Business success demands effective decision-making, on-time reporting, and accurate data entry. Still, sometimes errors enter the system—and poor invoice processing is a primary reason.

Users may not discover inaccuracies caused by an incorrectly processed invoice until they prepare the accounts payable (AP) trial balance. This leads to late reporting and delayed decisions. If no one discovers the errors, executives might make decisions based on inaccurate reports.

Accuracy in accounts payable trial balance is crucial. It positively impacts working capital to improve operational control and future planning. To demonstrate how your business can ensure an accurate trial balance and improve processing (so you can reap the rewards of control and planning), we discuss:

- AP invoice processing and AP trial balance preparation

- The value derived from improved invoice processing

- Nine common causes of inefficient, multi-site processing

- How accounts payable trial balance errors impact your vendors

- The solution for first-time-right trial balances and how Order.co helps you deliver them

Download the free ebook: How Automation Can Solve Finance Teams’ Biggest Challenges

What is an accounts payable trial balance?

The accounts payable trial balance—also called the accounts payable trial balance report—is a listing of the end balance in the chart of accounts. It includes subtotals for partial and unpaid invoices appearing on each general ledger (GL) account.

The AP trial balance enables accounting to post payable liabilities to the general ledger. Accurate and comprehensive inclusion of those payable liabilities helps the business reconcile initial journal entries, bookkeeping records, and sub-ledger balances with bank statements and other documents. The amounts are later totaled and posted to the correct general ledger account. They eventually appear as current liabilities on the balance sheet.

Trial balance and invoice processing: The main points to consider

The C-suite creates business success by ensuring all external and internal actions deliver intended results efficiently and accurately. Every aspect of corporate finance significantly impacts outcomes, particularly the AP process. While accounts payable is only part of the overall accounts structure, effective invoice processing is a valuable subtask to prioritize.

Invoice processing improves when your accounts payable account is accurate, fully inclusive, and timely. Therefore, accuracy and transparency become the norm across the entire accounts payable processing system. Together, they enable greater accuracy to support C-suite decision-making.

Here are some common positive outcomes of accurate accounts payable:

- Operations maximize working capital

- Companies allocate funds to spur growth versus maintaining current operations

- Vendor relationships improve

- Accounting team members work more efficiently

The value of improved invoice processing

Accurate invoice processing determines overall control of the accounts payable process. It enables AP teams to make the best use of cash and available credit within an accounting period.

Accuracy and timeliness, in many instances, come from adopting a comprehensive, automated AP system that offers validation and tracking for accounts payable, accounts receivable, expense account data, etc.

The gold standard is an automated AP system that handles daily transactions and produces the required management and financial reports for that accounting period, including the trial balance report.

9 Common pitfalls of multi-site AP processing

Businesses with several sites, functions, and divisions often create accounting process silos. Each site, function, and division has a separate bookkeeping system to record and account for its procurements and payments. This may extend to separate order approval, procurement, and accounts receivables processes.

Individual procurers in each location may have the same preferred vendors for products and services as other procurers. However, if they order separately, it duplicates efforts and robs the company of leverage.

Redundant and siloed ordering affects the business in several ways:

- Multiple invoices matching each order and delivery

- Maverick spend and budget waste

- Missed opportunities for bulk discounts

- Poorly negotiated terms and conditions

- More complex invoice processing

- Increased invoice exceptions and errors

- Potential for procurement fraud

- Higher overall spending and overhead

- Weakened cash position and credit access

Problems of interim trial balance reports

Beyond ineffective and decentralized purchasing, each site or function often prepares separate financial statements up to a predetermined level. For example, they may:

- Balance the accounts payable and receivable ledger accounts

- Produce separate (balanced or unbalanced) AP trial balance reports

- Have separate operating and P&L Accounts

Bookkeeping entries, account balances, and any supporting documentation go to the head office. They’re then summarized for the accounting period. After reconciliation, the AP teams use the balances to create an overall trial balance report before posting it to the general corporate ledger. Alternatively, the approved reporting system may require each site or silo to prepare basic bookkeeping figures to be aggregated at the corporate level.

