditional accounts payable process works

- What an automated accounts payable process looks like

- The benefits of accounts payable automation

What is the accounts payable process?

Business operations are based on the flow of expenditure and revenue within a company. Accounts payable procedures manage the expenditure and purchasing side of things. Their primary function is to ensure company expenses are paid.

The AP process involves capturing data on invoices for all invoice formats (digital and paper), ensuring invoices are coded with the correct accounts and costs, matching the invoices to purchase orders, and processing the payments.

The manual nature of the traditional accounts payment approach increases the risk of human errors, redundancies, and time wasted. With inefficient processes, the procure-to-pay (P2P) cycle can take up to three months.

The consequences of inefficient accounts payable

Disorganization in the accounts payable process can lead to many negative business impacts:

- Fines and late charges

- Vendor relationship challenges

- Employee burnout and turnover

- Supply chain and distribution delays

- Manufacturing and shipping disruptions

- Credit and funding issues

- Cash flow fluctuations

There are also other challenges with manual accounts payable processes:

- Expense reporting and tracking

- Susceptibility to risk and third-party fraud

- Increased spending on AP team wages

- Lack of data visibility

- Communication delays

- Payment exceptions

What does an automated AP process do?

An accounts payable team is responsible for collecting invoices, confirming three-way matching, and conveying payment. Due to the number of stakeholders involved, cycle times for purchasing and payment are usually long and riddled with challenges.

An automated accounts payable process eliminates the bottlenecks. Through automation, your accounts payable department benefits from increased efficiency and accuracy, cost savings, and reduced exception rates.

7 Major benefits of automating your AP process

Change can be hard, but it’s necessary. In a volatile economic landscape, enhancing efficiency in your accounts payable procedure plays a crucial role in your potential growth.

Here are seven key areas where AP automation improves the process:

1. Time savings

Time is money, yet nearly two-thirds of companies are throwing away AP budgets with manual processes. Automated processes make it possible to do more repetitive tasks with fewer AP staff hours. Many tasks can be converted into touchless processes through automation:

- Scanning vendor invoice headers and line-item data using optical character recognition (OCR)

- Routing purchases orders and payables through predetermined business processes

- Handling three-way matching with no human involvement

2. Streamlined invoice processing

Approximately 3.6% of all invoices entered manually have errors or discrepancies. Through automation, your purchasing department can set internal controls that make its AP processes streamlined and accurate, requiring minimal oversight. This increased efficiency comes with several key benefits:

- Virtually no human errors

- Ease of budgeting, sending and receiving reports, and auditing and preparing financial statements

- Reduced risk of overpaid, miscoded, duplicate, or late payments

- Automatic exceptions flagging for invoice approval, review, and reconciliation

3. Greater operational control

With the traditional AP process, it’s easy to lose track of invoices due to miscoded documents or misplaced paperwork. With such limited operational control, business owners end up paying late fees for missing or delayed invoice payments.

Accounts payable software solutions eliminate these challenges in a few ways:

Automation: Creating automated workflows for accounts payable procedures eliminates invoice exception risks. Since everything takes place in the system, losing invoices becomes a thing of the past. The platform handles invoices in the order your team uploads them. The time saved through automation can instead be directed toward other activities that increase organizational efficiency.

Exception handling: With the process improvement that comes with automation, resolving errors in vendor payments is easy and fast. If there is a problem with a particular invoice, the system will automatically flag and reroute it to the appropriate person immediately.

Risk avoidance: Fraud is one of the primary risks of manual payment processes. Identifying fraudulent invoices is an elusive task, as is rectifying them once an incident occurs. A manual system makes it difficult to conduct thorough audits. In an automated accounting system, all the necessary invoice data is in one place. Unverified or suspect payments are easier to identify and investigate.

4. Discounts on early payments

Delays in the accounts payable approval process lead to supplier fines. Conversely, timely payments result in discounts. While 42% of respondents to a recent study cited early payment discounts as a top priority, achieving this objective with a manual process is nearly impossible.

An automated AP process streamlines invoice processing, allowing you to take full advantage of early payment discounts.

5. Integration solutions

Operational efficiency is improved when your procurement function integrates with your larger tech stack. Through integration, accounting can share data with other vital systems such as financial planning and analysis (FP&A) tools, enterprise resource planning (ERP) systems, and other internal databases.

6. Increased productivity

Talent plays a significant role in the success of a company. Organizations look beyond credentials to pursue innovative personnel with leadership qualities that can help steer the business forward.

In building a modern procurement team, creating an environment that maximizes each member’s potential is essential. AP automation solutions remove redundant processes so team members can focus on core business functions to increase revenue.

7. Improved vendor relationships

Delays in the processing and payment cycle lead to difficulties with supplier relationships. An automated accounts payable process improves supplier relationships in several ways:

- Helping you adhere to payment schedules and supplier payment terms

- Enabling invoicing through email, electronic delivery, or paper

- Automating renewals and enabling lifecycle evaluations

Next steps to automating your accounts payable process

An automated AP process benefits you and your suppliers. The AP process is fast and accurate when teams use automated accounting software, saving time and avoiding potential losses from fraud or duplicate payments. For your suppliers, efficiency eliminates delays for accounts receivable. Automation ensures strong, long-term relationships with your most important suppliers.

To learn more about using best-in-class accounts payable automation software to increase operational efficiency, download our Operational Efficiency Handbook.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

Procure-to-pay (P2P) is the process an organization uses to source, negotiate, purchase and pay for goods and services. A powerful, effective procure-to-pay (P2P) cycle is critical for your business.

As Forbes Councils Member Peter Nesbitt notes, the way companies spend money has changed dramatically over the past several years. Businesses no longer rely on a top-down model for purchasing and spending. As a result, P2P cycles and technology have changed dramatically.