A major and common problem for head office-based accounts payable processing teams is that any errors in the interim AP trial balance reports are difficult to locate once they extend to the corporate level. One silo’s accounts payable trial balance may appear accurate because its debits and credits balance out. An error within an account number may have gone unnoticed.

Alternatively, an error of commission in one liability account may be balanced by an error of omission in another. The net result is that the errors may remain invisible until a vendor’s invoice amount is underpaid, overpaid, or missed.

The immediate result of such mistakes is more research and corrections work for AP. This wastes time and creates inaccuracies in finalized financial reporting. Miscalculated payable liabilities in the general ledger are concerning since the executive team may base decisions on faulty reports.

The downstream effect of inaccuracies in any AP trial balance reports is payment delays for vendor invoices. A vendor that has accepted orders, shipped products or services to separate sites, and submitted accurate invoices should have a reasonable expectation of timely payment. Failure to pay because of internal AP errors may lead to delivery suspensions or renegotiation of credit agreements.

A balanced trial balance may still not be accurate

Balanced AP trial balance reports are a prerequisite for producing accuracy across siloed departmental and corporate general ledgers. However, balanced trial balance reports may still have equalizing errors of omission or commission concerning debits and credits.

AP trial balances may also have errors of principle, such as if a clerk incorrectly posts a vendor’s invoice for services or materials to a capital acquisition account. This can result from something simple like a misunderstood product code or mistyped account number.

Therefore, a trial “balance of balances” is not a guarantee of accuracy. As a result, it cannot be relied upon to prove there are no unbalanced journal entries or that the financial statements will be accurate.

How Order.co helps accounts payable trial balance reporting

Accurate and timely reporting is essential for businesses to achieve and maintain financial control and for the C-suite to make valid decisions. Improving preparation starts with making improvements in AP invoice processing.

The goal is for AP processing to be simple and accurate. That helps ensure trial balance reports are accurate before you enter data into the general ledger and publish the balance sheet.

By implementing a procurement solution like Order.co, businesses automate and streamline many of the processes that lead to more accurate invoices and AP trial balances, such as:

- Avoiding the nine pitfalls common to multi-site procurement and processing

- Increasing visibility to improve capital efficiency

- Improving vendor relationships through timely, accurate payments

- Operating a transparent, automated system—from product sourcing to invoicing and payment

To learn more about improving your AP processing with Order.co, request a demo.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

Having the right financial professionals on your team is critical to securing your company’s bottom line. After all, these are the people responsible for managing your accounts payable ledger and future planning, as well as optimizing your budgets by aligning spending, curbing fraud, and eliminating maverick spending that harms your profitability.

Spend analysis is a method the best financial professionals use to examine their companies’ core financial operations and maintain long-term financial health.

This type of analysis shows organizations how they spend their money on products, materials, and services. It allows finance and procurement teams to identify their primary expenses and purchases.

Download the free ebook: How to Show Your CFO You're Saving Money

With this data, firms make better forecasts, ensure budgetary compliance, and improve their financial performance.

Does your business need a comprehensive process to optimize and track the budget and control maverick spend? In this guide, you’ll learn several ways your business or procurement department can conduct a spend analysis of your accounts payable ledger.

In this article, we’ll discuss:

- How to define accounts payable (AP) spend analysis of general ledger (GL) balances

- The top four benefits of spend analysis for businesses

- How to conduct a seven-step spend analysis process

What is an accounts payable spend analysis of general ledger balances?

An accounts payable spend analysis is a critical process within strategic sourcing. AP spend analysis helps companies improve their financial processes by:

- Reviewing payment, purchasing, and spending practices

- Gaining clarity into the organization’s overall cash flow

- Improving efficiency and optimizing buying power

- Managing long-term risks and enforcing contract compliance

- Reviewing budget and forecasting needs

- Tracking income statements and account balances

Accounts payable ledgers explained

An accounts payable (AP) ledger, sometimes called a creditors’ ledger, shows the past transactions between a company and its suppliers. It includes information such as amounts owed, dates, and other details relevant to the repayment of short-term liabilities.