A well-crafted procurement process is an enablement tool for teams. It reduces friction in the supply chain and speeds the delivery of products to market. But the traditional procurement model—driven by manual processes and limited visibility—is no longer sufficient for driving growth.

Download the free ebook: The Procurement Strategy Playbook

Using technology to optimize procure-to-pay (P2P)

Thanks to next-generation P2P technology, meeting your financial goals and tracking your spending at scale are easier. These systems enable classification and analysis capabilities critical to managing business spending and reducing costs. They reduce value-sapping maverick spending, improve your functionality, and ensure your accounts payable team is focused on the right tasks to create value.

We’ll discuss:

- The components that make up the procure-to-pay process

- Best practices for increasing operational efficiency

- How to implement next-generation technology

What are the steps in the procure-to-pay cycle?

The procure-to-pay process includes all the steps necessary to purchase materials and services for your organization. It begins with a purchase request and follows a predictable (and trackable) path to invoice approval and payment.

The 7 steps of a P2P process:

- Identify needs: In the initial steps of the process, a stakeholder identifies a product or service they need. Depending on the need, they may outline requirements for the procurement department.

- Requisition materials: The stakeholder submits a purchase requisition. Department heads and Finance sign off and approve that requisition so that Finance or Procurement can move forward with the purchase.

- Source the materials: Effective sourcing is critical to ensure that you have a solid supplier who will offer your business the best possible deal on your goods.

- Create a purchase order: Upon approval of the purchase and sourcing, the Purchasing team or stakeholder submits a purchase order to begin the transaction. This is routed to the supplier for fulfillment.

- Receive the goods: Once fulfillment is complete, accounting conducts the three-way matching process to ensure the ordered goods and actual deliveries align. The financial team will ensure that no discrepancies exist that could cause problems with the process.

- Approve the invoice: Once reconciled, Procurement teams approve the vendor invoice for AP processing.

- Pay the vendor: The vendor gets paid for their services based on the terms of the contract. Post-payment, the accounting team may implement contract management and analysis. This is part of the supplier lifecycle management process.

Best practices for your P2P cycle

Rather than just checking the boxes, routing the request, and moving forward without attention to detail, take the time to optimize your P2P process. Ensure the best tools and processes—namely, procure-to-pay software—are in place to manage your P2P cycle effectively.

The best P2P management practices usually include:

- A documented intake or requisition process

- An approval process with a standard list of approvers

- Budgetary review through finance or procurement

- A strategic sourcing program to identify the best suppliers

- Negotiating and contract prerequisites for each purchase

- Purchase order review and shipment reconciliation process

- Centralized vendor payment and contract management

Procure-to-pay software increases the effectiveness of a well-executed purchasing process. It simplifies the overwhelming process of managing the sourcing, purchase, and payment of goods and services.

Using software is the best way to create a scalable solution that grows along with your company. Even better, P2P software often results in net savings well above the investment in automation.

P2P software automates many repetitive tasks that bog down your purchase-to-pay process, including:

- Vendor sourcing and selection

- Purchase requisition and purchase order approvals

- Invoice approval and invoice processing

5 goals to strive for in your P2P cycle

These best practices improve the procure-to-pay process flow and realize better cost savings for your organization. Identifying your desired outcomes of a program—whether its streamlining operations, increasing cost savings, creating scalability, or improving inventory management—helps you make decisions about your program.

1. Increase visibility in your purchasing process

Visibility is critical in tracking the success of your procure-to-pay cycle. It enables your stakeholders to track each purchase through the process. It also creates an audit trail and a source for data reporting.

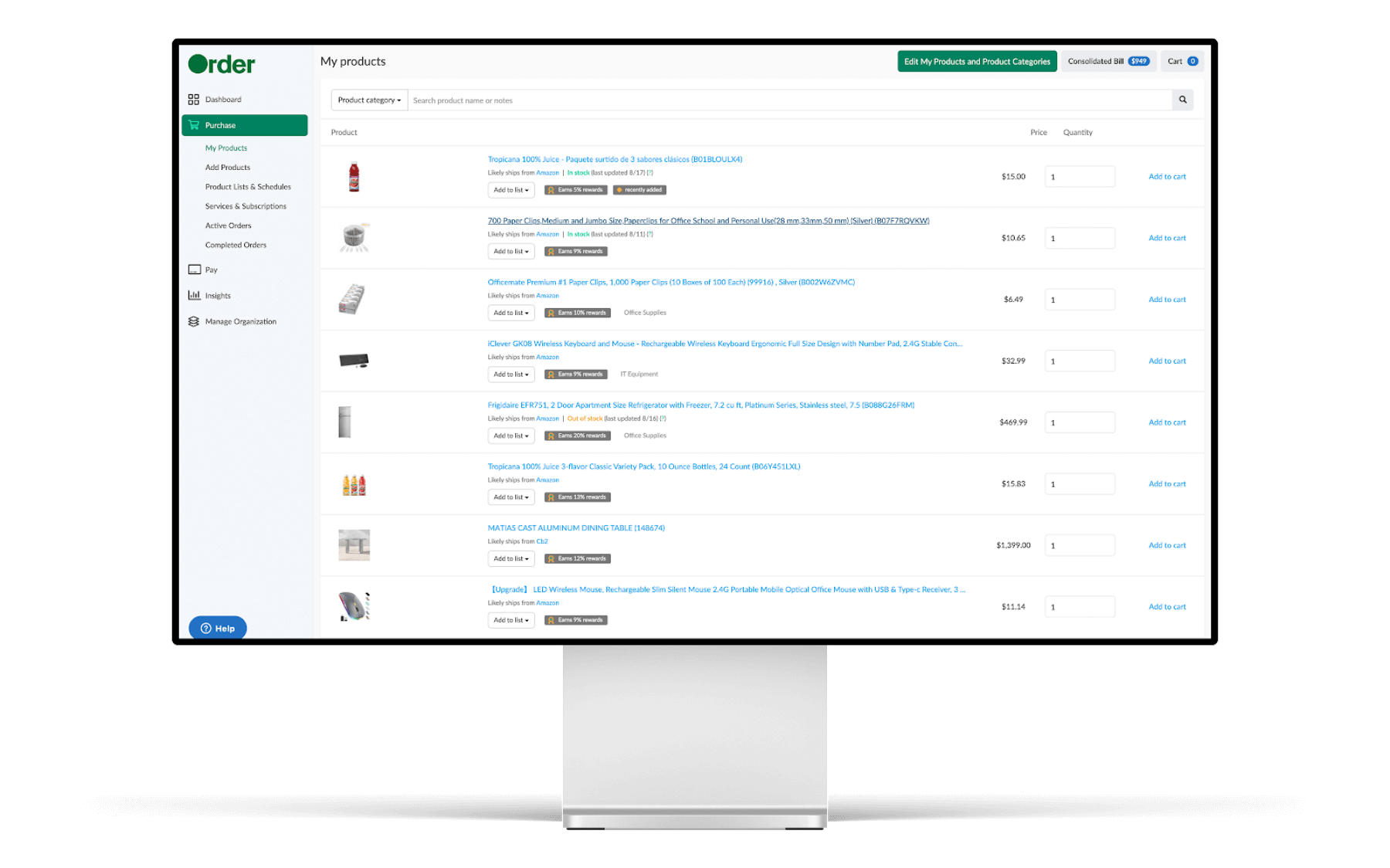

Order.co provides real-time spend data, coded down the line, product, user, or location level. This data helps your finance team make critical decisions about your purchases. This next-generation visibility—which offers insight into the latest changes in your inventory, availability, and purchases—helps your finance team and other decision-makers see and adjust to changes in your procurement function. It ensures that you’re buying what you need, with competitive pricing and high levels of compliance.

2. Automate the accounts payable department

Automation has become increasingly common across many industries, and the procure-to-pay cycle is no exception. Automating your accounts payable function can result in as much as a 60% increase in productivity and an 83% reduction in purchase order processing time.

Order.co automates many of the steps involved in the P2P cycle. It also helps organizations implement strategic sourcing to ensure the best sourcing for high-volume or high-cost goods. This automated sourcing has helped many clients save an average of 8% on their procurement costs.

3. Use a dynamic system to manage the payment process

Vendor payments are a critical part of your P2P process. Optimizing the payment process with the right workflow reduces payment errors, eliminates time-consuming research and corrections, and ensures payments align with business needs and cash flow.

A dynamic procure-to-pay solution allows businesses to manage payments according to changing business considerations, consolidate payments into a single invoice, and reduce the time spent handling the accounts payable process.

4. Optimize ordering and logistics

Transparency is crucial to maintain effective ordering processes. It ensures you have the right items coming in at the right times.

An effective P2P process helps you optimize your ordering across your organization. It also provides insights into standard pricing, total cost, and other critical metrics for maintaining inventory control without sacrificing cost efficiency.

Order.co allows organizations to order the goods they need across departments or locations, providing continuity and cost efficiency.

5. Coordinate and manage delivery schedules.

Monitoring delivery schedules through an automated notification system helps you better plan inventory receipt and distribution. It also increases supply chain resiliency, allowing the business to respond to changes in availability, delivery status, and quantity without disruption to normal operations.

How technology software enables P2P

Maintaining an effective procure-to-pay cycle with a manual process becomes more complex as the business grows. By implementing technology, you can automate repetitive tasks and reduce the errors associated with processing purchases and tracking deliveries on a spreadsheet.

Using P2P software, businesses can automate much of the process, including:

- Purchase requisition and purchase order creation

- Purchase approvals

- Vendor sourcing and e-procurement

- Delivery tracking and reconciliation

- Three-way matching

- Invoice coding, processing, and approval

- Supplier lifecycle management

Using software to drive the procure-to-pay process also gives your business access to powerful analytics and robust reporting tools that improve the procurement function, save money, and increase efficiency.

Order.co streamlines your P2P cycle

Digital transformation has revolutionized the P2P cycle. With a procure-to-pay solution like Order.co, businesses have the power to implement total spend management, eliminate inefficiencies, and protect the bottom line—all while allowing locations to quickly and easily order the supplies they need. Schedule a demo of Order.co today to get started.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

Automation and digital administration of the procurement process is advancing quickly. As technology advances, it is easier for businesses to see real-time pricing data and, as a result, gain more control over their spend management.

In fact, with the right strategy, your business could automate nearly half of the procurement process tasks currently bogging your team down. To maintain a competitive advantage, your procurement team must be at the forefront of these emerging technologies.

The potential upsides to automating your source-to-pay process are astonishing. Automation unlocks cost savings while freeing up time for your procurement team to hunt down new sources of value for your business.

In this article, we will break down key concepts regarding digitizing your source-to-pay process:

- What is the source-to-pay process?

- What are the benefits of source-to-pay automation?

- What are the steps in automating the sourcing-to-pay process?

- How do different technologies improve source to pay?

What is the source-to-pay process?

The source-to-pay procurement process is the workflow companies use to find suppliers, purchase goods, track procurement metrics, and manage procurement spending.

The importance of source-to-pay automation cannot be understated. Businesses that neglect budgetary control and spend management risk losing their competitive advantage. The first step is having clear insight into the emerging technologies that assist with all facets of procurement, such as supply chain management, sourcing, and contract management.

How is source to pay (S2P) different from procure to pay (P2P)?