Compiling an AP ledger brings together all available vendor payment information in one place. This makes it easy to track all your creditor payments, due dates, and associated information. The ledger also acts as a budgetary control tool that compares to the general ledger for accuracy. This is a dual control process, where one employee enters transactions and another employee checks for issues or errors.

4 Benefits of spend analysis

Spend analysis provides businesses with a qualitative advantage over their competitors. For this reason, nearly 60% of organizations are considering using advanced and predictive analytics in their practices.

Many of these companies cite the following benefits from analyzing their spending data:

1. Increased spend visibility

Spend visibility is more than tracking company spending. It is a detailed analysis that provides insights into how money travels through the business. It also helps companies identify suspicious activity or fraud.

Spend analysis provides a full history of how an organization spends each dollar during the entire purchase cycle, from sourcing to payment. For instance, if you hire a construction contractor for your company, detailed transaction reporting will identify the employee that approved the quote.

2. Identifying outstanding saving opportunities

Spend analysis identifies new opportunities to reduce companies’ total budgetary costs. The data they receive allows financial professionals to understand spending at the line-item level and develop a pipeline to optimize that spending.

This analysis can also create or capture value through process optimization, where the procure-to-pay process is automated to reduce invoice and purchase order life cycles. This improves supplier relationship management and increases productivity, accuracy, and cost reductions.

An enterprise-level platform helps companies conduct spend analyses to track their cash flow and save money. Xpres Spa, an airport spa destination, says that Order.co’s software has helped the company save 9.6% on its products while simplifying delivery to airports.

“From our first meeting in spring 2016 to now, Order.co has helped us find savings and solutions to match ever-increasing demand,” said Tesh Ramsarup, Director of Operation Services for Xpres Spa. “The knowledge gained over the past three years has allowed us to make decisive choices to provide our people with the best tools and our customers with exceptional service—all while being conscientious of spending.”

You can read the entire case study here.

3. Superior spend forecasting models

Spend analysis constructs better forecasting models that predict ways businesses can take advantage of savings in future quarters.

Spend forecasting integrates historical data analysis with market intelligence and forecasting trends from various sources. It provides decision-makers with reliable insights they can use to optimize their supply chain, slash costs, and make strategic spending decisions. This enables companies to optimize profits and attain a market advantage.

In the past, financial teams created their spend forecasting models manually—they combined months of analysis to identify cost-cutting strategies. Unfortunately, many opportunities expired before they could capitalize on them.

The digital era provides real-time descriptive analytics (analysis of historical data). Companies use descriptive analytics to identify patterns they can leverage to create steady forecasting models and improve their financial performance. With holistic data categorization, simplified trend analysis, and improved spend forecasting methods, organizations build reliable spend data performance sets from specified periods.

4. Ability to track diversity reporting

When spending data is organized into a centralized platform, a wealth of data becomes available for analysis and action. Diversity is one such category. By identifying and collecting diversity information from current supplier relationships, businesses can examine and improve their diversity numbers across all accounts. This data both informs future spending and helps businesses communicate the positive impacts of their strategic partnerships.

How to conduct a spend analysis process of your accounts payable ledger

Now that you know why a spend analysis is critical, we’ll walk you through completing a spend analysis at your company. Here are seven steps to get you started:

1. Use the right accounting system to conduct a spend analysis

Your finance team should have the tools they need to do a comprehensive spend analysis of your financial statements.

You’ll recognize the right accounting system tool when it offers these advantages:

- Contract management improves because the tool extracts insights from actual data and journal entries instead of only from forecasted pricing and vendor performance benchmarks.

- Supplier relationships are efficient and strategic. Software like Order.co monitors vendor balances, tracks merchandise inventory, eliminates redundant relationships, and shifts your focus to shared economic opportunities.

- The tool offers insights for reducing waste, increasing efficiency, and lowering procurement costs. At the same time, it improves general cost reduction initiatives across your entire organization. Ultimately, you will be able to increase the value of your company assets at a lower cost and strengthen your bottom line.

- Indirect spend, ad hoc spend, payable balances, and project-based budgets integrate into your spend data for analysis.