The source-to-pay process differs in scope from procure to pay (also called purchase-to-pay). While P2P deals only with the purchase and payment of goods or services, S2P encompasses the entire procurement process, from vendor selection to payment remittance.

A P2P platform helps you input existing vendor information to manage the purchase and payment workflow. S2P further helps you discover and evaluate new potential vendors to work with.

Benefits of the S2P process

Establishing a source-to-pay process improves the efficiency and cost-effectiveness of your procurement function. Using automation to enhance the process further extends its value.

Reduced cycle times: A streamlined process makes everything from approvals to payments go faster. This reduces the time to close on new purchases and takes the workload for closing deals off the plate of busy accounts payable professionals.

Better cash efficiency: Source-to-pay automation allows companies to find the best deals for the items they need and process purchases with less human intervention. This results in better direct and indirect savings and higher cash efficiency.

Fewer errors: Manual source-to-pay processes require significant work from your AP teams. When teams shoulder the burden of manual processing, errors naturally follow. Automating your source-to-pay process drastically reduces the exception rate in your purchases and invoice processing.

Steps in the source-to-pay process

A streamlined source-to-pay process follows a predictable pattern. It begins with an intake form from your stakeholder and proceeds through sourcing, selection, order, delivery, and payment. Ideally, the process works as follows:

- Intake: A stakeholder with a specific need fills out an intake form and routes the purchase requisition for approval. The intake form should include all the necessary information to make the purchase. Alternatively, a stakeholder whose organization uses a source-to-pay solution selects what they need from a curated catalog or list of vendors within the platform and goes from there.

- Approval: Procurement researches potential suppliers and creates a shortlist. Once a supplier is selected and price and terms are negotiated, procurement transmits a purchase order for fulfillment. This process is handled within a platform, so the approval process begins with an understanding that the purchase will occur with an approved vendor.

- Fulfillment: The supplier delivers the goods, and procurement (or accounting) reconciles the order against the purchase order and invoice. This is called three-way matching. A platform can handle most of this process automatically while your teams work on higher-value tasks.

- Payment and reconciliation: If everything matches, accounting pays the invoice. In a platform, payment may be automated directly through the system. After payment, Finance tracks the data and conducts spend management to ensure supplier performance and competitive agreements.

Refining your source-to-pay process

With so many complex new processes to consider, it may seem daunting to determine where to start automating your procurement process. Remember, the only thing you can do is start from where you are.

If you’re currently using multiple systems scattered across departmental silos, start there. Work toward tearing down the walls of the silos and coordinating each team’s efforts. Identify each step in your procurement process and estimate the value of closing the gaps you find. Your business will see a notable boost in productivity when placing and receiving orders and processing payments.

Projects of this magnitude require champions. Find a leader to serve as the torch-bearer for the project. Your champion project leader should identify your processes’ main pain points and bottlenecks. Then you can experiment with solutions for those areas.

Identifying the best, cheapest, and simplest solutions from the beginning goes a long way. It helps you avoid stumbling into pitfalls or burdening your IT team with a massively complex solution, only to find that it might not achieve the expected results.

How machine learning enables the source to pay process

Applications for machine learning in the procurement process handle complex rules. Machine learning requires some recognizable pattern to achieve peak performance at uncovering sourcing opportunities. For example, machine learning tools can handle spend analysis areas that traditionally require human judgment, such as assigning transactions to spend categories.

Automating this process leads to greater accuracy and wiser decision-making, thanks to real-time spend analysis information. Machine learning helps your business with supplier management by enabling you to examine in-depth information about supplier relationships. In turn, you significantly boost your strategic sourcing strategy.

Cognitive agents

Cognitive agents are synonymous with artificial intelligence in many ways. Drawing from complex master data, cognitive agents pull the information necessary to plan your sourcing strategy or determine the best course of action.

The best example of using cognitive agents is the process chatbots use. The chatbot system searches a database of the most common questions to provide predetermined answers.

In the procurement process, cognitive agents may soon be beneficial for more complex tasks, such as comparing cost, quality, and more with a database of similar products. Cognitive agents and machine learning tools handle highly complex areas, such as developing spend category strategies and identifying the most beneficial supplier relationships.

Robotic process automation (RPA)

This is a relatively new term in the procurement playing field. In contrast to machine learning, Robotic process automation (RPA) automates simple, repetitive tasks. Using bots, RPA accesses software the same way a human would. This eliminates the need to delve into software’s underlying code and saves a lot of time and resources. Robotic Process Automation easily handles many source-to-pay processes, such as invoice processing, ERP, and RFx.

Smart workflow

Traditionally, siloed departmental tasks contribute to wasted time and increased effort to be consolidated. Smart workflows link tasks performed by different people using different machines to streamline processes, such as risk management, and organize them around journeys. For example, tasks can be routed between the procurement and finance teams to simplify contract management.

Instead of making incremental gains by applying optimization efforts in each department silo, smart workflow processes produce tangible benefits for the entire organization. They begin closing the black holes caused by lag time and lack of coordination between tasks. As a result, businesses experience better forecasting, spend management, and cost savings.

Natural language processing (NLP)

Natural language processing is technology that allows computers to understand and respond to human speech in text or voice format. (If you’ve ever asked Siri or Google “Where is the nearest gas station?”, you’ve used NLP.)

Natural language processing, especially when combined with RPA, streamlines the procurement process by organizing unstructured data found in free-form text. It searches through suppliers’ information for specific terms and matches the order requirements, such as pricing, to groups of suppliers.

After automatically sending out requests for bids, a member of your team receives the bids and makes the final determination. NLP is most useful as a connection between human input and structured data that machines use.

Automation is an untapped source of value

The value generated by automating your source-to-pay process is shown in:

- Reducing the amount of work

- Reducing cycle times

- Improving compliance

- Creating significant cost savings

- Having better supplier management

By finding the right procurement software that mimics its human equivalent, your company streamlines business processes and contract management with ease.

Work smarter, not harder, to maintain your competitive advantage. Letting the machines do the repetitive tasks is definitely smarter. It frees up your team to focus on strategy. Plus, there’s an added benefit to procurement automation that is sometimes overlooked: employee happiness.

How Order.co supported ZeroCater’s source-to-pay automation

An employee calling a task “the bane of their existence” is your first clue that there’s an issue. If your accounts payable team is frequently asking what website employees are purchasing from, it’s time to investigate solutions to compliance issues seriously.

This question and sentiment alerted ZeroCater that they had serious issues within their procurement process. Lack of clarity in their approvals process led to rogue spend and inaccurate spend analysis—ultimately negatively impacting their cash flow.

After implementing Order.co, ZeroCater was able to:

- Significantly reduce their cycle times

- Streamline their payment process

- Get the entire team on board with a more efficient process

As a result, ZeroCater cut their invoices from around 200 per month down to three or four—a whopping 50x reduction. This freed their procurement and finance teams to identify new sources for creating additional value.

Order.co focuses on providing the best user experience with a single platform that streamlines every level of your procurement process. We provide an end-to-end purchasing and payment platform with intuitive functionality and solid integrations to help your procurement team’s onboarding go smoothly.

Request a demo of Order.co to see how procurement software centralizes and streamlines your source-to-pay process.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

You probably think you need a procurement department to really do procurement right. Procurement is the process a company follows to acquire services and supplies. It’s a process that has a lot of moving parts, and requires strategic thinking. When successful, procurement creates systemic controls that can reduce costs and mitigate the risks inherent in conducting business with multiple suppliers and vendors.

Historically, procurement is a complex and time-consuming endeavor, filled with necessary but repetitive tasks and hours of manual effort. The procurement process is so involved and so important, it can often feel like it’s just too much for one person to tackle.

Or is it?

Today’s companies can take advantage of artificial intelligence (AI) advances that allow workers across industries to automate repetitive tasks. AI is reshaping the future of procurement and simplifying the procurement process so any business can do it — whether you’re just one person or you have a dedicated procurement team.

AI automates cost comparisons, helping businesses save money

AI automates the cost-comparison process, which saves your employees time and your company money.

Without AI, cost comparisons are time-consuming and inefficient. Manual cost comparisons and strategic sourcing — i.e., sourcing supplies in bulk or bundling supplies with other products in order to reduce costs — require hours or even days of employee time. With AI, cost comparisons can happen almost instantly. AI automates strategic research that compares costs and identifies savings opportunities, so you can find the best price without wasting your team’s time or risking the possibility of human error.

Moreover, if multiple departments are making purchasing decisions, procurement teams can have a hard time sourcing strategically and reining in spending. By using a single automated system, companies avoid duplicate, unnecessary, or over-budget purchases and add controls to the procurement process.

Mediaplanet used Order.co’s AI to save an average of 8.8% on the products it purchased, in addition to countless hours of time saved for employees who no longer needed to perform manual cost comparisons. Order.co automatically scanned sites for vendor and product substitutions that could save the business money.

AI makes vendor relationships easy to manage

AI automates the vendor management process, keeping information up-to-date, products reordered, and invoices completed. Automating the process allows the procurement team to focus on higher-impact areas.

Without AI, vendor management requires frequent attention. Procurement teams must keep all vendor-related information organized and up-to-date, reorder products when supplies run low, and record and pay invoices on time.

AI-driven vendor management systems allow teams to automate orders, so they don’t need to manually order supplies each time. This saves team members time and ensures the company never runs out of needed products.

AI can also automate the invoicing process, which can save hundreds of hours of time per year. A recent Censuswide survey found that 72% of finance teams are spending almost 520 hours per year (10 hours a week) on accounts-payable related tasks that could be automated. From invoice processing, supplier inquiries, and supplier payments execution to PO matching, new supplier registration, and payment reconciliation, teams are wasting time on needlessly manual tasks.

By automating these tasks, team members can reallocate their time to higher-impact projects that require their particular expertise and strategic thinking. According to this same survey, of the CFOs who automated some or all of their finance processes, 40% noted an improved supplier experience.

ZeroCater used Order.co’s AI to streamline invoices from 200/month to three or four/month. Before using Order.co, the company’s IT and operations manager spent one to two full days each month manually recording and paying receipts and invoices. By automating, he was able to focus on other tasks, and the company added tighter cost controls to save money in the long run.

AI performs spend analytics, so teams can measure vendor success

AI gathers data and gives automatic insights so that teams can assess the success of their vendor relationships in a more agile way.

Spend analysis — i.e., the process whereby companies analyze their procurement spend and identify opportunities to decrease costs and increase efficiency — is incredibly important to the procurement process. According to APQC research, organizations with spend analysis programs have more efficient and less costly procurement processes. In addition to cost-savings, spend analysis programs result in faster responses from suppliers, a more streamlined procurement process, and a more efficient procurement staff, among other benefits.

Without AI, spend data takes a lot of time to recover and organize. When a spend analysis program is manual, procurement needs to work with multiple teams, dedupe multiple spreadsheets, and manually manipulate the data in order to derive actionable insights.

AI that tracks spend data can automate reports and present near-instant analysis. This saves time for team members and uncovers opportunities for further cost-savings and efficiencies. Identifying such opportunities more quickly increases a company’s agility — aided by AI, employees can make real-time cost-saving decisions and realize immediate benefits.

For example, NY Kids Club uses Order.co’s Analytics page to assess where it spends the most money and where it can save. Real-time analytics allows the company immediate insight into its vendor spend, so it can make adjustments that save money.