Accounting software is designed to help your organization view all your spend data in one place for easier access and better analysis.

For example, NY Kids Club uses the Order.co platform to manage and control all their spend analysis, journal entries, and balance sheets.

2. Define your objectives

The next step for your AP spend analysis process is to define your objectives. Clear goals make data gathering and analysis efforts easier. Here are some common objectives to follow during your spend analysis:

- Understand your spend at a basic level, including your cash flow, debt amounts, and current liabilities, so your team can identify savings opportunities

- Track key vendors so your finance team or procurement office can define and execute a strategic vendor plan

- Discover key spend areas that affect your earnings before interest, taxes, depreciation, and amortization (EBITDA)—including COGS (cost of goods sold) and SG&A (sales, general, and administrative)

3. Identify all spend data sources

Next, create an inventory of all the systems where your spend data lives, including payable journals, payable subsidiary ledgers, and general ledger accounts. This should include all your departments, accounts payable, general ledger, p-cards, credit cards, and eprocurement system.

This step will help AP capture all your spend data for analysis. If your business has separate business units, locations, or verticals, you’ll likely have to integrate multiple channels.

Take care to create uniformity in your data sources throughout the next steps. Without uniformity across your organization, data integrity is easily compromised. For example, inconsistency in coding materials or describing products ordered can make it difficult to accurately analyze that data later on.

A simple inventory table should capture the total amount of data in subsidiary ledgers and may include the following data sets:

- System name

- Business units

- Type of spend

An effective software platform helps your company keep internal control of your data from subsidiary ledgers, general ledger accounts, income statements, and a variety of bookkeeping sources.

4. Create a spend category tree

Next, establish a spend category tree. This tree can span continents, cost centers, functions, organizational belongings, and responsibilities. Since you’re pulling data from multiple systems, you will probably have different fieldsets.

Identify the data you want to capture. Then use a shared schema to capture what that data means. This step will ensure the information gathered across data sources adheres to a unified standard for analysis.

Most enterprise resource planning (ERP) systems use unified methods to categorize spending transactions into buckets. The most common approach used is a general ledger chart of accounts. You can also use your own in-house or industry-specific schema if that fits your purpose better.

Here are two additional standard schema classification options:

- United Nations Standard Products and Services Code (UNSPSC): This global, open standard is an efficient way to classify your products and services. It is free to browse and download in PDF form. You can also download alternative formats from the UNSPSC website for $100.

- North American Industry Classification Schema (NAICS): Federal agencies use this code to classify businesses. It’s the primary classification schema system used by the US government for reporting statistics.

5. Identify and extract data

Extract the spend data from all your ledgers. For instance, pull data from your subsidiary ledger, general ledger, and accounts payable ledger via your ERP system.

You can also draw this data from your company’s invoice management system. This should include all invoices and invoice rows associated with supplier information, dates, totals, currency, accounts, and cost centers. Your accounts payable process should capture all this information on invoices down to the item level.

6. Cleanse your data

Cleanse, correct, and standardize the data in your accounts payable ledger. Fix any misspelled item or supplier names. Also, eliminate any duplicates and manage errors in your supplier list. This step will help you better control accounts in your AP departments.

7. Categorize your purchases

Categorize your AP data. Classify all information starting on the account level.

Next, analyze your suppliers. Depending on how you’ve constructed your spend category tree, suppliers may fit into one or several categories.

Create categories for invoice numbers, vendor accounts, vendor balances, and income statements. Pay attention to whether suppliers belong to multiple categories.

Use Order.co to simplify accounts payable spend analysis

Businesses that conduct spend analyses have a distinct advantage over their competitors—they see improved spend visibility, cash flow, and vendor relationships. Spend analysis produces superior forecasting models and diversity reports.

Before starting a spend analysis, select a reliable accounting platform. It will help your finance team conduct a thorough, error-free analysis. Choose software that will cover all the bases:

- Buying and approving products

- Setting budgets for each accounting period

- Enforcing approvals by user, location, product, and category

- Providing real-time analytics for actionable purchasing insights

A platform like Order.co enables your finance team to conduct a spend analysis that tracks your spend and saves you money.