AI simplifies the procurement process, but it can’t do it all

An effective and efficient procurement process is essential — and with AI, it’s attainable for companies of all sizes and all resource levels. AI simplifies the procurement process and, in so doing, identifies time- and cost-saving opportunities for businesses. AI can’t realize these opportunities on its own, however. To add true value to a company, AI needs to team up with the company’s employees.

While AI automates much of the procurement process, operations and finance teams still need to oversee the technology to effectively guard against risk. For example, AI may be able to identify vendors that offer lower prices, but human workers still need to decide whether an affiliation with a particular vendor could tarnish the company’s reputation or lead to a potential security issue.

AI can do a lot, but it can’t do it all. When you use tools like Order.co, you can empower your employees to leverage AI smartly and strategically — in a way that saves time for them and cuts costs for you.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

Are you paying six figures for your procurement solution system and still using emails and spreadsheets to conduct purchases? You’re not alone.

Many businesses invest in a procure-to-pay solution, only to be disappointed when procurement inefficiencies like high spend and time delays remain unresolved.

Failure to automate and streamline purchase and supply chain systems affects spend management. Manual and siloed systems make it difficult to track expenditures across the company. These systems are prone to errors, inconsistencies, and duplications that inflate spending. Companies using such systems also lose opportunities to negotiate on bulk orders, foregoing direct savings.

While a procure-to-pay solution has many benefits, a company must choose the right system based on its needs, objectives, and stakeholders. This article highlights the main pitfalls companies fall into when investing in a procure-to-pay solution. It covers what to do to avoid these problems and ensure the successful implementation of the right procurement system.

In this article, we’ll dive into:

- Why a procure-to-pay solution can fail

- The best procure-to-pay solutions of 2022

- How to best implement P2P software

Download the free ebook: The Procurement Strategy Playbook

Why do procure-to-pay solutions fail?

The most common culprits in a failing procure-to-pay process are lack of visibility and lack of process. Establishing a repeatable review, approval, and documentation process allows organizations to capture vital information on each purchase and integrate that data into the accounting and reporting process.

No management validation

Like any other important organizational decision, purchase-to-pay solution systems must have the approval of the company management. Unfortunately, many companies do not prioritize supply chain processes.

As such, related technology upgrades can encounter opposition from the top. Failure to convince senior managers of the need to change supplier management systems results in a lack of validation and cooperation when implementing new processes. Instead, they stick to old systems.

Poor onboarding processes

The managers, employees, and vendors who use P2P systems determine their success or failure. Without proper training, sensitization, and support, your colleagues can sabotage a new P2P system.

Additionally, a Tungsten report shows it’s normal for employees and suppliers to resist change—especially if new solutions are introduced without sufficient preparation.

Poor user interfaces

Many employees and suppliers fail to use their procure-to-pay solution because of complicated software, poor system interfaces, and bad user experience. Most of the creators of SaaS programs tend to be technical professionals concerned with the complexities of different systems. If left to create a P2P system on their own, such professionals are less likely to consider the technical and knowledge gaps of the intended users.

Lack of automation and integrated systems

In many large organizations, different departments and external suppliers have independent operating systems and tools in place. Various departments manage requisition, sourcing, procurement, and accounts payable processes. Furthermore, departments might work with different suppliers that use their own independent systems.

Many departments, vendors, and suppliers insist on sticking to their established processes in scenarios such as when introducing a new ERP system. The widespread use of paper invoices and manual systems further exacerbates this.

Unless all the departments and vendors involved streamline their processes and use a unified automated system, enforcing a single P2P solution is practically impossible. Non-integrated systems ruin the essence of purchase-to-pay solutions because they create room for confusion, delays, and inflated purchases.

Spend visibility and reporting challenges

The unintegrated and manual systems discussed above make tracking spending difficult and prevent access to real-time data. Such outdated systems and processes mean that reports must be obtained from diverse sources and compiled later.

Many procurement systems lack built-in reporting functionality and spend visibility. This limits employees’ use of the system and forces them to generate reports manually. Such systems make it difficult to get accurate, real-time data or conduct analyses.

Companies also sometimes avoid procure-to -pay software that has an automated system and produces auto-generated reports because of pricing factors.

Top procure-to-pay tools of 2022

If you’re looking for the right solution to automate your procurement process, check out these top-rated options. To learn more about each, read our full review of today's top 7 procure-to-pay tools.

Order.co

Order.co combines simple, intuitive design with powerful back-end features to create a platform everyone in your organization will value. It offers purchasing through a streamlined catalog with dynamic spend permissions and guidelines. Order.co is great for companies of any stage or size, with capabilities to support multiple locations using centralized, automated functionality.

PRM360

PRM360 gives buyers using the platform for e-procurement a visible, streamlined process. It features real-time reporting on bid processes and automated payment solutions for quick, spend-optimized procurement. The platform is best for mid-market and enterprise customers.

Coupa

Coupa is one of the largest solutions for enterprise customers looking to automate the procurement process. The platform offers a guided buying process with vendor management, inventory management, and other features. Coupa is a component of the Coupa digital management suite for end-to-end enterprise resource planning (ERP).

Zycus

Enterprise users choose Zycus because of its compliant, guided buying options. The tool uses an AI engine to enable and automate the procurement process. It offers robust integrations that allow users to extend the platform for controlling and monitoring spend and risk.

JAGGAER

Billed as the world’s largest independent spend management tool, JAEGGER serves clients across all market segments with procurement management and processing. The tool integrates with other top-quartile business management tools to enable automated P2P.

The keys to the successful implementation of procure-to-pay software

Despite the challenges some companies face when buying and implementing their procure-to-pay solution, the ability of these systems to reduce maverick spending and save time cannot be ignored.

In order to select and properly implement the right P2P system for your company, bear the following things in mind:

Start with a needs analysis

A SaaS or SAP solution will only work if it addresses your company’s needs. Knowing your current purchasing process and P2P process helps determine whether you need a sourcing system, purchasing tools, vendor management system, or a full P2P system. It also reveals budgetary issues, gaps in business processes, supplier relationships, strategic sourcing, and spend management.

Knowing the current problems and the proposed procurement system’s potential solutions gives you more leverage when bringing your management and team on board. Moreover, a needs analysis enables you to identify the best individuals for implementing your new procurement solution and helping the team adjust.

Move to a pilot phase and continuous evaluation

Based on your needs analysis, choose a user-friendly system that fits the capacities of your organization, employees, and vendors. Then conduct a pilot phase to test whether your software solution is feasible and compatible with your transaction needs and lifecycle. Once implemented, you will also need to evaluate your P2P solution periodically to ensure that you are reaping the intended results and conducting data-backed optimization.

Continue with stakeholder education and involvement

Apart from conducting a pilot phase, also educate and involve your employees and the vendors or suppliers who will be using your P2P solution. Involving all the relevant teams helps you get important user feedback and suggestions for the system.

Training and providing necessary information through videos, handbooks, and FAQs reduces challenges for colleagues, vendors, and suppliers as they adapt to the new system. This empowers them to adopt and implement your P2P management solutions quickly.

Choose full automation and integration of purchase requisitions

If you really want to reduce inefficiencies through a procure-to-pay suite, opt for an automated and integrated solution. Access to data will make it easier for your employees to avail reports upon request. Ensuring every department in your company and external team uses the same procure-to-pay software will fast-track its implementation and improve your procurement processes.

Automation should include a mobile approach to allow all relevant stakeholders to access the system anywhere they have an internet connection. This reduces delays in decision-making and approval of requisitions. In addition, your automated P2P solution provider should advise on the best way to migrate and store your data when transitioning to the new system. Given the sensitivity of data, ensure migration and storage are secure.

When done correctly, automation and integration enhance transparency and cut out bureaucratic delays. It facilitates timely payments and deliveries while giving employees time to focus on other important duties.

Appoint a P2P system manager

A good procurement system is only as efficient as those managing it.

Unless you appoint specific people to be accountable for properly implementing your P2P system, you will end up with poor implementation and blame games amongst employees and different departments.

If your organization has no supply chain department, allocate this task to the finance team or outsource management services, preferably from your procure-to-pay solution service provider. Alternatively, hire an in-house team or form a department tasked with handling all your e-procurement matters, depending on your needs.

Plan compliance and policy reforms

Regardless of how well you prepare your employees, vendors, and suppliers, you will still encounter some form of resistance during the implementation of your new procure-to-pay solutions. Some suppliers and vendors might insist on using their own system, while your employees may struggle to adapt to the new way of doing things.

This calls for compliance and policy reforms compelling everyone to adhere to your new contract management and procurement process. If anyone comes with a non-purchase order invoice, refer them to the new invoicing and three-way compliance requirements.

If you compromise on this, you risk failure and the possibility that your P2P system might never be used. The best way to introduce these reforms is to communicate them to all the relevant stakeholders and employees at least three months before they come into action.

Start looking for the spend management system that fits your needs

Choosing a needs-based procure-to-pay solution and involving both your team and external stakeholders ensures the success of your new procurement management system.

Order.co is a user-friendly, intelligent spend management system that works for your entire organization by:

- Giving your finance and operations teams full visibility into tracing and managing all their purchasing needs

- Providing other departments with easy traceability of their spending

- Allowing users to make purchases and pay for goods on one platform

The time to automate your process and close cash gaps is now. Begin by choosing the right software to enable your organization. Check out our guide, Choose the Right Procurement Technology, to start your search.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

The thought of choosing a vendor management system might make your skin crawl. When would you even find the time? But like most finance and operations professionals, you know if you don’t do it now, you’ll be wishing you did as your department gets busier.

A vendor management system (VMS) can profoundly impact your business and its day-to-day operations. This solution centralizes purchasing, budgeting, vendor selection, delivery tracking, invoicing, and reporting. Managing these processes is time intensive and costly, which explains why more than half of companies are currently focusing on digital transformation as a top priority.

But how do you choose the right VMS: one within the budget that will address your unique day-to-day challenges?

It isn’t complicated if you are pragmatic in your approach. To help, we’ve created the following roadmap, with an overview of the key features you’ll want in your VMS automation software. Let’s take a look.

What is a vendor management system (VMS)?

A vendor management system is a cloud-based software tool that helps organizations track and manage the supplier relationships that keep their businesses moving forward. A vendor management system centralizes data for each of the suppliers or service vendors a company works with. Common data stored within a VMS includes the following:

- Supplier contact information

- Supplier payment details and terms

- Copies of vendor agreements

- Standard purchase price data

- Historical purchase requisitions or purchase orders

- Vendor invoice images and due dates

- Payment confirmations

- Vendor lifecycle evaluation data

- Supplier performance evaluations

- Notes and supporting documentation

Why are vendor management systems important?

Organizations conduct business with a growing number of external vendors. Managing dozens or hundreds of vendor relationships manually can lead to costly and time-consuming issues with ordering, compliance, and payment.

Implementing a software solution for managing and centralizing your vendor data reduces or eliminates these issues.