For more information on using data and technology to drive business growth, download our complimentary ebook, “Creating a Growth Machine.”

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

When it comes to your company’s financial health, revisiting the basics can bring new perspectives to current problems. Consider a sports analogy:What do the world’s most famous coaches make their players do in the off season? Practice the fundamentals. Coaches have their teams practice rookie-level drills because it trains their minds and bodies to react with cat-like reflexes. They solidify the fundamentals to the point they're instinctual.

The same concept applies to any profession, whether you’re a novice or an expert. Even if you know the fundamentals, there is a reason for the adage, ‘Use it or lose it.’

That is why we are going back to the basics in this article to re-examine T-accounts.

Download the free tool: Financial Audit Preparation Checklist

What is an accounts payable T-account?

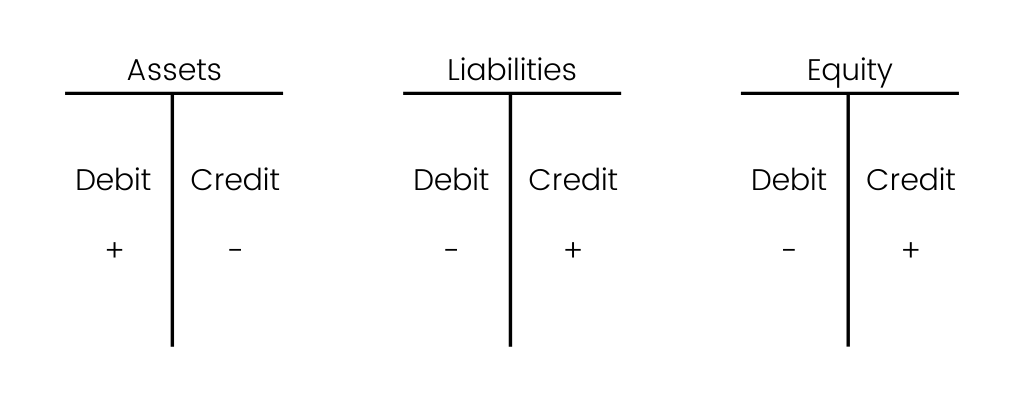

A T-account is named for the visual presentation of double-entry bookkeeping. The left side of the ‘T’ is where a debit is recorded in the general ledger, and the right side is for credits. Each account — whether it’s accounts payable, accounts receivable, payroll, assets, etc. — will have its own T-account setup. The account title sits above the top bar of the ‘T.’

In double-entry bookkeeping, each accounting entry affects at least two of the company’s accounts. When a debit is entered onto the left side of one account, it sends a credit to the right side of another account. The reverse is also true. If you enter a transaction on the credit side in one account, there will be a corresponding entry on the debit side of another account. In this way, debits and credits increase or decrease the corresponding accounts to keep the books balanced.

Examples of accounts payable T-account

T-accounts are a useful visual representation of many types of balance activities. Some common types of T-account representations are:

Assets: Cash transactions, accounts receivable, physical inventory, hard assets like furniture, or technical assets such as computers and phones

Liabilities: Accounts payable, loans, and notes payable

Revenue: Receipt of payment from customers for goods or services

Expenses: Costs incurred to run the business such as rent, supplies, insurance coverage, incidentals, travel, and utilities

Equity: The conversion of company funds into financial instruments, such as shares sold as part of employee stock purchase plans (ESPP) or incentive shares

T-Accounts and their role in accounting systems

The most common method for bookkeeping is the double-entry accounting system of T-accounts. For the balance sheet to be balanced, a business transaction entered into the system must take away from one account and add the same amount to another and vice versa. The most common reason for balance sheet discrepancies is a ledger account entry erroneously placed on the debit side or credit side of the wrong account.