By using a vendor management system to track supplier agreements and relationships, organizations can reap substantial benefits:

- Reducing spending on materials, goods, and services

- Consolidating suppliers into a preferred program

- Tracking reorder and renewal information

- Improving supplier compliance rates

- Streamlining the procurement strategy and process

- Automating the accounts payable (AP) process

- Improving decision-making through better data visibility

How vendor management systems save money

Though it may seem contradictory, investing in the right vendor management system can result in net savings for your organization. It can reduce your bottom line, eliminate discrepancies due to human error, and free up your team from manual processes. All of these have the potential to reduce the overhead costs associated with AP department administration, invoice processing, and data entry. With automation, there are many ways to save:

- Reducing the cost to process an invoice by up to 80%

- Increasing invoice processing flow from tens to thousands per day

- Eliminating costly and time-wasting invoice exceptions

- Taking advantage of early payment discounts for timely payments

- Reducing financial liabilities from third-party risk

All this being said, it’s essential to choose the best VMS solution for your business and its unique needs. Let’s look at the features that make a vendor management system useful. What features should a vendor management system have?

Steps to choosing a vendor management system

The process for selecting a vendor management system should be thorough and carefully considered. It should address any pain points your business currently experiences and offer solutions for improving your vendor management processes.

Establish goals for the system

It may sound obvious, but the first step to choosing a vendor management system is understanding why you need one. If you identify the pain points you want to solve before you kick off your search, you’ll bring direction to your research, which will enable you to measure each solution by its ability to meet your specific objectives. Think about this in both the short and the long term.

Ask yourself some questions:

- How much accounts payable automation (if any) do we currently use?

- What are the most pressing problems with our current vendor management and accounting system?

- How often does the accounts payable department deal with issues like invoice exceptions, late payments, double-entry issues, or late fees?

- Has the team encountered wide-scale issues such as fraudulent invoices or missing invoice payments?

Based on the above information, you may determine some short-term or long-term goals for your procurement function.

Assess your current system

Once you determine what you need most, look at what you have currently in place. Understanding how AP automation will fit into the larger tech stack and approval process can help guide decision-making.

If your organization has existing systems in place (either manual or automated), ask the following:

- Do we currently have a procure-to-pay system in place, and is it fit for service according to our current operations?

- What internal controls or workflow options are currently in place for things like invoice approval, three-way matching, vendor payments processing, etc.?

- How do we currently access, edit, and use invoice data? What data formats do we need to incorporate?

Examine integration potential

The vendor management system you select should be compatible with your existing tech stack without jeopardizing your company’s data. Consult with your IT and compliance teams to ensure that the solutions you’re considering work well with the technology you already use and that you can trust each one to protect your data.

- Start by setting up a quick call with someone on your IT team. Let them know you are considering a few software solutions, and ask whether there are any questions you should ask vendors about application programming interfaces (APIs). Your IT team may have documented requirements or supplier questionnaires available to use.

- Then, reach out to your compliance department as part of the interdepartmental approval process. They can help you evaluate whether vendors are housing company data safely. They may even have established criteria that all vendors must meet.

- Based on this information, identify at least three suppliers or AP automation solutions that may fit your current business processes and meet your future goals. Look for a solution that offers a flexible and intuitive platform, a high level of security for sensitive data like financial statements and payment processing, and plenty of integration options.

Prepare for VMS product demos

Once you’ve identified the vendors you want to consider, set up a demo with each. During these demos, control the narrative by focusing on what you need from a vendor management system to succeed.

Before the demo, prepare a list of questions you’ll need answered in order to feel confident enough to make a decision. Have a sense of your budget and estimate how much you hope to save by investing in vendor management software. You can also ask a member of your IT team to join the demo if it makes you feel more confident.

At the beginning of the demo, remind the sales representative of your pain points and goals. This will help ensure that he or she focuses on your unique needs, and it will set up the conversation to address your specific questions.

Evaluate vendor management systems with a scorecard

Once you have evaluated the product offering for each shortlisted supplier, you should be close to a decision. If you have difficulty choosing between two closely matched options, consider using a decision matrix to clarify your needs and advance to a final decision.

The following matrix covers key decision criteria for a vendor management solution. To use the matrix, answer each question on the left on a scale of 1 to 5 and note it in the column on the right. Tally up your responses for a final score. Do this for each vendor, and then select the vendor with the highest score.

Question | Rating (1–5) 1: Strongly disagree 2: Disagree 3: Sort of agree 4: Agree 5: Strongly agree |

|---|---|

Is the VMS within my budget? | |

Will the VMS recommend alternative brands and products that may save my business money? | |

Is the VMS likely to bring savings of at least 8% to my business purchasing? | |

Will the VMS reduce the number of people needed to complete a purchase? | |

Will the VMS make the purchasing process faster? | |

Do I trust the VMS to house my company’s data? | |

Will the VMS make it easier to set and enforce budgets? | |

Will the VMS help to integrate finance, operations, and purchasing in one platform? | |

Will the VMS enable my business to make purchases for multiple locations in one order? | |

Will the VMS allow my team members to streamline approvals? | |

Do I trust the business behind the VMS to onboard my team and troubleshoot any issues we may have using the software? | |

Does the VMS provide invoicing data validation and purchasing reports? | |

Does the VMS integrate with other software solutions in my company’s existing tech stack? | |

| TOTAL SCORE |

Feel confident about your VMS decision

By taking the time to evaluate and select the right vendor management system, you can arrive at a decision and implement it with confidence.

Order.co brings together the best features of a vendor management system in an intuitive platform. It works with enterprise resource planning (ERP), finance, and accounting solutions to provide total visibility into your financial life. It offers full automation of the AP process and flexibility to serve your business across all locations and applications. With Order.co, your purchasing department can shed the busywork and build stronger supplier relationships with ease.

To see how Order.co could fit within your organization, schedule a demo.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

![[eBook] How Automation Can Solve Finance Teams’ Biggest Challenges](https://www.order.co/wp-content/uploads/2022/09/finance-and-automation-ebook-640x480.jpg)