The idea of an accounts payable T-account gets a little confusing for even the most seasoned professional bookkeepers. When using a T-account, you must ensure the correct figure is applied to the correct side of the ‘T.’ It’s common to think of a debit entry as a subtraction to an account and a credit entry as an addition to an account. But this is not always the case:

- Entering a debit (left side) transaction to cash accounts, accounts receivable, or asset accounts like inventory and PP&E increases the account. When you enter a credit (right side) into these accounts, it decreases the amount.

- For the liabilities or shareholders’ equity accounts, debit entry decreases the amount and a credit increases it.

- Income statements also rely on the accuracy of the accounts payable T-account journal entry to reflect accurate figures.

- Accounts that track expense accounts, revenue accounts, gains, and losses use the debit/credit method in the same way as accounts receivable. A debit transaction increases the revenue accounts and a credit entry decreases it. Conversely, a debit will decrease the amount for expense accounts, whereas a credit will increase it.

Case in point: If your business issues common stock, you debit the cash account and credit the shareholders’ equity account to reflect this. But if an employee leaves before their shares are fully vested, they forfeit their shares and you record it as a debit to the shareholder’s equity account and a credit to the cash account.

How do AP T-accounts help spend management?

T-accounts allow a business to easily track its spending. You can see journal entries over a given period of time and view business transactions. But a T-account doesn’t necessarily help your business make wise decisions regarding managing its spending intelligently.

Accounting software tracks your company’s balance sheet and income statements. But it can only give you dynamic figures that provide superficial insight into ways to improve spend management.

The biggest problem with every fast-paced business is identifying areas that are leaking cash unnecessarily. Obvious signs in your financial statements — such as the accounts payable figure being much higher than the accounts receivable — stand out. But without 100% visibility into your spend management, you’ll be left high and dry on how to curb your spending. Worse yet, you may find some balances inflated or deflated, painting a picture that may not reflect reality. Working capital, cash flow, and your bank account suffer as a result.

Streamlining accounts payable

Streamlining your accounts payable and accounts receivable processes may sound like a daunting task, especially when you work with a significant number of vendors. But eliminating maverick spend means finding ways to gain clarity on your company’s balance sheet. Simplifying your procurement process across different accounts with vendors is the first step toward reducing the time spent on the short-term process. This will significantly reduce money spent in the long term.

To help you understand what we mean, let’s take a look at the story of one of our customers, [solidcore]. As a health and wellness company, [solidcore] was expanding quickly with increasing demand for their products and services. In one year, they doubled the number of locations from 25 to 50. With such explosive growth comes a lot of chaos if you’re not properly prepared.

At first, [solidcore] held multiple accounts across multiple vendors and multiple users. Spend tracking was chaotic. The accounts payable department recorded receipts in the general ledger one by one, leading to a backlog. Without a proper purchasing management system, company executives couldn’t get real-time, accurate data on their cash flow, current assets, and expense accounts.

Since implementing Order.co, [solidcore] streamlined a process that once took at least two days and tons of back-and-forth emails for its 25 locations. Today, the process takes about four hours across all 50 locations. Now [solidcore] can see their spending at the product, location, and aggregate levels. With standardized processes steadily implemented in a more reliable manner, the company has much more transparency in its working capital and bank account balance than ever before.

Since implementing Order.co, [solidcore] streamlined a process that once took at least two days and tons of back-and-forth on emails for 25 locations. Today, the process only takes about four hours across all 50 locations.

Use Order.co to streamline accounts payable

Whether refining the fundamentals or digging deep to find innovative ways to streamline your accounts payable process, expertise requires your eyes to stay on the prize—but on potential hindrances, too. The figures on your company’s financial statements tell only a small part of the story even though they reflect the bigger picture.

Using the Order.co platform, many basic tasks such as reporting and visualization, invoice reconciliation, and spend analysis happen automatically within the platform. It takes the guesswork out of managing spending across locations and gives accounting professionals granular insight into every dollar flowing into and out of the organization.

Order.co offers growing businesses the most comprehensive and user-friendly accounts payable management & automation available. We invite you to request a free demo to learn more.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

![[eBook] How Automation Can Solve Finance Teams’ Biggest Challenges](https://www.order.co/wp-content/uploads/2022/09/finance-and-automation-ebook-640x480.jpg)